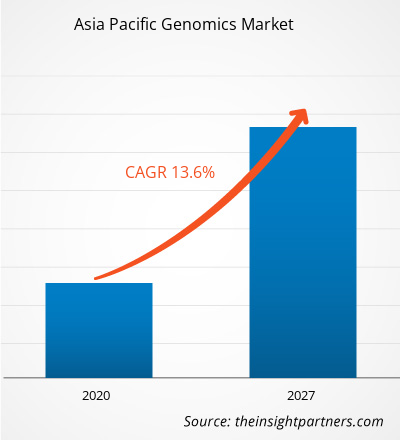

The Asia Pacific Genomics market is expected to reach US$ 11,574.11 million in 2027 from US$ 4,269.80 million in 2019. The market is estimated to grow with a CAGR of 13.6% from 2020-2027.

Genomics is a branch of biotechnology concerned with applying the techniques of genetics and molecular biology to the genetic mapping and DNA sequencing of sets of genes or the complete genomes of selected organisms, with organizing the results in databases, and with applications of the data (as in medicine or biology). The major factors attributing to the growth of the genomics market are growing government support and increased number of genomics studies, declining sequencing cost, increased genomics applications. The scope of the genomics market includes technology, product and service, application, end-user, and region.

Japan Genomics Market Revenue and Forecasts to 2027 (US$ MN)

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

ASIA PACIFIC GENOMICS MARKET SEGMENTATION

By Technology

- Sequencing

- Microarray

- Polymerase Chain Reaction

- Nucleic Acid Extraction and Purification

- Others

By Product and Services

- Instruments/Systems

- Consumables

- Services

By Application

- Diagnostics

- Drug Discovery and Development

- Precision/Personalized Medicine

- Agriculture & Animal Research

- Others

By End User

- Research Centers

- Hospitals & Clinics

- Biotechnology & Pharmaceutical Companies

- Others

By Country

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

Company Profiles

- Illumina, Inc.

- Danaher

- F. HOFFMANN-LA ROCHE LTD.

- BIO-RAD LABORATORIES INC.

- General Electric Company

- THERMO FISHER SCIENTIFIC INC.

- Agilent Technologies, Inc.

- Eurofins Scientific

- QIAGEN

- BGI

Asia Pacific Genomics Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 4,269.80 Million |

| Market Size by 2027 | US$ 11,574.11 Million |

| Global CAGR (2020 - 2027) | 13.6% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Technology, Product & Service, Application, End User, and Country

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Australia, China, Japan, South Korea

Trends and growth analysis reports related to Life Sciences : READ MORE..

- Illumina, Inc.

- Danaher

- F. HOFFMANN-LA ROCHE LTD.

- BIO-RAD LABORATORIES INC.

- General Electric Company

- THERMO FISHER SCIENTIFIC INC.

- Agilent Technologies, Inc.

- Eurofins Scientific

- QIAGEN

- BGI

Get Free Sample For

Get Free Sample For