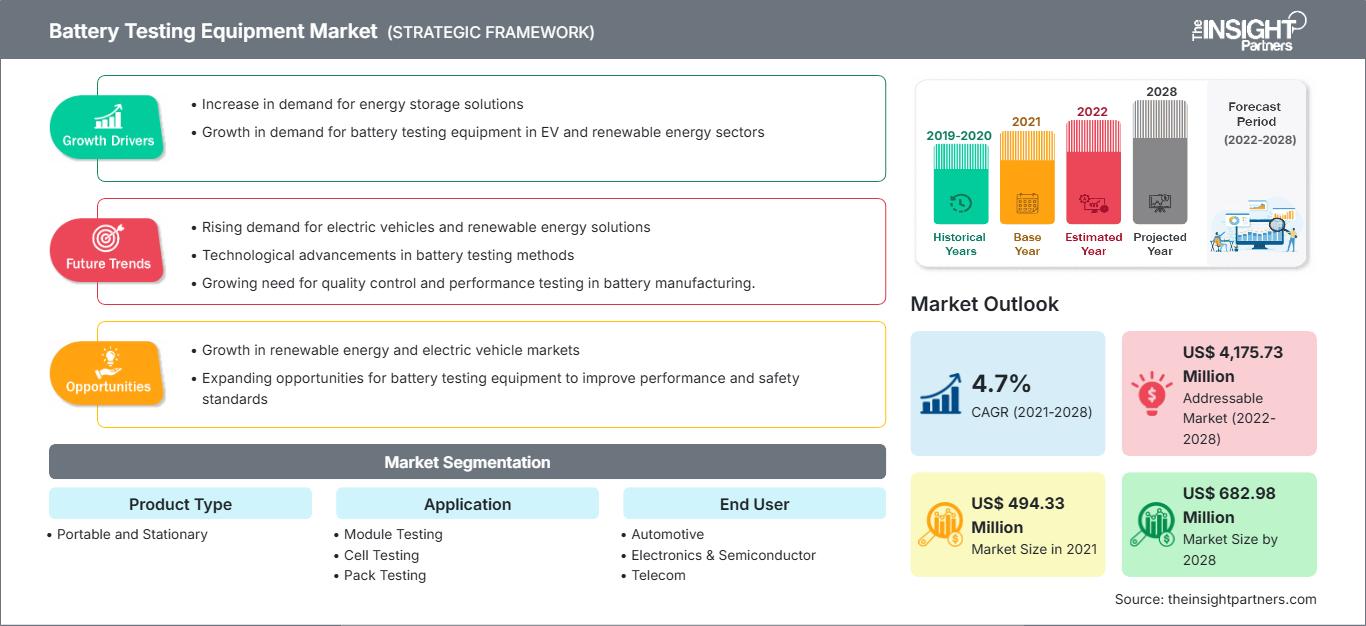

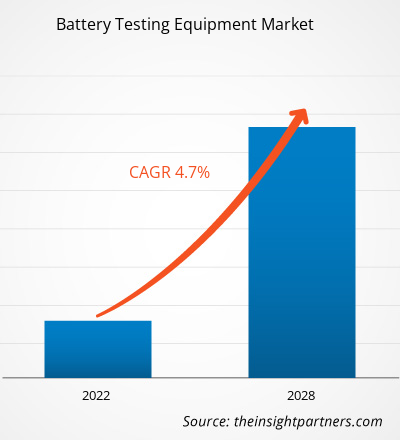

2021年电池测试设备市场价值为4.9433亿美元,预计到2028年将达到6.8298亿美元;预计2021年至2028年的复合年增长率为4.7%。

航空航天、国防、汽车和医疗保健等行业正在大力投资先进技术,以利用先进机械增强自身能力,并为客户提供更优质的服务。美国、法国、瑞典、英国和其他国家/地区的公司正在为其全球客户开发先进的电池测试设备。美国陆军对先进电池的采购量不断增加也支撑了市场的增长。此外,电动垂直起降飞机(eVTOL)的发展以及德国、阿联酋和新加坡等国政府为发展城市空中交通基础设施而采取的举措,预计将推动电池测试设备市场参与者的增长。

美国、中国、印度等国国防开支的增加预计将在未来几年推动电池测试设备市场的增长。由于与邻国边境冲突的增多,印度、中国和印度尼西亚等发展中国家正致力于加强军事能力。中国和印度等国制造业的扩张也进一步推动了电池测试设备市场的增长。

自定义此报告以满足您的要求

您将免费获得任何报告的定制,包括本报告的部分内容,或国家级分析、Excel 数据包,以及为初创企业和大学提供超值优惠和折扣

电池测试设备市场: 战略洞察

-

获取本报告的主要市场趋势。这个免费样本将包括数据分析,从市场趋势到估计和预测。

COVID-19 疫情对北美电池测试设备市场增长的影响

受 COVID-19 疫情影响,美国是北美受影响最严重的国家。许多制造工厂要么暂时关闭,要么以最低限度的员工人数运营;零部件供应链中断;这些都是北美制造商面临的一些关键问题。

由于美国拥有大量的电池测试设备、零部件制造商和行业,疫情爆发严重影响了每个行业的生产和创收。制造员工数量减少导致产量下降。另一方面,原材料供应有限和航空航天业关闭也影响了美国的电池测试设备市场。然而,美国不断增加的军费开支以及特斯拉等公司对电动汽车的不断发展,预计将在不久的将来为电池测试设备市场参与者提供增长机会。

市场洞察 -电池测试设备市场

不断增长的交通运输需求推动了

由于中国、印度、韩国等发展中经济体居民的可支配收入不断增加,对汽车的需求也在增加。根据印度汽车制造商协会 (SIAM) 的数据,从 2019 年 9 月到 2020 年 9 月,印度的乘用车销量增长了 26.45%。知名汽车制造公司加大投资以及亚太地区政府对汽车制造的有利规范等因素预计将推动该地区电池测试设备市场的增长。此外,越南等国政府为扩大汽车工业而采取的举措也有望推动电池测试设备市场规模的增长。

基于产品类型的见解

根据产品类型,电池测试设备市场细分为便携式电池测试设备和固定式电池测试设备。 2020 年,固定式电池测试设备领域占据电池测试设备市场的主导地位,市场份额达 54.1%。固定式电池测试包括:在新电池验收测试中,进行容量测试;进行阻抗测试以确定电池的基线值;以及在电池保修期内,在 2 年内重复上述测试过程。测试过程每季度检查一次阀控铅酸 (VRLA) 电池的阻抗,并在预期使用寿命达到 25% 时进行容量测试。

基于应用的洞察

根据应用,电池测试设备市场细分为模块测试、电芯测试和电池组测试。电芯测试领域在 2020 年占据市场主导地位。进行电芯压力测试是为了评估电池对电气、环境和机械应力等的响应。电芯测试可以延长电池寿命,并模拟复杂的真实测试曲线。此外,电池测试仪用于对锂离子电池、双电层电容器 (EDLC) 和锂离子电容器 (LIC) 进行测试。预计这将扩大电池测试设备的市场规模。

根据地域划分,电池测试设备市场分为五大区域,即北美、欧洲、亚太地区、中东和非洲 (MEA) 和南美地区 (SAM)。2020 年,北美占据最大收入份额,其次是欧洲和亚太地区。预计从 2020 年到 2028 年,亚太地区的市场复合年增长率将达到 5.8%,是最快的。Arbin Instruments、Century Yuasa Batteries Pty Ltd.、Chauvin Arnoux、Chroma Systems Solutions, Inc.、DV Power、Extech Instruments、Megger、Midtronics, Inc.、Storage Battery Systems, LLC 和厦门天马电池设备有限公司是本次市场研究中涉及的生态系统关键参与者。

电池测试设备市场区域洞察

The Insight Partners 的分析师已详尽阐述了预测期内影响电池测试设备市场的区域趋势和因素。本节还讨论了北美、欧洲、亚太地区、中东和非洲以及南美和中美洲的电池测试设备市场细分和地域分布。

电池测试设备市场报告范围

| 报告属性 | 细节 |

|---|---|

| 市场规模 2021 | US$ 494.33 Million |

| 市场规模 2028 | US$ 682.98 Million |

| 全球复合年增长率 (2021 - 2028) | 4.7% |

| 历史数据 | 2019-2020 |

| 预测期 | 2022-2028 |

| 涵盖的领域 |

By 产品类型

|

| 覆盖地区和国家 |

北美

|

| 市场领导者和主要公司简介 |

|

电池测试设备市场参与者密度:了解其对业务动态的影响

电池测试设备市场正在快速增长,这得益于终端用户需求的不断增长,而这些需求的驱动因素包括消费者偏好的不断变化、技术进步以及对产品优势的认知度不断提高。随着需求的增长,企业正在扩展产品线,不断创新以满足消费者需求,并抓住新兴趋势,从而进一步推动市场增长。

- 获取 电池测试设备市场 主要参与者概述

电池测试设备市场的参与者主要专注于开发先进高效的产品并开展合作。

- 2021 年,是德科技公司 (Keysight Technologies, Inc.) 与 Proventia Oy 合作,改进电动汽车 (EV) 电池测试解决方案。

- 2021 年,Chroma 推出了电动滑板车 (E-Scooter) 快速充电测试系统,以协助 CHAdeMO 协会检查电动汽车充电接口刺激器。随着电动汽车行业的国际化发展,该系统还将助力制定两轮电动汽车快速充电测试标准的协议检查表。

- 历史分析(2 年)、基准年、预测(7 年)及复合年增长率

- PEST和SWOT分析

- 市场规模、价值/数量 - 全球、区域、国家

- 行业和竞争格局

- Excel 数据集

近期报告

相关报告

客户评价

购买理由

- 明智的决策

- 了解市场动态

- 竞争分析

- 客户洞察

- 市场预测

- 风险规避

- 战略规划

- 投资论证

- 识别新兴市场

- 优化营销策略

- 提升运营效率

- 顺应监管趋势

获取免费样品 - 电池测试设备市场

获取免费样品 - 电池测试设备市场