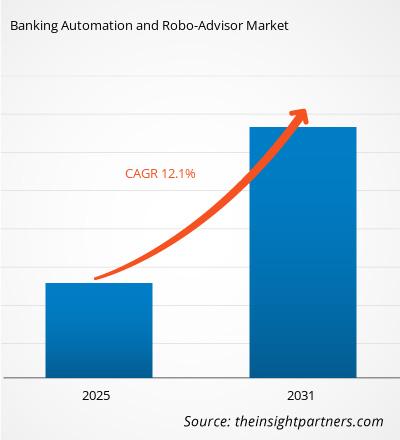

The banking automation and robo-advisor market is expected to register a CAGR of 12.1% from 2023–2031. Growing demand for digital baking services and adoption of Artificial Intelligence (AI) driven technologies are likely to remain a key banking automation and Robo-Advisor market trend.

Banking Automation and Robo-Advisor Market Analysis

Banking and financial business processes contain a large number of repeated procedures, making them perfect for banking automation technology. While some of this digital revolution has entailed the development of complicated automation tools for investing and fraud detection systems, some of the most important benefits have come from automating smaller, more everyday processes that are common within these institutions. The automated transition has also allowed banks to leverage data to expand their existing product and service offerings.

Banking Automation and Robo-Advisor Market Overview

A robo-advisor is a digital financial advisor who offers financial advice or manages investments with little to no human participation. Robo-advisors are supposed to provide digital advice based on inputs from investors. Robo-advisors use computers to analyze and forecast investor preferences, risks, and objectives. Banking automation and Robo-advisors have altered the financial services business by offering customers efficient and tailored solutions. The market for banking automation and Robo-advisors is growing rapidly due to rising demand for automated financial services, enhanced customer experience, and cost-effectiveness.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONBanking Automation and Robo-Advisor Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Banking Automation and Robo-Advisor Market Drivers and Opportunities

Increasing Demand for Digital Banking Services to Favor Market

The growing desire for improved client experiences and expanded use of cloud-based technologies by the banking sector and other financial institutions is driving the expansion of digital banking. A customer-centric approach, data-driven results, and an emphasis on digital experience are critical components of digital banking's success. The main advantages of digital banking include ease of use, a simple sign-up process, decreased transaction fees, customizable features, and an anytime banking capability. All these factors are expected to boost the growth of banking automation and robo-advisor market during the forecast period.

Rising Adoption of Artificial Intelligence (AI) Driven Technologies – An Opportunity in Banking Automation and Robo-Advisor Market

Digital technology is having an impact on practically every industry, changing not only the industries but also the way organizations function. Every industry is currently assessing choices and adopting strategies to prosper in this technologically advanced environment. To meet customer expectations, the banking sector has expanded its reach into retail, IT, and telecom areas, offering services like mobile banking, e-banking, and real-time money transfers. These enhanced features enable users to access banking at their convenience, but they come at a cost to the banking system. Trending banking apps are adopting artificial intelligence for a variety of reasons, including greater competition in the banking sector, a push for process-driven services, consumer requests for more tailored solutions, and increased employee efficiency. All these factors are expected to create lucrative opportunities for the market during the forecast period.

Banking Automation and Robo-Advisor Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Banking Automation and Robo-Advisor market analysis are type and application.

- By type, the market is segmented into robotic process automation, customer service chatbots, and robo-advisors.

- The Robo-advisors segment is expected to grow during the forecast period as robo-advisors automate portfolios, making investments accessible and affordable. Robo-advisors represent a new and strong tool in the financial scene, democratizing access and simplifying portfolio management.

- By application, the market is segmented into BFSI, Government/Public Sector, and Others.

- Based on organization size, the market is segmented into large enterprises and small and medium enterprises.

Banking Automation and Robo-Advisor Market Share Analysis by Geography

The geographic scope of the banking automation and robo-advisor market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

North America held a prominent share in the banking automation and robo-advisor market in 2023. This growth may be attributable to rising demand for digital banking services and increased acceptance of automated financial advice. Further, the presence of key market players and early technological adoption are also anticipated to boost the market growth in this region during the forecast period. Asia Pacific region is predicted to grow at a significant pace during the forecast period. This growth may be attributed to the growing digital banking initiatives by the government and the growing adoption of digital banking services.

Banking Automation and Robo-Advisor Market Regional Insights

The regional trends and factors influencing the Banking Automation and Robo-Advisor Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Banking Automation and Robo-Advisor Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Banking Automation and Robo-Advisor Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 12.1% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Banking Automation and Robo-Advisor Market Players Density: Understanding Its Impact on Business Dynamics

The Banking Automation and Robo-Advisor Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Banking Automation and Robo-Advisor Market top key players overview

Banking Automation and Robo-Advisor Market News and Recent Developments

The Banking Automation and Robo-Advisor market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the Market for innovations, business expansion, and strategies:

- In 2024, IBM launched a US$500 million venture fund to invest in a range of AI companies - from early-stage to hyper-growth startups - focused on accelerating generative AI technology and research for the enterprise. (Source: IBM, Press Release)

Banking Automation and Robo-Advisor Market Report Coverage and Deliverables

The “Banking Automation and Robo-Advisor Market Size and Forecast (2021–2031)” report provides a detailed analysis of the Market covering the following areas:

- Banking Automation and Robo-Advisor market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Banking Automation and Robo-Advisor market trends

- Detailed pest/porter’s five forces and swot analysis

- Banking Automation and Robo-Advisor market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Banking Automation and Robo-Advisor industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For