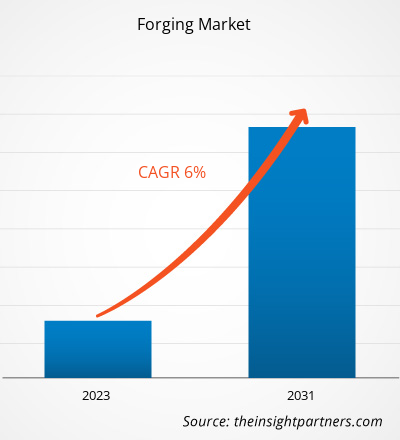

The forging market size is projected to reach US$ 124.7 billion by 2031 from US$ 78.1 billion in 2023. The market is expected to register a CAGR of 6% during 2023–2031. A rise in investment toward renewable energy generation and increased demand from the aerospace, automotive, and construction industries are a few factors driving the forging market.

Forging Market Analysis

The global forging market is growing modestly owing to the increasing demand from the automotive and aerospace industries. The rising air passenger traffic has resulted in the expansion of the aerospace sector, boosting the manufacturing of forged aerospace parts. Also, various governments across the globe are increasingly investing in wind energy projects, which is surging the demand for wind energy forged components. However, the availability of cheap substitutes and high costs are restraining the forging market expansion to a certain extent.

Forging Market Overview

With the mounting population and industrialization, the demand for energy is rising at the global level. The rise in energy consumption has boosted the need for investment in power generation plants and infrastructure development, further driving the demand for forged components such as fitting, flanges, valves, studs, vessels, and nuts. The forging industry has achieved a significant place in the global industrial economy by producing components with unique advantages that are difficult to duplicate. The strength, reliability, and durability of forged components have made them the preferred choice in a variety of industrial applications where fatigue life and fracture toughness are critical to the safety of people and equipment.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Forging Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Forging Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Forging Market Drivers and Opportunities

Increasing Demand for Forged Steel in Automotive Industry

The durability, reliability, and strength of steel forgings make it a preferred choice in the automotive industry. Stainless steel, alloy, and carbon steel are among the extensively used steel types in the automotive industry for producing various components such as connecting rods, control arms, rocker arms, crankshafts, camshafts, tie rod ends, and steering knuckles. The steel forging process can produce automotive parts with near-net shapes, requiring no further machining through the closed die method, thus saving both money and time. Also, the closed die forging method can be used to customize all kinds of automotive components made from steel alloys, such as ASTM4140 steel and AISI 1045 steel. The closed die steel forging techniques are mostly used for manufacturing automotive parts for various commercial and passenger vehicles and lightweight steel forgings for electric vehicles (EVs). Thus, the growing use of forged steel in the automotive industry is driving the forging market.

Improving Economic Conditions and Technological Advancements in Forging Equipment and Process

In the fast-developing industries, the demand for complex and innovative forged products is rising. The automated closed die forging process has drawn the attention of equipment suppliers toward the development of new forging equipment and forging processes. In commercial aerospace applications, these new forging machines are able to forge extra-large nickel- and titanium-based alloy parts. Currently, automation in the industry has a moderate positive impact on the growth of the closed-die forging market, but it is expected to increase during the forecast period.

The companies operating in this market are engaged in providing lean, resilient, flexible, and adaptable forging processes to sustain the rising competition in the metal forming market. Further, end-use industries such as oil & gas, shipbuilding, automotive, power generation, aerospace, and construction are experiencing significant growth in nations such as India and China for closed-die forged products. Thus, improving economic conditions and constant technological innovations in forging techniques are expected to provide opportunities in the forging market during the forecast period.

Forging Market Report Segmentation Analysis

The key segments that contributed to the derivation of the forging market analysis are technique, material, and industry.

- Based on technique, the forging market has been divided into closed-die forging, open-die forging, and seamless forging. The closed die forging segment held the largest market share in 2023.

- Based on material, the forging market has been divided into nickel-based alloys, titanium alloys, aluminum alloys, steel alloys, and others. The steel alloys segment held the largest market share in 2023.

- By industry, the market is segmented into automotive, aerospace, railway, heavy equipment, and wind power. The automotive segment dominated the market in 2023.

Forging Market Share Analysis by Geography

The geographic scope of the forging market report is mainly classified into five regions: North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America.

Asia Pacific dominated the forging market in 2023. The Asia Pacific forging market is segmented into Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific. The rising demand for metal-forged components from applications including railway, construction, power generation, aerospace, and automotive is anticipated to fuel the forging market growth during the forecast period. China is the key consumer and manufacturer of metal forgings in Asia Pacific. China is exporting a large number of forged products to American and European countries. The presence of various associations in China working for the growth of the forging process is one of the major factors contributing to the growth of the forging market.Moreover, due to market and government pressure, China’s forging industry is striving to produce forgings with higher precision, higher efficiency, more pervasive digitalization, lighter weight, and lower energy consumption. Many excellent achievements have been observed recently in forging-machinery R&D and manufacturing, application of simulation, IT application and especially precision forging.

Forging Market Regional Insights

The regional trends and factors influencing the Forging Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Forging Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Forging Market

Forging Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 78.1 Billion |

| Market Size by 2031 | US$ 124.7 Billion |

| Global CAGR (2023 - 2031) | 6% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Technique

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Forging Market Players Density: Understanding Its Impact on Business Dynamics

The Forging Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Forging Market are:

- Alcoa Corporation

- All Metals & Forge Group

- CFS Machinery Co., Ltd.

- Ficep SpA

- Bharat Forge Limited

- Allegheny Technologies Incorporated

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Forging Market top key players overview

Forging Market News and Recent Developments

The forging market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the forging market are listed below:

- In April 2024, Ramkrishna Forgings signed a supply agreement with the largest passenger EV manufacturer in the US. Through this deal, the company will supply powertrain components and debut as a supplier in the US EV market.

- In February 2024, US Forged Rings announced an investment of US$ 700 million in the offshore wind industry for the construction of a tower fabrication facility and a steel forging plant. Through this development, the company will strengthen its position in the market.

Forging Market Report Coverage and Deliverables

The “Forging Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Forging market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Forging market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Forging market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the forging market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

Get Free Sample For

Get Free Sample For