The nuclear decommissioning service market in North America was valued US$ 1.92 billion in 2019 and is projected to reach US$ 3.35 billion by 2027; it is expected to grow at a CAGR of 7.3% from 2020 to 2027.

Nuclear power plants play a crucial role in the North America Nuclear Decommissioning Service Market electricity generation sector. The US has 98 nuclear power plants across 30 states, while Canada has 19, followed by Mexico with 2 nuclear power plants. These countries depend heavily on nuclear power generation; however, the US and Canadian governments have plans to decommission some of the nuclear power plants as a result of increasing environmental concerns. A total of 104 nuclear power plants are in the phase of decommissioning, the US leading with 86 counts followed by Canada with 18.

The decommissioning of these plants is set to be executed through 2040. As of 2017, a total of 10 commercial nuclear reactors in the US have been successfully decommissioned, and another 20 US nuclear reactors are currently in different stages of the decommissioning process.

Several companies have been awarded contracts to dismantle the phased-out nuclear power plants. The decommissioning service providers are required to adhere to the norms set by the Nuclear Regulatory Commission (NRC), a regulatory body of the US government. Some of the rules laid down by the NRC include cleanup of radioactively contaminated plant systems and structures, and removal of the radioactive fuel. Similarly, in Canada, the CNSC regulates the entire lifecycle of nuclear power plants.

In 2018, Oyster Creek Nuclear Generating Station, owned and operated by Exelon, announced the retirement of the plant by 2019. The Comprehensive Decommissioning International (CDI), a joint venture between Holtec (new owner) and SNC-Lavalin, is the contractor for the Oyster Creek decommissioning project. The CDI sub-contracted GE Hitachi Nuclear Energy (GHNE) to carry out the decommissioning project.

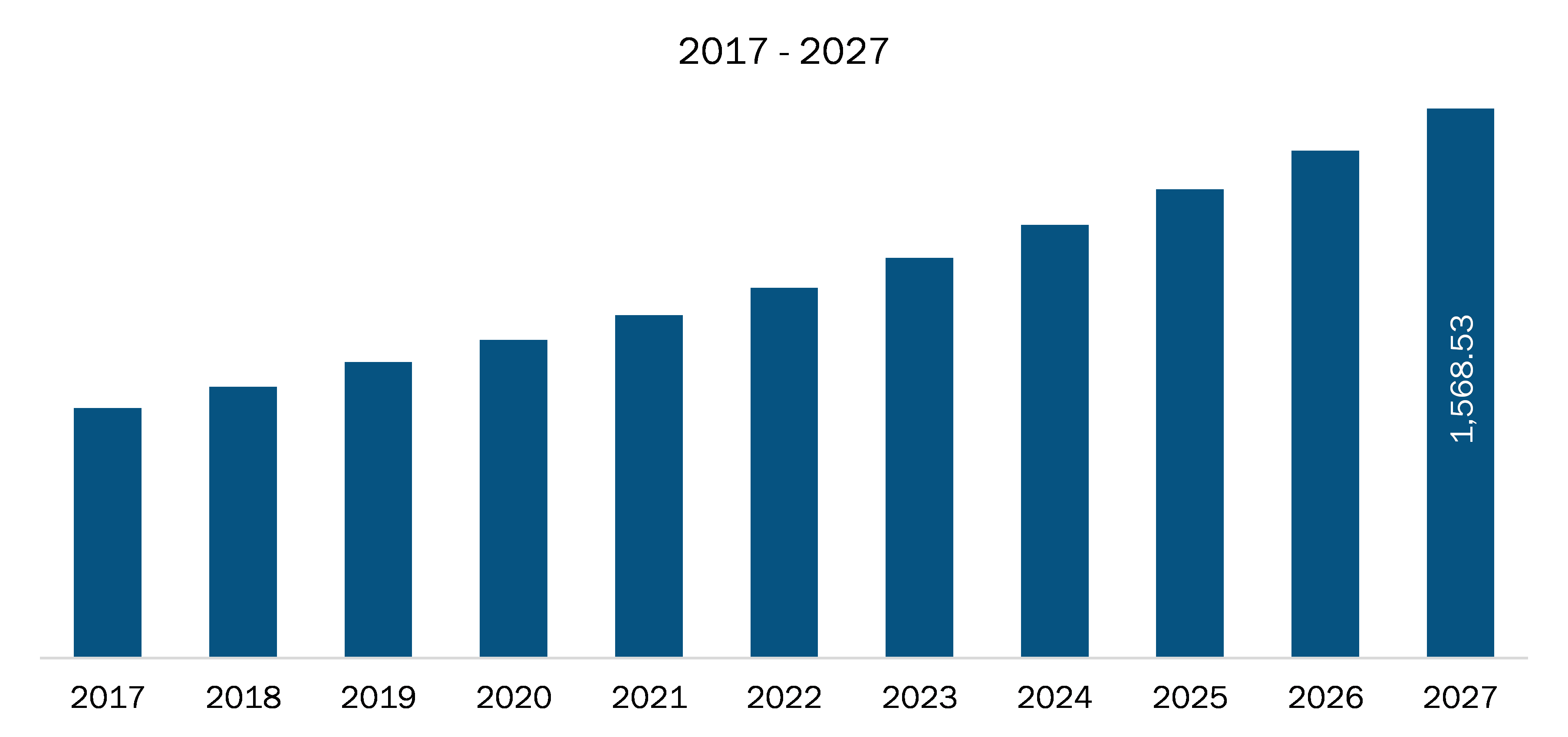

The nuclear decommissioning services market in Canada is projected to reach US$ 732.63 million in 2027. Canada has 19 nuclear power plants, which generate 15% of the country’s overall electricity generation. Canada has planned to decommission two of its nuclear power plants in recent years. The demand for renewable energy generated electricity is surging in the country, thereby offering the nuclear power plant dismantling service providers an opportunity to enhance their respective businesses. For instance, in 2020, Korea Hydro & Nuclear Power (KHNP) has sealed an agreement with a Canadian nuclear power reactor company to dismantle nuclear power plants at Darlington and Pickering in Ontario. According to KNHP, this contractual agreement is anticipated to facilitate the company to strengthen its expertise in decommissioning heavy water reactors and would also help them to expand globally.

Canada Nuclear Decommissioning Service Market Revenue and Forecast to 2027 (US$ Mn)

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America Nuclear Decommissioning Service Market–Segmentation

North America Nuclear Decommissioning Service Market, by Reactor Type

- Pressurized Water Reactor

- Boiling Water Reactor

- Gas Cooled Reactor

North America Nuclear Decommissioning Service Market, by Strategy

- Immediate Dismantling

- Deferred Dismantling

- Entombment

North America Nuclear Decommissioning Service Market, by Application

- Commercial Power Reactor

- Prototype Power Reactor

- Research Reactor

North America Nuclear Decommissioning Service Market, by Capacity

- Below 100 MW

- 100 – 1,000 MW

- Above 1,000 MW

North America Nuclear Decommissioning Service Market, by Country

- U.S.

- Canada

North America Nuclear Decommissioning Service Market-Companies Mentioned

- AECOM

- Bechtel Corporation

- EnergySolutions

- GE Hitachi Nuclear Energy (GEH)

- Westinghouse Electric Company LLC

- NorthStar Group Services, Inc.

- Manafort Brothers Incorporated

- Fluor Corporation

- Atkins

- Babcock International Group PLC

North America Nuclear Decommissioning Service Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 1.92 Billion |

| Market Size by 2027 | US$US$ 732.63 Million |

| CAGR (2020 - 2027) | 7.3% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Reactor Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For