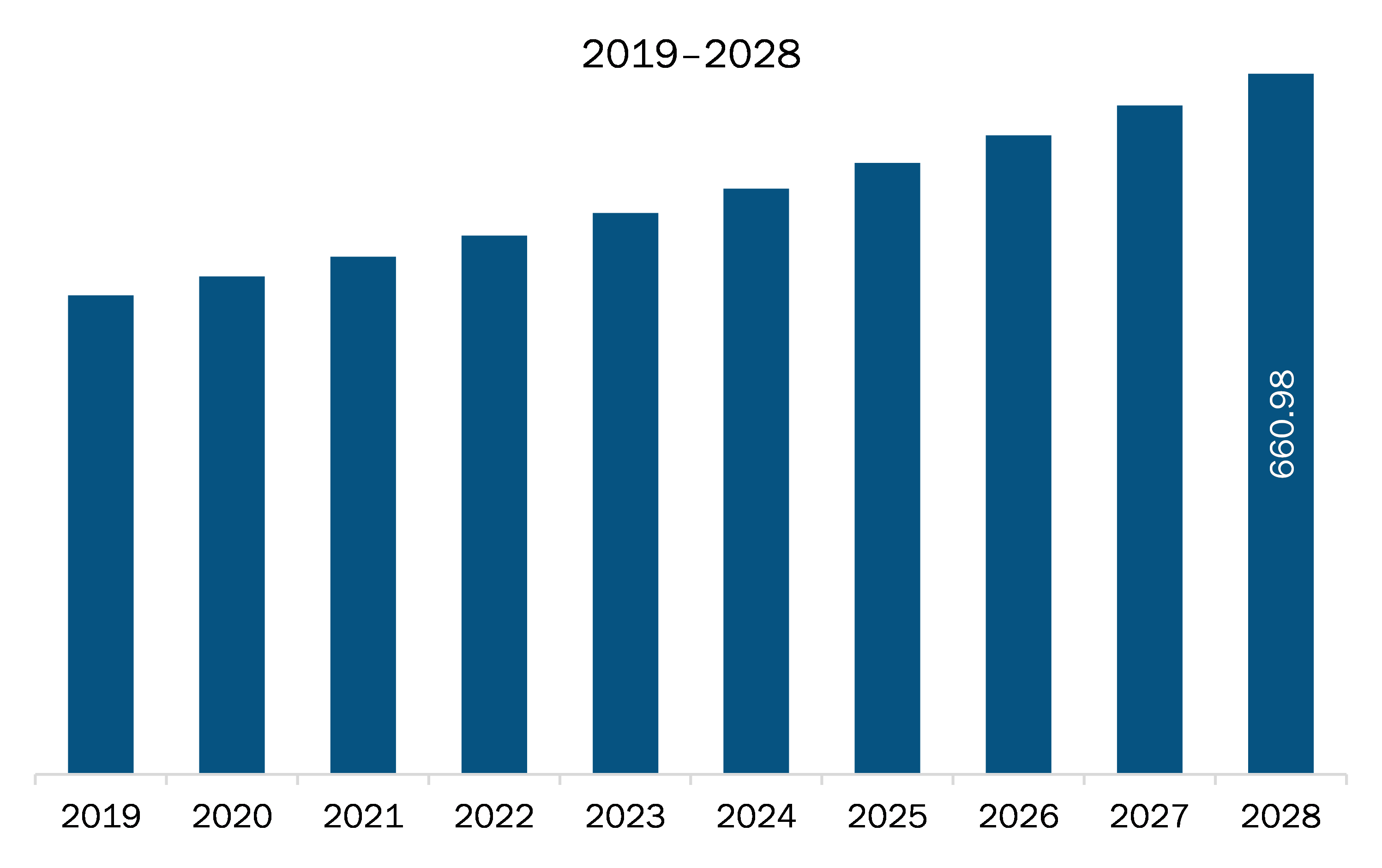

The North America micro coils market is expected to grow from US$ 488.31 million in 2021 to US$ 660.98 million by 2028; it is estimated to grow at a CAGR of 4.4% from 2021 to 2028.

The US, Canada, and Mexico are economies in North America. Increasing prevalence of cardiac aneurysm will escalate the market in coming years. Cardiovascular diseases (CVDs) are likely to remain the major cause of morbidity and mortality across the North America. Heart failure, stroke, rheumatic heart disease, aortic aneurysm, and peripheral artery disease are among the most common CVDs. Unhealthy diet adoption, tobacco consumption, sedentary lifestyle, and alcoholism are the major factors leading to rise in incidence of CVDs across the region. According to the World Health Organization (WHO), CVDs are number one cause of death across the region. Also, in 2020, the Centers of Disease Control and Prevention (CDC) estimated that, on an average, one death after every 36 seconds is recorded due to CVDs in the US. Further, as per the American Heart Association (AHA) 2019 statistics, 121.5 million adults in the US, which is around half of the US adult population, suffer from CVDs. The cardiac aneurysm is majorly caused due to the blockages in the aortic artery. The blockages can also be seen in chest or the abdomen. The prevalence of the cardiac aneurysm is growing. For instance, as per the recent study published by the Society for Vascular Surgery (SVS) in 2020, thoracic aortic aneurysms occur in every 6 to 10 per 100,000 people in the US. Moreover, according to the same study, 20.0% of the cases with thoracic aortic aneurysm are genetic. In addition, around 2 million people are diagnosed with an abdominal aortic aneurysm in the US each year. The study also highlights that a ruptured abdominal aortic aneurysm is the 15th leading cause of death in the US. Such high prevalence of CVDs prominently boosts the number of heart procedures. According to a study published by Society of Thoracic Surgeons (STS) in 2020, there is a massive increase in the number of TAVR procedures across the US. The factor ultimately drives the growth of the North America micro coils market.

In case of COVID-19, North America is highly affected specially the US. In the US, due to an increasing number of infected patients, healthcare professionals and leading organizations are distracting the flow of healthcare resources from research & development to primary care, which is slowing down the process of innovation. According to Society of Thoracic Surgeons, Cardiovascular surgery volumes in the United States fell by more than half during the COVID-19 pandemic’s first wave, with the biggest drops observed in the New England and mid-Atlantic regions. The exorbitant number of COVID cases have resulted in cancellation of doctor's appointment, decreased in demand for the elective neurosurgery, disruption in supply chain due to long period of lockdown. For instance, Medtronic plc, a company that generates the majority of its sales and profits from the U.S., has suffered a decrease in revenue of 1 percent in the fiscal year 2020 compared to the fiscal year 2019 in the neurovascular category.However, most of the countries in the North America has started vaccinating its population on a larger scale. This is expected to lower the intensity of COVID19 pandemic in the region. Owing to which the patients post vaccination are undergoing the pending medical procedures such as the surgeries, vascular treatments, and others. The healthcare systems in the region has regained its capacity since the start of the pandemic. The patient care has been improving as compares to the earlier time of the pandemic where in the line of treatments was not well defined. However, the development of the treatments and reductions in the death rate has gained confidence in the doctors and patients. Thus, it is expected to have low negative impact on the Micro Coil market in the region.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the North America micro coils market. The North America micro coils market is expected to grow at a good CAGR during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America Micro Coils Market Segmentation

North America Micro Coils Market – By Type

- Detachable Coils

- Pushable Coils

North America Micro Coils Market – By Material

- Platinum

- Platinum Tungsten Alloy

- Platinum & Hydrogel

North America Micro Coils Market – By Application

- Oncology

- Urology

- Others

North America Micro Coils Market – By End User

- Hospitals

- Ambulatory Surgical Centers

- Others

North America Micro Coils Market, by Country

- US

- Canada

- Mexico

North America Micro Coils Market -Companies Mentioned

- Balt USA LLC

- Boston Scientific Corporation

- Classic Coil Company

- Cook Medical LLC

- Johnson and Johnson Medical Devices (Depuy Synthes)

- KANEKA CORPORATION

- Medtronic

- Penumbra, Inc.

- Stryker Corporation

- Terumo Corporation

North America Micro Coils Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 488.31 Million |

| Market Size by 2028 | US$ 660.98 Million |

| CAGR (2021 - 2028) | 4.4% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For