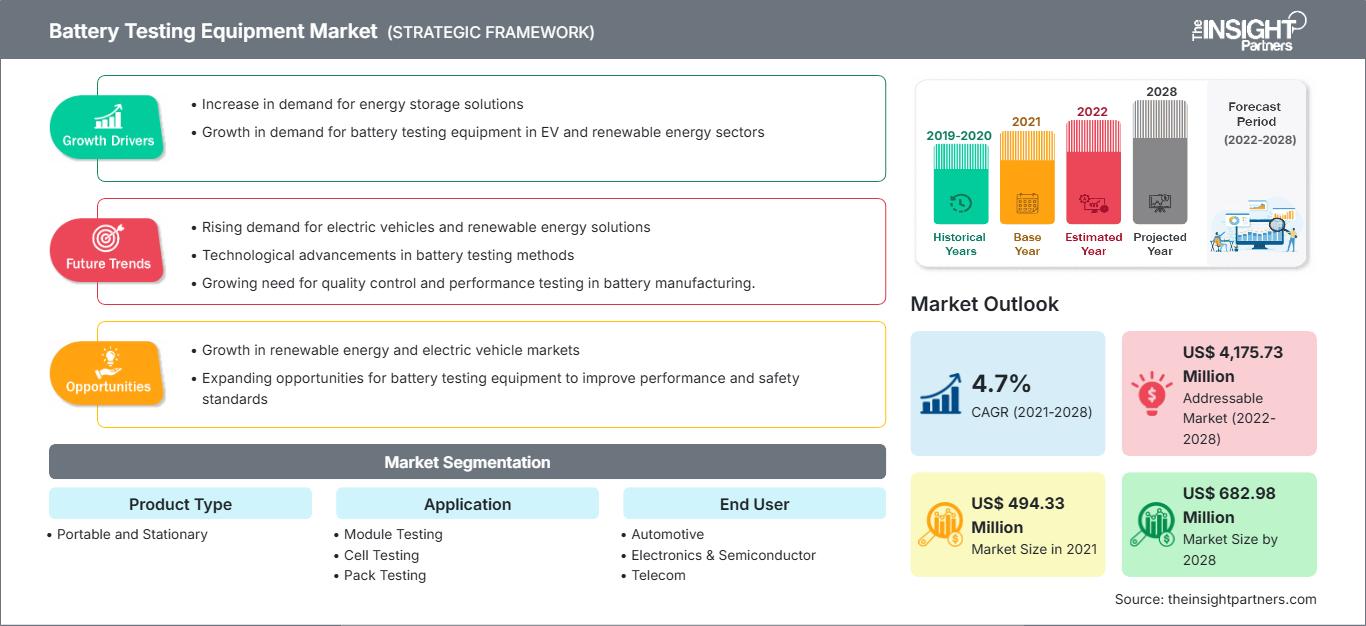

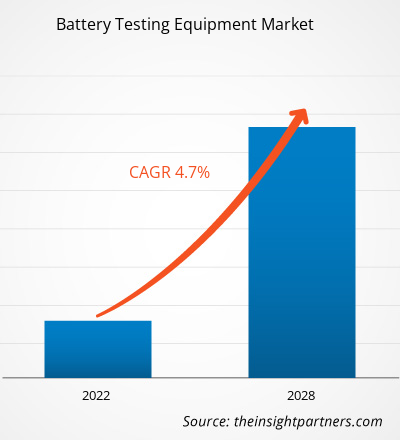

El mercado de equipos de prueba de baterías se valoró en US$ 494,33 millones en 2021 y se proyecta que alcance los US$ 682,98 millones para 2028; se estima que crecerá a una CAGR del 4,7% de 2021 a 2028.

Industrias como la aeroespacial y de defensa, la automotriz y la salud están invirtiendo fuertemente en tecnologías avanzadas para fortalecer sus capacidades con maquinaria avanzada y ofrecer servicios mejorados a sus clientes. Empresas en EE. UU., Francia, Suecia, el Reino Unido y otros países están desarrollando equipos avanzados de prueba de baterías para sus clientes globales. El aumento en la adquisición de baterías avanzadas por parte del Ejército estadounidense también impulsa el crecimiento del mercado. Además, se espera que el desarrollo de vehículos eléctricos VTOL y las iniciativas de gobiernos como Alemania, Emiratos Árabes Unidos y Singapur para desarrollar infraestructura de movilidad aérea urbana impulsen el crecimiento del mercado de equipos de prueba de baterías.

Se espera que el aumento del gasto en defensa en países como EE. UU., China, India y otros impulse el crecimiento del mercado de equipos de prueba de baterías en los próximos años. Países en desarrollo como India, China e Indonesia se centran en fortalecer sus capacidades militares debido al aumento de los conflictos fronterizos con países vecinos. La expansión de los sectores manufactureros en países como China e India impulsa aún más el crecimiento del mercado de equipos de prueba de baterías.

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

Mercado de equipos de prueba de baterías: Perspectivas estratégicas

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Impacto de la pandemia de COVID-19 en el crecimiento del mercado de equipos de prueba de baterías en América del Norte

Estados Unidos es el país más afectado de Norteamérica por la COVID-19. Muchas plantas de fabricación cerraron temporalmente o operan con personal mínimo; la cadena de suministro de componentes y piezas está interrumpida; estos son algunos de los problemas críticos que enfrentan los fabricantes norteamericanos.

Dado que Estados Unidos cuenta con una mayor cantidad de equipos de prueba de baterías, fabricantes de componentes e industrias, el brote ha afectado gravemente la producción y la generación de ingresos. La menor cantidad de personal de fabricación ha resultado en una menor producción. Por otro lado, la disponibilidad limitada de materias primas y el cierre de la industria aeroespacial también han afectado al mercado de equipos de prueba de baterías en Estados Unidos. Sin embargo, se espera que el aumento del gasto militar del país y el creciente desarrollo de vehículos eléctricos por parte de empresas como Tesla brinden oportunidades de crecimiento a los actores del mercado de equipos de prueba de baterías en el futuro cercano.

Perspectivas del mercado: mercado de equipos de prueba de baterías

La creciente demanda de transporte impulsará el

Debido al aumento de la renta disponible de las personas en economías en desarrollo, como China, India, Corea del Sur y otras, la demanda de vehículos ha aumentado. Según la Sociedad de Fabricantes de Automóviles de la India (SIAM), las ventas de vehículos de pasajeros en la India aumentaron un 26,45 % entre septiembre de 2019 y septiembre de 2020. Se espera que factores como el aumento de las inversiones de importantes fabricantes de vehículos y las normas gubernamentales favorables para la fabricación de vehículos en Asia Pacífico impulsen el crecimiento del mercado de equipos de prueba de baterías en la región. Además, se espera que las iniciativas de los gobiernos de países como Vietnam para expandir su industria automotriz impulsen el tamaño del mercado de equipos de prueba de baterías.

Información basada en el tipo de producto

Según el tipo de producto, el mercado de equipos de prueba de baterías se segmenta en equipos portátiles y estacionarios. El segmento de equipos estacionarios lideró el mercado con una participación del 54,1 % en 2020. Las pruebas de baterías estacionarias se realizan para comprobar la capacidad de la batería nueva como parte de la prueba de aceptación, para comprobar la impedancia y establecer los valores de referencia, y para repetir el proceso de prueba en un plazo de dos años para la garantía. El proceso de prueba verifica la impedancia trimestralmente en celdas de plomo-ácido reguladas por válvula (VRLA) y realiza pruebas de capacidad cada 25 % de su vida útil prevista.

Perspectivas basadas en aplicaciones

Según su aplicación, el mercado de equipos de prueba de baterías se segmenta en pruebas de módulos, celdas y paquetes. El segmento de pruebas de celdas lideró el mercado en 2020. Las pruebas de estrés de celdas se realizan para evaluar la respuesta a tensiones eléctricas, ambientales y mecánicas, entre otras. Las pruebas de celdas prolongan la vida útil de la batería y simulan perfiles de prueba complejos en condiciones reales. Además, los probadores de celdas están diseñados para realizar pruebas en baterías de iones de litio, condensadores eléctricos de doble capa (EDLC) y condensadores de iones de litio (LIC). Se prevé que esto impulse el tamaño del mercado de equipos de prueba de baterías.

Según la geografía, el mercado de equipos de prueba de baterías se segmenta en cinco regiones principales: Norteamérica, Europa, Asia-Pacífico, Oriente Medio y África (MEA) y Sudamérica. En 2020, Norteamérica registró la mayor participación en los ingresos, seguida de Europa y Asia-Pacífico, respectivamente. Se prevé que el mercado en Asia-Pacífico crezca a la tasa de crecimiento anual compuesta (TCAC) más rápida, del 5,8 %, entre 2020 y 2028. Arbin Instruments, Century Yuasa Batteries Pty Ltd., Chauvin Arnoux, Chroma Systems Solutions, Inc., DV Power, Extech Instruments, Megger, Midtronics, Inc., Storage Battery Systems, LLC y Xiamen Tmax Battery Equipments Limited se encuentran entre los actores clave del ecosistema que se analizaron en este estudio de mercado.

Perspectivas regionales del mercado de equipos de prueba de baterías

Los analistas de The Insight Partners han explicado detalladamente las tendencias regionales y los factores que influyen en el mercado de equipos de prueba de baterías durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de equipos de prueba de baterías en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

Alcance del informe de mercado de equipos de prueba de baterías

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2021 | US$ 494,33 millones |

| Tamaño del mercado en 2028 | US$ 682,98 millones |

| CAGR global (2021-2028) | 4,7% |

| Datos históricos | 2019-2020 |

| Período de pronóstico | 2022-2028 |

| Segmentos cubiertos |

Por tipo de producto

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de equipos de prueba de baterías: comprensión de su impacto en la dinámica empresarial

El mercado de equipos de prueba de baterías está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y un mayor conocimiento de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían su oferta, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

- Obtenga una descripción general de los principales actores clave del mercado de equipos de prueba de baterías

Los actores que operan en el mercado de equipos de prueba de baterías se centran principalmente en el desarrollo de productos y colaboraciones avanzados y eficientes.

- En 2021, Keysight Technologies, Inc. y Proventia Oy colaboraron para mejorar las soluciones de pruebas de baterías de vehículos eléctricos (EV).

- En 2021, Chroma lanzó un sistema de pruebas de carga rápida para patinetes eléctricos para ayudar a la Asociación CHAdeMO a verificar los estimuladores de la interfaz de carga de vehículos eléctricos. En consonancia con el crecimiento internacional de la industria de vehículos eléctricos, también contribuirá a definir la Hoja de Verificación del Protocolo para los estándares de pruebas de carga rápida de vehículos eléctricos de dos ruedas.

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Informes relacionados

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de equipos de prueba de baterías

Obtenga una muestra gratuita para - Mercado de equipos de prueba de baterías