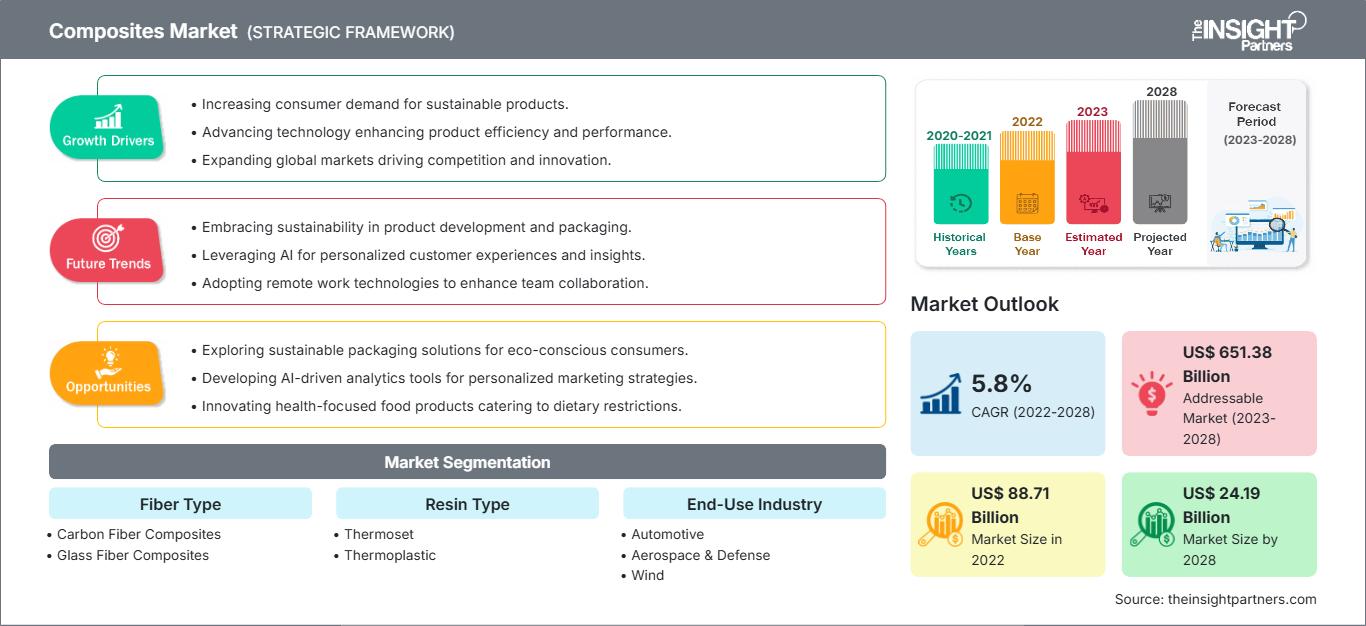

Composites Market Dynamics and Developments by 2028

Composites Market Forecast to 2028 - COVID-19 Impact and Global Analysis By Fiber Type (Carbon Fiber Composites, Glass Fiber Composites, and Others), Resin Type [Thermoset (Polyester, Vinyl Ester, Epoxy, Polyurethane, and Others) and Thermoplastic (Polypropylene, Polyethylene, Polyvinylchloride, Polystyrene, Polyethylene Terephthalate, Polycarbonate, and Others)], and End-Use Industry (Automotive, Aerospace & Defense, Wind, Construction, Marine, Sporting Goods, and Others)

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2028- Report Date : Mar 2026

- Report Code : TIPRE00005319

- Category : Chemicals and Materials

- Status : Upcoming

- Available Report Formats :

- No. of Pages : 160

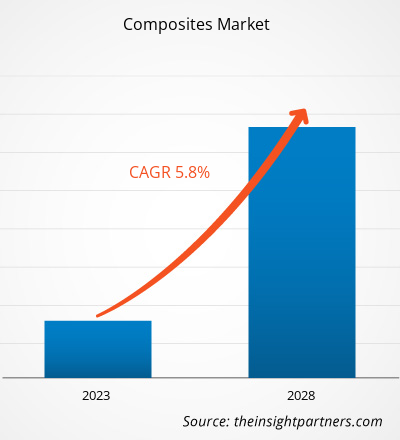

The composites market size is expected to grow from US$ 88,710.42 million in 2022 to US$ 124,185.35 million by 2028; it is estimated to grow at a CAGR of 5.8% from 2022 to 2028.

Composites are light in weight as compared to most woods and metals. The lightweight property of composites makes their usage important in automobiles and aircraft, where less weight offers better fuel efficiency. Nowadays, designers of airplanes are greatly concerned with weight, as reducing a craft’s weight reduces the amount of fuel it needs and increases the speed it can reach. Moreover, composites resist damage from the weather and harsh chemicals. They can be molded into complicated shapes more easily than most other materials.

In 2022, Asia Pacific held the largest revenue share of the global composites market. The demand for composites in Asia Pacific is increasing due to the growing use of composites in various end-use industries such as automotive, wind energy, construction, sporting goods, and many others. The growing building & construction industry is a strong contributor to the composites market growth in the region. Asia Pacific is witnessing urbanization, along with the rising construction of residential and commercial projects. Moreover, the per capita income in the region has increased, coupled with the development of affordable residential buildings. This has resulted in rapid urbanization in Asia Pacific. The beneficial government policies related to residential property developments in several countries of the region propelled urbanization. Moreover, countries such as China and India are amongst the world’s top five countries with installed wind power. All these factors positively contribute to the composites market growth in the region.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONComposites Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Composites Market

Industries such as automotive, aerospace, construction, marine, and energy have been the major contributors to the demand for composites. In 2020, these industries had to slow down their operations due to disruptions in the value chain caused by the shutdown of national and international boundaries. The shortage of manpower resulted in the deceleration of composite production and distribution operations. Disruptions in the global supply chain and shutdown of resin production facilities led to a severe spike in the prices of composites. Lockdowns imposed by different countries in 2020 hampered the ability of industries to maintain inventory levels. Moreover, sanitary measures and other COVID-19 precautions significantly reduced production capacity, creating a shortage of composite inventory. However, in 2021, the global marketplace began recovering from the losses incurred in 2020 as governments of different countries announced relaxation in social restrictions. Moreover, rising vaccination rates contributed to improvements in the overall conditions in different countries, which led to conducive environments for industrial and commercial progress. According to the World Economic Forum, the COVID-19 pandemic has the potential to bring innovations in home designs and is expected to provide new opportunities in the field of house renovation. This factor is projected to provide lucrative opportunities for the composites market growth during the forecast period.

Market Insights

Increasing Demand for Lightweight Materials from Automotive & Aerospace Industry

Automotive manufacturers prefer lightweight materials for manufacturing automobiles while ensuring safety and performance. Lightweight materials have excellent potential for increasing fuel efficiency. A 10% decrease in vehicle weight can result in a 6–8% enhancement in fuel economy. Advanced materials such as carbon fiber composites have the potential to reduce the weight of automotive components by 50-75%. The application of composites in the automotive sector continues to grow. Plastic composites have excellent acoustic and thermal properties compared to composites of nonrenewable origin, making them ideal for vehicle’s interior parts. Further, they are suitable for the manufacturing of non-structural interior components, including seat fillers, seat backs, headliners, interior panels, and dashboards. In addition, aircraft manufacturers are making efforts to enlarge primary thermoplastic structures in business jets and commercial aircraft. They have been the early adopters of long fiber-reinforced thermoplastics.

Fiber Type Insights

Based on fiber type, the global composites market is segmented into carbon fiber composites, glass fiber composites, and others. The global composites market share for the glass fiber composites segment was the largest in 2022. Glass fiber composites are produced by various manufacturing technologies and are used for a wide range of applications. Glass fibers showcase several properties, namely, high strength, flexibility, durability, and resistance to chemical damage. It can be in the form of roving, chopped strands, yarns, fabrics, and mats. Each type of glass fiber has distinct properties and is used for various applications in the form of polymer composites. Glass fiber composite materials are highly preferred for industrial applications due to their favorable characteristics such as high strength-to-weight ratio, good dimensional stability, good resistance to heat & corrosion, good electrical insulation properties, ease of fabrication, and relatively low cost.

The key players operating in the global composites market include DuPont de Nemours Inc, Gurit Holding AG, Hexion Inc, Mitsubishi Chemical Holdings Corp, Nippon Electric Glass Co Ltd, Owens Corning, SGL Carbon SE, Teijin Ltd, Solvay SA, and Toray Industries Inc. Players operating in the global composites market focus on providing high-quality products to fulfill customer demand. They are also focusing on strategies such as investments in research and development activities and new product launches.

Report Spotlights

- Progressive industry trends in the composites market to help players develop effective long-term strategies

- Business growth strategies adopted by developed and developing markets

- Quantitative analysis of the composites market from 2020 to 2028

- Estimation of global demand for composites

- Porter’s Five Forces analysis to illustrate the efficacy of buyers and suppliers operating in the industry

- Recent developments to understand the competitive market scenario

- Market trends and outlook, as well as factors driving and restraining the growth of the composites market

- Assistance in the decision-making process by highlighting market strategies that underpin commercial interest, leading to the market growth

- The composites market size at various nodes

- Detailed overview and segmentation of the market, as well as the composites industry dynamics

- The composites market size in various regions with promising growth opportunities

The regional trends and factors influencing the Composites Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Composites Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Composites Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 88.71 Billion |

| Market Size by 2028 | US$ 24.19 Billion |

| Global CAGR (2022 - 2028) | 5.8% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Fiber Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Composites Market Players Density: Understanding Its Impact on Business Dynamics

The Composites Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Composites Market top key players overview

Global Composites Market

Based on fiber type, the global composites market is segmented into carbon fiber composites, glass fiber composites, and others. Based on resin type, the global composites market is bifurcated into thermoset and thermoplastic. The thermoset segment is further segmented into polyester, vinyl ester, epoxy, polyurethane, and others. The thermoplastic segment is subsegmented into polypropylene, polyethylene, polyvinylchloride, polystyrene, polyethylene terephthalate, polycarbonate, and others. Based on end-use industry, the global composites market is segmented into automotive, aerospace & defense, wind, construction, marine, sporting goods, and others.

Company Profiles

- DuPont de Nemours Inc

- Gurit Holding AG

- Hexion Inc

- Mitsubishi Chemical Holdings Corp

- Nippon Electric Glass Co Ltd

- Owens Corning

- SGL Carbon SE

- Teijin Ltd

- Solvay SA

- Toray Industries Inc.

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For