Livestock and Poultry Segment Bolsters Veterinary Healthcare Market Growth

According to our new research study on "Veterinary Healthcare Market Forecast to 2031 – Global Analysis – by Animal Type, Product Type, End User", the market was valued at US$ 93.49 billion in 2024 and is projected to reach US$ 156.53 billion by 2031; it is estimated to register a CAGR of 7.7% during 2025–2031. The Veterinary Healthcare Market report emphasizes the trends prevalent in the global market, along with drivers and deterrents affecting its growth.

The increasing prevalence of zoonotic diseases and soaring initiatives for animal health contribute to the growing Veterinary Healthcare Market size. However, the high complexity and cost of veterinary drug development and approval processes hamper the growth of the market. Further, technological advancements in veterinary healthcare are expected to bring new Veterinary Healthcare Market trends in the coming years.

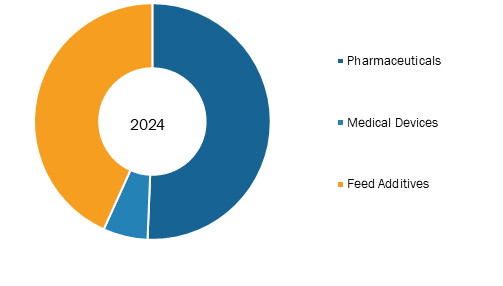

Veterinary Healthcare Market Share, by Product Type, 2024 (%)

Veterinary Healthcare Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Animal Type (Companion and Livestock and Poultry), Product Type (Pharmaceuticals, Medical Devices, and Feed Additives), End User (Veterinary Hospitals, Clinics, and Others), and Geography

Veterinary Healthcare Market Analysis by Size, Share & Growth 2031

Download Free Sample

Source: The Insight Partners Analysis

Surging Prevalence of Zoonotic Diseases Propels Veterinary Healthcare Market Growth

Zoonotic diseases, which spread from animals to humans, are caused by viruses, bacteria, parasites, and fungi and lead to illnesses that can range from mild to severe and potentially even cause death. According to an article published by the Center for Disease Control (CDC) in February 2024, over 60% of infectious diseases in humans can be transmitted from animals, and 75% of emerging infectious diseases in humans originate from animals. Each year, zoonotic diseases cause 2.5 billion human infections and 2.7 million deaths worldwide. According to the World Organization for Animal Health (WOAH), nearly 60% of pathogens causing human diseases come from domestic animals or wildlife, and 80% of bioterrorism-related pathogens originate from animals. Common zoonotic diseases include Ebola, rabies, salmonella, anthrax, Lyme disease, E. coli, and bird flu. HIV originated as a zoonosis before mutating into human-only strains. As per the World Health Organization (WHO), animal diseases lead to over 20% of global production losses in livestock, threatening the livelihoods of rural communities dependent on animal agriculture. The increasing incidences of zoonotic diseases propel the demand for vaccinations and diagnostic tests. This demand is driving the emphasis on animal healthcare products and services, as pet owners and farmers aim to protect their animals and, in turn, safeguard human health. Efforts to manage and treat zoonotic diseases have fueled the development of new medications and treatments. This expansion in treatment options contributes to market growth as companies invest in research and development to address these health challenges.

The veterinary healthcare market analysis has been carried out by considering the following segments: animal type, product type, end user, and geography. Based on animal type, the veterinary healthcare market is divided into companion, livestock, and poultry. The livestock and poultry segment held the largest share of the veterinary healthcare market in 2024.

By product type, the global veterinary healthcare market is categorized into pharmaceuticals, medical devices, and feed additives. The pharmaceuticals segment held the largest share of the veterinary healthcare market in 2024. The growing demand for veterinary pharmaceuticals has fuelled the introduction of innovations by market players in the veterinary healthcare market. In April 2023, MSD Animal Health announced that its Bovilis Intranasal RSP Live vaccine received a license for use in calves starting from the day of birth. This vaccine is designed to immunize calves against Bovine Respiratory Disease (BRD) caused by Bovine Respiratory Syncytial Virus (BRSV) and Parainfluenza Virus 3 (Pi3).

In April 2023, Vetnostrum launched six new veterinary products for livestock and companion animals. These products include Oestrufix Oral Solution, Depamycin Injection, and Tulamax Injection for the treatment of diseases in livestock, and Earton Otic Solution, Achebye Injection, and Pimotonic Tablet for companion animals.

Market players are expanding their businesses to capitalize on the expanding veterinary healthcare. In 2023, Accord Healthcare, a pharmaceutical company in Europe, launched a new Animal Health division to improve services for veterinarians.

Per end user, the global veterinary healthcare market is segmented into veterinary hospitals, clinics, and others. The veterinary hospitals segment held the largest share of the veterinary healthcare market in 2024.

The geographic scope of the Veterinary Healthcare Market report includes the assessment of the market performance in North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America. North America dominated the market in 2024.

The veterinary healthcare market in North America is segmented into the US, Canada, and Mexico. The US holds the largest market share, followed by Canada. The demand for veterinary healthcare in the region is fueled by the increasing government support to provide cost-effective healthcare services and the rising strategic developments by Elanco, Zoetis Inc., and Boehringer Ingelheim Animal Health USA, Inc. An expanding healthcare industry that demands frameworks and guidelines based on real-world data for their business models contributes to the veterinary healthcare market growth.

The market growth across the European region is attributed to the presence of various market players, rising research and development activities in the veterinary industry, a growing number of diagnostics laboratories, and the increasing prevalence of zoonotic diseases, including foodborne diseases such as salmonellosis, listeriosis, and campylobacteriosis, as well as vector-borne diseases such as West Nile virus and tick-borne encephalitis.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com