Non-Viral Methods Segment Held Largest Share of Transfection Reagents and Equipment Market in 2022

According to our new research study on “Transfection Reagents and Equipment Market Forecast to 2030 – Global Analysis – by Modality, Product, Application and End User,” the transfection reagents and equipment market is expected to grow from US$ 1,170.79 million in 2022 to US$ 2,145.03 million by 2030; it is anticipated to record a CAGR of 7.8% from 2022 to 2030. The report emphasizes the trends in the global transfection reagents and equipment market and the drivers and deterrents affecting its growth.

Based on modality, the transfection reagents and equipment market is classified into viral, non-viral, and hybrid methods. In 2022, the non-viral methods segment held the largest share of the market. The non-viral methods segment will record the highest CAGR from 2022 to 2030. The non-viral-based transfection approach can be further classified into physical/mechanical and chemical methods. Commonly used physical/mechanical transfection methods include electroporation, sonoporation, magnetofection, gene microinjection, and laser irradiation. Electroporation is a commonly used physical transfection method that uses electrical voltage to transiently increase the cell membrane permeability to allow the entry of foreign nucleic acid into the cells. Ultrasound-assisted transfection or sonoporation involves using a microbubbles technique to create holes into the cell membrane to ease the transfer of genetic materials, while laser irradiation-assisted transfection uses a laser beam to create small holes in the plasma membrane to allow the entry of foreign genetic substances. Chemical transfection methods can be categorized as liposomal-based or non-liposomal-based. Liposomal-based transfection reagents permit the formation of positively charged lipid aggregates that can smoothly combine with the phospholipid bilayer of the host cell to permit the entry of foreign genetic materials with minimal resistance. Non-liposomal transfection reagents can be divided into several classes: calcium phosphate, dendrimers, polymers, nanoparticles, and non-liposomal lipids. Viral vector systems include retroviruses, adenoviruses (AdV), adenovirus-associated viruses (AAV), lentiviruses (LV), and bacteriophages. Most gene therapy drugs currently available on the market use viruses as vectors. Although viral vectors pose disadvantages such as high immunogenicity, safety hazards, and production difficulties, their higher transfection efficiencies present a unique advantage in gene delivery. Generally, retroviruses can only be used to transfect dividing cells, while adenoviruses, AAVs, and herpes viruses can be used to transfect dividing and non-dividing cells.

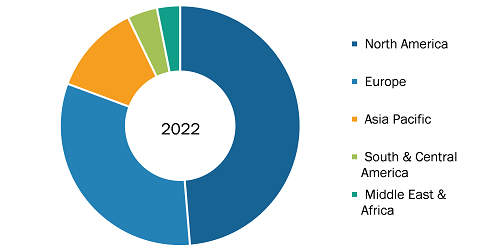

Transfection Reagents and Equipment Market, by Region, 2022 (%)

Transfection Reagents and Equipment Market Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Reagents and Instruments), Method (Viral Methods, Non Viral Methods, and Hybrid Methods), Application (Biomedical Research, Protein Production, and Therapeutic Delivery), End User (Academics & Research Institutes and Pharmaceutical & Biotechnology Companies), and Geography

Transfection Reagents and Equipment Market Size by 2030

Download Free Sample

Source: The Insight Partners Analysis

The transfection reagents and equipment market is bifurcated into reagents and equipment based on product. In 2022, the reagents segment held a larger share of the market. The reagents segment is expected to record a higher CAGR from 2022 to 2030. The demand for transfection reagents is increasing with an upsurge in product launches and the focus on scaling up the transfection process. In August 2021, Mirus Bio launched the TransIT VirusGEN GMP Product Line, which provides transfection reagents and enhancers to support viral vector manufacturing for gene therapy development and related processes. The TransIT VirusGEN GMP transfection reagent was developed to enhance the delivery of transfer vaccine DNA to suspension and adherent HEK 293 cells to better the production of recombinant AAV and LV vectors. The growing focus on launching GMP-complaint transfecting reagents to enhance vectors' production capacity further fuels the market's market for transfection reagents.

Based on application, the transfection reagents and equipment market is classified into biomedical research, protein production, and therapeutic delivery. In 2022, the biomedical research segment held the largest share of the market. The market for this segment is expected to grow at the fastest CAGR from 2022 to 2030. Transfection has emerged as a crucial biomedical research technique due to its ability to manipulate gene expression. Gene transfer has been proposed as a new approach to enhance the effectiveness of anti-tumor drugs in treating intractable or metastatic cancers. The association of gene therapy and drugs (similar therapy) has been reported to increase the antiproliferative effects of classic colorectal, lung, pancreatic, bladder, and breast cancer treatments, among others. Cultivated mammalian cells have become a dominant medium for manufacturing recombinant proteins for clinical applications due to their ability to aid proper protein folding, assembly, and posttranslational modifications. Genetically engineered mammalian cell lines generally secrete biotherapeutics into their culture medium, and they can then be purified for homogeneity and sterilized under well-defined regulated conditions. The development of a process for manufacturing recombinant proteins in mammalian cells follows a well-established process that starts with transferring a recombinant gene with the necessary transcriptional regulatory elements to the cells by transfection.

Based on the end user, the transfection reagents and equipment market is classified into academic and research institutes and pharmaceutical and biotechnological companies. In 2022 the academic and research institutes segment held a larger market share. The pharmaceutical and biotechnological companies market is expected to grow at a higher CAGR from 2022 to 2030. A cumulative portfolio of the global biopharmaceutical industry reflects an increase in competition in therapeutics, an upsurge in the use of large molecule drugs, growth in the number of personalized or targeted products, and a rise in treatments for many orphan diseases. These trends have led to biopharmaceutical products with extremely limited production runs, highly specific research requirements, and genotype-based products. This fundamental shift in the product mix and a shift in focus on improving the effectiveness and efficiency of production are driving the popularity of technologies and processes necessary to support advanced biopharmaceutical manufacturing.

Thermo Fisher Scientific Inc., Promega Corporation, Qiagen N.V., Merck KGaA, Lonza Group, F.Hoffmann-La Roche Ltd, Bio-Rad Laboratories Inc., Mirus Bio LLC, MaxCyte Inc, and Polyplus-Transfection SA are a few of the key companies operating in the transfection reagents and equipment market. These companies adopt product innovation strategies to meet the increasing customer demand, allowing them to maintain their brand name.

The report segments the transfection reagents and equipment market as follows:

Based on product, the transfection reagents and equipment market is classified into reagents and equipment. In 2022, the reagents segment held a larger share of the market. The reagents segment will record a higher CAGR from 2022 to 2030. Based on modality, the transfection reagents and equipment market is classified into viral, non-viral, and hybrid methods. In 2022, the non-viral methods segment held the largest share of the market. This segment is expected to register the fastest CAGR during 2022–2030. In terms of application, the transfection reagents and equipment market is classified into biomedical research, protein production, and therapeutic delivery. In 2022, the biomedical research segment held the largest share of the market. The market for this segment is expected to grow at the fastest CAGR from 2022 to 2030. Based on the end user, the transfection reagents and equipment market is classified into academic and research institutes and pharmaceutical and biotechnological companies. In 2022, the academic and research institutes segment accounted for a larger market share. The pharmaceutical and biotechnological companies market is expected to grow at a higher CAGR from 2022 to 2030. Based on geography, the transfection reagents and equipment market is segmented into North America (US, Canada, and Mexico), Europe (UK, Germany, France, Italy, Spain, and Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, and Rest of Asia Pacific), the Middle East & Africa (UAE, Saudi Arabia, South Africa, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com