Page Updated:

Jan 2022

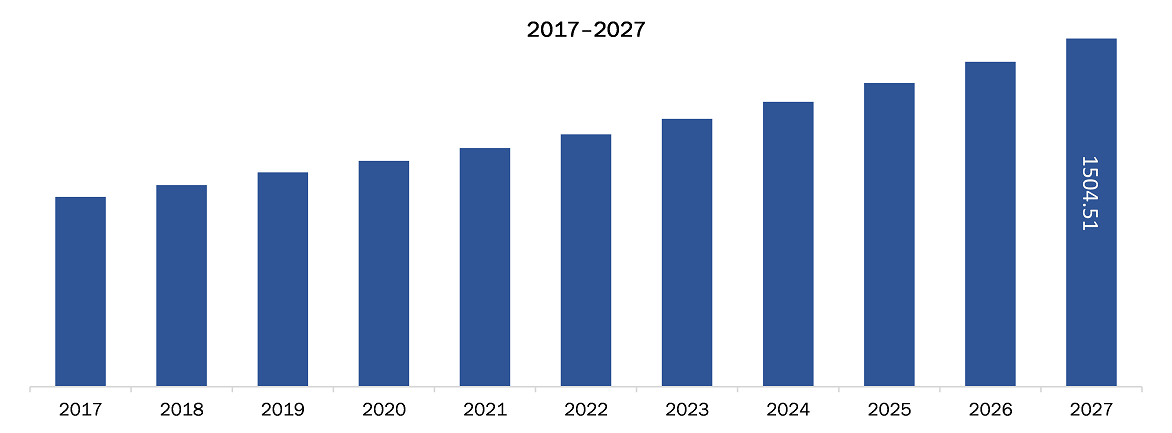

The Carbon Fiber Market in Europe is expected to grow from US$ 721.82 million in 2019 to US$ 1504.51 million by 2027; it is estimated to grow at a CAGR of 9.8% from 2020 to 2027.

The UK, Russia, and Germany are major economies in Europe. Surge in demands from automotive and aerospace applications recently gained momentum after weak growth over the past few years the automotive manufacturers are demanding new and innovative high-quality material for producing automotive components. As carbon fibers offer high modulus and specific strength, fatigue strength, stiffness, and pressure-withstanding capacity; lower thermal expansion coefficient; corrosion resistance; and other beneficial properties; these are being widely used in the automotive and other industrial applications. These fibers are widely preferred over aluminum and steel. Also, the rising demands of lightweight materials, along with government initiatives to reduce the harmful gas emissions and increase fuel efficiency, is expected to drive the market for carbon fiber in automotive applications. The carbon fibers are widely used for transporting and storing liquefied and compressed natural gas in automotive applications, with major demands from Europe. Furthermore, carbon fiber is also used in the aerospace industry. Carbon fiber has high chemical resistance, tensile strength, stiffness, and low thermal expansion and weight properties which makes it suitable for aerospace application. It is used in designing, assembling, and manufacturing various types of aircraft. Over the past few years, the aerospace industry has switched from aluminum material to carbon fiber for the construction of the aircraft. Carbon fiber aircraft will burn and consume lesser amount of fuel due to its lightweight. Due to lesser fuel consumption, the aircraft will also have enough fuel left to cover long distances. These advantages of carbon fiber provide a lucrative opportunity for market players over the forecast period. Carbon fiber is also used in high-end bike frames, tennis rackets and surfboards is also bolstering the growth of the industry.

In Europe, currently the UK and Russia are the hardest-hit countries by the coronavirus pandemic. It is estimated to suffer an economic hit due to a lack of revenue from various industries, as the country recorded the highest number of coronavirus cases followed by France, Spain, Italy, and Germany. Other member states have implemented drastic measures and travel restrictions, including partially closing their borders. This is anticipated to impact market growth in Europe

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the Carbon Fiber Market Europe Carbon Fiber Market is expected to grow at a good CAGR during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Europe Carbon Fiber Market Segmentation

Europe Carbon Fiber Market – By Raw Material

- PAN

- Pitch

Europe Carbon Fiber Market– By End Use Industry

- Automotive

- Aerospace and Defense

- Construction

- Sporting Goods

- Wind Energy

- Others

Europe Carbon Fiber Market – By Country

- Germany

- France

- Hungary

- UK

- Russia

- Rest of Europe

Europe Carbon Fiber Market -Companies Mentioned

- DowAksa

- Formosa Plastic Corporation

- Hexcel Corporation

- Hyosung Corporation

- Kureha Corporation

- Mitsubishi Chemical Corporation

- SGL Carbon

- Solvay

- Teijin Limited

- Toray Industries,Inc

Europe Carbon Fiber Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 721.82 Million |

| Market Size by 2027 | US$ 1504.51 Million |

| CAGR (2020 - 2027) | 9.8% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Raw Material

|

| Regions and Countries Covered |

Europe

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Our Clients

Sales Assistance

US: +1-646-491-9876

UK: +44-20-8125-4005

Email:

sales@theinsightpartners.com

Chat with us

87-673-9708

ISO 9001:2015

Get Free Sample For

Get Free Sample For