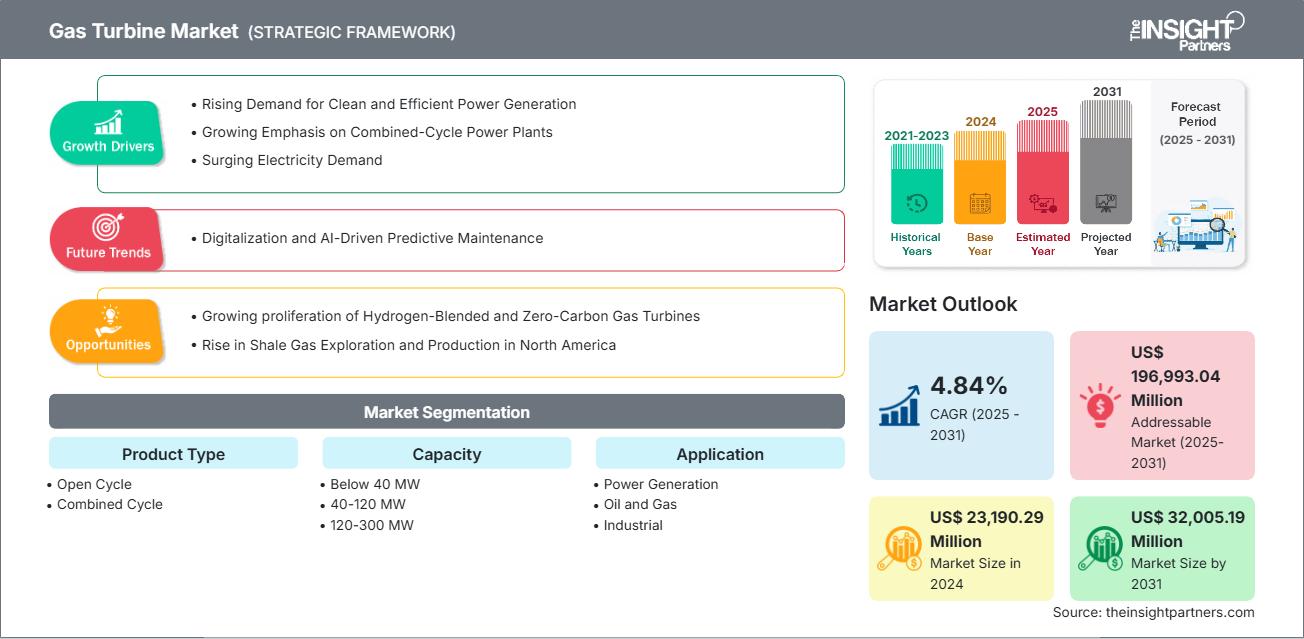

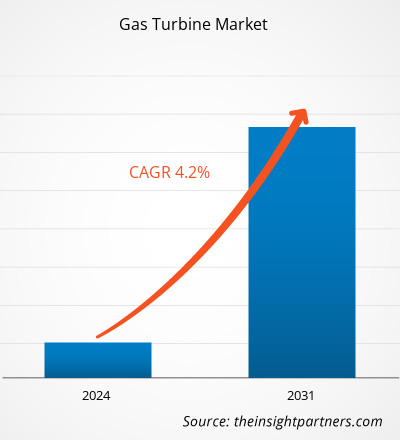

燃气轮机市场规模预计将从 2024 年的 231.9029 亿美元增至 2031 年的 320.0519 亿美元。预计 2025-2031 年期间该市场的复合年增长率 为4.84%。

燃气轮机市场分析

对清洁高效发电的需求不断增长,对联合循环发电厂的日益重视,电力需求的激增,以及天然气供应和基础设施建设的不断推进,正在推动市场增长。预计在预测期内,氢混合和零碳燃气轮机的日益普及,以及北美页岩气勘探和生产的兴起,将为市场带来丰厚的利润。数字化和人工智能驱动的预测性维护预计将在2025年至2031年期间成为燃气轮机市场的趋势。

燃气轮机市场概况

全球燃气轮机市场在整个能源和工业格局中至关重要。不断增长的能源需求、日益严格的环境法规以及涡轮机技术的不断进步推动了燃气轮机市场的增长。燃气轮机在发电、工业应用以及向清洁能源转型中发挥着关键作用。严格的环境法规正在推动公用事业和工业企业采用更清洁的能源解决方案。与燃煤电厂相比,燃气轮机的二氧化碳排放量更低,正成为发电的首选替代方案。这与全球脱碳和采用低碳能源技术的趋势相一致。

您可以免费定制任何报告,包括本报告的部分内容、国家级分析、Excel 数据包,以及为初创企业和大学提供优惠和折扣

燃气轮机市场:战略洞察

-

获取此报告的顶级关键市场趋势。此免费样品将包括数据分析,从市场趋势到估计和预测。

燃气轮机市场驱动因素和机遇

市场驱动因素:

-

清洁能源需求不断增长:

由于燃气轮机的排放量比煤炭低,因此在联合循环发电厂中的应用日益广泛,有助于实现全球脱碳目标。 -

工业应用的增长:

石油和天然气、制造业和化工等行业正在采用燃气轮机来实现可靠、高效的发电。 -

技术进步:

涡轮机材料、冷却技术和数字监控系统的创新正在提高效率、寿命和性能。 -

能源安全和电网稳定性:

燃气轮机具有快速启动能力,使其成为平衡可再生能源和确保电网可靠性的理想选择。 -

政府激励措施和政策:

对清洁能源技术的支持性法规和激励措施正在鼓励对燃气轮机基础设施的投资。

市场机会:

-

混合系统集成:

将燃气轮机与可再生能源和储能系统相结合,为灵活和可持续发电开辟了新的可能性。 -

新兴市场扩张:

东南亚、非洲和拉丁美洲等地区的快速城市化和工业化对高效电力解决方案的需求不断增加。 -

改造和升级:

老化发电厂通过涡轮机升级、提高效率和减少排放,为实现现代化提供了机会。 -

氢燃料涡轮机:

开发能够使用氢气或氢气-天然气混合物运行的涡轮机是向净零过渡的一个重要机遇。 -

数字化和预测性维护:

采用人工智能和物联网进行实时监控和预测性维护可以减少停机时间和运营成本。

燃气轮机市场报告细分分析

为了更清晰地了解燃气轮机市场运作方式、增长潜力和最新趋势,我们将燃气轮机市场划分为不同的细分市场。以下是大多数行业报告中使用的标准细分方法:

按技术分类:

-

开式循环燃气轮机

这些燃气轮机运行时无需热回收系统,非常适合需要快速启动和较低资本投入的应用。它们通常用于峰值负荷发电站和应急备用系统。虽然效率低于联合循环系统,但它们的操作灵活简便。

-

联合循环燃气轮机

这些系统集成了燃气轮机和蒸汽轮机,利用余热最大化能源输出。由于其效率高、排放低,它们成为基载发电的首选。联合循环电厂在注重清洁、可持续能源解决方案的地区占据主导地位。

按容量:

-

低于40兆瓦

小容量风力涡轮机适用于分散式发电、移动式机组和备用系统。其紧凑的尺寸和快速的部署使其非常适合偏远地区或离网地区。

-

40–120 兆瓦

中型燃气轮机服务于工业设施、小型公用事业和区域电网。它们兼顾效率和可扩展性,常用于需要电力和热能的热电联产系统。

-

120–300 兆瓦

这些涡轮机部署在大型工业园区和公用事业规模的发电厂中。它们效率高,通常是联合循环系统的一部分,为区域能源供应做出重大贡献。

-

300兆瓦以上

大型发电厂使用大容量涡轮机。这些涡轮机的设计旨在实现最大输出功率和效率,通常采用先进材料和数字监控系统。这一环节对于满足国家电网需求和整合可再生能源至关重要。

按应用:

- 发电

- 石油和天然气

- 工业的

按地域划分:

- 北美

- 欧洲

- 亚太地区

- 拉美

- 中东和非洲

亚太地区的燃气轮机市场预计将出现最快的增长。

燃气轮机市场区域洞察

Insight Partners 的分析师已详尽阐述了预测期内影响燃气轮机市场的区域趋势和因素。本节还讨论了北美、欧洲、亚太地区、中东和非洲以及南美和中美洲的燃气轮机市场细分和地域分布。

燃气轮机市场报告范围

| 报告属性 | 细节 |

|---|---|

| 2024年的市场规模 | 231.9029亿美元 |

| 2031年的市场规模 | 320.0519亿美元 |

| 全球复合年增长率(2025-2031) | 4.84% |

| 史料 | 2021-2023 |

| 预测期 | 2025-2031 |

| 涵盖的领域 |

按产品类型

|

| 覆盖地区和国家 |

北美

|

| 市场领导者和主要公司简介 |

|

燃气轮机市场参与者密度:了解其对业务动态的影响

燃气轮机市场正在快速增长,这得益于终端用户需求的不断增长,而这些需求的驱动因素包括消费者偏好的转变、技术进步以及对产品优势的认知度的提升。随着需求的增长,企业正在扩展产品线,不断创新以满足消费者需求,并抓住新兴趋势,从而进一步推动市场增长。

- 获取燃气轮机市场主要参与者概览

燃气轮机市场份额按地区分析

燃气轮机市场分为五大区域:北美、欧洲、亚太地区(APAC)、中东和非洲(MEA)以及南美(SAM)。2024年,北美占据市场主导地位,其次是欧洲和亚太地区。

得益于先进的基础设施、技术创新以及发电和工业领域的强劲需求,北美在全球燃气轮机市场占据主导地位。得益于丰富的天然气资源和煤炭替代趋势,美国引领了联合循环燃气轮机的广泛部署。该地区还在氢能兼容和碳捕集就绪的燃气轮机技术方面处于领先地位。燃气轮机对电网可靠性至关重要,尤其是在可再生能源并网日益普及的背景下。北美强大的航空航天和国防工业为燃气轮机发展做出了重大贡献,巩固了其在固定式和航空燃气轮机领域的领先地位。

以下是各地区市场份额和趋势的摘要:

1. 北美

-

市场份额:

由于已建立的能源基础设施和技术领先地位,其份额显著增加。 -

关键驱动因素:

- 老化的发电厂正在用高效的燃气轮机进行升级。

- 对灵活发电的需求强劲,以支持可再生能源整合。

- 有通用电气 (GE) 和西门子能源 (Siemens Energy) 等主要原始设备制造商。

-

趋势:

联合循环装置和氢能涡轮机开发的增长。

2.欧洲

-

市场份额:

受脱碳目标和能源转型政策的推动,这一增长潜力巨大。 -

关键驱动因素:

- 欧盟气候目标鼓励低排放技术。

- 一些国家正在用天然气替代煤炭。

- 高度采用联合循环系统以提高效率。

-

趋势:

越来越关注氢兼容涡轮机和数字监控解决方案。

3. 亚太地区

-

市场份额:

由于工业扩张和城市化而快速增长。 -

关键驱动因素:

- 中国、印度和东南亚等国家的电力需求不断增长。

- 政府对天然气发电厂的投资。

- 新兴经济体的基础设施发展。

-

趋势:

转向中高容量涡轮机并与可再生能源相结合。

4.中东和非洲

-

市场份额:

温和但不断扩大,特别是在石油资源丰富的国家。 -

关键驱动因素:

- 在石油和天然气作业以及海水淡化厂中使用燃气轮机。

- 对能源多样化和电网可靠性的投资。

- 天然气资源的可用性。

-

趋势:

用于峰值负荷和工业用途的开式循环涡轮机的增长。

5.南美洲

-

市场份额:

具有增长潜力的新兴市场。 -

关键驱动因素:

- 偏远地区和工业地区需要可靠的电力。

- 由于气候变化,一些国家从水力发电转向天然气发电。

- 政府对能源基础设施的支持。

-

趋势:

采用小型至中型容量涡轮机和混合系统。

燃气轮机市场参与者密度:了解其对业务动态的影响

中等市场密度和竞争

由于通用电气 Vernova 公司、西门子股份公司、三菱重工有限公司、卡特彼勒公司、川崎重工有限公司等老牌企业的存在,竞争处于中等水平,也加剧了不同地区的竞争格局。

这种激烈的竞争促使公司通过提供以下产品脱颖而出:

- 多样化的产品类型和材料满足了不同的消费者需求,从而加剧了竞争。

- 较低的进入门槛允许许多小型和区域性参与者进入市场。

- 定制化需求推动品牌不断创新、差异化。

- 全球和本地制造商的强大影响力加剧了价格和功能竞争。

- 电子商务的增长使得直接面向消费者的销售成为可能,从而提高了市场饱和度。

- 智能棚屋和模块化设计等技术进步提高了创新风险。

- 对价格敏感的消费者会推动积极的定价和促销策略。

机遇与战略举措

-

混合能源整合

将燃气轮机与可再生能源(太阳能、风能)和储能系统相结合,以增强电网的灵活性和可靠性。

-

低碳和氢燃料的采用

开发能够使用氢气或氢气-天然气混合物运行的涡轮机,以支持脱碳并实现气候目标。

-

数字化与智能监控

集成物联网和人工智能进行预测性维护、实时性能优化和远程诊断,以减少停机时间和运营成本。

-

模块化和可扩展设计

提供可根据需求扩展的模块化涡轮机系统,特别适用于工业和远程应用。

-

新兴市场的扩张

通过基础设施建设和本地化制造,满足亚太、非洲和南美洲日益增长的能源需求。

-

电子商务和直销渠道

利用数字平台为工业客户提供设备销售、服务订阅和虚拟配置工具。

-

灵活的所有权模式

引入租赁、基于绩效的合同和服务即产品模式,以降低前期成本并吸引新客户。

-

战略伙伴关系和联盟

与 EPC 公司、能源公用事业公司和技术提供商合作,扩大市场范围并加速创新。

在燃气轮机市场运营的主要公司有:

- GE Vernova公司

- 西门子股份公司

- 三菱重工业有限公司

- 卡特彼勒公司

- 川崎重工业有限公司

- 贝克休斯公司

- Capstone绿色能源控股公司

- 美国工业锅炉

- 唐卡斯特集团

- Vericor 电力系统。

免责声明:以上列出的公司没有按照任何特定顺序排列。

研究过程中分析的其他公司:

- 奥雷利亚涡轮机公司

- 杰瑞能源装备技术股份有限公司

- 电力系统制造有限责任公司

- APR能源

- 马普纳集团

- 东方电气集团

- 上海电气

- 斗山能源公司

- 中国航发燃气轮机公司

- 俄罗斯技术联合发动机公司

- 劳斯莱斯公司

- IHI电力系统有限公司

燃气轮机市场新闻及最新发展

-

GE Vernova签署EPC合同

GE Vernova(纽约证券交易所代码:GEV)已从Técnicas Reunidas和Orascom Construction(TR & ORASCOM CONSTRUCTION)获得五台7H级燃气轮机的订单,其中包括三台7HA.03和两台7HA.02机组。这两家公司以各占50%股份的合资方式,签署了沙特阿拉伯东部省Qurayyah独立发电厂(IPP)扩建项目的工程、采购和施工(EPC)合同。(来源:GE Vernova,新闻稿,2025年5月)

-

Capstone Green Energy Holdings, Inc.签署供应协议

Capstone Green Energy Holdings, Inc. 和 Capstone Green Energy, LLC. 宣布,其澳大利亚分销商 Optimal Group 已被选为大洋洲一个偏远社区发电项目的 EPC(工程、采购和施工)承包商。该项目将部署两台可扩展配置的 Capstone C1000S Signature 系列微型燃气轮机,为该偏远社区提供初始 2 兆瓦 (MW) 的可靠低排放电力。该系统设计为可扩展,最高可达 5MW。(来源:Capstone Green Energy Holdings, Inc.,新闻稿,2025 年 5 月)

燃气轮机市场报告范围和交付成果

《燃气轮机市场规模和预测(2021-2031)》报告对以下领域进行了详细的市场分析:

- 燃气轮机市场规模以及全球、区域和国家层面涵盖的所有主要细分市场的预测

- 燃气轮机市场趋势以及市场动态,例如驱动因素、限制因素和关键机遇

- 详细的 PEST 和 SWOT 分析

- 燃气轮机市场分析涵盖主要市场趋势、全球和区域框架、主要参与者、法规和最新市场发展

- 行业格局和竞争分析,涵盖市场集中度、热图分析、知名参与者以及燃气轮机市场的最新发展

- 详细的公司简介

- 历史分析(2 年)、基准年、预测(7 年)及复合年增长率

- PEST和SWOT分析

- 市场规模、价值/数量 - 全球、区域、国家

- 行业和竞争格局

- Excel 数据集

近期报告

相关报告

客户评价

购买理由

- 明智的决策

- 了解市场动态

- 竞争分析

- 客户洞察

- 市场预测

- 风险规避

- 战略规划

- 投资论证

- 识别新兴市场

- 优化营销策略

- 提升运营效率

- 顺应监管趋势

获取免费样品 - 燃气轮机市场

获取免费样品 - 燃气轮机市场