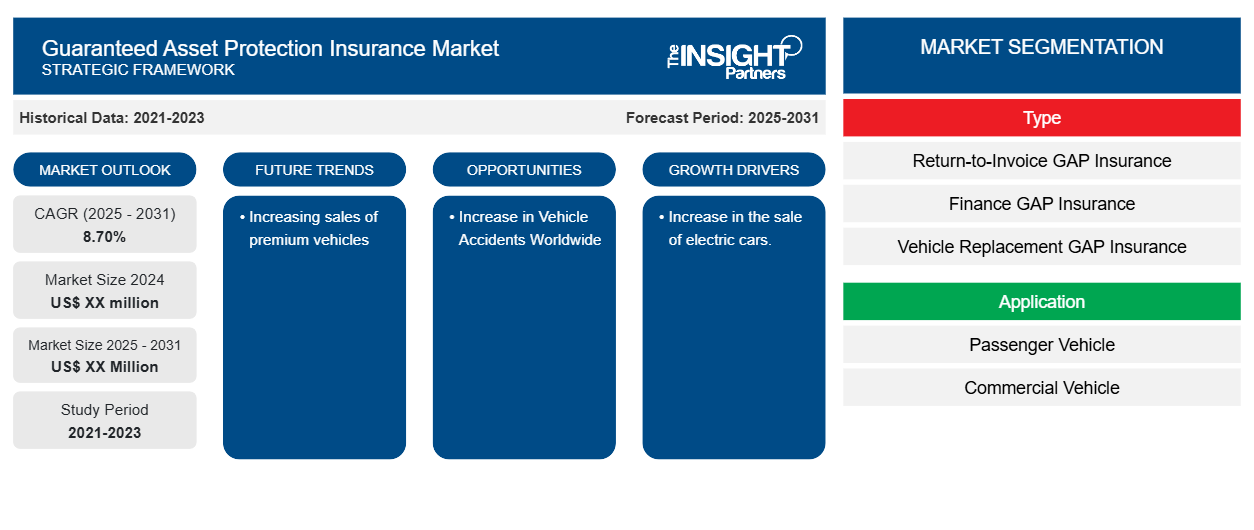

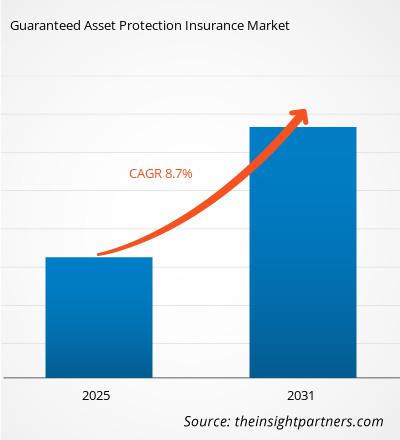

The guaranteed asset protection insurance market size is expected to register a CAGR of 8.7% during 2023–2031. Increasing sales of premium vehicles is likely to remain a key trend in the market.

Guaranteed Asset Protection Insurance Market Analysis

The guaranteed asset protection insurance market includes growth prospects owing to the current market trends and their foreseeable impact during the forecast period. The guaranteed asset protection insurance market is growing due to the increase in the sale of electric cars. The increase in vehicle accidents worldwide provides lucrative opportunities for guaranteed asset protection insurance market growth.

Guaranteed Asset Protection Insurance Market Overview

GAP is an optional product that covers the difference between the amount consumers owe on auto loans and the amount the insurance company pays if a consumer’s car is stolen. Standard auto insurance only pays an amount up to the value of your vehicle. However, GAP covers the loss customers would suffer if their loan balance is higher than the value of the vehicle. The settlement amount is determined by subtracting depreciation for the vehicle's age, mileage, physical condition, and other factors from the car's original cost, which is the car's actual cash value at the time of the occurrence.

Customizee This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONGuaranteed Asset Protection Insurance Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Guaranteed Asset Protection Insurance Market Drivers and Opportunities

Increase in the Sale of Electric Cars to Favor Market

The demand for electric vehicles is growing at a faster rate from 2021, owing to increasing investment in manufacturing plants. The growing demand for electric vehicles is primarily attributed to the increasing demand for low-emission vehicles, and growing supportive regulations for zero-emission vehicles through subsidies & tax rebates have compelled manufacturers to provide electric cars across the globe. As per the Global Electric Vehicle Outlook, sales of electric cars exceeded 10 million, with 14% of all new cars sold being electric, a jump from 9% in 2021. Moreover, 2.3 million EVs were sold only in the first quarter of 2023. Thus, an increase in the sale of electric cars will drive the guaranteed asset protection insurance market growth.

Increase in Vehicle Accidents Worldwide

According to the Global Status Report on Road Safety by the World Health Organisation (WHO), approximately 1.19 million people die each year due to road traffic crashes. Between 20 and 50 million more people suffer non-fatal injuries, with many incurring a disability. Due to such increasing road accidents, guaranteed asset protection insurance is necessary as it will reimburse costs based on the current value of the car after an accident.

Guaranteed Asset Protection Insurance Market Report Segmentation Analysis

Key segments that contributed to the derivation of the guaranteed asset protection insurance market analysis are type and application.

- Based on type, the guaranteed asset protection insurance market is divided into return-to-invoice GAP insurance, finance GAP insurance, vehicle replacement GAP insurance, return-to-value GAP insurance, and others.

- By application, the market is segmented into passenger vehicles and commercial vehicles.

Guaranteed Asset Protection Insurance Market Share Analysis by Geography

The geographic scope of the guaranteed asset protection insurance market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America. North America is expected to grow with the highest CAGR in the market over the forecast period.

The total passenger car sales in North America was 13.9 million units in 2022, according to the OICA. The US is the largest car market, accounting for over 90% of North America’s sales volume. Canada is the second largest car market in the region, with sales of 2.2 million units in 2022. As per the data published by the International Energy Agency (IEA), the demand for battery electric vehicles (BEV) in the US grew from 231 thousand units in 2021 to 466 thousand units in 2021; also, the demand for plug-in hybrid electric vehicles (PHEV) increased from 64 thousand units in 2021 to 165 thousand units in 2021. Such increased growth of vehicles drives the region’s growth.

Guaranteed Asset Protection Insurance Market Regional Insights

The regional trends and factors influencing the Guaranteed Asset Protection Insurance Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Guaranteed Asset Protection Insurance Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Guaranteed Asset Protection Insurance Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 8.70% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Guaranteed Asset Protection Insurance Market Players Density: Understanding Its Impact on Business Dynamics

The Guaranteed Asset Protection Insurance Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Guaranteed Asset Protection Insurance Market top key players overview

Guaranteed Asset Protection Insurance Market Report Coverage and Deliverables

The “Guaranteed Asset Protection Insurance Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Guaranteed asset protection insurance market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Guaranteed asset protection insurance market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Guaranteed asset protection insurance market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the guaranteed asset protection insurance market

- Detailed company profiles

Frequently Asked Questions

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For