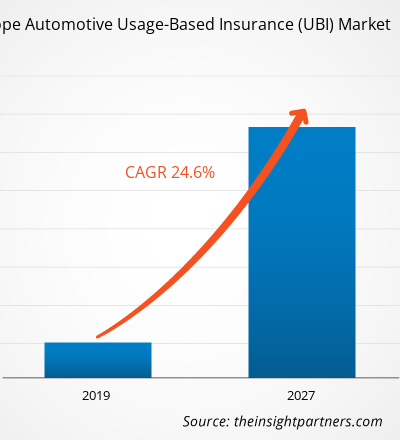

Automotive UBI market in Europe is expected to grow from US$ 6.01 Bn in 2018 to US$ 43.30 Bn by the year 2027 with a CAGR of 24.6% from the year 2019 to 2027.

The rising trend of mobility-as-a-service (MaaS) and wide-range of insurance premiums are boosting the growth of the automotive UBI market. Moreover, the significant partnerships among the insurance companies and telematics companies are anticipated to propel automotive UBI market growth in the forecast period. The UBI market is maturing substantially over the years in the countries, namely the US, Italy, and the UK. The insurance companies offering telematics insurance is constantly leveraging on various factors to enhance the solutions and deliver their customers with better schemes. One of the significant trends in the automotive UBI market is the increasing number of partnerships among telematics companies and insurance companies. These partnerships are nourishing the UBI ecosystems in various countries, and the same trend is anticipated to increase the market size in the coming years. For instance, Vodafone Automotive and Generali Spain to boost the telematics insurance sector in the Spanish automotive industry. Generali Spain is one of the leading insurance providers, and with this partnership, both the companies are expected to digitalize the vehicle insurance sector. Further, Allianz, a prominent insurance brokerage company, extended its partnership with Marmalade, a British insurance company. The agenda of this partnership was to offer the insurance policyholders a smart digital customer interaction platform through new mobile application and portal.

The PHYD segment is one of the leading policy types with the highest market share in the Europe automotive UBI market. UBI utilizes actual driver data for calculating the premiums, which are more discrete and precise than traditional methods. This results in potential savings to the customers’. The two basic types of automotive UBI include pay-as-you-drive (PAYD) and or pay-how-you-drive (PHYD). Each of these types is analyzed slightly different information to determine premium rates for customers’. The PHYD method of calculating UBI also helps in reducing accident frequency as the driver is cautious about driving behavior. Moreover, since the risk rate of an accident is high for young drivers, PHYD for teen drivers is resulting beneficial for society. PHYD is more mature than PAYD, contributing more comprehensive data to customers and insurers. Also, for insurers, PHYD offers benefits such as price accuracy, correction of risk misclassifications, enabling lower premiums, and fighting fraudulent claims, etc.

Italy dominated the automotive UBI market in 2018 and is anticipated to continue its dominance in the market across the European region through the forecast period. The automotive UBI market in Europe is dominated by Italy and the UK, however, acceptance in other markets are noticeably lower. Some of the countries that are expected to witness growth in the near future include Spain, France, Austria, Scandinavia, Benelux, Switzerland, and Germany, among others. The figure given below highlights the revenue share of the Canada in the European Automotive UBI market in the forecast period:

Rest of Europe Automotive UBI Market Revenue and Forecasts to 2027 (US$ Bn)

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

EUROPE AUTOMOTIVE UBI MARKET SEGMENTATION

By Technology Fitted

• Smartphones• Black Box • Dongles• OthersBy Policy Type

• Pay-As-You-Drive (PAYD)• Pay-How-You-Drive (PHYD)By Country

• Italy• UK• Germany• Rest of EuropeAutomotive UBI Market - Companies Mentioned

• Allstate Insurance Company• Allianz SE • Ingenie Services Limited• Octo Telematics S.p.A• Vodafone Automotive S.P.A.• AXA SA• Liberty Mutual Insurance Company• TomTom Telematics BV• Sierra Wireless, Inc.• Unipolsai Assicurazioni S.p.A.Europe Automotive Usage-Based Insurance (UBI) Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 6.01 Billion |

| Market Size by 2027 | US$ 43.30 Billion |

| Global CAGR (2019 - 2027) | 24.6% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Technology Fitted

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Occupational Health Market

- Pressure Vessel Composite Materials Market

- Radiopharmaceuticals Market

- Smart Parking Market

- Legal Case Management Software Market

- Extracellular Matrix Market

- Greens Powder Market

- Parking Management Market

- Artificial Intelligence in Healthcare Diagnosis Market

- Drain Cleaning Equipment Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Technology Fitted, and Policy Type

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

UK, Germany, France, Italy, Russia

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

The List of Companies

- Allianz SE

- Assicurazioni Generali S.p.A.

- AXA SA

- Liberty Mutual Insurance Company

- MS&AD Insurance Group Holdings, Inc.

- Octo Telematics S.p.A

- Sierra Wireless, Inc.

- TomTom Telematics BV

- Unipolsai Assicurazioni S.p.A.

- Vodafone Automotive S.P.A

Get Free Sample For

Get Free Sample For