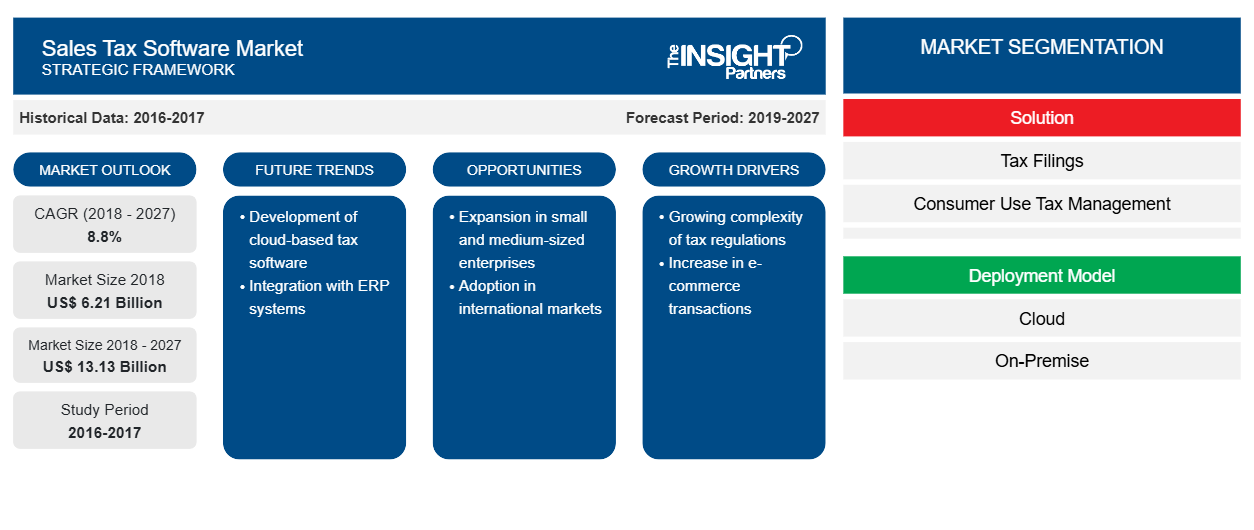

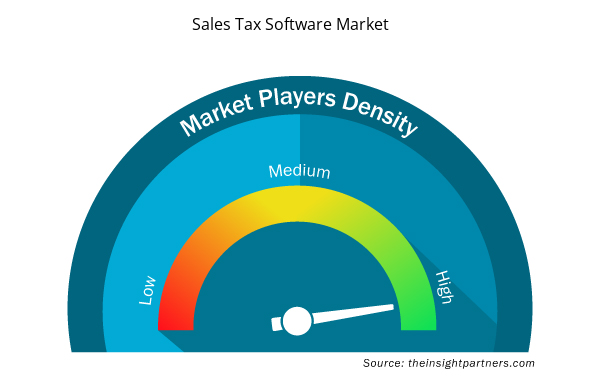

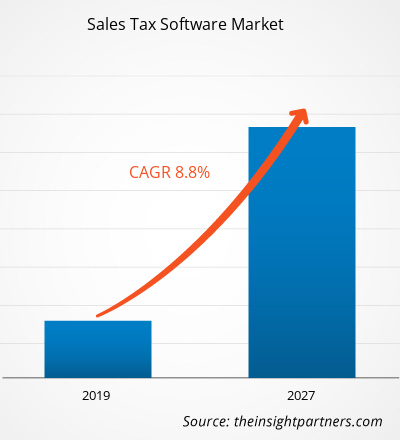

[Research Report] The sales tax software market accounted to US$ 6.21 Bn in 2018 and is expected to grow at a CAGR of 8.8% during the forecast period 2019 - 2027, to account to US$ 13.13 Bn by 2027.

Among the various geographic regions, North America was the leading sales tax software market, and it is anticipated to be the highest revenue contributor throughout the forecast period. The growth and adoption in North American sales tax software market is primarily driven by the growing demand of sales tax software from various industries such as retail, IT & telecom, transportation, and healthcare among others.

Market Insights

Focus on constantly updating tax laws and regulations across the globe

Sales tax and indirect taxes are major sources of revenue for governments, and efficient as well as elaborate tax laws help authorities collect maximum tax revenue. With increasing cross border trade and online retail around the world, coupled with latest trends such as e-commerce and digitalization, taxation authorities around the world are constantly updating their tax laws and regulations to cover these recent developments in global market places. The effect of tax laws and regulations changes is uncertain and depends on multiple factors, hence, businesses need to invest substantial amount of resources to understand and evolve their sales tax determination calculations. With humans involved, there is a high risk of missing important details which could lead to calculation errors and penalties from authorities. Large enterprises understood this need and are investing in automation of sales tax determination, and filing process in order to reduce chances of human error, however, small and medium sized businesses are still in the process of adapting to the idea of automation and digitization. Hence, continuously changing tax laws and regulations are expected to drive the future growth of sales tax software market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Sales Tax Software Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Sales Tax Software Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Increase in digitization if fueling the overall growth in sales tax software market

This digitization revolution around the world presents a massive opportunity for businesses to utilize digital services and automation in order to transform their business models, and existing processes for increasing operational efficiency and revenue. Digital transformation or digitization of businesses is basically the integration of digital technology in various business processes, organizational activities and business models. End to end business process optimization, operational efficiency, reduction of cost and human errors are some of the major drivers for digital transformation in any industry. The paradigm shift of companies from traditional processes to digital and automated processes has reaped multiple benefits for the enterprises, ranging from improved efficiency to reduced cost and increased revenue opportunities. In addition to this, the technological advancements in cloud computing and storage technology, the power of cloud based platforms has increased multi-fold during the last decade. This has further created new opportunities for enterprises to opt for cloud based sales tax software.

Component Insights

The global sales tax software market by component was led by tax determination & filing solutions segment. Compliance document management solutions held the second largest share in sales tax software market in 2018, and is anticipated to increase its shares during the forecast period from 2019 – 2027.

Deployment Type Insights

The global sales tax software market by deployment type was led by cloud segment. Companies are more inclined towards cloud-based sales tax software, as the tax return is automatically backed up secure servers. Cloud-enabled software allows businesses to swiftly expand without making significant investments into their technology infrastructure, as cloud technologies are tremendously adaptive to accelerated rates of change. They are adaptive to dynamic regulatory and reporting environments.

Industry Vertical Insights

The global sales tax software market is segmented by industry vertical as BFSI, retail, IT & telecom, transportation, healthcare, and others. In 2018, retail held the largest revenue share global sales tax software market and is anticipated to continue its dominant position during the forecast period from 2019 – 2027. The other end-user of sales tax software market includes energy, manufacturing, education, and hospitality.

The market players present in sales tax software market are mainly focusing on product enhancements by implementing advanced technologies. By signing partnership, contracts, joint ventures, funding, and inaugurating new offices across the world permit the company to maintain its brand name globally. Few of the recent developments in the global sales tax software market are listed below:

2019:Sovos Compliance and Tytho signed a strategic partnership agreement to reinforce the position in tax leadership and also to assist with the implementation of Sovos Compliance solutions and promote its product as well.

2017:TaxJar closed US$ 60 Mn in Series A funding round from Insight Venture Partners. The most recent funding of US$ 2Mn was led by Rincon Venture Partners and Daher Capital in 2014. The funding would allow the company to focus on product development and business development strategies.

2018:Ryan extended the scope of alliance with Avalara to provide advisory services for motor fuel companies which are looking to switch ERP systems to gain efficient tax determination and reporting.

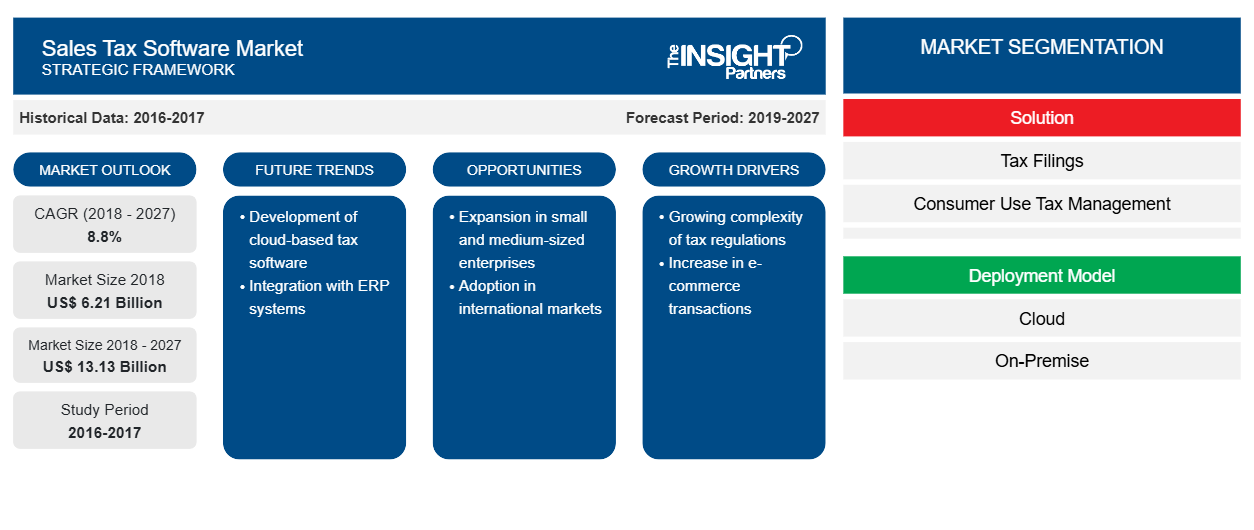

Sales Tax Software Market Regional Insights

The regional trends and factors influencing the Sales Tax Software Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Sales Tax Software Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Sales Tax Software Market

Sales Tax Software Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 6.21 Billion |

| Market Size by 2027 | US$ 13.13 Billion |

| Global CAGR (2018 - 2027) | 8.8% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Solution

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Sales Tax Software Market Players Density: Understanding Its Impact on Business Dynamics

The Sales Tax Software Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Sales Tax Software Market are:

- Apex Analytix

- Avalara, Inc.

- Ryan, LLC

- The Sage Group PLC

- Sovos Compliance LLC.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Sales Tax Software Market top key players overview

GLOBAL SALES TAX SOFTWARE MARKET – MARKET SEGMENTATION

By Component

- Tax Determination & Filing Solutions

- Compliance Document Management Solutions

- Services

By Deployment Type

- Cloud

- On-Premise

By Industry Vertical

- BFSI

- IT and Telecom

- Retail

- Healthcare

- Transportation

- Others

By Geography

North America

- U.S.

- Canada

- Mexico

Europe

- France

- Germany

- UK

- Russia

- Italy

- Rest of Europe

Asia Pacific (APAC)

- South Korea

- China

- India

- Japan

- Australia

- Rest of APAC

Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

South America (SAM)

- Brazil

- Argentina

- Rest of SAM

Company Profiles

- APEX Analytix

- Avalara, Inc.

- Ryan, LLC

- The Sage Group Plc

- Sovos Compliance LLC

- Taxjar

- Thomson Reuters Corporation

- Vertex, Inc.

- Wolters Kluwer (CCH Incorporated)

- Xero Limited

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Solution ; Deployment Model ; Industry Vertical

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Mexico, UK, Germany, Spain, Italy, France, India, China, Japan, South Korea, Australia, UAE, Saudi Arabia, South Africa, Brazil, Argentina

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

The List of Companies - Sales Tax Software Market

- Apex Analytix

- Avalara, Inc.

- Ryan, LLC

- The Sage Group PLC

- Sovos Compliance LLC.

- Taxjar

- Thomson Reuters Corporation

- Vertex, Inc.

- Wolters Kluwer (CCH Incorporated)

- Xero Limited

Get Free Sample For

Get Free Sample For