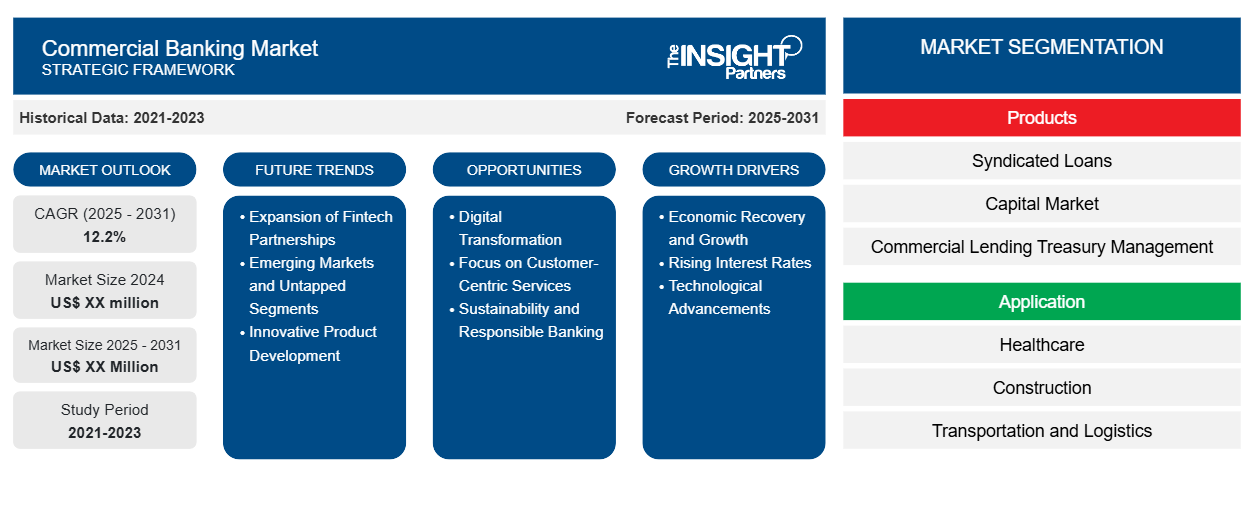

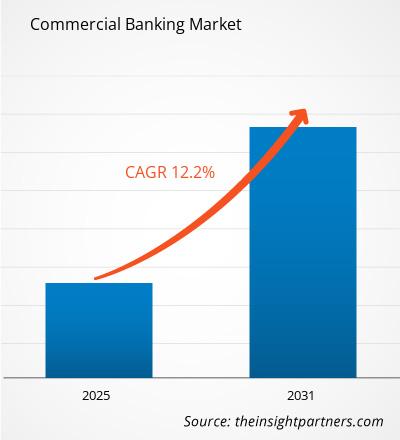

The Commercial Banking Market is expected to register a CAGR of 12.2% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The report is segmented by Products (Syndicated Loans, Capital Market, Commercial Lending Treasury Management, Project Finance, and Others). The report further presents analysis based on the Application (Healthcare, Construction, Transportation and Logistics, Media and Entertainment, and Others). The global analysis is further broken-down at regional level and major countries. The Report Offers the Value in USD for the above analysis and segments.

Purpose of the Report

The report Commercial Banking Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Commercial Banking Market Segmentation

Products

- Syndicated Loans

- Capital Market

- Commercial Lending Treasury Management

- Project Finance

Application

- Healthcare

- Construction

- Transportation and Logistics

- Media and Entertainment

Customizee This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONCommercial Banking Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Commercial Banking Market Growth Drivers

- Economic Recovery and Growth: The commercial banking market is significantly driven by the ongoing economic recovery and growth observed in various regions. As economies rebound from the impacts of the pandemic, businesses are increasingly seeking financial support for expansion, operational costs, and investments. This surge in demand for loans and credit facilities is prompting banks to enhance their lending capabilities. Moreover, a growing economy typically leads to increased consumer spending, which further stimulates the need for banking services, thereby driving growth in the commercial banking sector.

- Rising Interest Rates: The recent trend of rising interest rates is another critical driver for the commercial banking market. Higher interest rates are expected to attract deposits back to commercial banks, providing them with more funds for lending activities. This shift not only enhances banks' profitability through increased interest income but also encourages a more competitive lending environment. As banks adjust their strategies to capitalize on these higher rates, they are likely to innovate their product offerings, thus driving further growth in the commercial banking sector

.

- Technological Advancements: Technological advancements are reshaping the commercial banking landscape, serving as a significant driver for market growth. The integration of digital banking solutions, mobile applications, and advanced data analytics is enabling banks to enhance customer experiences and streamline operations. These technologies allow for more efficient transaction processing, improved risk assessment, and personalized banking services. As banks continue to invest in technology to meet evolving customer expectations, the commercial banking market is poised for substantial growth and transformation.

Commercial Banking Market Future Trends

- Expansion of Fintech Partnerships: The rise of fintech companies presents significant opportunities for traditional commercial banks. By partnering with fintech firms, banks can leverage innovative technologies and solutions to enhance their service offerings. These collaborations can lead to improved customer experiences, streamlined operations, and access to new markets. As banks seek to remain competitive in a rapidly evolving landscape, forming strategic alliances with fintechs can provide them with the agility and technological edge needed to thrive.

- Emerging Markets and Untapped Segments: There is a substantial opportunity for growth in emerging markets and untapped customer segments within the commercial banking sector. Many developing regions are experiencing economic growth and increasing demand for banking services. By expanding their presence in these markets, banks can tap into new customer bases and diversify their portfolios. Additionally, targeting underserved segments, such as small and medium-sized enterprises (SMEs) and rural populations, can provide banks with opportunities for growth and increased market share.

- Innovative Product Development: The commercial banking market is ripe for innovative product development, particularly in response to changing customer needs and preferences. Banks have the opportunity to create new financial products that cater to specific industries, demographics, or emerging trends, such as sustainability-focused loans or digital payment solutions. By being proactive in product innovation, banks can differentiate themselves in a competitive market and attract a broader range of customers, ultimately driving growth and profitability.

Commercial Banking Market Opportunities

- Digital Transformation: A prominent trend in the commercial banking market is the ongoing digital transformation of banking services. Financial institutions are increasingly adopting digital platforms to enhance customer engagement and streamline operations. This trend includes the implementation of online banking services, mobile apps, and automated customer service solutions. As customers demand more convenient and accessible banking options, banks are investing in technology to provide seamless digital experiences, which is becoming a critical differentiator in the competitive landscape.

- Focus on Customer-Centric Services: There is a growing trend towards customer-centric services in the commercial banking sector. Banks are recognizing the importance of understanding customer needs and preferences to tailor their offerings accordingly. This shift involves leveraging data analytics to gain insights into customer behavior and preferences, allowing banks to provide personalized products and services. By focusing on customer satisfaction and loyalty, banks aim to enhance their competitive edge and foster long-term relationships with clients.

- Sustainability and Responsible Banking: Sustainability is becoming an increasingly important trend in the commercial banking market. Financial institutions are recognizing the need to incorporate environmental, social, and governance (ESG) factors into their operations and lending practices. This trend is driven by growing consumer awareness and demand for responsible banking practices. Banks are now focusing on financing sustainable projects, promoting green initiatives, and adopting ethical lending policies. This shift not only aligns with global sustainability goals but also attracts a new segment of environmentally conscious customers.

Commercial Banking Market Regional Insights

The regional trends and factors influencing the Commercial Banking Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Commercial Banking Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Commercial Banking Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 12.2% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Products

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Commercial Banking Market Players Density: Understanding Its Impact on Business Dynamics

The Commercial Banking Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Commercial Banking Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Commercial Banking Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Commercial Banking Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

Frequently Asked Questions

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For