Online Banking Solution Market Outlook, Segments, Geography, Dynamics, and Insights by 2031

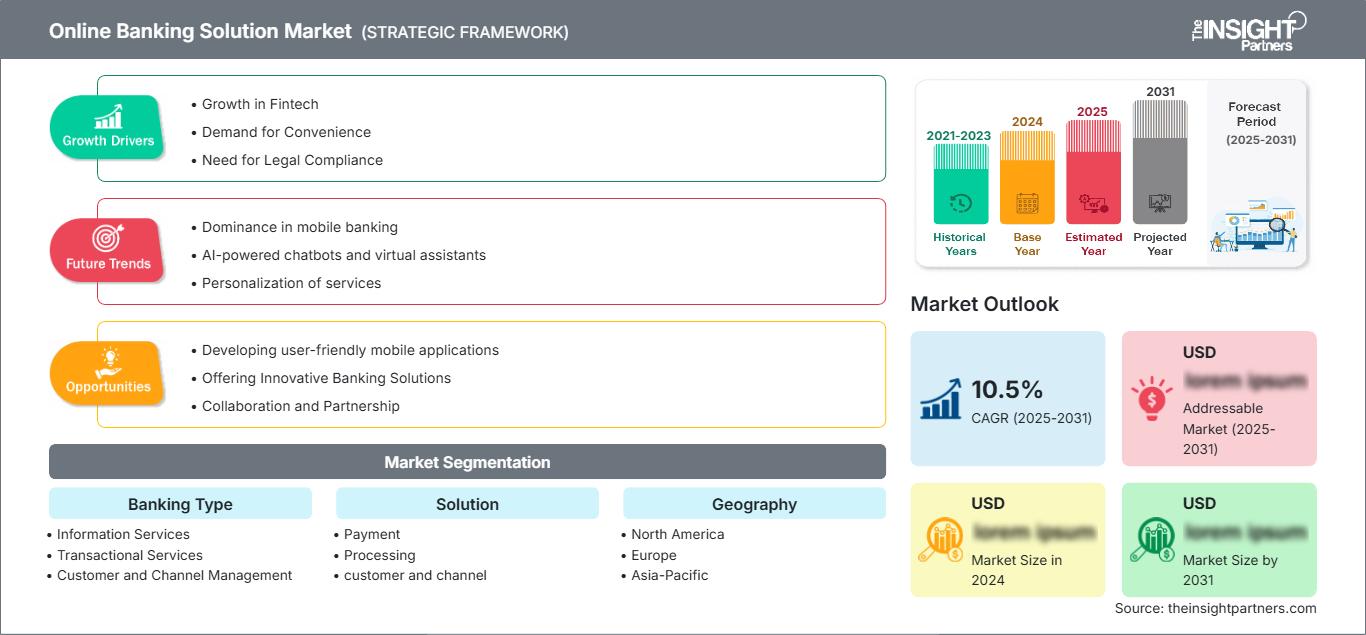

Online Banking Solution Market Size and Forecasts (2021 - 2031), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: by Banking Type (Informational Services, Transactional Services, Communicative services); Solution (Payments, Processing Services, Customer and Channel Management, Risk Management, Others) , and Geography (North America, Europe, Asia Pacific, and South and Central America)

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Mar 2026

- Report Code : TIPRE00012346

- Category : Banking, Financial Services, and Insurance

- Status : Upcoming

- Available Report Formats :

- No. of Pages : 150

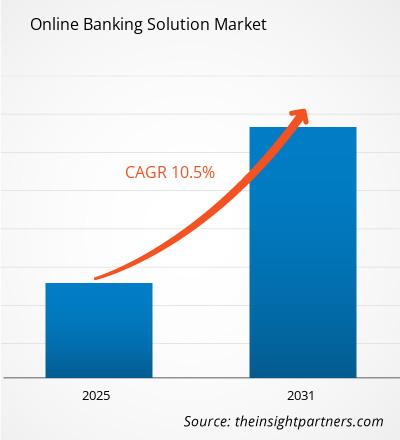

The Online Banking Solution Market is expected to register a CAGR of 10.5% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The research on the Online Banking Solution market conducts an in-depth analysis of the current status of this vital industry, while highlighting areas for further growth. They are segmented into banking type, solution, and others. The segmentation would also provide details on particular market dynamics and consumer preferences of different applications.

Purpose of the Report

The report Online Banking Solution Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Online Banking Solution Market Segmentation

Banking Type

- Information Services

- Transactional Services

- Customer and Channel Management

- Others

Solution

- Payment

- Processing

- customer and channel

- risk management

Customizee This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONOnline Banking Solution Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Online Banking Solution Market Growth Drivers

- Growth in Fintech: Online banking is bound to keep developing alongside the growth in fintech innovations. Basically, because scrum fintech companies keep pushing the right buttons with their new products and solutions that dare mainstream banking, established banks really do not have much of a choice but to step up their online banking services simply to keep up. Such dynamism nurtures innovation and builds an environment in which banks will be compelled to adapt to constantly evolving customer needs. Increased users exert pressure on the financial institutions to further develop their online services. In essence, this is a race in which the institution has to innovate their services just to meet customer expectations.

- Demand for Convenience: Online banking provides the platform for account management, the ability to execute transactions, and other various financial products at any time of the day. To that effect, it has been said that 59 percent of consumers prefer online banking due to its ease and convenience; banks are also investing in user interfaces and mobile phones. In addition, COVID-19 hastened the adoption of online banking solutions due to lockdown and social distancing, forcing many consumers to shift to digital channels. In fact, McKinsey recorded an astonishing use of digital banking during the pandemic, registering at 20% and with many users suggesting usage for a very long period beyond the loosening of restrictions. Such rapid movement underlines the imperative for hardening digital platforms in banks to make them sufficiently secure to reassure customers.

- Need for Legal Compliance: Banks ensure that this legal compliance inspires higher degrees of trust and confidence among customers. Other key trends of change in the online banking arena are through the integration of artificial intelligence and machine learning. These technologies allow banks to offer personalized services, enhance fraud detection, and improve customer service via chatbots and virtual assistants.

Online Banking Solution Market Future Trends

- Dominance in mobile banking: Dominance in mobile banking is an indicator of the most profound trend in the online banking solution market. Changing consumer preferences in the wake of smartphone usage have led consumers to manage their finances increasingly on mobile applications. No wonder, mobile offerings are high on the priority list of most banks, with features such as mobile check deposits, instant fund transfers, and real-time account management. This would further customer convenience and also provide an excellent way to take on competition in digital-first markets. Online banking could also be done with AI in assistance, so as to revolutionize the way it communicates with its customers.

- AI-powered chatbots and virtual assistants: These technologies can handle consumer queries and responses with desired efficiency, deliver personalized advisory services in finance, and generally raise the level of engagement between banks and their customers. With the use of big data analytics, banks can analyze user behavior in order to make interactions and recommendations much more personalized, thus making the experience more rewarding for customers. The main focus of online banking would be on a strong security system. Due to the increase in cyber-related threats, banks have begun their early adoption of multi-factor authentication, biometric verification, and more complex encryption. Full-scale protection over customer data instills trust and confidence in online banking platforms; thus, while still primary, highly secure institutions where safety measures are strong would be a better choice in retaining and attracting customers.

- Personalization of services: With data analytics, a bank gets the opportunity to render personalized financial products and customized services to customers, per each one's needs and preferences. Such personalization enhances satisfaction and increases customer loyalty, as users feel valued and understood. Such banks draw one's attention to financial wellness and, in general, to consumer education. It provides tools for customers in order for them to take control of their finances by setting a budget and achieving savings goals.

Online Banking Solution Market Opportunities

- Developing user-friendly mobile applications: Now that consumers increasingly use their smartphones to conduct daily financial transactions, banks can cash in on this trend by developing user-friendly mobile applications through which frictionless experiences can be enabled. Embedding such features as biometric authentication, personalized dashboards, and instant notifications of transactions, therefore, will enhance customer satisfaction and loyalty.

- Offering Innovative Banking Solutions: Even a bank in this regard could present itself as a trusted advisor and hence offer budgeting tools, savings goal trackers, and financial planning resources. This could also mean that with increased interest in sustainability, new opportunities will arise where the banking industry will be able to lead in green finance initiatives-such as eco-friendly investment products or loans for sustainable projects that are in demand by the environmentally conscious consumer.

- Collaboration and Partnership: The sharing of best practices with FinTech firms is building innovation and increasing the services available. This will facilitate old banks with more agile startups to achieve better technological synergy, and introduce newer solutions like blockchain for safe transactions or data analytics for personal, customized marketing.

Online Banking Solution Market Regional Insights

The regional trends and factors influencing the Online Banking Solution Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Online Banking Solution Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Online Banking Solution Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 10.5% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Banking Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Online Banking Solution Market Players Density: Understanding Its Impact on Business Dynamics

The Online Banking Solution Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Online Banking Solution Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Online Banking Solution Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Online Banking Solution Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

Frequently Asked Questions

Ankita is a dynamic market research and consulting professional with over 8 years of experience across the technology, media, ICT, and electronics & semiconductor sectors. She has successfully led and delivered 100+ consulting and research assignments for global clients such as Microsoft, Oracle, NEC Corporation, SAP, KPMG, and Expeditors International. Her core competencies include market assessment, data analysis, forecasting, strategy formulation, competitive intelligence, and report writing.

Ankita is adept at handling complete project cycles—from pre-sales proposal design and client discussions to post-sales delivery of actionable insights. She is skilled in managing cross-functional teams, structuring complex research modules, and aligning solutions with client-specific business goals. Her excellent communication, leadership, and presentation abilities have enabled her to consistently deliver value-driven outcomes in fast-paced and evolving market environments.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For