Educational Furniture Market Key Players and Forecast by 2030

Educational Furniture Market Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis By Material (Wood, Plastic, Metal, and Others), Product Type (Benches and Chairs, Desks and Tables, Storage Units, and Others), and End Use (Institutional [Elementary School, Secondary School, and Higher Education] and Residential)

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Report Date : Nov 2023

- Report Code : TIPRE00028349

- Category : Consumer Goods

- Status : Published

- Available Report Formats :

- No. of Pages : 154

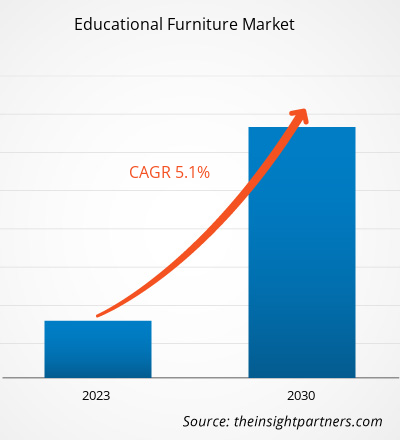

[Research Report] The educational furniture market size is projected to grow from US$ 7,783.45 million in 2022 to US$ 11,611.64 million by 2030; the market is expected to register a CAGR of 5.1% from 2022 to 2030.

Market Insights and Analyst View:

Educational furniture includes desks, chairs, whiteboards, cabinets, storage cabinets, and locker desks. The rising requirement for ergonomic furniture designs to ensure the proper posture of children is one of the key factors driving the demand for modern educational furniture in elementary schools. The rising trend of micro-schooling, especially after the pandemic, drives the demand for flexible educational furniture. Micro-schools provide personalized learning environments due to their smaller class size. These schools require flexible furniture such as round tables, stools, soft-seating chairs, and adjustable desks to accommodate individual work, group projects, and interactive small-group activities promoting easy learning. Further, increased focus on aesthetics drives the demand for stylish yet durable furniture that creates comfortable learning spaces that keep students focused. These factors significantly drive the growth of educational furniture market.

Growth Drivers and Challenges:

Schools and universities strive to operate with greater sensitivity toward the environment; thus, the demand for sustainable educational furniture is rising. Green classrooms and school-wide “go green” initiatives are growing as educators encourage students to adopt values supporting environment-friendly behavior. Sustainable storage products, chairs, and desks are widely preferred in classrooms across the world. Such furniture products are manufactured using eco-friendly materials such as polypropylene, renewable timber, or steel, which meet emission standards mandatory for approval; moreover, they are designed to maintain indoor air quality.

Using sustainable materials in furniture manufacturing also allows manufacturers to recycle product waste, thus preventing the deposition of waste into landfills. For example, Paragon Furniture Inc. uses recycled or recovered fibers for manufacturing its wood products. Governments of various countries are encouraging enterprises to introduce products that promote the sustainable construction of schools. Similarly, the Leadership in Energy and Environmental Design (LEED) Green Building Rating System by the US Green Building Council encourages the construction of sustainable, high-performance facilities, and the adoption of sustainable furniture in schools and other educational facilities. A rise in the number of such initiatives to promote sustainable infrastructure is likely to create lucrative opportunities for the growth of the educational furniture market in the coming years.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONEducational Furniture Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The "Global Educational Furniture Market" is segmented on the basis of material, product type, end use, and geography. Based on material, the educational furniture market is segmented into wood, plastic, metal, and others. By product type, the market is segmented into benches and chairs, desks and tables, storage units, and others. In terms of end use, the market is categorized into institutional and residential. The institutional segment is further segmented into elementary school, secondary school, and higher education. Geographically, the educational furniture market is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Russia, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America)

Segmental Analysis

Based on material, the educational furniture market is segmented into wood, plastic, metal, and others. In 2021, the wood segment held the largest market share. Wooden furniture is among the most popular furniture globally, owing to its durable and low-maintenance nature compared to other materials. Additionally, wood furniture is one of the most eco-friendly and highly sustainable solutions compared to plastic or other manmade materials. Owing to its high demand among the consumers, wood is conventionally the most preferred material for furniture production.

By end use, the institutional segment held the largest share in 2022. The digital transformation of the education sector has bolstered the demand for furniture catering to digital learning requirements. Colleges and universities are increasingly investing in furniture that can accommodate laptops, tablets, and digital textbooks. These institutes are also investing in aesthetic furniture for high-visibility areas such as libraries, cafeterias, laboratories, and conference rooms to attract students as well as faculty and improve the learning environment. The number of students enrolled in colleges, universities, and schools is increasing with time owing to rising importance of primary as well as higher education in developed as well as developing countries across the globe. According to the National Center for Education Statistics, in 2021, about 19 million students in the US attended colleges and universities. With increasing number of student enrollments, there is a rising need for modern, ergonomically designed educational furniture. This factor is significantly driving the educational furniture market growth.

Regional Analysis:

Based on geography, the educational furniture market is divided into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. The global educational furniture market was dominated by North America, which accounted for US$ 3,493.99 million in 2022. Europe is a second major contributor, holding approximately 24% share of the global market. Additionally, Asia Pacific is expected to grow considerably at a CAGR of 5–6% during the forecast period. The US is a major contributor to the regional market, followed by Canada and Mexico, respectively. Educational institutions in North America are upgrading their existing resources and procuring innovative furniture. Effective manufacturing and trade policies are also contributing to the growth of the educational furniture market. In addition, ergonomically designed school furniture to prevent health issues in children, especially arising from incorrect posture, is gaining significant traction in this region. The US marks the presence of major educational furniture manufacturers, namely Fleetwood Furniture, Herman Miller Inc, and Steelcase Inc. Further, Simplova, Institutional Furniture Ltd, RJH Solutions, and CDI Spaces are among the educational furniture manufacturers and suppliers operating in Canada. According to the 2021 Infrastructure Report Card published by the American Society of Civil Engineers, there are ~84,000 public schools with ~100,000 buildings in the US, with an estimated enrollment of 56.8 million by 2026. Thus, an increase in the number of schools, an inclination toward modern and ergonomic furniture, and the presence of educational furniture manufacturers are expected to boost the educational furniture market in North America during the forecast period.

Industry Developments and Future Opportunities:

Various initiatives taken by the key players operating in the educational furniture market are listed below:

- In 2022, AFC Furniture Solutions acquired Wipro Enterprises, which designs and owns brands such as Xbench, Vibrant, and Livo.

- In 2023, Smith System and its parent company, Steelcase, announced the designation of six new premier dealer partners.

The regional trends and factors influencing the Educational Furniture Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Educational Furniture Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Educational Furniture Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 7.78 Billion |

| Market Size by 2030 | US$ 11.61 Billion |

| Global CAGR (2022 - 2030) | 5.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Material

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Educational Furniture Market Players Density: Understanding Its Impact on Business Dynamics

The Educational Furniture Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Educational Furniture Market top key players overview

COVID-19 Impact:

During the initial phase of the COVID-19 pandemic, the implementation of lockdown restrictions and shutdown of manufacturing units led to production shortfall, creating a demand and supply gap. The profitability of various small-scale and large-scale educational furniture manufacturers were hevily hampered. However, educational institutes and schools were working remotely through online classes, which surged the demand for furniture such as desks and chairs at home. Due to the remote working of schools and colleges and the increase in online coaching, there was an increase in the demand for educational furniture products owing to the increasing need for comfortable seating at home.

In 2021, various economies resumed operations as governments of various countries announced relaxation in the previously imposed restrictions, which boosted the global marketplace. Manufacturers were permitted to operate at full capacity, which helped them overcome the demand and supply gap and other repercussions. As numerous citizens of many countries were fully vaccinated by 2021, the educational furniture manufacturers focused on increasing their production to revive their businesses. This positively impacted the growth of the educational furniture market.

Competitive Landscape and Key Companies:

The top 10 companies operating in the global educational furniture market are AFC Furniture Solutions Pvt Ltd, Fleetwood Group Inc, Scholar Craft Products Inc, Smith Systems Manufacturing Co, Knoll Inc, Haworth Inc, Vitra International AG, Virco Manufacturing Corp, Office Line Srl, and Creaciones Falcon SLU. These players focus on developing innovative furniture with ergonomic designs to cater to the consumer demand.

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For