Bulk Tray Lyophilization Segment Drives US Bulk Lyophilization Services Market Growth

According to our new research study named "US Bulk Lyophilization Services Market Forecast to 2031 – Country Analysis – by Lyophilization Format, Scale, Service Type, End User," the market was valued at US$ 340.37 million in 2024 and is projected to reach US$ 573.30 million by 2031; it is expected to register a CAGR of 7.8% during 2025–2031. The robust growth in the biopharmaceutical sector, the increase in outsourcing demand, stringent regulatory compliance and technological advancements, adoption of advanced monitoring systems, focus on sustainability and green technologies, integration of AI, automation, and robotics are projected to bring new US bulk lyophilization services market trends in the coming years.

The US biopharmaceutical industry is a major driver of global innovation, and its expansive growth is the key reason behind the rising bulk lyophilization services market. The use of biopharma pipelines filled with complex therapies is leading to the need for freeze-drying (lyophilization) of drug substance and drug product on a bulk scale, which, so far, was a niche-occupying area, is now becoming an indispensable manufacturing service. This expedites drug delivery while research and development and regulatory approval investments continue to rise. In 2022, the member companies of the Pharmaceutical Research and Manufacturers of America (PhRMA) invested ~US$101 billion in research and development, a clear indication that the industry is focusing on innovation and advanced therapeutics. The US biotech scene has also looked quite promising over the last several years. Biotech venture funding bounced back sharply with a 70.9% increase in the value of deals during Q3 2025 compared to the previous quarter; therefore, the investors' trust in novel biologic development is getting renewed. The money inflow is in line with a 4.5% compound annual growth rate in revenues that the top 17 US biopharma firms under Morningstar coverage are projected to have until 2029, which results from the breakthroughs in oncology and immunology.

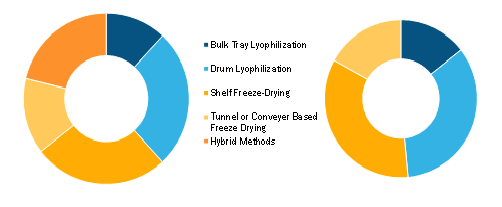

US Bulk Lyophilization Services Market, by Lyophilization Format (%)

US Bulk Lyophilization Services Market Size and Forecast (2021 - 2031), Country Share, Trend, and Growth Opportunity Analysis Report Coverage: By Lyophilization Format (Bulk Tray Lyophilization, Drum Lyophilization, Shelf Freeze-Drying, Tunnel or Conveyer Based Freeze Drying, and Hybrid Methods), Scale (Small Scale or Lab Scale, Pilot Scale, and Commercial and Industrial Scale), Service Type (Custom Process Development and Optimization, Pilot Scale and Research and Development Lyophilization, and Full Scale Commercial Bulk Lyophilization), and End User (Pharmaceutical and Biotechnology Companies, Research and Academic Institutes, and Others)

US Bulk Lyophilization Market Growth Analysis 2025-2031

Download Free Sample

Source: The Insight Partners Analysis

Biologics, which are responsible for more than 40% of the new molecular entity approvals by the FDA, have been growing at a yearly average rate of 12.5% over the last five years (from 2017), thus they have been outpacing traditional small-molecule drugs. In 2024, the FDA approved 55 new therapeutics, of which nearly half were biologics. Lyophilization is most often used to prevent the degradation of biologics during storage and transport. Such an expansion directly boosts the demand for bulk lyophilization as the companies in the biopharma industry contract the production with the organizations of development and manufacturing (CDMOs) so that they can efficiently scale up the production. The rise in the complexity of biologics, for example, protein formulations with a high concentration, requires the use of advanced lyophilization methods in order to keep the bioactivity intact. The buildup of cancer drugs, consequently, has increased the demand for stable drugs in powder form capable of withstanding worldwide supply chains. Several examples serve to illustrate this connection. The case of Amgen's Neulasta, a lyophilized biologic for chemotherapy-induced neutropenia, is the motive for the change; the lyophilized stability is what allows the sustained release to be delivered through the on-body injector system, thus supporting more than 1 million treatments annually in the US.

Vaccine preservation is one more major factor. After COVID, the US has experienced a considerable growth in lyophilized vaccine formulations, as this method prolongs shelf life up to 36 months and thus supports emergency preparedness, which is clearly demonstrated by the Strategic National Stockpile's focus on freeze-dried therapeutics. With the biopharma research and development expenditure reaching US$150 billion per year in the US, the industry's expansion is the main reason why bulk lyophilization services have to transition from being a mere niche to becoming an indispensable one and, thus, create a stable ecosystem for innovations that save lives. Those service providers who are able to offer GMP-compliant lyophilization capabilities that are scalable, high-throughput, validated, and agile to meet the needs of commercial and late-stage launches will obtain a strong position to make a substantial gain in the market.

US Bulk Lyophilization Services Market Analysis Based on Segmental Evaluation:

Based on product type, the US bulk lyophilization services market is segmented into bulk tray lyophilization, drum lyophilization, shelf freeze-drying, tunnel or conveyor-based freeze-drying, and hybrid methods. The bulk tray lyophilization segment held a significant US bulk lyophilization services market share in 2024. Bulk tray lyophilization is a landmark method in the market, where large volumes of pharmaceutical, biotechnological, and nutraceutical products are processed on stacked trays inside controlled freeze-drying chambers, thus allowing freezing, primary drying under vacuum, and secondary drying to remove bound moisture to be carried out uniformly. The main advantage of this format is that it can handle biologics that are sensitive and active pharmaceutical ingredients (APIs) that need precise temperature control to keep their structural integrity and bioactivity; hence, it is a must for contract development and manufacturing organizations (CDMOs) serving the biopharma sector, which is growing rapidly. One of the best illustrations is the freeze-drying of monoclonal antibodies for cancer immunotherapies, such as those by Amgen and Genentech, where trays enable scalable batch processing without a drop in potency.

The segment expansion is mainly due to the demand for stable injectables with extended shelf-life, which have been approved rapidly by the US Food and Drug Administration (FDA), with more than 50 novel biologics being approved annually, and the rise of personalized medicine that requires tailoring of drying protocols. Moreover, the growth in vaccine manufacturing—made visible by the post-pandemic mRNA vaccine stabilizer capacity increase—has led to a higher dependency on tray systems for their load-size and formulation adaptability flexibility. Besides environmental sustainability being a factor that fosters the use of trays, as energy-efficient tray models lower carbon footprints in line with EPA regulations, and the progress in automated loading and unloading stages, which shortens the operational time by up to 30%, also contribute to this trend.

The expansion of contract lyophilization offerings, as exemplified by Emergent BioSolutions, is a result of this trend, and it is a driver of the biotech startups, which outsource to acquire know-how without making a heavy investment in capital. On top of that, the growing pharmaceutical industry is taking advantage of trays' capability to keep volatile compounds safe, thus being in line with the consumer trend for functional foods. Implementation of the ICH guidelines by regulators worldwide ensures that the quality remains consistent, thus trust and investment are facilitated.

Hudson Valley Lyomac, Alcami Corporation, Affinity Life Sciences, OFD Life Sciences, Quality BioResources, Symbiosis, Lyophilization Technology, Inc., Attwill, PCI Pharma Services, and Catachem Inc are are among the leading companies profiled in the US bulk lyophilization services market report.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com