With increasing requirement for better picture quality by the selfie generation of today, the demand for camera integrated devices such as tablets, mobile phones, computers and digital cameras is booming, which is said to be the major driver for image sensor market. Also, other factors such as advancement in sensor technologies like backlight illumination complementary metal-oxide semiconductor (CMOS) and low cost availability of the image sensors are expected to boost the market globally. The major reasons hindering the market could be the falling demand for photographic equipment specially designed for capturing still images and high maintenance cost of these devices. The image sensing market has great scope for growth in verticals such as the security, medical and architectural industry, as demand for advanced image technology in these industries is increasing day by day creating high opportunity for the image sensor market.

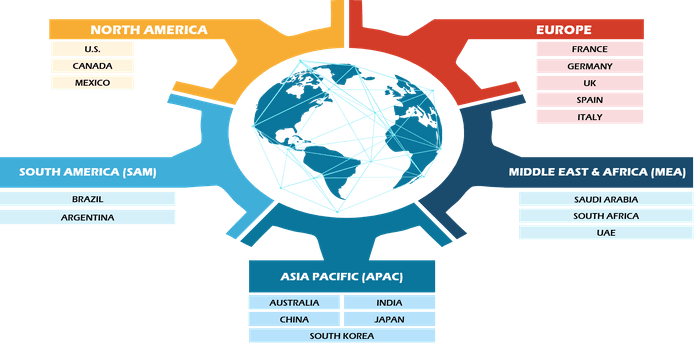

This market is segmented on the basis of technology, application and region. The technology segment of image sensor market comprises the charged-coupled device (CCD), CMOS, contact image sensors (CIS) and hybrid. CMOS are cost efficient and less power consuming then the other technologies and also used by majority of electronic device manufacturers, thus, it has the dominance in market with respect to other technologies. The application segment of image sensor market is classified into automotive, consumer electronics, aerospace, defense, medical and surveillance industry. From the application point of view the consumer electronics captures the majority of the market shares followed by medical and surveillance. The market is broadly segmented in five regions, viz., North America, Asia Pacific, Europe, South America, and Middle East & Africa. The region wise segment of the market is majorly captured by Asia- Pacific and specifically China, Japan and South Korea, that is more than a quarter of the entire market followed by North America and Europe, which, are expected to grow at steady pace and gain the equivalent market in coming years. Other regions such as South America and Middle East are also expected to register a decent growth rate during the forecast period.

Some of the key players in this market include GalaxyCore Inc., SK Hynix Inc., Samsung Electronics Co. Ltd., Toshiba Corporation, Panasonic Corporation, ON Semiconductor Corporation, Sony Corporation, Sharp Corporation, Omni Vision technologies Inc., Teledyne Technologies, Inc., CMOSIS NV, e2v technologies Inc., Baumer, Ltd., Honeywell Process Solutions, Weber Ultrasonics GmbH, Nanomotion, Ltd., Siemens AG, and Pepperel+Fuchs GmbH among others. REGIONAL FRAMEWORK

Have a question?

Naveen

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

GalaxyCore Inc.

SK Hynix Inc.

Samsung Electronics Co. Ltd.

Toshiba Corporation

Panasonic Corporation

ON Semiconductor Corporation

Sony Corporation

Sharp Corporation

Omni Vision technologies Inc.

Teledyne Technologies, Inc.

CMOSIS NV

e2v technologies Inc.

Baumer, Ltd.

Honeywell Process Solutions

Weber Ultrasonics GmbH

Nanomotion, Ltd.

Siemens AG

Pepperel+Fuchs GmbH

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Image Sensors Market

Apr 2024

Robotic Crawler Camera System Market

Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component [Hardware (Cameras, Crawlers, Cable Drums, Control Units, and Others), Software, and Service], Application (Drain Inspection, Pipeline Inspection, and Tank Void Capacity or Conduit Inspection), and End User (Residential, Commercial, Municipal, and Industrial)

Apr 2024

Inertial Sensor for Land Defense Systems Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Technology (FOG, MEMS, and Others) and Application (Stabilization Missile Systems, Stabilization Turret-Cannon Systems, Land Navigation Including Land Survey, Missile GGM-SSM, Stabilization Active Protection System, Stabilization of Optronics System, and Others)

Apr 2024

Drone Lithium Battery Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis By Battery Type (Li-ion, Li-Po, and Li-S), Battery Capacity (Below 3,000 mAh; 3,000–5,000 mAh; and Above 5,000 mAh), Drone MTOW (Below 100 Kgs, 100–200 Kgs, and Above 200 Kgs), Wing Type (Fixed Wing and Rotary Wing), and End Use (Military and Commercial)

Apr 2024

ASRS for Garments on Hangers Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis By Type (Garment Rail System, Garment Conveyor, Garment Property Storage, and Others) and Application (Warehousing and Logistics, Retail 3PL, Hotels, Hospitals and Institutes, and Others)

Apr 2024

Analog to Digital Converter Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type (Integrating Analog to Digital Converters, Delta-Sigma Analog to Digital Converters, Successive Approximation Analog to Digital Converters, Ramp Analog to Digital Converters, and Others), Resolution (8-Bit, 10-Bit, 12-Bit, 14-Bit, 16-Bit, and Others), and Application (Industrial, Consumer Electronics, Automotive, Healthcare, Telecommunication, and Others)

Apr 2024

Laser Distance Sensor Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Distance (Between 2 and 10 Meters, Between 11 and 100 Meters, Between 101 and 200 Meters, and Between 201 and 500 Meters), Accuracy (1 mm at 2 Sigma, 3 mm with 2 Sigma, and 5 mm at 2 Sigma), and End User (Manufacturing, Construction, Automotive and Robotics, Aerospace and Defense, Geospatial Industry, and Others)

Apr 2024

Rugged Tablet Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis By Type (Fully Rugged Tablet, Semi Rugged Tablet, and Ultra Rugged Tablet); Operating System (Android, Windows, and iOS); and Application (Aerospace & Defense, Automotive, Construction, Energy & Utilities, Manufacturing, Oil & Gas, and Others)

Apr 2024

Rear Door Heat Exchanger Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type (Active and Passive) and End User (Data Center, IT and Telecommunication, Semiconductor, Education, Government, and Others)