Orthopedic Surgery Segment by Application to Account for Largest Share in Surgical Stapling Devices Market during 2022–2028

According to our latest study on “Surgical Stapling Devices Market Forecast to 2028 – COVID-19 Impact and Global Analysis – by Product, Type, Application, and End User,” the surgical stapling devices market is expected to grow from US$ 4,795.8 million in 2022 to US$ 7,747.1 million by 2028; it is estimated to grow at a CAGR of 8.3% from 2022 to 2028. The report highlights the key factors driving the surgical stapling devices market growth and prominent players with their developments in the surgical stapling devices market.

Based on application, the surgical stapling devices market is segmented into orthopedic surgery, endoscopic surgery, cardiac and thoracic surgery, abdominal and pelvic surgery, and others. The orthopedic surgery segment held the largest share of the surgical stapling devices market in 2022 and is expected to grow at the highest CAGR during the forecast period. The factor driving the orthopedic surgery segment mainly includes growing preferences over suture methods, especially if the cut is wide and large. For instance, MedShape Inc., a developer of orthopedic devices using advanced functional materials, announced the full commercial launch of the DynaClip Bone Fixation system. Featuring superelastic nickel-titanium (NiTiNOL) technology, the DynaClip represents the next generation in bone stapling by providing both dynamic compression and reliable durability to withstand the demanding loading conditions in the foot and ankle. Furthermore, Tyber Medical earned US Food and Drug Administration (FDA) 510(k) clearance for its new NiTy+ One-Shot staple fixation system.

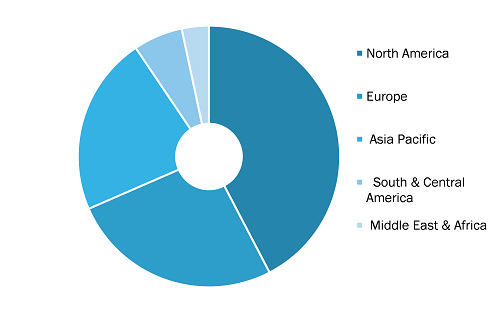

Surgical Stapling Devices Market, by Region, 2022 (%)

Surgical Stapling Devices Market Forecast to 2028 - COVID-19 Impact and Global Analysis By Product (Powered Surgical Staplers and Manual Surgical Staplers), Type (Disposable Surgical Staplers and Reusable Surgical Staplers), Application (Orthopedic Surgery, Endoscopic Surgery, Cardiac and Thoracic Surgery, Abdominal and Pelvic Surgery, and Others), and End User (Hospitals and Ambulatory Surgical Centers)

Surgical Stapling Devices Market by Size, Share & Trend Analysis 2028

Download Free Sample

Source: The Insight Partners Analysis

The number of cardiovascular, general, orthopedic, gynecological, and cancer surgeries performed in hospitals is increasing worldwide. For instance, according to a research article published on PubMed.gov, the number of isolated heart transplants in Germany reached ~340 surgeries in 2020, accounting for a 2.1% increase compared to 2019. As per the national library of medicine, total 310 million major surgeries were performed every year on global level, out of which ~40-50 million were performed in the US and ~20 million in Europe. The geriatric population is prone to severe health conditions, which may require surgeries as a treatment option. Surgeries for hernias, cataracts, and joint replacement are more common among these people. Further, aesthetic surgical procedures are more common among people working in the entertainment industry. These surgeries are performed on patients who require the replacement of a body part due to an injury or a deformity. Therefore, a rise in the number of surgeries performed at hospitals or similar healthcare centers drives the demand for surgical stapling devices for the closure of incision sites.

Moreover, the cases of work-related injuries or occupational injuries are rising worldwide. Poor working conditions are the leading cause of chronic wounds among people. According to the International Labor Organization, ~2.3 million people yearly suffer from work-related accidents. These wounds affect their health and quality of life. The burden of chronic wounds eventually underlines the need for advanced wound care management. Various countries spend significant amounts on treating injuries and avoiding associated risks. For instance, the US healthcare system spends over US$ 25 billion on treating wounds and related complications every year. With a surge in cases of chronic wounds, the demand for surgical stapling devices is also increasing worldwide as it is one of the easy and quick method of wound closure and it also enhances the healing process.

The sudden outbreak of COVID-19 has had a severe impact on the surgical staple industry due to the lockdown measures across the world that have resulted in decreased public mobility and a sudden halt on surgical procedures that are non-immediate and are being postponed to decrease the burden on healthcare infrastructure. According to the article titled ' Elective surgery cancellations due to the COVID-19 pandemic: global predictive modelling to inform surgical recovery plans' published in the British Journal of Surgery in May 2020, based on 12 weeks of peak disruption to hospital services due to COVID-19, around 28.4 million elective surgeries worldwide were canceled or postponed in 2020. However, going forward, the market is expected to experience a spur after the relaxation of lockdown restrictions. The Italian Society of Urology (SIU), the Spanish Urological Association (AEU), the German Society of Urology (DGU), the French Association of Urology (AFU), and the British Association of Urological Surgeons (BAUS) have collaborated to develop guidelines for performing selective diagnostic and surgical procedures.

Intuitive Surgical Inc., Medtronic Plc, Ethicon USA LLC, Frankenman International Ltd, Panther Healthcare Medical Equipment Co Ltd, B. Braun SE, Grena Ltd, Conmed Corp, 3M Co, and Purple Surgical UK Ltdare among the leading companies operating in the global surgical stapling devices market.

Various organic and inorganic strategies are adopted by companies operating in the surgical stapling devices market. Organic strategies mainly include product launches and product approvals. Acquisitions, collaborations, and partnerships are among the inorganic growth strategies witnessed in the surgical stapling devices market. These growth strategies allow the market players to expand their businesses and enhance their geographic presence, thereby contributing to the overall surgical stapling devices market growth. Further, acquisition and partnership strategies help them strengthen their customer base and expand their product portfolios.

A few of the significant developments by key market players are listed below.

- In June 2022, Ethicon launched next generation Echelon 3000 stapler designed for exceptional access and control. It is digitally enabled device that provides surgeons with simple, one-handed powered articulation to help address the unique needs of their patients. Designed with 39% greater jaw aperture and a 27% greater articulation span,3,4 ECHELON 3000 gives surgeons better access and control over each transection, even in tight spaces and on challenging tissue.

- In December 2021, Intutive Surgical Inc received FDA clearance for 8 mm SureForm 30 Curved-Tip Stapler. and reloads for use in general, thoracic, gynecologic, urologic, and pediatric surgery.

- In March 2021, Ethicon launched of the ECHELON+ Stapler with GST Reloads, a new powered surgical stapler designed to increase staple line security and reduce complications through more uniform tissue compression and better staple formation, even in challenging situations.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com