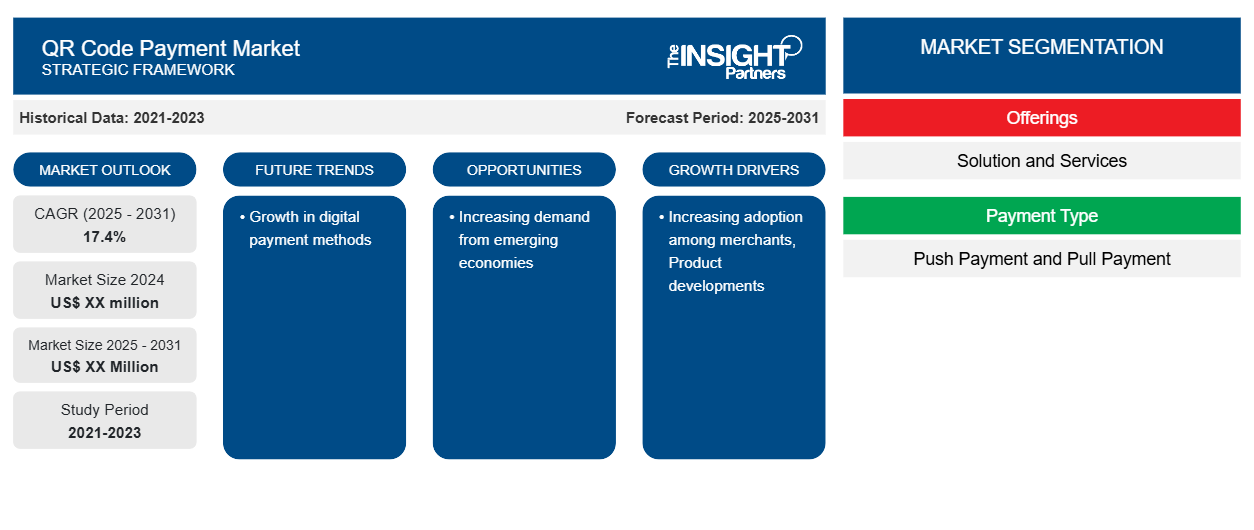

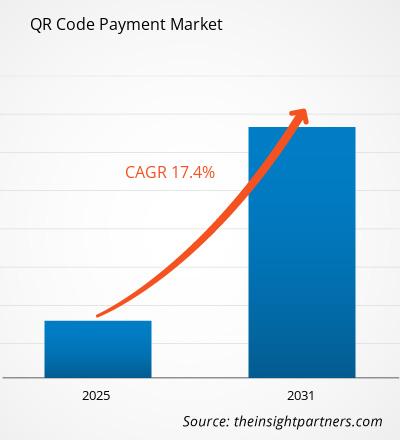

The QR Code Payment market is projected to expand at a CAGR of 17.4% from 2025 to 2031. With the expansion of QR code payment systems in recent years, financial transactions have experienced an extreme change over the years. QR code payments have increased in numerous aspects of daily life, including retail shopping, bill payments, and other areas. This technology has become prevalent owing to its extensive acceptance across numerous industries. The features of QR codes comprise improved security, scalability, seamless user experience, and ease of use.

QR Code Payment Market Analysis

The QR code payment market has seen an increase in adoption in recent years, driven by numerous factors. One of the important drivers is the growth of smartphone usage, predominantly in developing countries such as India. As more individuals gain access to affordable smartphones, they are progressively turning to QR code payments as a suitable and easy way to make transactions. Furthermore, the fast adoption of digital payments is another foremost driver fueling the market growth. With consumers gradually moving away from cash and towards electronic payments, merchants are looking for novel ways to provide digital payment options. QR code payment delivers a cost-effective and simple way to make transactions without needful costly point-of-sale terminals or other hardware.

QR Code Payment Market Industry Overview

- A Quick Response (QR) code is a two-dimensional code that is capable of 360-degree (omni-directional) high-speed reading and stores a larger amount of information per unit area. It has a pattern of black squares that are arranged on a square grid with a white background and imaging devices, such as smartphone cameras, that can be used to read these QR codes.

- While scanning a QR code, the horizontal and vertical patterns of the matrix are decoded by the software on a smartphone and are further converted into a string of characters. Depending on the command of those characters, the smartphone opens a browser link, confirms payment information, and verifies geolocation.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONQR Code Payment Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

QR Code Payment Market Driver and Opportunities

Rapid Adoption of QR Code Payments among Merchants to Drive the QR Code Payment Market

- Numerous businesses engage in providing an extensive range of goods and are increasingly providing QR code payment market options to their customers. For instance, in China, the merchant generates both the invoice of a particular amount & the QR code and displays the QR code on the screen of the smartphone.

- Furthermore, the customer scans to pay the merchant through the generated QR code from their mobile wallet application. Furthermore, millennials are the major target customer segments for merchants, as they largely use smartphones for making purchases, which propels the growth of the QR code payment market.

Surge in Adoption of QR Codes Payment Services in Developing Economies to Create Lucrative Market Opportunities

- Developing economies, such as China and India, have a high penetration of smartphones along with increasing 3G and 4G connectivity users. In addition, both countries account for more than one-third of the world’s population, thus posing the maximum market potential for the QR code payment market. It is anticipated that approximately 90% of the population under the age of 30 years reside in these emerging markets. Growth in the middle-class segment, rapid urbanization, rise in literacy level, and increase in tech-savvy youth generation would increase the consumption rate in emerging economies, thus leading to the QR codes payment market growth.

QR Code Payment Market Report Segmentation Analysis

The key segments that contributed to the derivation of the QR code payment market analysis are offerings, solutions, payment type, transaction channel, and end-user.

- Based on Offerings, the market is segmented into solution and services.

- The solution segment dominated the market in 2023. The QR code payment system is generally customizable, which means that it can be personalized to the precise needs of a business, such as integrating with online stores or existing POS systems.

- The dynamic QR code held prominent market share in 2023. Dynamic QR codes can be generated in real time and can hold different data or amounts depending on the transaction, making them extremely versatile. The flexibility allows businesses to generate personalized payment experiences for their clientele, such as offering promotions or discounts based on customer data or purchase history.

- Based on payment, the market is bifurcated into push payment and pull payment.

- Based on transaction channels, the market is segmented into face-to-face and remote.

- End-User (Restaurant, Retail & E-commerce, E-ticket Booking, and Others.

QR Code Payment Market Share Analysis By Geography

- The scope of the QR code payment market is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America.

- The North America regional market is projected to grow at a substantial CAGR during the forecast period. The market growth growth is attributed to numerous factors, such as high smartphone penetration, robust financial infrastructure, and the popularity of digital payments. With a developed and mature economy, North America has an affluent and large consumer base that values speed and convenience in payment transactions.

QR Code Payment Market Regional Insights

The regional trends and factors influencing the QR Code Payment Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses QR Code Payment Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

QR Code Payment Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 17.4% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Offerings

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

QR Code Payment Market Players Density: Understanding Its Impact on Business Dynamics

The QR Code Payment Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the QR Code Payment Market top key players overview

QR Code Payment Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the QR code payment market. Some of the recent key market developments are listed below:

- In December 2022, Brazil based QR code technology and instance payment solution provider to financial institutions, Matera, announced the launch of its operations in the US and established new headquarters in San Francisco to expand its business presence. [Source: Matera, Company Website]

QR Code Payment Market Report Coverage & Deliverables

The QR code payment market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. The market report "QR Code Payment Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

Frequently Asked Questions

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For