Rise in Preference for Float Glass in Electronic Industry to Escalate Float Glass Market Growth During 2021–2028

According to our latest market study on “Float Glass Market Forecast to 2028 – COVID-19 Impact and Global Analysis – by Type (Clear Glass, Tinted Glass, Textured Glass, and Others) and Application (Automotive and Transportation, Building and Construction, Electronics, and Others),” the float glass market was valued at US$ 73,897.83 million in 2020 and is projected to reach US$ 1,07,991.35 million by 2028; it is expected to grow at a CAGR of 5.0% from 2021 to 2028. The report highlights key factors driving the float glass market growth and prominent players along with their developments in the float glass market.

Float glass is an extremely smooth and distortion-free glass. The glass is used in various end-use industries, such as building and construction, automotive, electronics, and solar. It is made by pouring the molten glass from a furnace into a chamber, which contains a bed of molten tin. The increasing use of float glass in interior design and modern architecture and in building and construction applications, such as ceiling, flooring, reflective, coated, windows, mirrors, tabletops, and insulated glass, propels the demand for float glass. In addition, the growing use of float glass in automotive applications is expected to drive the growth of the float glass market during the forecast period.

There has been a rising preference for float glass in the electronic industry worldwide due to its various benefits. Through a series of processing on float glass, including cutting, coating, drilling, grinding, and screen printing, the glass can be used for electronic or electric equipment such as LCD screen, touch screen, advertising machine screen, flat panel, and electromagnetic oven. Along with this, indium tin oxide (ITO) and anti-reflection (AR) coating will help in reducing the light reflectivity and assist in providing the necessary electrical conductivity for the glass screen. Manufacturers are focusing on producing thin sheet float glass, which will be used in various electronic appliances. For instance, AGC manufactured thin sheet float glass, used in next generation displays, touchscreens, lightings, and high-tech applications. Along with this, Schott BOROFLOAT—the world's first floated borosilicate glass—is being used to manufacture biochips, DNA sequencers, and chemical reactor inspection panels. Custom soda-lime float glass is increasingly used in non-scientific applications, including protecting CCTV cameras, picture framing applications, and flat panel displays. Thus, increased usage of float glass in the electronic industry will drive the float glass market worldwide.

AGC Inc.; Nippon Sheet Glass Co., LTD (NSG Group); Xinyi Glass Holdings Limited; SCHOTT AG; Guardian Industries Holdings; Cardinal Glass Industries, Inc.; China Glass Holdings Limited; Shenzhen Sun Global Glass Co. Ltd.; Saint Gobain Glass India; and Qingdao Migo Glass Co. Ltd. are among the well-established players operating in the float glass market.

Impact of COVID-19 Pandemic on Float Glass Market

The shutdown of various manufacturing plants and factories in North America, Europe, Asia Pacific, South America, and the Middle East & Africa due to the COVID-19 pandemic has hampered the global supply chain and manufacturing processes, delivery schedules, and product sales. In addition, the restrictions imposed by countries in Europe, Asia, and North America are affecting business collaborations and partnership opportunities. The ongoing COVID-19 pandemic has had a negative impact on the float glass market due to the disruptions in the production and supply chain. The glass shortfall is expected to last until 2021, causing disruptions in a variety of businesses. Glass supply is tightening and has become more costly to purchase because of a various issue, such as the worldwide pandemic and international tariffs. As a result of the global pandemic, many factories and manufacturers had to suspend or slow down glass production, making it exceedingly difficult to meet current demands. Restarting the factories after being closed or producing at a low level for an extended period may be exceptionally challenging, especially if the companies aren't operating at full capacity owing to health and safety regulations. Further, with COVID-19 vaccinations being a high priority for both the public and the health business, the availability of glass has been redirected to the cause, which has led to the unavailability of glass for other industries, thus creating shortage of glass in the float glass market.

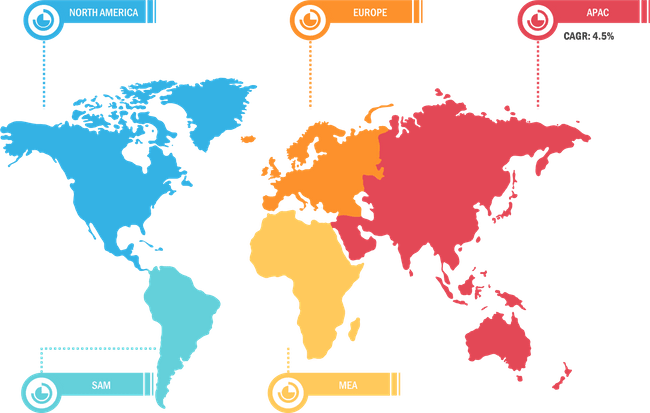

Float Glass Market by Region, 2020

Float Glass Market Growth Report | Size, Share Insights 2028

Download Free Sample

Float Glass Market Forecast to 2028 - COVID-19 Impact and Global Analysis By Type (Clear Glass, Tinted Glass, Textured Glass, and Others) and Application (Automotive and Transportation, Building and Construction, Electronics, and Others) and Geography

Float Glass Market Growth Report | Size, Share Insights 2028

Download Free SampleFloat Glass Market Forecast to 2028 - COVID-19 Impact and Global Analysis By Type (Clear Glass, Tinted Glass, Textured Glass, and Others) and Application (Automotive and Transportation, Building and Construction, Electronics, and Others) and Geography

The “Global Float Glass Market Analysis to 2028” is a specialized and in-depth study of the chemicals and materials industry with a special focus on the global float glass market trend analysis. The report aims to provide an overview of the float glass market. The float glass market is segmented on the basis of type, application, and geography. Based on type, the float glass market is segmented into clear glass, tinted glass, textured glass, and others. Based on application, the float glass market is segmented into automotive and transportation, building and construction, electronics, and others. Based on geography, the float glass market is segmented into five main regions—North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com