Need to Decrease Dependency on Fossil Fuels to Escalate Market Growth During 2020–2028

According to the latest market study on “Bio-Based Ethylene Market Forecast to 2028 – COVID-19 Impact and Global Analysis – by Raw Material (Sugars, Starch, and Lignocellulosic Biomass) and End-User Industry (Packaging, Detergents, Lubricant, and Additives),” the market was valued at US$ US$ 414.34 million in 2019 and is projected to reach US$ 718.32 million by 2028; it is expected to grow at a CAGR of 6.4% from 2020 to 2028. The report highlights key driving factors and prominent market players along with their developments in the market.

Bio ethylene is now well known since it is used as a transportation fuel. Different types of natural resources such as sugars (sugarcane, sugar beets, and sweet sorghum), starch (corn and wheat), and lignocellulosic biomass (wood and grass), are used as raw materials in the production process. Bio ethylene is gaining importance from fuel additives, packaging, and detergent producing manufacturers. Industries looking for bio-based materials highly prefer utilizing bio ethylene in their products.

Ethylene is used as a feedstock for many downstream chemical products. It is one of the largest bulk chemicals and is extensively used in the production of plastics. Due to the wide-scale applications of ethylene, its demand is likely to continue to rise in the coming years. Traditionally, ethylene is manufactured from petroleum derivatives, which is resulting in the depletion of fossil fuels. To overcome this problem, biomass feedstock is considered a reliable alternative for the manufacturing of bio-based ethylene. Bio-ethylene is produced from bioethanol, which is widely made using lignocellulose biomass such as wood, sugarcane, and corn-starch, thus, reducing the dependency on petroleum derivatives, as well as on fossil fuels. Bio-based products produced using local resources are also capable of cutting down a country’s dependency on fossil fuel imports, thereby stimulating the domestic economy.

Further, bio-based ethylene reduces greenhouse gas emissions both during production and use. However, the environmental performance of bio-ethylene principally depends on the regional conditions of the production of bioethanol, emission of greenhouse gases caused due to the changes in land usage, and conditions of the necessary energy systems. However, bio-based ethylene can significantly decrease the environmental impact of chemical industries. Thus, urgent need to reduce the dependency on fossil fuels and rise in awareness regarding environmental sustainability are bolstering the bio-based ethylene market growth. Bio-based ethylene and petroleum-based ethylene are chemically identical, and thus, the existing production capacities and equipment can be used to produce other downstream products, including plastics as usual, without having much impact on the existing market, which is another factor supporting the market growth.

The COVID-19 outbreak is adversely affecting economies and industries in various countries due to lockdowns, travel bans, and business shutdowns. The global consumer goods industry is one of the significant industries suffering severe disruptions such as supply chain breaks, technology event cancellations, and office shutdowns. Several companies have already announced possible delays in product deliveries and slump in future sales of their products. Besides, the global travel bans imposed by countries in Europe, Asia, and North America are hindering business collaborations and partnership opportunities. All these factors are adversely affecting the consumer goods industry, which is restraining the growth of the bio-based ethylene market.

Braskem SA, The Dow Chemical Company, LyondellBasell Industries Holdings B.V., SABIC, and Oxy Low Carbon Ventures (OCLV) are among the well-established players in the global bio-based ethylene market. Companies in this market have been continuously focusing on strategies such as product developments, plant expansions, and mergers and acquisitions to expand their footprint worldwide and fulfill the growing demand of the market. For instance, in February 2021, Braskem SA started expanding its production capacity of green ethylene which is the principal feedstock obtained from sugarcane ethanol used to produce renewable resins. The green ethylene is produced at the company's plant in Triunfo, the Rio Grande do Sul, whose capacity will be expanded from the current 200 kton/year to 260 kton/year. The expansion project was budgeted at US$ 61 million.

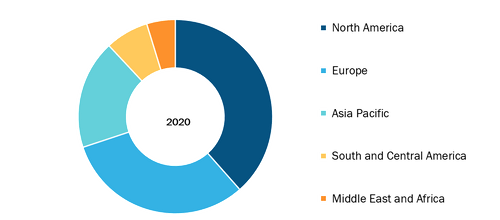

Geographic Overview of Bio-Based Ethylene Market

Bio-Based Ethylene Market Dynamics and Analysis by 2028

Download Free Sample

Bio-Based Ethylene Market Forecast to 2028 - COVID-19 Impact and Global Analysis By Raw Material (Sugars, Starch, and Lignocellulosic Biomass) and End-User Industry (Packaging, Detergents, Lubricant, and Additives)

Bio-Based Ethylene Market Dynamics and Analysis by 2028

Download Free SampleBio-Based Ethylene Market Forecast to 2028 - COVID-19 Impact and Global Analysis By Raw Material (Sugars, Starch, and Lignocellulosic Biomass) and End-User Industry (Packaging, Detergents, Lubricant, and Additives)

The report segments the global bio-based ethylene market as follows:

Bio-Based Ethylene Market, by Raw Material- Sugars

- Starch

- Lignocellulosic Biomass

- Packaging

- Detergents

- Lubricant

- Additives

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Rest of Europe

- Asia Pacific (APAC)

- Australia

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- South Africa

- Saudi Arabia

- UAE

- Rest of Middle East & Africa

- South America

- Brazil

- Argentina

- Rest of South America

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com