eVTOL Aircraft Market Share and Forecast by 2031

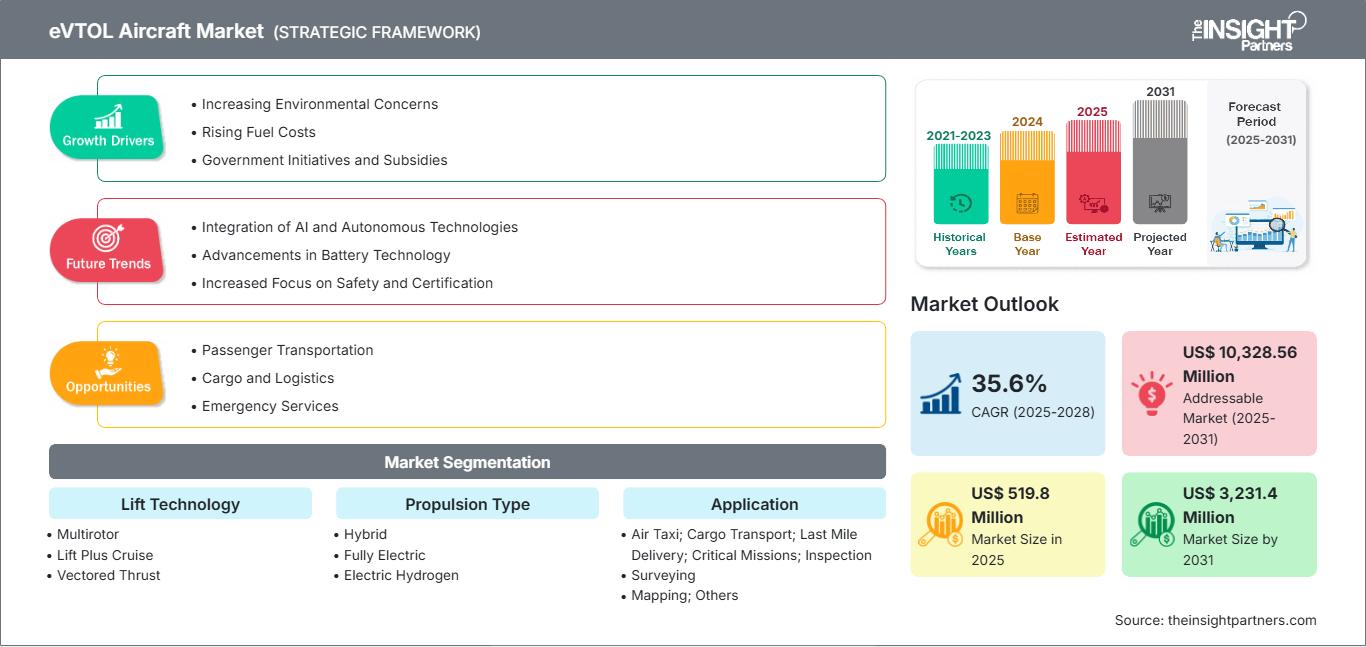

eVTOL Aircraft Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Lift Technology (Multirotor, Lift Plus Cruise, Vectored Thrust, and Others), Propulsion Type (Hybrid, Fully Electric, and Electric Hydrogen), Application (Air Taxi; Cargo Transport; Last Mile Delivery; Critical Missions; Inspection, Surveying, and Mapping; and Others), and Operation Mode (Piloted, Optionally Piloted, and Autonomous)

Historic Data: 2021-2023 | Base Year: 2025 | Forecast Period: 2025-2031- Report Date : Apr 2026

- Report Code : TIPRE00007568

- Category : Aerospace and Defense

- Status : Data Released

- Available Report Formats :

- No. of Pages : 182

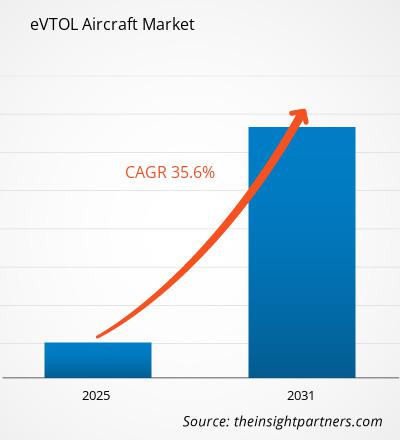

The eVTOL aircraft market is expected to grow from US$ 519.8 million in 2025 to US$ 3,231.4 million by 2031; it is expected to grow at a CAGR of 35.6% from 2025 to 2031.

Based on region, the global eVTOL aircraft market is segmented into North America, Europe, Asia Pacific, and the Rest of World. In 2024, Europe is expected to lead the market with a substantial market share, followed by North America. Further, North America is expected to register the highest CAGR in the market from 2025 to 2031.

The eVTOL aircraft market is in the development phase in the European countries; however, the leading companies are strategically working to leverage the market dynamics. For instance, Volocopter GmbH, a German aircraft manufacturer and a leading pioneer of urban air mobility (UAM), had planned to launch the world’s first-ever eVTOL suite of services with the help of passenger air taxis and heavy-lift cargo drones between 2024 and 2026. Also, in March 2022, Jetex and Volocopter signed a strategic partnership agreement to define a safe and sustainable model of urban air mobility. The partnership was established to deploy and operate permanent, economically sustainable, and integrated UAM taxi takeoff and landing infrastructure and services for passenger transportation.

North America is expected to be the fastest-growing region in the global eVTOL aircraft market during the forecast period, according to the market analysis. This is owing to the presence of many eVTOL companies in the region that include vendors such as Archer Aviation, Alakai Skai, Opener Aero, BETA Technologies, Gravitas, Joby Aviation, Wisk Aero LLC., Jaunt Air Mobility, Kittyhawk, and Bell Textron Inc. The eVTOL aircraft market is in the development phase and is expected to grow in the coming years in North America, owing to a rising number of investments and strategic initiatives from key players in the eVTOL aircraft industry. For instance, in February 2021, United Airlines and Archer Aviation announced a partnership to leverage the international carrier's aviation experience. As per the partnership, United Airlines would purchase 200 eVTOL aircraft from Archer. In addition, in June 2021, Vertical Aerospace announced deals worth US$ 4 billion with American Airlines, Virgin Atlantic, and leasing group Avolon for up to 1,000 of its VA-X4 eVTOL aircraft.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONeVTOL Aircraft Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on eVTOL Aircraft Market

The overall impact of the COVID-19 pandemic on the aviation industry is severe. The global aviation industry is expected to lose ~US$ 200 billion from 2020 to 2022. The impact of the pandemic has led to declined aircraft production, disrupted supply chain during the FY 2020, postponement of new orders, transportation challenges for sourcing materials or parts, and labor challenges for the aviation industry vendors. This had also adversely affected the eVTOL industry. As the eVTOL industry is still in its development phase and is required to have a rising economic growth to sustain the developments across the eVTOL industry, the ongoing projects such as testing, certification, and production of prototypes have been severely impacted during the pandemic.

Market Insights – eVTOL Aircraft Market

Europe leads in the adoption of eVTOL aircraft, technological advancements, and expenditure on eVTOL technologies. This is primarily driving the eVTOL aircraft market growth. The European eVTOL aircraft market has started witnessing rapid recovery for its development. Companies such as Lilium and Volocopter have also witnessed a rising number of pre-orders expected to increase the market size once it is commercialized. For instance, in 2021, Lilium announced that it had already secured a contract worth US$ 1 billion wherein the company is about to provide 220 units of its 5-seater eVTOL aircraft to Luxaviation Group. Moreover, in 2022, Lilium got another pre-order of 150 six-passenger jets that NetJets will provide in the coming years. The lockdown further discontinued the eVTOL aircraft and its prototype production and testing from 2020 to 2021. However, in contrast to the factors mentioned above, the European eVTOL aircraft market players managed to acquire contracts related to eVTOL aircraft development from investors and partners across the region. This further enabled the market players to generate revenues, perform various flight tests and contribute to the eVTOL aircraft market development.

The eVTOL aircraft market is segmented into lift technology, propulsion type, application, and operation mode. Based on lift technology, the eVTOL aircraft market is segmented into multirotor, lift plus cruise, vectored thrust, and others. Based on propulsion type, the market is segmented into hybrid, fully electric, and electric hydrogen. Based on application, the market is categorized into air taxi; cargo transport; last mile delivery; critical missions; inspection, surveying, and mapping; and others. Based on operation mode, the eVTOL aircraft market is segmented into piloted, optionally piloted, and autonomous.

Airbus (The Netherlands), Bell Textron Inc. (US), Boeing (US), Eve Air Mobility (Brazil), Lilium GmbH (Germany), Opener (US), EHang (China), BETA Technologies (US), Pipistrel Group (Slovenia), Volocopter GmbH (Germany), Joby Aviation Inc. (US), Heart Aerospace (Sweden), and Archer Aviation Inc. (US) are among the players profiled during the study of the eVTOL aircraft market.

eVTOL Aircraft

eVTOL Aircraft Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 519.8 Million |

| Market Size by 2031 | US$ 3,231.4 Million |

| Global CAGR (2025 - 2031) | 35.6% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Lift Technology

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

eVTOL Aircraft Market Players Density: Understanding Its Impact on Business Dynamics

The eVTOL Aircraft Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

The eVTOL aircraft market players are mainly focused on the development of advanced and efficient products, mergers, and partnerships.

- In 2022, Thales partnered with Eve for eVTOL development. Thales announced to support the development of its eVTOL aircraft in Brazil. The strategic partnership involves a series of joint studies over a twelve-month period, which started in January 2022, on the technical, economic, and adaptable feasibility of a 100% electrically powered aircraft.

- In 2021, Heart Aerospace partnered with Arennova Aerospace S.A. to co-design the structure for the new ES-19 electric aircraft – an all-electric aircraft designed to carry nineteen passengers on short regional routes. Aernnova Aerospace S.A. will work with Heart's engineers in designing the wing, the fuselage, and the empennage.

Frequently Asked Questions

Development of electric propulsion-based eVTOL aircraft

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For