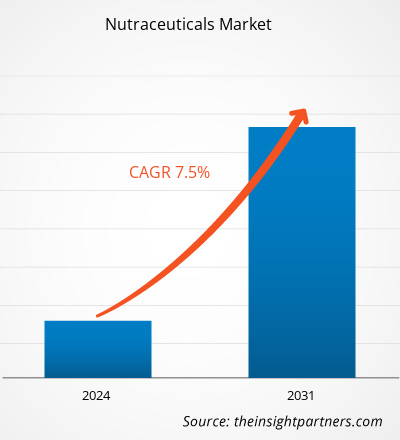

The nutraceuticals market size is projected to reach US$ 895.76 billion by 2031 from US$ 500.77 billion in 2023. The market is expected to register a CAGR of 7.5% during 2023–2031. The plant-based and organic nutraceuticals are likely to bring new trends into the market during the forecast period.

Nutraceuticals Market Analysis

The rising health consciousness among people, owing to the increasing prevalence of obesity, diabetes, and other diseases, are among the major factors driving the nutraceuticals market. The preference for an active lifestyle favors the market growth in North America. The rapidly progressing e-commerce industry drives the online sales of nutraceuticals, in turn contributing to the market growth.

Nutraceuticals Market Overview

Consumers in developed and some developing countries are highly attracted to functional products, mainly on account of the added health and wellness benefits. Nutraceuticals are associated with various medicinal and health benefits, such as to improve the function of the immune system, boost gut health, and others. Rising healthcare costs, coupled with the increasing geriatric population across the world, propels the adoption of various nutraceuticals such as dietary supplements, functional food and beverages, and sports nutrition products. Growing consumer focus on preventive health and health-promoting diets, and increasing instances of lifestyle-related disorders further add to the popularity of nutraceuticals.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Nutraceuticals Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Nutraceuticals Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Nutraceuticals Market Drivers and Opportunities

Innovations and Strategic Developments Fuel Nutraceuticals Market

The nutraceuticals market across the world is growing with significant investments by manufacturers in research & development, partnerships, and collaborations to launch innovative products to tap into unexplored market segments. In February 2022, PepsiCo's Rockstar Energy brand launched a "hemp-infused drink" in the US. The energy drink, branded "Rockstar Unplugged," contains hemp seed oil, vitamin B complex, spearmint, and lemon balm; moreover, the drink contains no sugar or calories. This product was made available in three flavors: blueberry, passionfruit, and raspberry-cucumber. Similarly, in March 2024, a dairy giant in Japan launched a milk beverage called "Meiji Eye and Sleep W Support," containing 7.5 mg of a functional ingredient—crocetin, which is a carotenoid derived from gardenia fruit and saffron. Owing to its small molecular weight, the drink can be easily absorbed into the body. Thus, the increasing product innovation by key market players worldwide is driving market growth.

Various nutraceutical manufacturers operating in Europe engage in collaborations to expand their customer base. For instance, in May 2024, DSM-Firmenich and Indena introduced dietary supplement solutions combining biotics and botanicals at Vitafoods Europe 2024, focusing on gut health, brain health, and healthy aging. In May 2024, Aliga Microalgae, a Danish food-tech company, acquired chlorella algae facilities in Holland, marking a move toward the commercialization of its chlorella algae products. With this acquisition, the company plans to scale up its production capacity of food ingredients and dietary supplements. Thus, the strategic development initiatives and continuous innovations by key market players propel the nutraceuticals market across the globe.

Rising Penetration of E-Commerce to Generate Growth Opportunities in Market

The emergence of e-commerce has significantly transformed the way people shop and spend their money. A positive change in the organized retail sector, a rise in the reach of smartphones and the internet, an upsurge in purchasing power, easy access to emerging technologies, and convenience provided by online retail shopping platforms from anywhere at any time are a few of the major factors bolstering the penetration of e-commerce worldwide. Consumers are becoming confident about purchasing various nutraceutical products online, moving from the traditional purchasing model to the home delivery service model. Moreover, online sales of nutraceuticals grew significantly during the COVID-19 pandemic due to the shutdown of physical stores and the government's imposition of social restrictions. As lockdowns constrained people's movement and compelled them to stay home, there was a substantial inclination toward online shopping. With the increasing penetration of online shopping, manufacturers began selling products through direct-to-customer (D2C) channels by launching their online retail sites, thereby eliminating the need to invest in expensive marketing and distribution infrastructure. For instance, Herbalife International, Inc; Now Foods; and Quest Nutrition have their own retail channels. Thus, the increasing dependency on e-commerce services and the adoption of the D2C strategy by manufacturers are expected to create lucrative opportunities for the nutraceuticals market growth in the coming years.

Nutraceuticals Market Report Segmentation Analysis

Key segments that contributed to the derivation of the nutraceuticals market analysis are type and distribution channel.

- Based on type, the nutraceuticals market is segmented into functional foods, functional beverages, and dietary supplements. The dietary supplements segment is further categorized into general wellness, sports nutrition, weight management, immune health, and others. The functional foods segment held the largest market share in 2023.

- In terms of distribution channel, the market is segmented into supermarkets and hypermarkets, specialty stores, online retail, convenience stores, and others. The supermarkets and hypermarkets segment held a significant share of the market in 2023.

Nutraceuticals Market Share Analysis by Geography

The geographic scope of the nutraceuticals market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America. North America dominated the market in 2023. Nutraceutical products such as functional food and beverages, and dietary supplements are gaining huge popularity among the American population. The increasing awareness of nutraceuticals and rising health concerns among consumers drive the North American nutraceuticals market. Obesity is a major cause of diabetes and other chronic diseases. According to the Trust for America's Health, as of September 2023, 41.9% of Americans in the US were obese. To overcome these health issues, a majority of the population is resorting to healthier diets with functional claims. They are also adopting an active lifestyle with the inclusion of physical exercises and sports which further boosts the demand for sports and health benefitting supplements. In response to this trend, several key players in the region are offering a comprehensive product portfolio of nutraceutical products. For instance, in November 2023, Vinatura Supplements LLC launched high-quality supplements for healthy living and wellness. The company aims to empower individuals focused on achieving optimal well-being.

Nutraceuticals Market Regional Insights

The regional trends and factors influencing the Nutraceuticals Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Nutraceuticals Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Nutraceuticals Market

Nutraceuticals Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 500.77 Billion |

| Market Size by 2031 | US$ 895.76 Billion |

| Global CAGR (2023 - 2031) | 7.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

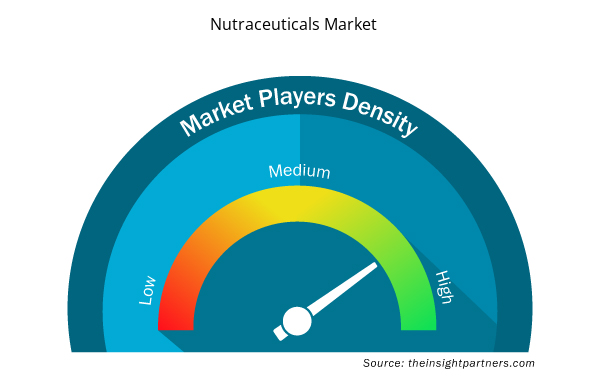

Nutraceuticals Market Players Density: Understanding Its Impact on Business Dynamics

The Nutraceuticals Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Nutraceuticals Market are:

- Glanbia Plc

- NOW Health Group Inc

- Amway Corp

- Nature's Bounty

- Garden of Life LLC

- Danone SA

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Nutraceuticals Market top key players overview

Nutraceuticals Market News and Recent Developments

The nutraceuticals market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A recent key development in the nutraceuticals market is mentioned below:

- Nutrartis has launched Cardiosmile, a natural supplement containing plant sterols, in the US market. The liquid sachet format offers a convenient and effective approach to healthy cholesterol management and heart health, suitable for daily routines. (Source: Nutrartis, Newsletter, September 2023)

- FrieslandCampina announced the launch of a new whey protein powder with protein ingredients meant to boost medical nutrition, support athletic performance, and promote gut health. (Source: FrieslandCampina, Company Website, November 2023)

- Glanbia Nutritionals introduced FerriUp, a new whey protein that provides a strong nutrient foundation for active women, a group that may experience depleted iron and energy levels. Glanbia's new FerriUp is a high-quality whey protein produced using their selective transfer membrane system, which concentrates the key nutrient components of whey. (Source: Glanbia Plc, Company Website, October 2022)

Nutraceuticals Market Report Coverage and Deliverables

The " Nutraceuticals Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Nutraceuticals market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Nutraceuticals market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter's Five Forces and SWOT analysis

- Nutraceuticals market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the nutraceuticals market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type ; Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Mexico, UK, Germany, Spain, Italy, France, India, China, Japan, South Korea, Australia, UAE, Saudi Arabia, South Africa, Brazil, Argentina

Frequently Asked Questions

Which region dominated the nutraceuticals market in 2023?

North America accounted for the largest share of the market in 2023.

Which are the leading players operating in the nutraceuticals market?

Glanbia Plc; NOW Health Group Inc; Amway Corp; Nature's Bounty; Garden of Life LLC; Danone SA; GNC Holdings, LLC; Quest Nutrition LLC; Kellanova; and Chobani LLC are a few of the key players operating in the nutraceuticals market.

What are the driving factors impacting the nutraceuticals market?

Consumer focus on preventive health, and innovations and strategic developments by market players are major factors contributing to the growth of the market.

What are the future trends of the nutraceuticals market?

Plant-based and organic nutraceuticals are likely to emerge as key trends in the market in the future.

What would be the estimated value of the nutraceuticals market by 2031?

The nutraceuticals market size is projected to reach US$ 895.76 billion by 2031.

Trends and growth analysis reports related to Consumer Goods : READ MORE..

The List of Companies - Nutraceuticals Market

- Glanbia Plc

- NOW Health Group Inc

- Amway Corp

- Nature's Bounty

- Garden of Life LLC

- Danone SA

- GNC Holdings, LLC

- Quest Nutrition LLC

- Kellanova

- Chobani LLC

Get Free Sample For

Get Free Sample For