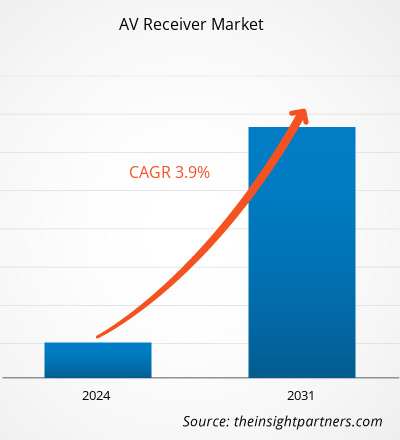

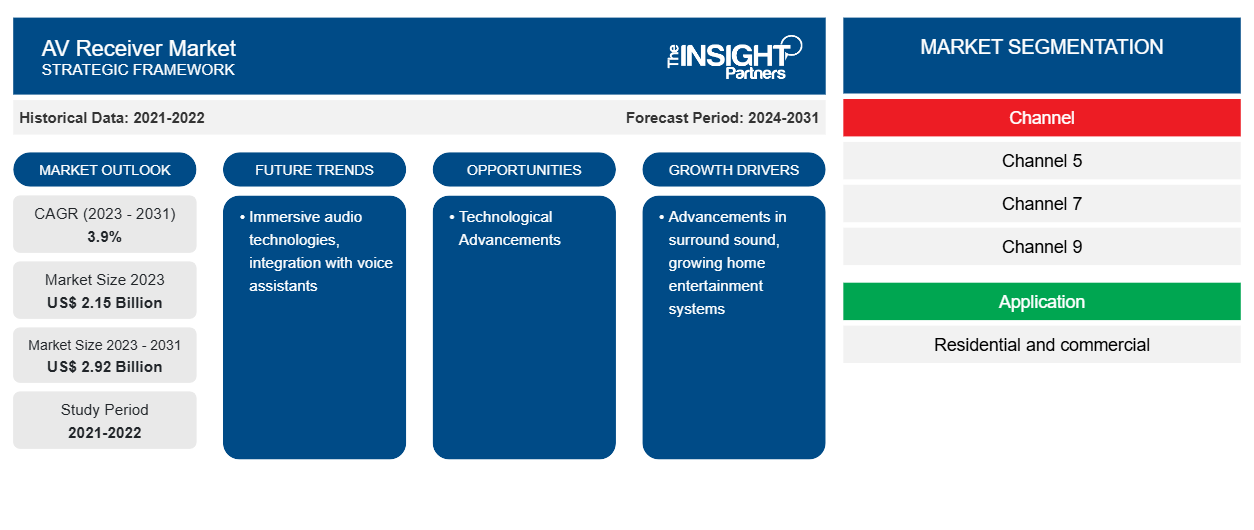

Se prevé que el tamaño del mercado de receptores AV alcance los 2.920 millones de dólares en 2031, frente a los 2.150 millones de dólares en 2023. Se espera que el mercado registre una CAGR del 3,9 % durante el período 2023-2031. Es probable que las tecnologías de audio inmersivo y la integración con asistentes de voz sigan siendo una tendencia clave en el mercado.

Análisis del mercado de receptores AV

El componente electrónico que alimenta y dirige la experiencia de cine en casa se llama receptor A/V. El centro de un sistema de cine en casa es, sin lugar a dudas, el receptor AV. Recibe señales de varias fuentes, tanto de audio como de imagen, y las envía a las salidas correspondientes. Por ejemplo, cuando un receptor AV y un reproductor de Blu-ray se conectan a través de HDMI para transmitir datos de audio y vídeo, el AVR envía las señales de audio al sistema de altavoces y la señal de vídeo a la pantalla asociada (TV o proyector). Los receptores AV de hoy en día son capaces de mucho más que sólo señales de audio. El receptor AV puede considerarse como el cerebro o la unidad central de procesamiento de un sistema de cine en casa. En términos de alternativas de entretenimiento para su sistema de cine en casa, estaría muy limitado sin él. Sin un receptor AV, la experiencia de cine en casa sería mediocre y aburrida. Además de hacer que las películas cobren vida, simplifica la gestión de sus invaluables componentes AV.

Descripción general del mercado de receptores AV

Este es un mercado impulsado por los productos de audio y video para el hogar. Además, ha cambiado significativamente de un año a otro a medida que los nuevos residentes intentan utilizar sus nuevas áreas de diversas maneras. Los receptores AV son uno de los componentes vitales de estos sistemas. El receptor es la piedra angular de un sistema de cine en casa contemporáneo. El receptor AV en un sistema de cine en casa ofrece una variedad de opciones de procesamiento de sonido envolvente, incluidos los códecs de audio inmersivo de vanguardia como DTS:X y Dolby Atmos, así como numerosos cambios de fuente de alta resolución. También suministra electricidad a los altavoces de un sistema.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Impulsores y oportunidades del mercado de receptores AV

Avances en sonido envolvente para favorecer al mercado

El cine en casa se ha revitalizado gracias a la rápida adopción del sonido envolvente basado en objetos y de códecs como DTS:X y Dolby Atmos. Se está produciendo un resurgimiento del sonido envolvente, impulsado por el cambio general del mercado hacia el audio envolvente. El uso del audio envolvente se está expandiendo a medida que lo adoptan más salas de música en vivo, teatros, museos y otros contextos comerciales. En lo que respecta al cine en casa, los receptores AV ofrecen una forma inigualable y a un precio razonable para que las personas disfruten de un audio envolvente en la comodidad de su sala de estar, incluidos los formatos de sonido envolvente basados en objetos como Dolby Atmos. Los AVR también se están preparando para el futuro al utilizar la tecnología más nueva, como HDMI 2.1, 8K y HDR10+.

Avances tecnológicos

El mercado de los receptores AV está experimentando un rápido desarrollo de las tendencias y la tecnología modernas, como lo demuestra el creciente número de nuevas opciones disponibles para los usuarios modernos que están abandonando los medios antiguos. Con la ayuda de la tecnología integrada, Internet de alta velocidad y actualizaciones frecuentes de software, el individuo medio puede ahora acceder fácilmente a una notable variedad de materiales de alta calidad. Además, la inteligencia artificial está colaborando estrechamente con la electrónica, en particular con los receptores contemporáneos, para desarrollar potentes herramientas para producir increíbles efectos de sonido que proporcionen a los oyentes una comodidad y un uso nunca antes vistos en los sistemas de entretenimiento doméstico . Esto está creando oportunidades para el crecimiento del mercado.

Análisis de segmentación del informe de mercado de receptores AV

Los segmentos clave que contribuyeron a la derivación del análisis del mercado del receptor AV son el canal y la aplicación.

- Según el canal, el mercado de receptores AV se divide en canal 5, canal 7, canal 9 y otros. El segmento del canal 7 tuvo la mayor participación en 2023.

- Según la aplicación, el mercado se divide en residencial y comercial.

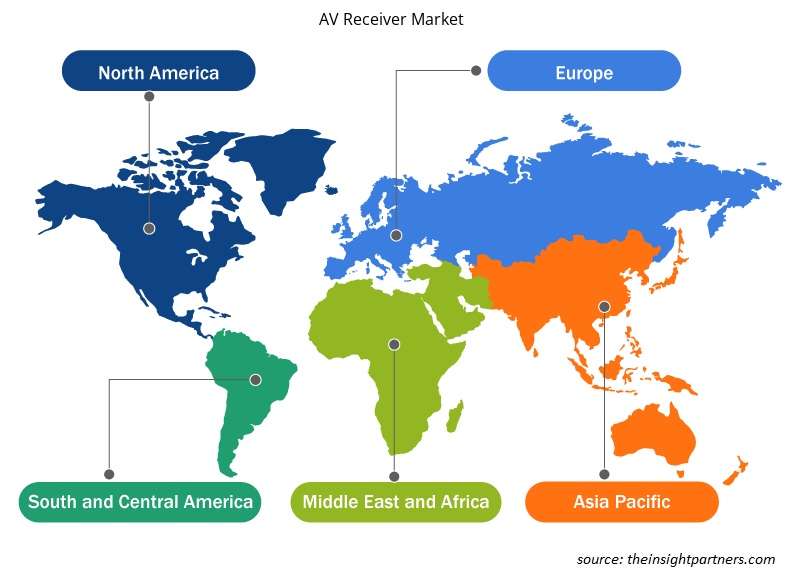

Análisis de la cuota de mercado de los receptores AV por geografía

El alcance geográfico del informe de mercado del receptor AV se divide principalmente en cinco regiones: América del Norte, Asia Pacífico, Europa, Medio Oriente y África, y América del Sur y Central.

América del Norte posee una participación significativa del mercado de receptores AV en 2023. Un alto nivel de ingresos disponibles permite a los consumidores de esta región realizar grandes inversiones en sistemas de entretenimiento doméstico, incluidos los receptores AV. La región también es más avanzada tecnológicamente y más madura cuando se consideran tecnologías como los receptores AV. Esto está impulsando el crecimiento del mercado de América del Norte.

Perspectivas regionales del mercado de receptores AV

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de receptores AV durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de receptores AV en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga los datos regionales específicos para el mercado de receptores AV

Alcance del informe de mercado de receptores AV

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2023 | US$ 2,15 mil millones |

| Tamaño del mercado en 2031 | US$ 2.92 mil millones |

| CAGR global (2023 - 2031) | 3,9% |

| Datos históricos | 2021-2022 |

| Período de pronóstico | 2024-2031 |

| Segmentos cubiertos |

Por canal

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de receptores AV: comprensión de su impacto en la dinámica empresarial

El mercado de receptores AV está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de receptores AV son:

- Arcam

- Electrónica LG

- Marantz

- Audio Pyle

- Corporación Yamaha

- Corporación Sony

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de receptores AV

Noticias y desarrollos recientes del mercado de receptores AV

El mercado de receptores AV se evalúa mediante la recopilación de datos cualitativos y cuantitativos a partir de una investigación primaria y secundaria, que incluye publicaciones corporativas importantes, datos de asociaciones y bases de datos. A continuación, se enumeran algunos de los avances en el mercado de receptores AV:

- ARCAM anuncia que todos los modelos actuales de la gama (AVR10, AVR20, AVR30 y AV40) podrán actualizarse a HDMI 2.1 en el cuarto trimestre de 2021. Los últimos modelos AVR de ARCAM ya ofrecen características y rendimiento de última generación, incluida la capacidad de conmutación de alta resolución HDMI 2.0 4K UHD. Diseñados desde el principio teniendo en cuenta la capacidad de actualización, hoy ARCAM anuncia que todos los modelos actuales de la gama (AVR10, AVR20, AVR30 y AV40) podrán actualizarse a HDMI 2.1 en el cuarto trimestre de 2021. (Fuente: ARCAM, comunicado de prensa, abril de 2021)

- Yamaha presenta receptores AV de última generación con múltiples entradas 8K, un nuevo aspecto y tecnología inmersiva. La nueva línea RX-V está posicionada para respaldar las últimas tendencias y especificaciones para el entretenimiento en el hogar, incluidos los juegos, tanto ahora como en el futuro. Esto incluye compatibilidad con 8K, HDMI 2.1 y HDR10+ para marcar el comienzo de una nueva era de pantallas dinámicas y posibilidades infinitas de lo que se puede ver y escuchar en el hogar. (Fuente: Yamaha Corporation, comunicado de prensa, agosto de 2020)

Informe de mercado sobre receptores AV: cobertura y resultados

El informe “Tamaño y pronóstico del mercado de receptores AV (2021-2031)” proporciona un análisis detallado del mercado que cubre las siguientes áreas:

- Tamaño del mercado de receptores AV y pronóstico a nivel global, regional y nacional para todos los segmentos clave del mercado cubiertos bajo el alcance

- Tendencias del mercado de receptores AV, así como dinámicas del mercado, como impulsores, restricciones y oportunidades clave

- Análisis detallado de las cinco fuerzas de Porter y PEST y FODA

- Análisis del mercado de receptores AV que cubre las tendencias clave del mercado, el marco global y regional, los principales actores, las regulaciones y los desarrollos recientes del mercado

- Panorama de la industria y análisis de la competencia que abarca la concentración del mercado, análisis de mapas de calor, actores destacados y desarrollos recientes para el mercado de receptores AV

- Perfiles detallados de empresas

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de receptores AV

Obtenga una muestra gratuita para - Mercado de receptores AV