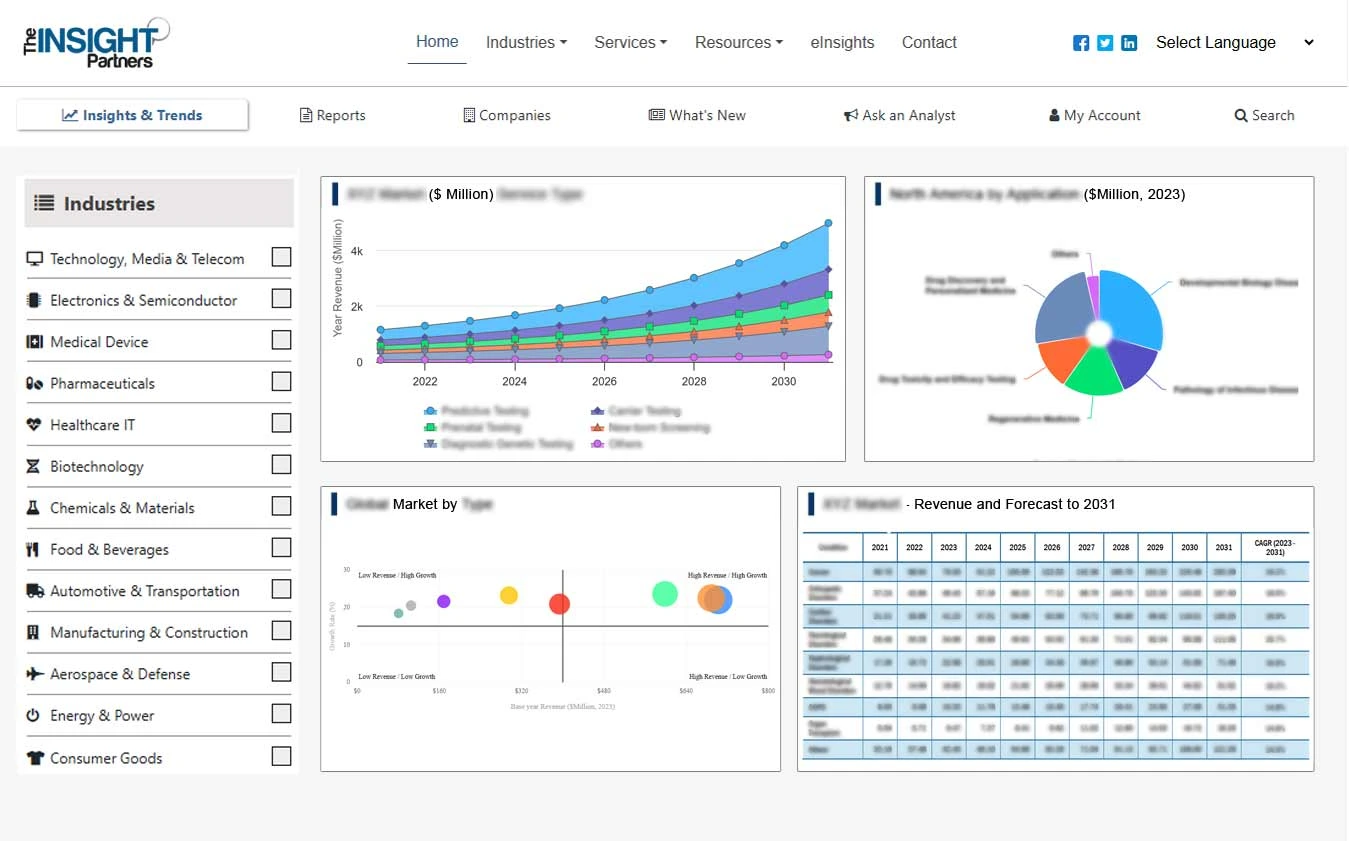

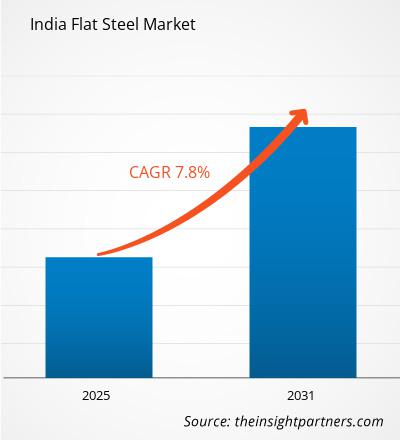

The India flat steel market is projected to grow from US$ 47.11 billion in 2024 to US$ 77.92 billion by 2031; the market is expected to register a CAGR of 7.8% during 2025–2031. The growing demand for sustainable steel production is likely to emerge as a prominent future trend in the market.

India Flat Steel Market Analysis

The India flat steel market is expanding owing to the abundant availability of raw materials and surging infrastructure investments in the country. According to the Confederation of Real Estate Developers' Associations of India, Gujarat witnessed construction commitments of 91 crore sq.ft of area, getting the Real Estate Regulatory Authority (RERA) registered for 2020-2023. In 2021-2022 alone, construction commitments of 26 crore sq.ft of development projects completed RERA registration. Gandhinagar, Ahmedabad, Surat, Rajkot, and Vadodara are among the top districts contributing to the state's construction sector. These districts hold an 82% share in total RERA-registered projects and a 93% share in the project market value. Such growing end-use industries fuel the demand for flat steel products in Gujarat.

India Flat Steel Market Overview

The country is home to the largest steel plants that contribute to the growing steel industry. SAIL's Bokaro and Rourkela Steel Plants, as well as Tata Steel's Jamshedpur facility, are major producers of flat steel products. Odisha is a steel production hub with numerous plants contributing to India's total steel output. The Meramandali plant of Tata Steel in Odisha is among the country's largest flat steel production plants. In February 2024, the JSW Group announced plans to establish a steel plant in Odisha with an investment of US$ 7.8 million and a production capacity of 13.2 million tons annually. Such increased production capacity in these states contributes to the adoption of flat steel in the country.

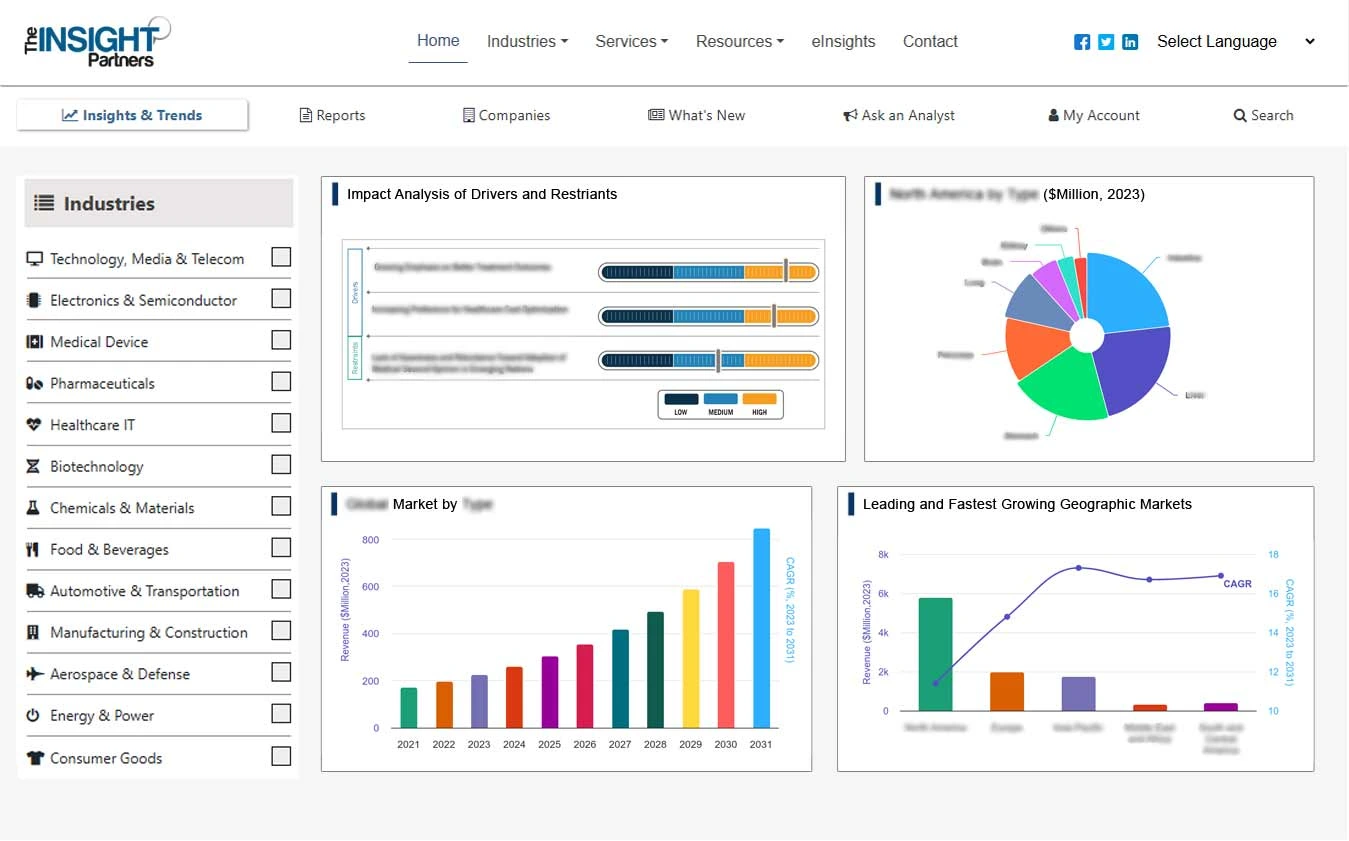

Strategic Insights

India Flat Steel Market Drivers and Opportunities

Surging Infrastructure Developments

According to the Press Information Bureau, public infrastructure is the backbone of economic development in India, enhancing connectivity and global trade. Favorable government initiatives and policies support the country's infrastructure development. In 2021, the government launched the PM Gati Shakti National Master Plan, which brought together ministries, including Roadways and Railways, to ensure coordinated execution and integrated planning of infrastructure projects in the country. This initiative aims to provide seamless connectivity for the movement of goods, services, and people across modes of transportation, thereby enhancing last-mile connectivity and reducing time.

According to the same source, India has the second-largest road network globally, and the total length of the country's National Highways expanded from 91,287 kilometers in 2014 to 146,145 kilometers as of 2024, forming the primary arterial network of India. The government has undertaken measures to strengthen and enhance its National Highway network through Bharatmala Pariyojana and the Special Accelerated Road Development Programme.

Flat steel bars are embedded in concrete for road foundations, pavement slabs, and retaining walls. This reinforcement improves load-bearing capacity, longevity, and resistance to cracking, ensuring the road surface can withstand heavy traffic and environmental stresses. Thus, the rising number of infrastructural developments drives the demand for flat steel products in the country.

Expanding Automotive Sector

India's automotive sector is expanding due to rising domestic production. The soaring interest of companies in exploring the rural markets contributes to the automobile sector's growth. The increasing logistics and passenger transportation sectors drive the commercial vehicle demand. According to the India Brand Equity Foundation, India is the largest producer of tractors, the second-largest bus producer, and the third-largest heavy truck manufacturer globally. The country's annual automobile production increased from 25.93 million in 2023 to 28.43 million in 2024. High-end automotive manufacturers witnessed an increase in their sales. In December 2024, Mercedes-Benz AG sold 1,468 luxury automotive units in India, the highest in the passenger vehicles segment. The nation's electric vehicle sales increased from 82,688 units in 2023 to 100,000 units in 2024. According to the India Energy Storage Alliance, the electric vehicle market size in India is anticipated to increase by 36% by 2026.

Automotive manufacturers manufacture engine components, including cylinder blocks and crankshafts, using flat-rolled carbon steel products. They also manufacture suspension components, such as struts, springs, and control arms. Flat-rolled carbon steel is durable and strong, which makes it ideal for the crucial components in automobiles required to withstand stress. It also helps reduce emissions and improve fuel efficiency. Thus, the growing automotive sector fuels the demand for flat steel products.

India Flat Steel Market Report Segmentation Analysis

Key segments that contributed to the derivation of the India flat steel market analysis are product type, process type, end use category, and end use industry.

- Based on product type, the market is segmented into hot-rolled, cold-rolled, galvanized, coated steel, and others. The hot rolled segment held the largest share of the India flat steel market in 2024.

- By process, the India flat steel market is divided into basic oxygen furnace, electric arc furnace, and induction furnace. The basic oxygen furnace segment held the largest share of the India flat steel market in 2024.

- Per end use category, the market is bifurcated into OEMs and MSMEs. The MSMEs segment held a larger share of the market in 2024.

- As per end use industry, the market is segmented into infrastructure, solar, automotive, electrical, marine, and others. The infrastructure segment is expected to dominate the market over the forecast period.

India Flat Steel Market Share Analysis by Region

South India leads India in per capita steel consumption, reflecting its industrial base and infrastructure growth. The region's steel production relies on a mix of iron ore, DRI (direct reduced iron), and scrap, supporting traditional and green steelmaking. According to the Ministry of Steel (PIB), the total number of finished steel products stood at 26.24 million tons as of 2024. The region's hot-rolled, cold-rolled, and galvanized steel capacity is expanding to meet rising infrastructure, automotive, and manufacturing demand while leading India's transition toward greener steel production. According to the Department of Electronics, Information Technology and Biotechnology, Karnataka is India's 4th largest automobile manufacturer, accounting for approximately 8.5% of the country's total.

The India flat steel market is growing due to favorable investments. Haryana is among the major steel-producing states in the Northern region. In May 2025, Jindal India, a major producer of galvanized coils, color-coated coils, and cold rolled steel, expanded its coated flat product capacity in Haryana with a current of 3 million tons annually, ramping up capacity to 4.2 million tons by 2027. The company's flat steel production capacity in 2025 is estimated at 2–3 MTPA for hot rolled, 1–2 MTPA for cold rolled, and 1.5–2 for MTPA, propelling the demand for flat steel in North India.

India Flat Steel Market Report Scope

India Flat Steel Market News and Recent Developments

The India flat steel market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases.

India Flat Steel Market Report Coverage and Deliverables

The "India Flat Steel Market Share and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- India flat steel market trends and forecast for all the key market segments covered under the scope

- India flat steel market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter's Five Forces and SWOT analysis

- India flat steel market analysis covering key market trends, country framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the India flat steel market

- Detailed company profiles

- التحليل التاريخي (سنتان)، السنة الأساسية، التوقعات (7 سنوات) مع معدل النمو السنوي المركب

- تحليل PEST و SWOT

- حجم السوق والقيمة / الحجم - عالميًا وإقليميًا وقطريًا

- الصناعة والمنافسة

- مجموعة بيانات Excel

- GNSS Chip Market

- MEMS Foundry Market

- Blood Collection Devices Market

- Advanced Planning and Scheduling Software Market

- Formwork System Market

- Sleep Apnea Diagnostics Market

- Medical Enzyme Technology Market

- Emergency Department Information System (EDIS) Market

- Authentication and Brand Protection Market

- Constipation Treatment Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

الأسئلة الشائعة

The abundant availability of raw materials and surging infrastructure developments drive the market growth.

The market is expected to register a CAGR of 7.8% during 2025–2031.

Sustainable steel production is expected to emerge as a future trend in the market during the forecast period.

JSW Steel Ltd, Tata Steel Ltd, Jindal Steel & Power Ltd, Posco Holdings Inc, ArcelorMittal Nippon Steel India, Namco Industries Pvt Ltd, Shah Alloys Ltd, Asian Mills Pvt Ltd, Asian Tubes Pvt Ltd, and Asian Tubes Pvt Ltd CR Division are key players operating in the market.

The List of Companies - India Flat Steel Market

- JSW Steel Ltd

- Tata Steel Ltd

- Jindal Steel & Power Ltd

- Posco Holdings Inc

- ArcelorMittal Nippon Steel India

- Namco Industries Pvt Ltd

- Shah Alloys Ltd

- Asian Mills Pvt Ltd

- Asian Tubes Pvt Ltd

- Asian Tubes Pvt Ltd CR Division

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

احصل على عينة مجانية لهذا التقرير

احصل على عينة مجانية لهذا التقرير