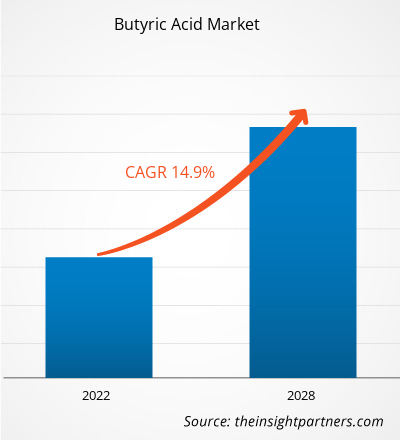

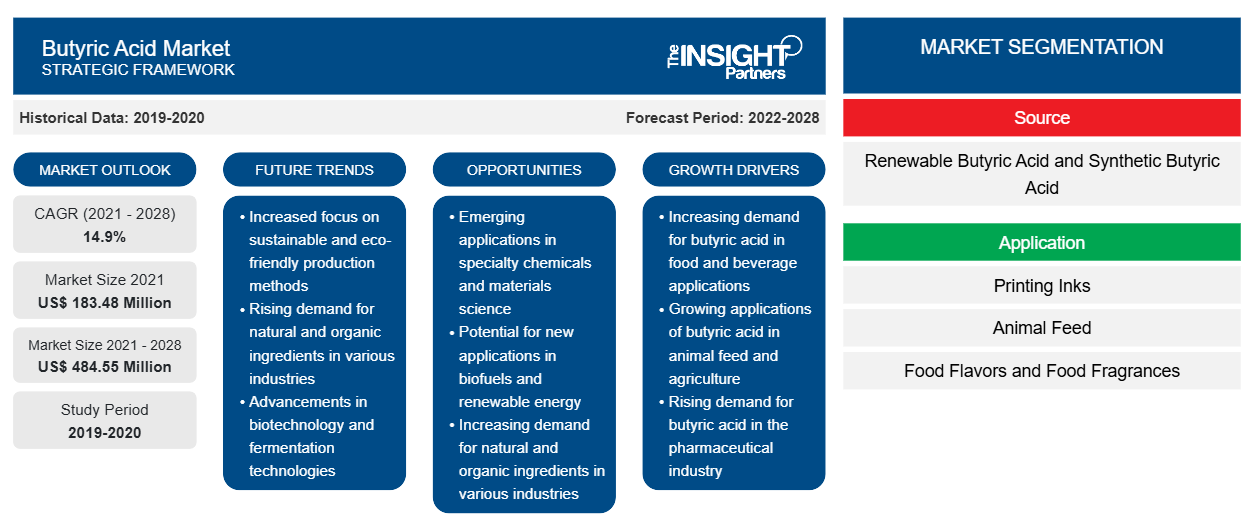

El mercado del ácido butírico se valoró en US$ 183,48 millones en 2021 y se proyecta que alcance los US$ 484,55 millones en 2028; se espera que crezca a una CAGR del 14,9% entre 2021 y 2028.

El ácido butírico es un líquido incoloro con un olor penetrante y desagradable. El ácido tiene varias aplicaciones importantes en las industrias química, alimentaria y farmacéutica. El ácido butírico tiene muchas aplicaciones en la industria farmacéutica.

En 2020, Asia Pacífico tuvo la mayor participación en los ingresos del mercado mundial. El creciente número de granjas ganaderas en Asia Pacífico está aumentando el consumo de alimento para animales y, en consecuencia, proliferando el mercado del ácido butírico . El crecimiento de las granjas ganaderas en la región de Asia Pacífico se puede atribuir a la mayor demanda de productos cárnicos de calidad debido a la mejora del ingreso per cápita y la creciente conciencia de la salud entre los consumidores de la región de Asia Pacífico.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Impacto de la pandemia de COVID-19 en el mercado del ácido butírico

La pandemia de COVID-19 ha afectado negativamente a las economías e industrias en varios países debido a los confinamientos, las prohibiciones de viaje y los cierres de empresas. En 2020, varias industrias tuvieron que ralentizar sus operaciones debido a las interrupciones en las cadenas de valor provocadas por el cierre de las fronteras nacionales e internacionales, lo que restringió la demanda de ácido butírico. La pandemia de COVID-19 provocó volatilidad en los precios de la materia prima necesaria para producir ácido butírico. El consumo mundial de ácido butírico disminuyó debido a la baja demanda de varios sectores posteriores, como los sabores alimentarios, las fragancias alimentarias y los intermedios químicos. La disponibilidad limitada de las materias primas y la reducción de la demanda de los sectores posteriores debido a la pandemia de COVID-19 han afectado negativamente al crecimiento del mercado del ácido butírico.

Perspectivas del mercado

Demanda creciente del sector de alimentos para animales

El ácido butírico es conocido por sus efectos beneficiosos sobre la salud y el desarrollo intestinal. Durante décadas, se ha utilizado en la industria de la alimentación animal para garantizar una mejor salud intestinal y el rendimiento animal. Además, el ácido butírico se ha convertido en una alternativa antibiótica de primera elección para los productores de pollos de engorde, ponedoras, pavos y cerdos con el cambio de la industria de la alimentación animal para reducir el uso de antibióticos.

En los últimos años, la industria ganadera en varios países se ha expandido rápidamente con el cambio en las preferencias dietéticas entre los consumidores hacia las proteínas animales. El crecimiento de la población, el aumento de los ingresos, la elevación del nivel de vida y la urbanización han sido los factores clave que impulsan la demanda de carne en todo el mundo. La creciente demanda de productos cárnicos resalta la necesidad de alimentos y aditivos para piensos. La creciente demanda de productos de alimentación animal en diferentes regiones impulsa la demanda de ácido butírico, impulsando así el crecimiento del mercado del ácido butírico.

El ácido butírico es uno de los ácidos grasos de cadena corta más beneficiosos que desempeña un papel clave en la mejora de la salud digestiva, el control del peso y la prevención del cáncer. El fuerte crecimiento de la industria farmacéutica en diferentes países del mundo está dando lugar a un uso cada vez mayor del ácido butírico para diversas aplicaciones. Además, existe un creciente interés en el uso del ácido butírico como precursor para la producción de biocombustibles. Se espera que esto ofrezca oportunidades lucrativas para el crecimiento del mercado del ácido butírico durante el período de pronóstico.

Información de origen

Según las fuentes, el mercado mundial de ácido butírico se ha segmentado en ácido butírico renovable y ácido butírico sintético. El segmento de ácido butírico sintético tuvo una mayor participación en el mercado mundial en 2020. El segmento de ácido butírico sintético representa una participación importante debido a su amplia aplicación para producir tintas de impresión, desinfectantes, sabores, medicamentos, perfumes, esencias y aditivos alimentarios, entre otros.

Algunos de los actores que operan en el mercado global del ácido butírico incluyen Eastman Chemical Company; OQ Chemicals GmbH; Tokyo Chemical Industry Co., Ltd.; Perstorp Holding AB; Alfa Aesar; MERCK KGaA; Vigon International, LLC.; Hefei TNJ Chemical Industry Co., Ltd.; KUNSHAN ODOWELL CO., LTD; y Yufeng International Co., Ltd. Los actores que operan en el mercado del ácido butírico se centran en proporcionar productos de alta calidad para satisfacer la demanda de los clientes. Estos actores del mercado están altamente enfocados en el desarrollo de ofertas de servicios innovadores y de alta calidad para satisfacer los requisitos de los clientes.

Perspectivas regionales del mercado del ácido butírico

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado del ácido butírico durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado del ácido butírico en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga datos regionales específicos para el mercado de ácido butírico

Alcance del informe de mercado de ácido butírico

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2021 | US$ 183,48 millones |

| Tamaño del mercado en 2028 | US$ 484,55 millones |

| CAGR global (2021-2028) | 14,9% |

| Datos históricos | 2019-2020 |

| Período de pronóstico | 2022-2028 |

| Segmentos cubiertos |

Por fuente

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de ácido butírico: comprensión de su impacto en la dinámica empresarial

El mercado del ácido butírico está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado del ácido butírico son:

- Compañía química Eastman

- OQ Productos químicos GmbH

- Industria química de Tokio Co., Ltd.

- Perstorp Holding AB

- Alfa Aesar

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de ácido butírico

Informe Destacado

- Tendencias progresivas de la industria en el mercado del ácido butírico para ayudar a los actores a desarrollar estrategias efectivas a largo plazo

- Estrategias de crecimiento empresarial adoptadas por los mercados desarrollados y en desarrollo

- Análisis cuantitativo del mercado del ácido butírico de 2019 a 2028

- Estimación de la demanda mundial de HR-PIB

- Análisis de las cinco fuerzas de Porter para ilustrar la eficacia de los compradores y proveedores que operan en la industria

- Avances recientes para comprender el escenario competitivo del mercado

- Tendencias y perspectivas del mercado, así como factores que impulsan y restringen el crecimiento del mercado del ácido butírico

- Asistencia en el proceso de toma de decisiones destacando las estrategias de mercado que sustentan el interés comercial y conducen al crecimiento del mercado.

- El tamaño del mercado del ácido butírico en varios nodos

- Descripción detallada y segmentación del mercado, así como la dinámica de la industria HR-PIB

- Tamaño del mercado del ácido butírico en diversas regiones con prometedoras oportunidades de crecimiento

Mercado mundial del ácido butírico

Fuente

- Ácido butírico renovable

- Ácido butírico sintético

Solicitud

- Tintas de impresión

- Alimento para animales

- Sabores y fragancias de los alimentos

- Intermedios químicos

- Farmacéutico

- Otros

Perfiles de empresas

- Compañía química Eastman

- OQ Productos químicos GmbH

- Industria química de Tokio Co., Ltd.

- Perstorp Holding AB

- Alfa Aesar

- Compañía Merck KGaA

- Vigon Internacional, LLC.

- Industria química Hefei TNJ Co., Ltd.

- Compañía Kunshan Odowell, Ltd.

- Compañía Internacional Yufeng, Ltd.

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Informes relacionados

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado del ácido butírico

Obtenga una muestra gratuita para - Mercado del ácido butírico