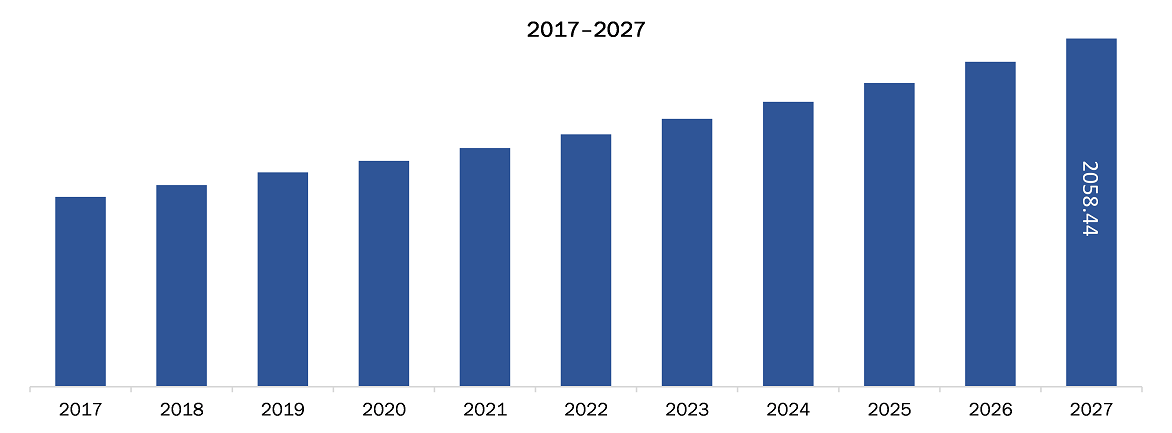

The Carbon Fiber Market in North America is expected to grow from US$ 907.32 million in 2019 to US$ 2058.44 million by 2027; it is estimated to grow at a CAGR of 10.9% from 2020 to 2027.

The US, Canada, and Mexico are major economies in North America. 5.1.1 Rising demands from automotive and aerospace applications recently gained momentum after weak growth over the past few years the automotive manufacturers are demanding new and innovative high-quality material for producing automotive components. These materials have to fulfill the high-performance need of automotive manufacturers and also meet the needs of the customer and society. Among the various materials, carbon fiber is considered as one of the most suitable materials for lightweight automobile parts. Moreover, the carbon-fiber-reinforced composites are used as the essential materials to substitute body and other parts in an automobile. The use of carbon fiber in the automobile industry has improved brake, steering, durability, and high fuel efficiency, leading to energy conservation and minimizing carbon dioxide emissions. Leading automotive manufacturers are using carbon fiber for manufacturing components. For instance, the Airbus A350 is 52 percent carbon fiber-reinforced polymer (CFRP) and the BMW i3 has mostly CFRP chassis. Carbon fiber is also used in high-end bike frames, tennis rackets and surfboards is also bolstering the growth of the industry.

The US has the highest number of confirmed cases of coronavirus, as, compared to Canada and Mexico. This is negatively impacting the consumer goods industry in the region as the COVID-19 pandemic negatively affects the supply and distribution chain.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the Carbon Fiber Market North America Carbon Fiber Market is expected to grow at a good CAGR during the forecast period.

North America Carbon Fiber Market Revenue and Forecast to 2027 (US$ Million)

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America Carbon Fiber Market Segmentation

North America Carbon Fiber Market – By Raw Material

- PAN

- Pitch

North America Carbon Fiber Market– By End Use Industry

- Automotive

- Aerospace and Defense

- Construction

- Sporting Goods

- Wind Energy

- Others

North America Carbon Fiber Market – By Country

- US

- Canada

- Mexico

North America Carbon Fiber Market -Companies Mentioned

- DowAksa

- Formosa Plastic Corporation

- Hexcel Corporation

- Hyosung Corporation

- Kureha Corporation

- Mitsubishi Chemical Corporation

- SGL Carbon

- Solvay

- Teijin Limited

- Toray Industries,Inc

North America Carbon Fiber Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 907.32 Million |

| Market Size by 2027 | US$ 2058.44 Million |

| CAGR (2020 - 2027) | 10.9% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Raw Material

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For