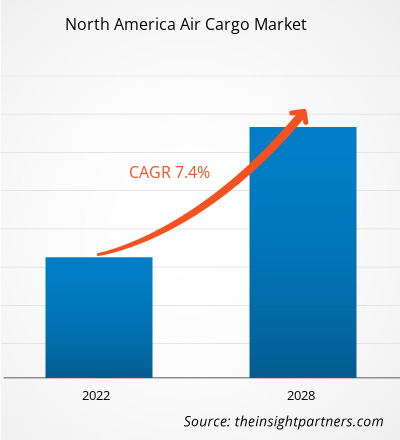

The air cargo market in North America is expected to reach US$ 51.29 million by 2028 from US$ 31.20 million in 2021. The market is estimated to grow at a CAGR of 7.4% from 2021 to 2028.

The US, Canada, and Mexico are major economies in North America. Online retailing attracts prospective customers than brick and mortar based competitors due to the global scale of the internet. In addition, e-commerce market players opt from a variety of logistics options such as the surface transport and air transport, to deliver packages to their customers. Therefore, as the e-commerce market is heating up, varying buying patterns and trends have been observed in different countries of the regions. Majority of the purchase is influenced by the demographics of the country such as the percentage of youth population indulging in e-commerce activity, the economy of the country, age group interested in e-commerce, and the level of awareness in the country. Thus, e-commerce is a future growth driver for the air cargo industry, as online shopping boosts the demand for parcel delivery services worldwide. Air cargo is well-positioned to serve their needs and deliver their goods with speed, efficiency, and reliability. The fast-growing cross-border e-commerce market remains a key driver in addition to rising domestic volumes sent by large and small e-retailers. Air cargo is an important for the e-commerce ecosystem in order to manage the transportation of goods globally. Air cargo service providers deliver upgraded technology, flexibility & scalability, and efficiency & specialization in the e-commerce business. There are numerous benefits pertaining to the e-commerce and they can get fulfilled if the company delivers to customers on time. Thus, several organizations such as international Air Transport Associations (IATA), International Federation of Freight Forwarders Associations (FIATA), Universal Postal Union (UPU), and World Customs Organizations (WCO) are engaged in improving air cargo services owing to the growing adoption of e-commerce. According to the IATA, in 2019, e-commerce represented around 15% of air cargo volumes owing to continuously growing in the COVID-19. The IATA assists the air cargo industry to capitalize on the growth of e-commerce. IATA also ensures that the air cargo industry has the correct global framework to offer the right logistics solutions for the e-commerce industry. Online shoppers are now purchasing frequently and cross-border e-commerce volumes are growing. Customers’ expectations are similar for domestic and cross border e-commerce. Therefore, the demand for air cargo is expected to surge during the forecast period with the rising number of online customers and increasing cross border sales.North America is engaging in development and adoption of new technologies due to favorable government policies to boost innovation and strengthen the infrastructure capabilities. The Canadian government is anticipated to aid the sector, including financial support to airlines. In addition, the US Government has vastly supported its airlines during the crisis, and there are still hopes for a second support package. According to the statistics by the International Air Transport Association (IATA), the industry-wide cargo ton-kilometers (CTKs), the month-on-month CTKs showed the fastest growth since May, at 3.7% in 2020. The rebound of the industry rebound remains largely driven by North American airlines. North American airlines also performed strongly in September 2020. This can be attributed to the increasing Asia–North America trade lanes due to strong demand for goods manufactured in Asia and the robust demand from domestic markets in the US. Moreover, the domestic market in North America has been outperforming significantly the region’s international routes due to the rising popularity of e-commerce since Q2 of 2020 when the country went into strict lockdown. Furthermore, the market players in North America are also open to the supply chain and critical supply. Hence, the Air Cargo Market in the region has been positively influenced by the pandemic.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the air cargo market. The North America air cargo market is expected to grow at a good CAGR during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America Air Cargo Market Segmentation

North America Air Cargo Market – By Type

- Air Mail

- Air Freight

North America Air Cargo Market- By Services

- Express

- Regular

North America Air Cargo Market – By End User

- Retail

- Pharmaceutical and Healthcare

- Food and Beverage

- Consumer Electronics

- Automotive

- Others

North America Air Cargo Market - By Country

- US

- Canada

- Mexico

North America Air Cargo Market -Companies Mentioned

- ANA Cargo

- Cargolux

- Cathay Pacific Airways Limited

- DHL International GmbH (Deutsche Post DHL Group)

- Emirates SkyCargo

- Etihad Cargo

- FedEx Corporation

- Lufthansa Cargo AG

- United Parcel Service of America, Inc.

North America Air Cargo Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 31.20 Million |

| Market Size by 2028 | US$ 51.29 Million |

| Global CAGR (2021 - 2028) | 7.4% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Service, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada

Trends and growth analysis reports related to Automotive and Transportation : READ MORE..

- ANA Cargo

- Cargolux

- Cathay Pacific Airways Limited

- DHL International GmbH (Deutsche Post DHL Group)

- Emirates SkyCargo

- Etihad Cargo

- FedEx Corporation

- Lufthansa Cargo AG

- United Parcel Service of America, Inc.

Get Free Sample For

Get Free Sample For