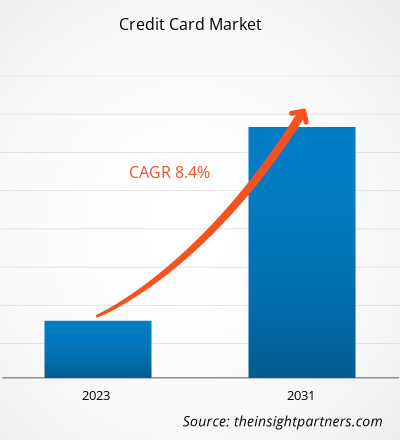

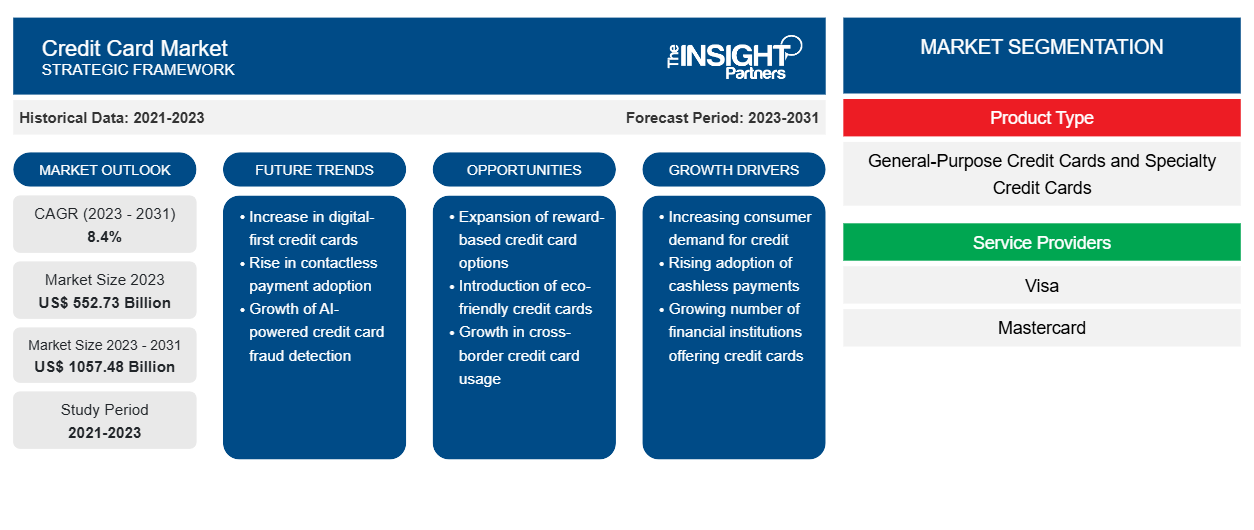

信用卡市场规模预计将从 2023 年的 5527.3 亿美元增长到 2031 年的 10574.8 亿美元;预计 2023 年至 2031 年的复合年增长率 为8.4%。对便捷现金替代品的需求不断增长是推动信用卡市场增长的主要因素之一。

信用卡市场分析

随着时间的推移,信用卡越来越受欢迎,因为它具有许多优点,包括比借记卡更安全、付款处理更快、可以免息付款等等。此外,由于终端消费者迅速采用信用卡进行分期付款购买以及购买各种昂贵商品的人数增加,该行业正在不断扩大。此外,它为终端消费者提供延长保修和购买保护,这进一步推动了市场的扩张。许多信用卡还提供旅行、租车和退货保护,这一事实正在推动全球信用卡市场的扩张。

信用卡市场概览

- 信用卡是由银行或金融服务公司提供的薄塑料或金属卡。

- 它使持卡人能够借钱从各种零售商处购物。

- 此外,银行和其他金融科技公司提供的信用卡使客户能够在销售点使用信用卡而不是现金支付各种服务。

- 此外,该卡还提供多种优惠,其中之一就是用户还可以将其购买转换为EMI并相应付款,这进一步促进了信用卡市场的增长。

定制此报告以满足您的需求

您可以免费定制任何报告,包括本报告的部分内容、国家级分析、Excel 数据包,以及为初创企业和大学提供优惠和折扣

-

获取此报告的关键市场趋势。这个免费样品将包括数据分析,从市场趋势到估计和预测。

信用卡市场驱动因素

信用卡需求增长推动信用卡市场增长

- 由于信用卡提供便捷的信贷、EMI设施、激励措施和各种优惠,因此全球对信用卡的需求正在增加。根据消费者金融保护局的数据,截至 2021 年底,美国 2.583 亿成年人中约有 1.906 亿人拥有以自己名义开设的信用卡账户。此外,根据CapitalOne 的数据,约 75% 的美国家庭至少拥有一张通用信用卡。

- 不仅发达国家,各个发展中国家的信用卡需求也在增长。根据印度储备银行 (RBI) 的报告,2023 年 4 月,印度的信用卡商户支付量约为 2.5亿。此外,2023 年该国的信用卡用户数量约为 8.5亿,高于 2022 年的 7.5亿。

- 因此,由于上述所有因素,全球对信用卡的需求不断增加,推动了信用卡市场的增长。

信用卡市场报告细分分析

- 根据产品类型,市场分为通用信用卡和专用信用卡。预计通用信用卡部分将在 2023 年占据相当大的信用卡市场份额。

- 预计通用信用卡部分在预测期内也将保持最高的复合年增长率,特别是因为这种卡为用户提供了大量独家奖励以及不同的福利。

信用卡市场份额按地区分析

信用卡市场的范围主要分为五个区域——北美、欧洲、亚太地区、中东和非洲以及南美。北美正在经历快速增长,预计将占据相当大的信用卡市场份额。该地区拥有大量市场参与者,包括美国银行公司、美国运通、摩根大通等。此外,该地区正在见证信用卡的快速普及。根据亚特兰大联邦储备银行的数据,美国 77% 的成年人至少拥有一张信用卡。此外,根据美国银行家协会的数据,2022 年第三季度,美国约有 4.41 亿人开设了信用卡账户。因此,上述所有因素都在推动该地区市场的增长。

信用卡市场区域洞察

Insight Partners 的分析师已详尽解释了预测期内影响信用卡市场的区域趋势和因素。本节还讨论了北美、欧洲、亚太地区、中东和非洲以及南美和中美洲的信用卡市场细分和地理位置。

- 获取信用卡市场的区域特定数据

信用卡市场报告范围

| 报告属性 | 细节 |

|---|---|

| 2023 年的市场规模 | 5527.3亿美元 |

| 2031 年市场规模 | 10574.8亿美元 |

| 全球复合年增长率(2023 - 2031) | 8.4% |

| 史料 | 2021-2023 |

| 预测期 | 2023-2031 |

| 涵盖的领域 |

按产品类型

|

| 覆盖地区和国家 |

北美

|

| 市场领导者和主要公司简介 |

|

信用卡市场参与者密度:了解其对业务动态的影响

信用卡市场正在快速增长,这得益于终端用户需求的不断增长,而这些需求又源于消费者偏好的不断变化、技术进步以及对产品优势的认识不断提高等因素。随着需求的增加,企业正在扩大其产品范围,进行创新以满足消费者的需求,并利用新兴趋势,从而进一步推动市场增长。

市场参与者密度是指在特定市场或行业内运营的企业或公司的分布情况。它表明在给定市场空间中,相对于其规模或总市场价值,有多少竞争对手(市场参与者)存在。

在信用卡市场运营的主要公司有:

- 美国银行公司

- 美国运通、花旗集团

- 巴克莱

- 汇丰银行

- 第一资本

免责声明:上面列出的公司没有按照任何特定顺序排列。

- 获取信用卡市场顶级关键参与者的概览

“信用卡市场分析”是根据产品类型、服务提供商、应用和地理位置进行的。根据产品类型,市场分为通用信用卡和专用信用卡。根据服务提供商,信用卡市场分为 Visa、Mastercard 和其他。根据应用,市场分为食品和杂货、消费电子产品、健康和药店、餐馆和酒吧、媒体和娱乐、旅行和旅游等。根据地理位置,市场分为北美、欧洲、亚太地区、中东和非洲以及南美。

信用卡市场新闻及最新发展

公司在信用卡市场采用无机和有机战略,例如并购。以下列出了一些近期的关键市场发展:

- 2023 年 8 月,花旗全球财富推出了 ULTIMA 万事达信用卡,面向包括香港和新加坡在内的亚洲花旗私人银行客户。该卡利用花旗的全方位财富连续性,提供该银行领先的信用卡特许经营权的最佳服务,以更好地服务亚洲潜在和现有的超高净值客户

[来源:花旗,公司网站]

- 2021 年 7 月,美国银行宣布推出美国银行无限现金奖励信用卡,客户可从所有购买中获得 1.5% 的无限现金返还。这张新信用卡是美国银行奖励卡系列中的最新一张,每张卡都旨在满足各种客户的需求。

[来源:美国银行,公司网站]

信用卡市场报告覆盖范围和交付成果

信用卡市场预测是根据各种二手和一手研究结果估算的,例如主要公司出版物、协会数据和数据库。市场报告“信用卡市场规模和预测(2021-2031 年)”对市场进行了详细分析,涵盖以下领域:

- 范围内涵盖的所有主要细分市场的全球、区域和国家层面的市场规模和预测。

- 市场动态,例如驱动因素、限制因素和关键机遇。

- 未来的主要趋势。

- 详细的 PEST 和 SWOT 分析

- 全球和区域市场分析涵盖主要市场趋势、主要参与者、法规和最新的市场发展。

- 行业格局和竞争分析包括市场集中度、热图分析、关键参与者和最新发展。

- 详细的公司简介。

- 历史分析(2 年)、基准年、预测(7 年)及复合年增长率

- PEST和SWOT分析

- 市场规模、价值/数量 - 全球、区域、国家

- 行业和竞争格局

- Excel 数据集

近期报告

客户评价

购买理由

- 明智的决策

- 了解市场动态

- 竞争分析

- 客户洞察

- 市场预测

- 风险规避

- 战略规划

- 投资论证

- 识别新兴市场

- 优化营销策略

- 提升运营效率

- 顺应监管趋势

获取免费样品 - 信用卡市场

获取免费样品 - 信用卡市场