The trade surveillance systems market size expected to reach US$ 2,789.52 million by 2028, registering at a CAGR of 16.5% from 2021 to 2028, according to a new research study conducted by The Insight Partners.

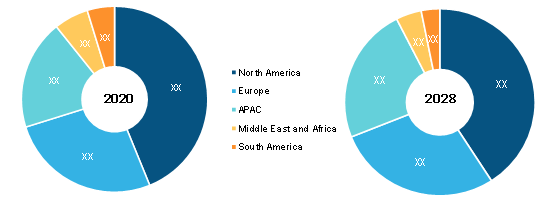

North America dominated the market in 2020 with a share of 43.8%. The Securities Exchange Act gives the U.S. Securities and Exchange Commission (SEC) considerable regulatory jurisdiction over the securities business. The act gives the government body an authority to register, regulate, and supervise brokerage firms, transfer agents, clearing agencies, and securities self-regulatory organizations (SROs) across the country. The New York Stock Exchange, the NASDAQ Stock Market, and the Chicago Board of Options are a few examples of securities exchanges. SROs consist of the Financial Industry Regulatory Authority (FINRA). The Act also recognizes and forbids the types of market behaviors, as well as gives the Commission disciplinary authority over regulated firms and their associates. The rising complexities in the security trading is creating the need for trade surveillance, which is driving the growth of the trade surveillance systems market across the region. The sudden lockdown imposed across the region, due to the COVID-19 outbreak, has severely impacted the stock market leading to high price volatility across the US, which reduced the trading activities. Therefore, the trade surveillance market witnessed decline in the growth. However, the normalization of economy from the third quarter of 2020 led to increase in trading activities across the region. Therefore, the investments are increasing in cloud-based trade surveillance solutions to enable remote surveillance of trading activities. Thus, the COVID-19 outbreak pandemic is having a moderate impact on the trade surveillance market in the region.

Europe stood second in the trade surveillance system market with a decent market share in 2020. The rise in investment frauds across Europe is propelling the need for trade surveillance systems. For instance, in May 2021, according to a news release from the European Union's law enforcement agency, Europol and numerous national law enforcement agencies busted an investment fraud and money laundering ring that caused losses of around US$ 36 million to hundreds of victims across Europe. The organization established an enterprise that included at least four online trading platforms that promised potential investors large rewards from cryptocurrency and high-risk trades. Advertisements on social media platforms and search engines influenced customers to join the application resulting in huge money losses. Thus, the rise in fraud trading platforms and cases is contributing to the high adoption of the trade surveillance systems in Europe, thereby contributing to the growth of the Europe trade surveillance systems market.

The trade surveillance system market players adopt several strategies to expand their business and maintain brand name across the world. For instance, in 2021, Bancomat and SIA SPA entered a strategic partnership to create a new supply chain for BANCOMAT, PagoBANCOMAT, and BANCOMAT Pay payment and cash withdrawal systems capable of reengineering and modernizing such services, thus creating the conditions to enable the domestic network also at an international level.

The global trade surveillance systems market is segmented on the basis of component, deployment, organization size, and geography. Based on component, the market is bifurcated into solutions and services. The market, by solutions, is sub segmented into risk and compliance, reporting and monitoring, surveillance and analytics, case management, and others. Similarly, by services, the market is further divided into managed services and professional services. Based on deployment, the trade surveillance systems market is bifurcated into cloud-based and on-premises. By organization size, the market is bifurcated into SMEs and large enterprises. Geographically, the trade surveillance systems market is segmented into North America (the US, Canada, and Mexico), Europe (France, Germany, Italy, the UK, Russia, and Rest of Europe), Asia Pacific (Australia, China, India, Japan, South Korea, and Rest of APAC), Middle East & Africa (Saudi Arabia, South Africa, the UAE, and Rest of MEA), and South America (Brazil, Argentina, and Rest of SAM).

Trade Surveillance System Market Breakdown— by region, 2020 and 2028

Trade Surveillance Systems Market Size & Share Report 2031

Download Free Sample

Trade Surveillance Systems Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Solutions and Services), Deployment (On-premise and Cloud), and Organization Size (SMEs and Large Enterprises), and Geography

Trade Surveillance Systems Market Size & Share Report 2031

Download Free SampleTrade Surveillance Systems Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Solutions and Services), Deployment (On-premise and Cloud), and Organization Size (SMEs and Large Enterprises), and Geography

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com