The advanced medical stopcock market is expected to reach US$ 1,230.60 million by 2028; registering at a CAGR of 4.6% from 2022 to 2028, according to a new research study conducted by The Insight Partners

Low-Pressure Stopcock Segment by Type to Account for Largest Share in Advanced Medical Stopcock Market during 2022–2028

The report highlights the key factors driving the advanced medical stopcock market growth and prominent players with their developments in the market.

Based on type, the advanced medical stopcock market is segmented into low-pressure stopcock, medium-pressure stopcock, and high-pressure stopcock. The low-pressure stopcock held the largest market share in 2022, and it is expected to continue its dominance during the forecast period. The factor driving the low-pressure stopcock segment is the rising prevalence of chronic health conditions. Based on end user, the advanced medical stopcock market is segmented into hospitals & clinics, ambulatory surgical centers, and homecare. In 2022, the hospitals segment accounted for the largest market share, and it is expected to register the highest CAGR from 2022 to 2028.

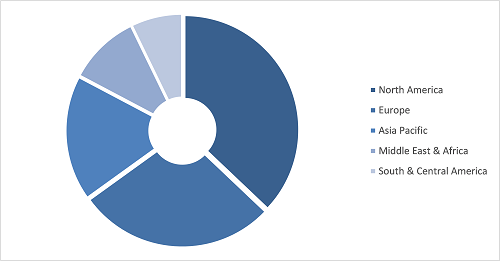

Advanced Medical Stopcock Market, by Region, 2022 (%)

Advanced Medical Stopcock Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Low-Pressure Stopcock, Medium-Pressure Stopcock, and High-Pressure Stopcock), End User (Hospitals & Clinics, Ambulatory Surgical Centers, and Homecare), and Geography

Advanced Medical Stopcock Market Growth Report by 2031

Download Free Sample

Stopcocks are devices used to direct the flow of fluid through an infusion system while allowing multiple fluids to be connected. Turning the exterior handle allows the clinician to choose the specific fluid or medication to flow at a given time. Stopcocks must meet many requirements of industry standards, such as flow rate, high- or low-pressure resistance, chemical resistance to lipid-based solutions, sterilization compatibility, dead space, and handle-rotating torque. The global advanced medical stopcock market growth is attributed to the growing prevalence of chronic diseases, increasing geriatric population, and rising number of surgical procedures. However, the safety risk associated with an advanced medical stopcock is hampering the market growth.

According to a report in November 2020 by Organization for Economic Co-operation and Development (OECD), the report says that prevention and treatment services for cardiovascular disease, cancer, and diabetes have been severely disrupted after the onset of the COVID-19 pandemic. Thus, there has been a negative impact on the advanced medical stopcock market during the first quarter of 2020 due to the lockdown and limited access to healthcare-related settings. However, after the ease of restrictions, there has been a high demand for advanced medical stopcocks owing to the rising demand for the treatment of cardiovascular disease, cancer, and diabetes, which contributes to the advanced medical stopcock market growth.

B. Braun SE, Smiths Medical Inc, Nipro Corp, Elcam Medical Group Co, Merit Medical Systems Inc, CODAN US Corp, Nordson Corp, Cook Medical LLC, JCM MED SaRL, and Utah Medical Products Inc. are among the leading companies operating in the global advanced medical stopcock market.

Various organic and inorganic strategies are adopted by companies operating in the advanced medical stopcock market. Organic strategies mainly include product launches and product approvals. Acquisitions, collaborations, and partnerships are among the inorganic growth strategies witnessed in the advanced medical stopcock market. These growth strategies allow the market players to expand their businesses and enhance their geographic presence, thereby contributing to the overall advanced medical stopcock market growth. Further, acquisition and partnership strategies help them strengthen their customer base and expand their product portfolios. A few of the significant developments by key market players are listed below.

- In October 2022, Nipro Corporation announced that one of its consolidated subsidiaries, Nipro Asia Pte. Ltd. has established a medical device sales subsidiary—Nipro Medical Philippines Corp.—in the Republic of the Philippines. Sales are scheduled to begin at this new subsidiary in January 2023.

- In January 2022, the hemodialysis Concentrate Factory, which has a construction footprint of around 4000m2 and an initial investment of USD 5 million, will enable B. Braun Vietnam to serve the local and international markets with more than 2.5 million units of 10-litre canisters of hemodialysis concentrate per year. The factory will also help create further capabilities and jobs for over 160 employees along with increase in sales of advanced medical stopcocks. It will also enable B. Braun Vietnam to continuously serve the markets and help to protect and improve the health of thousands of patients every day in Vietnam and around the world.

- In June 2020, Nordson acquired Fluortek, a plastic extrusion manufacturer that provides custom-dimensioned tubing to the medical device industry. As Nordson Medical continues to expand its diversified product offerings, the acquisition enhances the company's ability to deliver critical components for the innovation of medical devices.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com