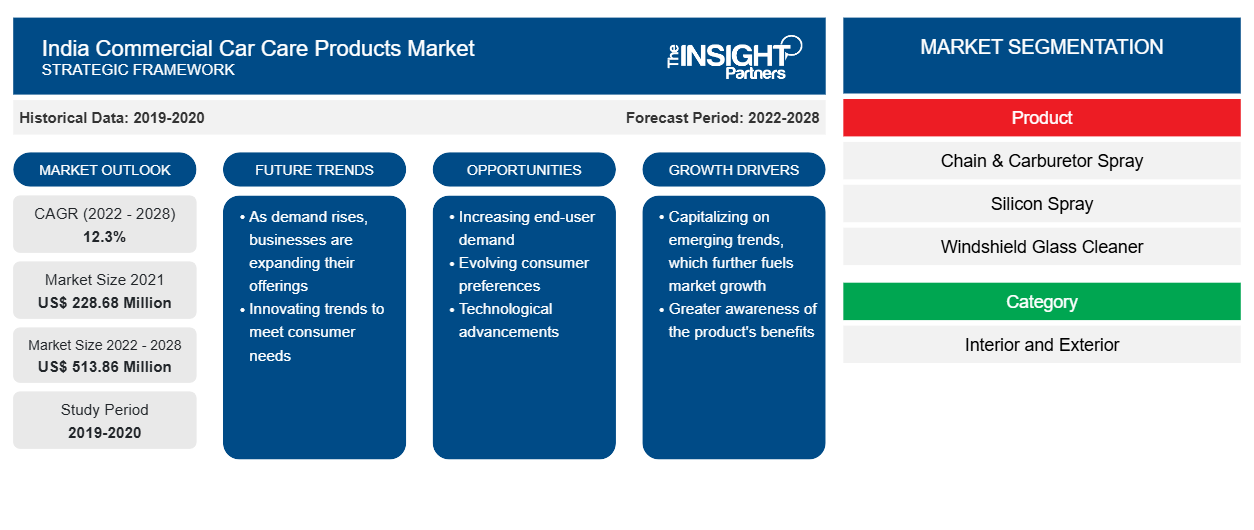

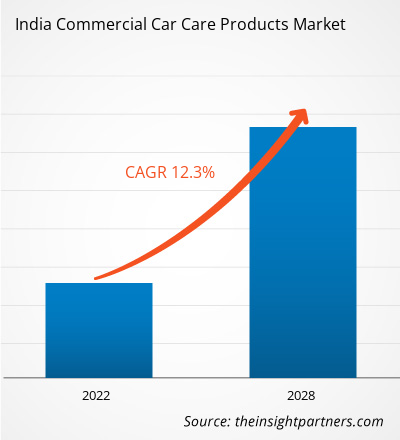

The India commercial car care products market is expected to grow from US$ 228.68 million in 2021 to US$ 513.86 million by 2028; it is estimated to grow at a CAGR of 12.3% from 2022 to 2028.

In India, a resurgence in new and used vehicle sales, aided by a rise in travel rates, is expected to boost the demand for auto maintenance products rapidly further influencing the demand in the India commercial car care products market. India Automotive Mission Plan 2016-26 is a collaborative endeavor by the Indian government and the Indian automotive industry to develop a path for the sector's development. India is a major vehicle exporter with excellent export growth prospects. Furthermore, various initiatives by the Indian government and key automotive manufacturers in the Indian market are predicted to propel the country to the forefront of the global two-wheeler and four-wheeler industries by the end of 2022.

This is predicted to enhance the demand for commercial car care products in the India commercial car care products market. For example, 3M gained 3.28% growth when the company resumed its Technological City plant operations in Bangalore on Wednesday, May 19, 2021. Moreover, Turtle Wax India plans to quadruple revenues in 2022. The company is optimistic about growth from its on-ground Car Care Studios, which extended to 14 locations by the end of March to reach 30 locations by December 2022. Such operations are positively impacting the India commercial car care products market.

Impact of COVID-19 Pandemic on India Commercial Car Care Products Market

The abrupt emergence of the COVID-19 pandemic in India forced the shutdown of vehicle manufacturing plants, affecting the demand for commercial car care products. Moreover, the country also isolated its import and export of critical raw chemicals and products for numerous automotive car care products, impacting various end-user industries' supply chains. The overall expansion of several associated automobile subsystems and car products, including the India commercial car care products market, is influenced by automotive sales in India. According to the Automotive Component Manufacturers Association ACMA, the total revenue of India's auto component business fell by 3% in March 2021. While car sales and manufacturing recovered in the second half of 2021, the first quarter of 2022 was once again plagued by difficulties, owing to the pandemic. Other areas, such as automotive aftermarkets, imports, and exports, also declined. At the same time, auto component exports fell by 8% to US$ 13.3 billion from 2020 to 2021.

Market Insights:

Increase in Sales of Second-Hand Cars

As a result of consumers' demand for high-quality automobiles at low prices, the market for used cars has grown tremendously contributing to the growth in the India commercial car care products market. Pollutants that cause vehicle paint and interiors to deteriorate are more likely to be detected in second-hand cars. An automobile may require car care products due to deterioration by sun rays, tree resin, road asphalt, sand, gravel, de-icing chemicals, bird guano, and other airborne contaminants. As a result, there is a higher demand in India commercial car care products market ; they assist in maintaining a used car's interiors, clean the exterior, extend the life of a vehicle, and add value to a used vehicle. According to the Volkswagen India Study for the pre-owned cars market, the used automobile industry has an unstructured environment, and organized dealers account for only 25% of the sales. However, due to coordinated efforts by large competitors and an increased willingness of customers to pay a premium for dependable automobiles, organized dealers' market share is expected to climb to 45% by 2025. Maruti Suzuki True Value and Mahindra First Choice, with 1,252 shops and over 1,700 touchpoints, top the organized sector. Volkswagen is also present in the market with its Das WeltAuto (DWA) network, which handles the acquisition and sale of pre-owned passenger vehicles from all manufacturers, as reported by AutoCar India in 2021. All these factors are contributing to the growth of the India commercial car care products market.

Product Segment Insight

Based on product, the India commercial car care products market is segmented into chain & carburetor spray, silicon spray, windshield glass cleaner, pressure washers & steam cleaners, polish wax, clay bars & sponges, brake cleaners and bleeding kits, dashboard cleaners, WD 40, engine D-greaser, car interior cleaners, tire dresser, battery terminal cleaner/ spray, engine contact cleaner, engine foam cleaner, engine shine & protector, engine oil flush for 2 & 4-wheeler, radiator flush, engine oil additive cleaner, fuel injector cleaner, engine fuel treatment additive cleaner, additive flusher, contact cleaners, adhesive cleaner, and others. The car interior cleaners segment led the India commercial car care products market with the largest share in 2021.

India Commercial Car Care Products Market, by Category (% share)

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Note: The outer circle represents the market size for 2028, and the inner circle represents the market size for 2021.

Category Segment Insights

Based on category, the India commercial car care products market is segmented into interior and exterior. The exterior segment accounted for a major share of the India commercial car care products market in 2021. The market for the exterior segment is anticipated to grow at a faster CAGR during the forecast period.

End-User Insights

Based on end-user, the India commercial car care products market is segmented into original equipment suppliers (OES) and independent aftermarket (IAM). The original equipment suppliers (OES) segment accounted for a major market share in 2021.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

India Commercial Car Care Products Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Companies operating in the India commercial car care products market adopt strategies such as mergers and acquisitions and market initiatives to maintain their market positions. A few of the notable developments by key players in the India commercial car care products market report are listed below:

- In February 2022, 3M acquired the technology assets of LeanTec. The acquisition reflects 3M's commitment to its "connected Bodyshop," one of its active digital platforms which integrates data collecting and analysis with product platforms to capitalize on evolving requirements and trends.

- In March 2020, Turtle Wax expanded into India to take advantage of the burgeoning auto maintenance market. Turtle Wax currently sells various automobile maintenance goods, including exterior and interior cleaning solutions, but it has no plans to open its own store. Instead, the corporation will concentrate on expanding its national footprint.

The report segments the India commercial car care products market as follows:

Based on product, the India commercial car care products market is segmented into chain and carburetor spray, silicon spray, windshield glass cleaner, pressure washers and steam cleaners, polish wax, clay bars and sponges, brake cleaners and bleeding kits, dashboard cleaners, WD 40, engine D-greaser, car interior cleaners, tire dresser, battery terminal cleaner/ spray, engine contact cleaner, engine foam cleaner, engine shine and protector, engine oil flush for 2 and 4-wheeler, radiator flush, engine oil additive cleaner, fuel injector cleaner, engine fuel treatment additive cleaner, additive flusher, contact cleaners, adhesive cleaner, and others. The car interior cleaners segment led the market with the largest share in 2021. In terms of category, the market is segmented into interior and exterior. The exterior segment led the market with a larger share in 2021. Based on end user, the market is segmented into original equipment suppliers (OES) and independent aftermarket (IAM). The original equipment suppliers (OES) segment led the India commercial car care products market with a larger share in 2021.

India Commercial Car Care Products Market – Company Profiles

- 3M

- Shell Plc

- Auto Bros

- Pidilite Industries Ltd.

- Twin Tech India Pvt. Ltd

- Clensta International

- Miracle

- Kangaroo Auto Care

- Green Duck Industries

- Wavex

India Commercial Car Care Products Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 228.68 Million |

| Market Size by 2028 | US$ 513.86 Million |

| CAGR (2022 - 2028) | 12.3% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

India

|

| Market leaders and key company profiles |

|

India Commercial Car Care Products Market Players Density: Understanding Its Impact on Business Dynamics

The India Commercial Car Care Products Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the India Commercial Car Care Products Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For