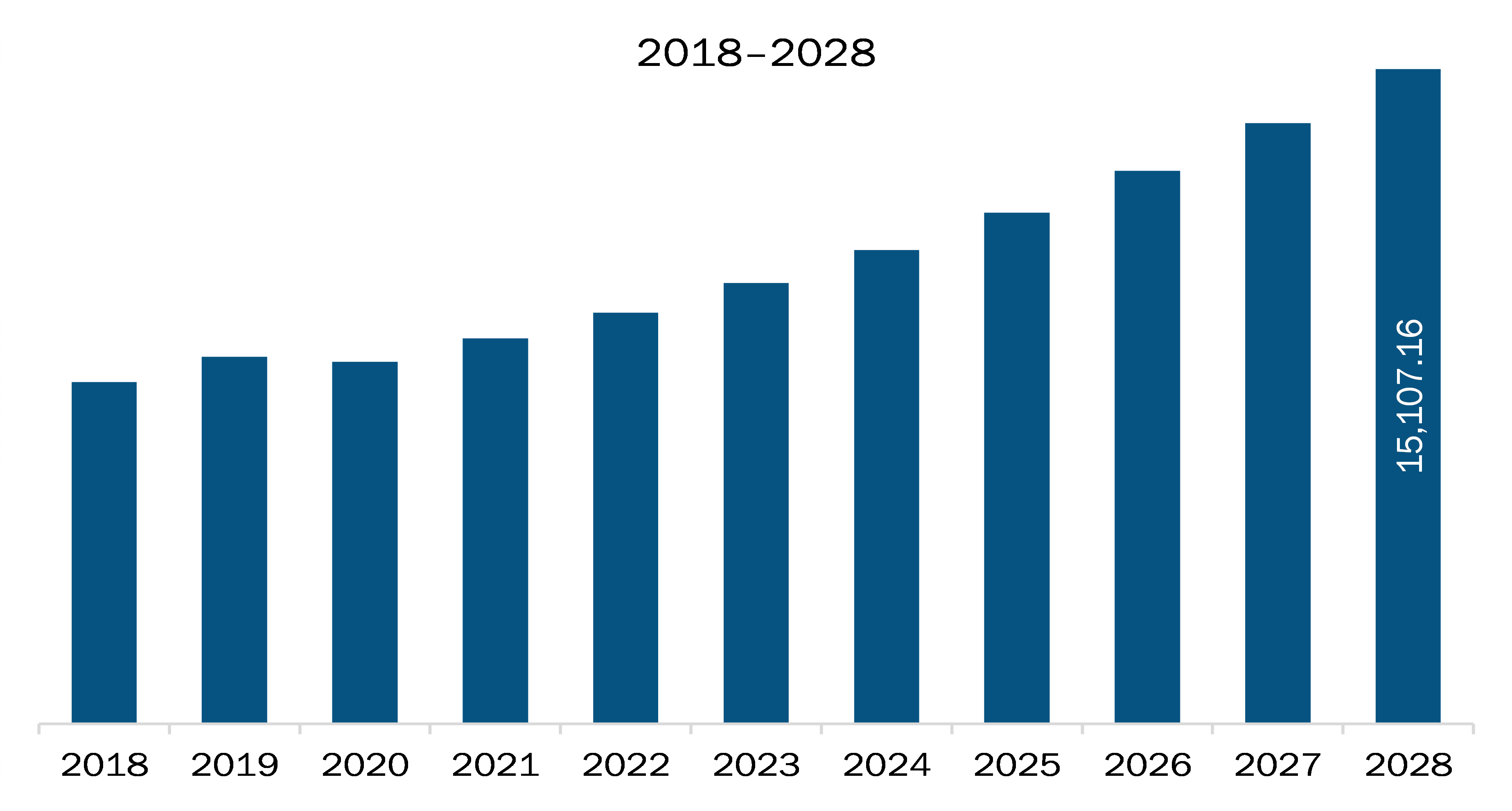

The APAC helicopters market is expected to grow from US$ 8,888.12 million in 2021 to US$ 15,107.16 million by 2028; it is estimated to grow at a CAGR of 7.9% from 2021 to 2028.

China, India, Japan, South Korea, and Australia are major economies in APAC. Mounting demand due to aging helicopter fleet is expected to fuel the market growth. Many countries across APAC region are now witnessing an increase in aging helicopter fleet size, which is creating immense demand for new and advanced helicopters. OEMs can effectively use this opportunity to strengthen their market position. For instance, in 2020, in India, The Hindustan Aeronautics Limited received the initial operational clearance for production of the light utility helicopter, which is set to replace the aging fleet of Cheetah and Chetak helicopters of the Indian armed forces. Further, according to a report published in 2018–2019, approximately 25% of the total helicopter fleet size in India is over 20 years old and falls under “fleet renewal pending “category, which is expected to create opportunity for OEMs in the market. South Korea, yet another prominent country in the market, is also planning to upgrade its helicopter fleet. In April 2021, the country announced (under Defense Acquisition Program Administration (DAPA)) that it is looking for more new attack helicopters for the Republic of Korea Army (RoKA) under the second phase of its ongoing helicopter recapitalization programme. All these ongoing upgrade programs taking place in various major countries are expected to create growth opportunity for OEMs for APAC region.

In case of COVID-19, APAC is highly affected specially India. The COVID-19 outbreak has resulted in a massive financial loss in the APAC region. The governments in APAC countries had taken possible steps to reduce its effects by announcing lockdown, which is negatively affecting the manufacturing sector. China, which is one of the leading aerospace manufacturing countries in the region, was one of the most affected countries in APAC during Q1 of 2020. Due to this, aircraft and aircraft component manufacturing facilities have been severely affected. India, Japan, and South Korea are still combating the virus. However, the countries have eased the lockdown measures, which is reflecting the restart of manufacturing facilities. Nonetheless, the remarkably lower volumes of general aviation and military helicopter production in India and Japan slowed down the demand for various components among the OEMs and aftermarket players. Currently, India is experiencing a massive outbreak of the second wave of COVID-19, leading the state governments to impose temporary lockdown measures. This factor is highlighting restrictions in helicopter production facilities. The helicopter manufacturers in India such as Hindustan Aeronautics Limited (HAL) and Tata Advanced Systems Limited (TASL), have been observing substantial disruption in the supply chain of several components, which is restraining the companies from producing pre-COVID production volumes. Hence, the domestic and international Helicopter market players supplying their products to HAL and TASL are witnessing a decline in sales.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the APAC helicopters market. The APAC helicopters market is expected to grow at a good CAGR during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

APAC Helicopters Market Segmentation

APAC Helicopters Market – By Type

- Single Rotor

- Multi Rotor

- Tilt Rotor

APAC Helicopters Market – By Weight

- Light Weight

- Medium Weight

- Heavy Weight

APAC Helicopters Market – By Application

- Commercial & Civil

- Transport

- Emergency Rescue

- Utility

- Training

- Military

- Attack and Reconnaissance

- Maritime

- Transport Search and Rescue

- Training

APAC Helicopters Market, by Country

- Australia

- China

- India

- Japan

- South Korea

- Rest of APAC

APAC Helicopters Market -Companies Mentioned

- Airbus S.A.S.

- Bell Textron Inc.

- Boeing

- Enstrom Helicopter Corp.

- Kaman Corporation

- Leonardo S.p.A.

- Lockheed Martin Corporation

- MD Helicopters, Inc.

- Russian Helicopters

Asia Pacific Helicopters Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 8,888.12 Million |

| Market Size by 2028 | US$ 15,107.16 Million |

| CAGR (2021 - 2028) | 7.9% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

Asia-Pacific

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For