IoT Valve Market Key Players and Forecast by 2031

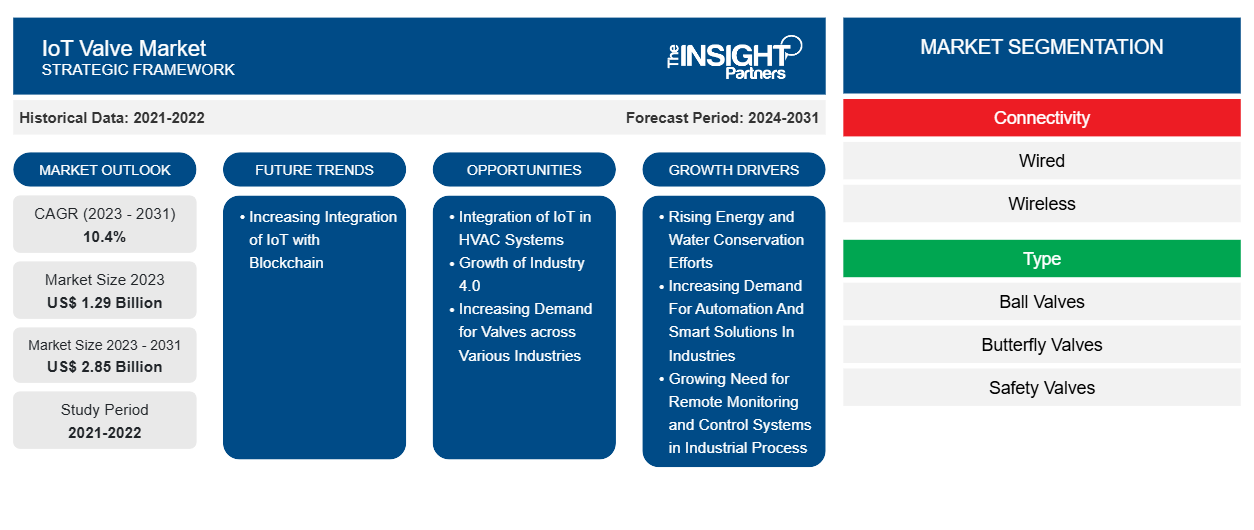

IoT Valve Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Connectivity (Wired and Wireless), Type (Pressure Independent Control Valve (PICV), Regular Valve, and Energy Valve), Regular Valve (Ball Valve, Butterfly Valve, Safety Valve, and Others)Â , End User (Industrial, Commercial, and Residential), and Geography

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2024-2031- Report Date : Sep 2024

- Report Code : TIPRE00026920

- Category : Electronics and Semiconductor

- Status : Published

- Available Report Formats :

- No. of Pages : 212

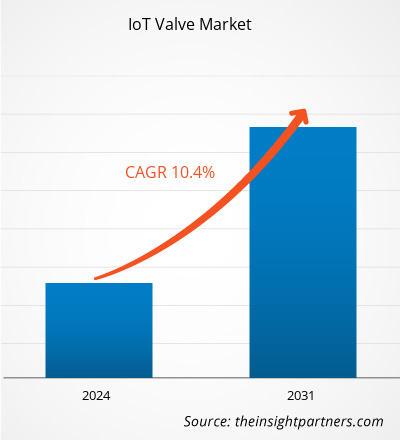

The IoT valve market size is expected to reach US$ 2.85 billion by 2031 from US$ 1.29 billion in 2023. The market is estimated to record a CAGR of 10.4% from 2023 to 2031. The increasing integration of IoT with Blockchain is likely to be a key market trend in the coming years.

IoT Valve Market Analysis

IoT valves have various applications. They can manage the distribution of water within a home or building, allowing for automated control of water usage in kitchens, bathrooms, and irrigation systems. Also, in manufacturing plants, these valves control the flow of liquids and gases. In utilities and infrastructure, these IoT valves are used in water distribution, wastewater treatment, and gas supply networks.

The demand for industrial valves across sectors such as pharmaceuticals, oil & gas, and chemicals and the rapid evolution of IoT technology fuel the global IoT valve market growth. By incorporating IoT capabilities, valves can be remotely controlled, monitored, and automated, reducing maintenance expenses and enhancing efficiency. For instance, with the integration of IoT technology in HVAC systems, intelligent HVAC systems are increasingly used and can be managed and monitored remotely. The rising adoption of IoT in diverse industries, including aerospace, elevators, and process automation, has increased the demand for IoT valves.

IoT Valve Market Overview

Advancements in IoT technology have transformed numerous industries, and one of the most innovative areas is the advancement of smart valves. Smart valves use IoT technology and present an exceptional breakthrough in the process valves industry, enabling the management of various processes and online monitoring control. These allow immediate response for machine learning, optimization, and safety events, along with equipment and machinery protection, device tracking, and additional customer-tailored benefits. Smart valves possess smart metering control systems, enabling accurate distribution and measurement of resources such as water and gas. Smart metering control reduces waste, optimizes resource usage, and improves performance by precisely controlling and monitoring flow rates. Smart valves provide affordable solutions by effectively utilizing resources. They provide accurate gas and water control and distribution, eliminating waste and reducing expenses. Smart valves help organizations reduce utility costs and maintenance costs by minimizing leaks and providing effective automation.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONIoT Valve Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

IoT Valve Market Drivers and Opportunities

Rising Energy and Water Conservation Efforts

The rise in energy and water conservation efforts is a significant driver for the IoT valves market. As the global focus intensifies on sustainable practices, governments, industries, and consumers are seeking solutions that optimize resource usage. IoT valves provide precise control, monitoring, and automation in these conservation efforts. In manufacturing plants, IoT valves can regulate the flow of steam, gases, and liquids used in various processes. Using sensors and data analytics, these valves can adjust the flow based on real-time requirements, reducing energy waste. For instance, Bosch is developing smart factories utilizing IoT in manufacturing. Sensors in these facilities collect data on all parts of the manufacturing procedure, which includes everything from the chain of distribution to the assembly line. Municipal water supply systems can leverage IoT valves to monitor and control water distribution networks. In a smart city project, IoT valves can detect leaks in the water supply system and shut off the affected section to prevent water loss. They can also optimize water pressure in different areas based on usage patterns, ensuring efficient water distribution. Governments are implementing stricter regulations on energy and water usage, incentivizing industries to adopt smart technologies. For instance, according to the report of Indian Infrastructure, as of April 5, 2024, 645 smart energy projects worth US$ 1,675.0 million have been completed, and 38 projects worth US$ 85.3 million are in progress in India. These projects have several components to ensure efficient energy utilization, such as smart lighting, buildings, metering, waste management, and mobility. Additionally, consumers are becoming more environmentally conscious, seeking products and solutions that contribute to sustainability.

Growth of Industry 4.0

Various countries are widely recognized as pioneers in the implementation of Industry 4.0, or the Fourth Industrial Revolution. The German government has recognized the need for a strategic development of Industry 4.0, providing significant funding for research and development and establishing partnerships between industry and academia. Under its Industrial Strategy 2030, the government set a goal of raising the share of German industries in gross value added in the Germany economy to 25% by 2030.

There is a rise in the incorporation of Industry 4.0 industries as various countries have a strong manufacturing base, which includes well-established companies such as Bosch, Siemens, and Volkswagen. These companies have been early adopters of new technologies and have invested heavily in research and development to create innovative solutions for the challenges of Industry 4.0, such as interoperability. The implementation of Industry 4.0 has had a significant effect on the manufacturing sector. For example, the use of data analytics and predictive maintenance has enabled companies to reduce downtime and improve the efficiency of their operations. The adoption of Industry 4.0 leads to the integration of AI, IoT, and sensors in components such as valves. Also, IoT valves are compatible with Industry 4.0 technologies; for example, the IoTH-800 Series, offered by Ultra Clean technology, is compatible with Industry 4.0. Thus, the growth of Industry 4.0 is likely to create opportunities for the proliferation of the global IoT valve market during the forecast period.

IoT Valve Market Report Segmentation Analysis

Key segments that contributed to the derivation of the IoT valve market analysis are connectivity, type, and end user.

- Based on connectivity, the market is segmented into wired and wireless. The wired segment held a larger IoT valves market share in 2023.

- Based on type, the market is segmented into energy valve, pressure-independent control valve (PICV), and regular valves. The pressure independent control valve (PICV) segment held the largest IoT valves market share in 2023.

- Based on end user, the market is divided into industrial, residential, and commercial. The industrial segment held the largest market share in 2023.

IoT Valve Market Share Analysis by Geography

The IoT valve market is segmented into five major regions: North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. Asia Pacific dominated the market in 2023, followed by North America and Europe.

The high penetration of the Internet across North America, coupled with initiatives by key market players to promote the use of digital technologies for seamless and smooth business operations and human error reduction, catalyzes the adoption of IoT valves across North America. In November 2021, Rusco, a US-based manufacturer of water sediment filtration products, announced the launch of "Smart Ball Valve." These valves can be operated using apps on Android and Apple devices and can be accessed on Zigbee and Wi-Fi models. They are made for commercial, municipal, and residential water filtration systems. This smart valve automates two basic functions—flow shut off and sediment flushing. The apps are alerted if something interrupts normal operations and provide a safe shut-off during power cuts, which improves the overall performance of a water filter system. Thus, the IoT valve market in North America is dominated by automation and the development of smart solutions in water filtration systems.

IoT Valve Market Regional Insights

The regional trends and factors influencing the IoT Valve Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses IoT Valve Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

IoT Valve Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1.29 Billion |

| Market Size by 2031 | US$ 2.85 Billion |

| Global CAGR (2023 - 2031) | 10.4% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Connectivity

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

IoT Valve Market Players Density: Understanding Its Impact on Business Dynamics

The IoT Valve Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the IoT Valve Market top key players overview

IoT Valves Market News and Recent Developments

The IoT valve market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the market are listed below:

- IMI plc acquired Heatmiser UK Ltd. for an enterprise value of US$ 119.5 million, with up to a further US$ 8.6 million based on Heatmiser's future financial performance. Heatmiser became part of IMI Hydronic Engineering ("IMI Hydronic"). (Source: IMI plc, Press Release, November 2022)

- Ultra Clean Holdings, Inc. acquired HIS Innovations Group, a privately held company based in Hillsboro, Oregon. HIS is a leading supplier to the semiconductor sub-fab segment, including the design, manufacturing, and integration of components, process solutions, and fully integrated subsystems. This acquisition aligns with UCT's long-term strategy to pursue sustained and profitable growth by offering a more diversified portfolio of high-quality, high-value solutions to its customers. (Source: Ultra Clean Holdings, Inc., Press Release, October 2023)

IoT Valve Market Report Coverage and Deliverables

The "IoT Valve Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering the areas mentioned below:

- IoT valves market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- IoT valve market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- IoT valve market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the IoT valve market

- Detailed company profiles

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For