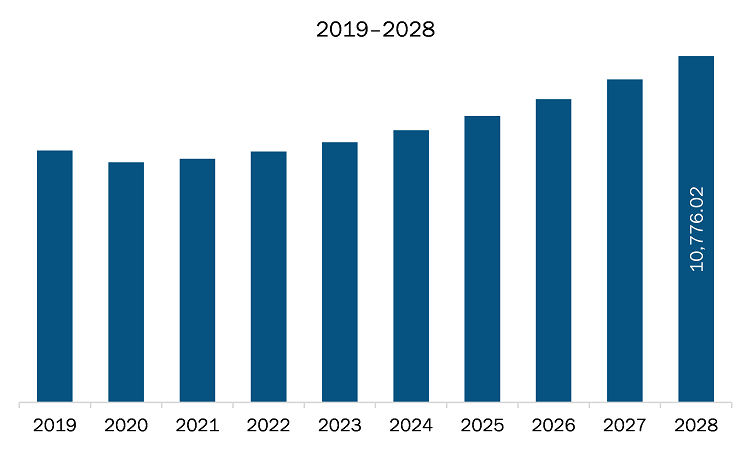

The commercial vehicle transmission oil pump and transmission system market in North America is expected to grow from US$ 7579.22 million in 2021 to US$ 10776.02 million by 2028; it is estimated to grow at a CAGR of 5.2% from 2021 to 2028.

The transmission system ensures a smooth and comfortable drive by transferring the maximum amount of power from an engine to the wheels via a gearbox. The majority of low- and mid-range vehicles now use semi-automatic and automatic transmission systems. The mobility and fuel efficiency of a car can be considerably influenced by an automated transmission system, depending on the electrical technology utilized in the transmission and the design of the transmission system. Automatic gearboxes or dual pedal technology is available in various configurations, such as Automatic Transmission (AT), Automated-Manual Transmission (AMT), Continuously Variable Transmission (CVT), Dual-Clutch Transmission (DCT), Direct Shift Gearbox (DSG), and Tiptronic Transmission. The shift from manual to automatic transmissions is driven by an increased desire for comfort and safety. Automatic gearboxes are comfortable, safe, environment friendly, and cost-effective. They also provide a superior driving experience. A driver does not need to handle the clutch with an automatic transmission, which is quite convenient, especially in urban stop-and-go traffic. Autonomous parking assistants, for example, make daily living accessible and are a precursor to utterly automated driving. Furthermore, automotive component makers are working hard to deliver cost-effective alternatives without sacrificing vehicle performance. To address the rising demand for transmission systems across the automotive sector, they adopt various business expansion methods. For instance, Aisin Seiki Co., Ltd. is concentrating its development and manufacturing skills on Toyota Motor Corp.'s manual transmission products under the Aisin AI brand. Thus, the high adoption rate of semi-automatic and automatic transmission systems in commercial vehicles is a significant factor driving the growth of the commercial vehicle transmission oil pump and transmission systems market.

North America is one of the leading regions in terms of the development and adoption of new technologies. This is mainly attributed to the favorable government policies that boost innovation and strengthen infrastructure capabilities. Hence, any hindrance to the growth of the industrial sector hampers the economic growth of the region. The US is the world’s worst-affected country due to the COVID-19 outbreak. The commercial vehicle transmission oil pump and transmission system market’s reliance on manufacturing companies, such as automobile companies and automobile component manufacturers, has been highlighted by the recent pause in manufacturing units due to the outbreak. The automobile industry is suffering a major setback owing to the strict restrictions on travel and the closures of international manufacturing activities, declining car sales, and large layoffs. The overall demand for transmission oil pumps and transmission systems is likely to increase once the industries attain normal operational conditions. These automotive parts are vital and much needed for the manufacturing of commercial vehicles. Favorable government policies, such as duty-free imports in Mexico, for the automotive sector in North America and ever-increasing investments by North American countries in advanced technology propel the demand for automotive parts in the region.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the North America commercial vehicle transmission oil pump and transmission system market. The North America commercial vehicle transmission oil pump and transmission system market is expected to grow at a good CAGR during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America Commercial Vehicle Transmission Oil Pump and Transmission System Market Segmentation

North America Commercial Vehicle Transmission Oil Pump and Transmission System Market – By Offering

- Transmission Oil Pump

- Transmission System

North America Commercial Vehicle Transmission Oil Pump and Transmission System Market – By Oil Pump Product Type

- Fixed Displacement Pump

- Variable Displacement Pump

North America Commercial Vehicle Transmission Oil Pump and Transmission System Market – By Oil Pump Type

- Vane Type

- Gear Type

- Rotor Type

North America Commercial Vehicle Transmission Oil Pump and Transmission System Market – By Transmission Type

- Manual Transmission

- Automatic Transmission

- Automated Manual Transmission

North America Commercial Vehicle Transmission Oil Pump and Transmission System Market – By Vehicle Type

- MCV (Class III and Class VI)

- HCV (Class VII to Class VIII)

North America Commercial Vehicle Transmission Oil Pump and Transmission System Market – By Powertrain Type

- Internal Combustion Engine

- Electric

- Hybrid

North America Commercial Vehicle Transmission Oil Pump and Transmission System Market – By Country

- US

- Canada

- Mexico

North America Commercial Vehicle Transmission Oil Pump and Transmission System Market –Companies Mentioned

- Allison Transmission Holding INC

- Daimler AG

- Eaton Group

- Mack Trucks

- Scania

- Sinotruk (Hong Kong) Limited

- Shaanxi Fast Auto Drive Co. Ltd.

- Volvo AG

- Voith GmbH & Co. KGaA

- ZF Friedrichshafen AG

- Hyundai Transys

- Mahle GmbH

- Concentric AB

- SHW AG

- BorgWarner Inc.

- Scherzinger Pumpen GmbH & Co. KG

- SLPT

North America Commercial Vehicle Transmission Oil Pump and Transmission System Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 7579.22 Million |

| Market Size by 2028 | US$ 10776.02 Million |

| CAGR (2021 - 2028) | 5.2% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Offering

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For