Military Protected Vehicles Market Size, Share, Growth Analysis, and Forecast to 2031

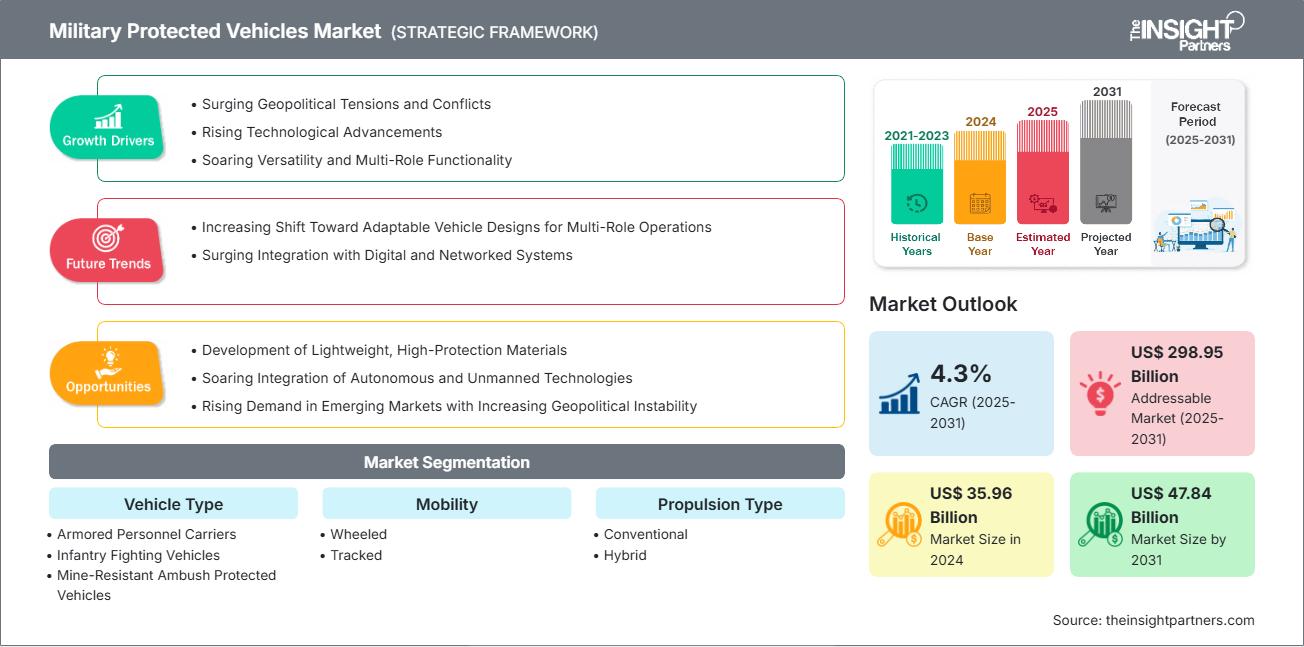

Military Protected Vehicles Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Vehicle Type (Armored Personnel Carriers, Infantry Fighting Vehicles, Mine-Resistant Ambush Protected (MRAP) Vehicles, Main Battle Tanks, Light Protected Vehicles, and Others), Mobility (Wheeled and Tracked), Propulsion Type (Conventional and Hybrid), Onboard Weapon System (Machine Guns, Missiles and Others), Protection Level (Ballistic Protection, Mine or IED Protection and Chemical and Biological Warfare Protection), Operation (Non-Amphibious Vehicles and Amphibious Vehicles), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Dec 2025

- Report Code : TIPRE00041485

- Category : Aerospace and Defense

- Status : Published

- Available Report Formats :

- No. of Pages : 434

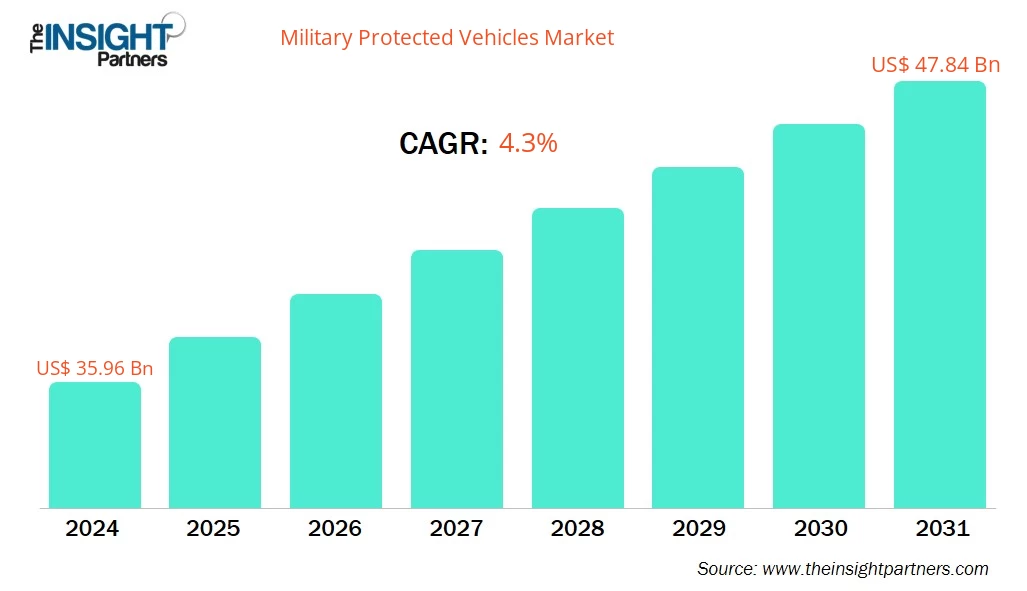

The Military Protected Vehicles Market size is expected to reach US$ 47.8 billion by 2031 from US$ 35.96 billion in 2024. The market is anticipated to register a CAGR of 4.3% during 2025–2031.

Military Protected Vehicles Market Analysis

The military protected vehicles market is growing steadily, driven by rising defense budgets, modernization programs, and asymmetric warfare threats, emphasizing enhanced survivability, mobility, modular armor, and advanced situational-awareness systems across armed forces.

Military Protected Vehicles Market Overview

Global demand for military protected vehicles is expanding as forces prioritize troop safety, adaptable armor, off-road performance, and digital integration to counter evolving threats and support modernization initiatives.

Customizee This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONMilitary Protected Vehicles Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Military Protected Vehicles Market Drivers and Opportunities

Market Drivers:

- Rising Geopolitical Tensions: Increasing border conflicts and regional instability boost the demand for protected and survivable military vehicles.

- Growing Focus on Soldier Safety: Armies are prioritizing vehicles with enhanced armor and blast protection to reduce battlefield casualties.

- Modernization of Military Fleets: Nations are replacing outdated armored vehicles with next-gen, highly mobile protected platforms.

- Advancements in Armor & Material Technology: New lightweight composites and modular armor systems improve protection without compromising mobility.

- Expansion of Peacekeeping & Counter-Terror Operations: Increased deployments require versatile, highly protected vehicles suited for diverse terrains.

Market Opportunities:

- Integration of AI, Sensors & Autonomous Systems: Incorporating smart situational-awareness tech and autonomous navigation creates demand for next-gen vehicles.

- Growing Demand for Modular Vehicle Platforms: Flexible, multi-mission designs enable customization, attracting procurement from diverse military forces.

- Rising Defense Budgets in Emerging Economies: Countries in APAC and MEA are investing heavily in armored vehicle acquisition.

- Upgradation & Retrofit Programs: Modernizing existing fleets with new armor kits, electronics, and mobility systems opens a large aftermarket.

Military Protected Vehicles Market Report Segmentation Analysis

The military protected vehicles market is categorized into distinct segments to understand its structure, growth prospects, and emerging trends. Below is the standard segmentation approach used in industry reports:

By Vehicle Type:

- Armored Personnel Carriers: Designed to safely transport troops in conflict zones with reliable protection and mobility.

- Infantry Fighting Vehicles: Combat-capable vehicles that carry infantry while offering heavier firepower and enhanced battlefield maneuverability.

- Mine-Resistant Ambush Protected: Built with specialized hulls to protect occupants from mines, IEDs, and ambush attacks.

- Main Battle Tanks: Heavily armored, high-firepower platforms used for frontline assault and dominant battlefield engagement.

- Light Protected Vehicles: Agile, lightly armored vehicles suited for reconnaissance, patrol, and rapid-response missions.

- Others: Includes specialized protected platforms such as command vehicles, ambulances, and engineering vehicles tailored for mission-specific roles.

By Mobility:

- Wheeled: High-mobility vehicles optimized for rapid movement on roads and mixed terrain with lower operating costs.

- Tracked: Heavily capable platforms designed for superior off-road performance and stability in rugged, high-intensity combat environments.

By Propulsion Type:

- Conventional

- Hybrid

By Onboard Weapon System:

- Machine Guns

- Missiles

- Others

By Onboard Weapon System:

- Ballistic protection

- Mine/IED protection

- Chemical and Biological Warfare Protection

By Operation:

- Non-Amphibious Vehicles

- Amphibious vehicles

By Geography:

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa

Military Protected Vehicles Market Regional Insights

The regional trends and factors influencing the Military Protected Vehicles Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Military Protected Vehicles Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Military Protected Vehicles Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 35.96 Billion |

| Market Size by 2031 | US$ 47.84 Billion |

| Global CAGR (2025 - 2031) | 4.3% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Vehicle Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Military Protected Vehicles Market Players Density: Understanding Its Impact on Business Dynamics

The Military Protected Vehicles Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Military Protected Vehicles Market top key players overview

Military Protected Vehicles Market Share Analysis by Geography

The military protected vehicles market in Asia Pacific is experiencing rapid growth driven by rising defense budgets, modernization of armed forces, and increasing regional security concerns. Emerging markets in South & Central America and MEA present untapped opportunities for military protected vehicles, enabling fleet modernization, enhanced troop protection, and expansion of defense capabilities.

The military protected vehicles market growth differs in each region due to variations in defense budgets, geopolitical tensions, and military modernization priorities. Below is a summary of market share and trends by region:

1. North America

- Market Share: Holds a significant portion of the global market

- Key Drivers:

- High defense budgets: High defense budgets enable procurement and upgrade of protected vehicles to maintain force readiness and technological superiority.

- Military modernization programs

- Advanced defense research and development

- Trends: Adoption of smart/autonomous systems.

2. Europe

- Market Share: Substantial share owing to early, stringent EU regulations

- Key Drivers:

- NATO / allied security cooperation: NATO and allied cooperation push European nations to invest in upgraded, interoperable protected vehicles, strengthening the joint defense posture.

- Increased defense spending

- Domestic armored‑vehicle manufacturing.

- Trends: Collaborative procurement & joint programs.

3. Asia Pacific

- Market Share: Fastest-growing region with dominant market share

- Key Drivers:

- Rising geopolitical tensions: Regional tensions and border security concerns prompt countries to raise defense spending and modernize fleets through domestic vehicle production.

- Growing defense budgets

- Push for indigenous production

- Trends: Expansion of local manufacturing & procurement.

4. Middle East and Africa

- Market Share: Although small, it is growing quickly

- Key Drivers:

- Regional conflicts & instability: Ongoing conflicts, insurgency, and terrorism in parts of the region spur governments to procure durable, well-protected vehicles for military and security operations.

- Counter‑terrorism and internal security needs

- Government investments in defense

- Trends: Demand for rugged, cost‑effective vehicles.

5. South & Central America

- Market Share: Growing Market with steady progress

- Key Drivers:

- Internal security & crime concerns: Rising organized crime and civil unrest drive demand for protected patrol and armored vehicles for law enforcement and internal security needs

- Border/policing vehicle demand.

- Limited defense‑budget expansion

- Trends: Gradual increase in armored vehicle procurement.

Military Protected Vehicles Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

Competition is intense due to the presence of major global players such as Lockheed Martin Corp; Roshel Inc.; General Dynamics Corp; Oshkosh Corp; Inguar Defence; Iveco Group NV; BMC Automotive Industry and Trade Inc; Paramount Group; ND Defense LLC; BAE Systems Plc; NIMR Automotive; Otokar Otomotiv ve Savunma Sanayi A.S.; Singapore Technologies Engineering Ltd; Patria Group; Nurol Makina; Tata Advanced Systems Limited; Lenco Industries, Inc; Mahindra & Mahindra Ltd.

This high level of competition urges companies to stand out by offering:

- Innovative and advanced products

- Customized Vehicle Solutions

- Enhanced clinical support

- Cost-effective options

- Rapid deployment capabilities.

Opportunities and Strategic Moves

- Expansion in emerging markets – Growing defense budgets in Asia Pacific, Middle East, and Africa.

- Government contracts & tenders– Targeting large-scale procurement programs.

Other companies analyzed during the course of research:

- Rheinmetall AG

- Nexter Systems

- Krauss‑Maffei Wegmann GmbH & Co. KG (KMW)

- Elbit Systems Ltd.

- Thales Group

- FNSS Defence Systems

- Denel Land Systems

- Plasan Sasa Ltd. (Plasan)

- Arquus Defense

- North Industries Corporation

- Uralvagonzavod

Military Protected Vehicles Market News and Recent Developments

- Roshel provides advanced armored solutions, September 2024 - Roshel strengthened its footprint across Europe by providing advanced armored solutions to law enforcement agencies. Recently, the Ministry of Interior of Sarajevo Canton has deployed Roshel’s Senator armored vehicles to enhance security and operational effectiveness.

- General Dynamics announced that its European division secured a contract, October 2025 - General Dynamics Corporation ranks among the 10 largest defense stocks in 2025. On October 20, the company announced that its European division secured a contract valued at US$ 3.5 billion to supply the German Army Reconnaissance Corps with next-generation reconnaissance vehicles.

Military Protected Vehicles Market Report Coverage and Deliverables

The "Military Protected Vehicles Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Military Protected Vehicles Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Military Protected Vehicles Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Real-time Location Systems Market For Healthcare analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the military protected vehicles market

- Detailed company profiles

Frequently Asked Questions

2. Growing Focus on Soldier Safety: Armies are prioritizing vehicles with enhanced armor and blast protection to reduce battlefield casualties.

1. High acquisition and development costs: Building modern protected vehicles with advanced armor, electronics, and protection systems demands a large upfront investment.

2. High maintenance & lifecycle costs: Beyond procurement, upkeep is expensive; this makes long-term ownership costly.

1. Modular and adaptable vehicle design

2. Hybrid‑electric and alternative propulsion systems

3. Advanced sensor suites, AI & digital integration

4. Active Protection Systems (APS) and enhanced survivability

5. Upgradable & retrofit‑friendly vehicles

1. AI‑enabled Active Protection Systems: AI/ML helps APS detect, classify, and respond to incoming threats (e.g., rockets, missiles) in real time.

2. Enhanced situational awareness & target recognition: With sensor fusion, computer vision, and ML algorithms, armored vehicles can identify targets or threats.

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For