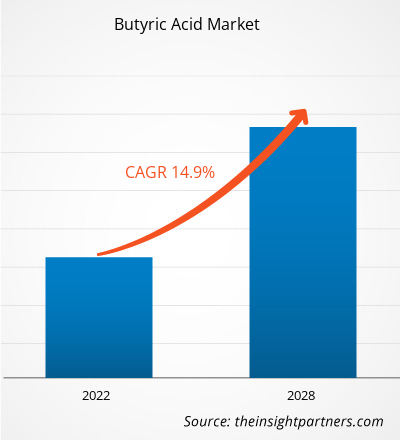

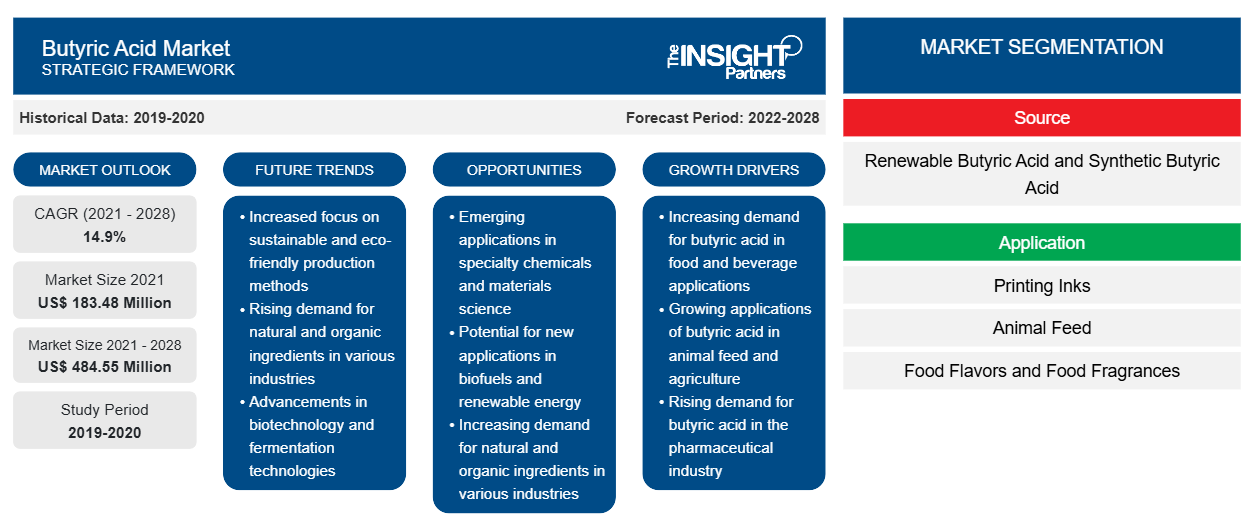

Der Markt für Buttersäure hatte im Jahr 2021 einen Wert von 183,48 Millionen US-Dollar und soll bis 2028 einen Wert von 484,55 Millionen US-Dollar erreichen; von 2021 bis 2028 wird ein durchschnittliches jährliches Wachstum von 14,9 % erwartet.

Buttersäure ist eine farblose Flüssigkeit mit einem penetranten und unangenehmen Geruch. Die Säure hat verschiedene wichtige Anwendungen in der Chemie-, Lebensmittel- und Pharmaindustrie. Buttersäure hat viele Anwendungen in der Pharmaindustrie.

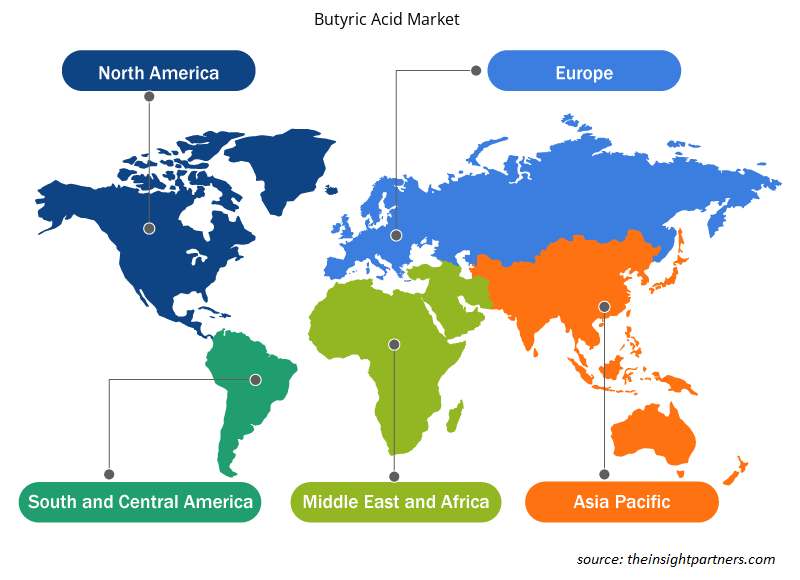

Im Jahr 2020 hatte der asiatisch-pazifische Raum den größten Umsatzanteil am Weltmarkt. Die wachsende Zahl von Viehzuchtbetrieben im asiatisch-pazifischen Raum erhöht den Verbrauch von Tierfutter und lässt in der Folge den Buttersäuremarkt wachsen . Das Wachstum der Viehzuchtbetriebe im asiatisch-pazifischen Raum ist auf die gestiegene Nachfrage nach hochwertigen Fleischprodukten aufgrund des steigenden Pro-Kopf-Einkommens und des wachsenden Gesundheitsbewusstseins der Verbraucher im asiatisch-pazifischen Raum zurückzuführen.

Passen Sie diesen Bericht Ihren Anforderungen an

Sie erhalten kostenlos individuelle Anpassungen an jedem Bericht, einschließlich Teilen dieses Berichts oder einer Analyse auf Länderebene, eines Excel-Datenpakets sowie tolle Angebote und Rabatte für Start-ups und Universitäten.

-

Holen Sie sich die wichtigsten Markttrends aus diesem Bericht.Dieses KOSTENLOSE Beispiel umfasst eine Datenanalyse von Markttrends bis hin zu Schätzungen und Prognosen.

Auswirkungen der COVID-19-Pandemie auf den Buttersäuremarkt

Die COVID-19-Pandemie hat sich aufgrund von Lockdowns, Reiseverboten und Betriebsschließungen negativ auf die Wirtschaft und Industrie in verschiedenen Ländern ausgewirkt. Im Jahr 2020 mussten verschiedene Industrien ihren Betrieb aufgrund von Störungen in den Wertschöpfungsketten aufgrund der Schließung nationaler und internationaler Grenzen verlangsamen, was die Nachfrage nach Buttersäure einschränkte. Die COVID-19-Pandemie führte zu Preisschwankungen bei den zur Herstellung von Buttersäure benötigten Rohstoffen. Der weltweite Verbrauch von Buttersäure ging aufgrund der geringen Nachfrage aus verschiedenen nachgelagerten Sektoren zurück, wie z. B. Lebensmittelaromen, Lebensmittelduftstoffen und chemischen Zwischenprodukten. Die eingeschränkte Verfügbarkeit der Rohstoffe und die geringere Nachfrage aus den nachgelagerten Sektoren aufgrund der COVID-19-Pandemie haben sich negativ auf das Wachstum des Buttersäuremarktes ausgewirkt.

Markteinblicke

Steigende Nachfrage aus dem Tierfuttersektor

Buttersäure ist für ihre positiven Auswirkungen auf die Darmgesundheit und -entwicklung bekannt. Seit Jahrzehnten wird sie in der Tierfutterindustrie verwendet, um die Darmgesundheit und die Leistungsfähigkeit der Tiere zu verbessern. Darüber hinaus ist Buttersäure für die Produzenten von Broilern, Legehennen, Truthähnen und Schweinen zu einer Antibiotikaalternative erster Wahl geworden, da die Tierfutterindustrie den Einsatz von Antibiotika reduzieren will.

In den letzten Jahren hat die Viehwirtschaft in verschiedenen Ländern mit der Verschiebung der Ernährungspräferenzen der Verbraucher hin zu tierischen Proteinen stark zugenommen. Bevölkerungswachstum, Einkommenszuwachs, steigender Lebensstandard und Urbanisierung sind die Schlüsselfaktoren, die die Nachfrage nach Fleisch weltweit ankurbeln. Die steigende Nachfrage nach Fleischprodukten unterstreicht den Bedarf an Tierfutter und Futterzusätzen. Die wachsende Nachfrage nach Tierfutterprodukten in verschiedenen Regionen steigert die Nachfrage nach Buttersäure und fördert damit das Wachstum des Buttersäuremarktes.

Buttersäure ist eine der vorteilhaftesten kurzkettigen Fettsäuren, die eine Schlüsselrolle bei der Verbesserung der Verdauungsgesundheit, der Gewichtskontrolle und der Krebsvorbeugung spielt. Das starke Wachstum der Pharmaindustrie in verschiedenen Ländern weltweit führt zu einer zunehmenden Nutzung von Buttersäure für verschiedene Anwendungen. Darüber hinaus besteht ein zunehmendes Interesse daran, Buttersäure als Vorläufer für die Herstellung von Biokraftstoffen zu verwenden. Dies dürfte im Prognosezeitraum lukrative Möglichkeiten für das Wachstum des Buttersäuremarktes bieten.

Quelle Einblicke

Basierend auf der Quelle wurde der globale Buttersäuremarkt in erneuerbare Buttersäure und synthetische Buttersäure segmentiert. Das Segment der synthetischen Buttersäure hatte im Jahr 2020 einen größeren Anteil am Weltmarkt. Das Segment der synthetischen Buttersäure nimmt den größten Anteil ein, da es unter anderem für die Herstellung von Druckfarben, Desinfektionsmitteln, Aromen, Medikamenten, Parfüms, Ostern und Lebensmittelzusatzstoffen verwendet wird.

Zu den Akteuren auf dem globalen Buttersäuremarkt gehören unter anderem Eastman Chemical Company; OQ Chemicals GmbH; Tokyo Chemical Industry Co., Ltd.; Perstorp Holding AB; Alfa Aesar; MERCK KGaA; Vigon International, LLC.; Hefei TNJ Chemical Industry Co.,Ltd.; KUNSHAN ODOWELL CO.,LTD; und Yufeng International Co.,Ltd. Die Akteure auf dem Buttersäuremarkt konzentrieren sich auf die Bereitstellung hochwertiger Produkte, um die Kundennachfrage zu erfüllen. Diese Marktteilnehmer konzentrieren sich stark auf die Entwicklung hochwertiger und innovativer Serviceangebote, um die Anforderungen der Kunden zu erfüllen.

Regionale Einblicke in den Buttersäuremarkt

Die regionalen Trends und Faktoren, die den Buttersäuremarkt im Prognosezeitraum beeinflussen, wurden von den Analysten von Insight Partners ausführlich erläutert. In diesem Abschnitt werden auch Buttersäuremarktsegmente und -geografie in Nordamerika, Europa, im asiatisch-pazifischen Raum, im Nahen Osten und Afrika sowie in Süd- und Mittelamerika erörtert.

- Erhalten Sie regionalspezifische Daten zum Buttersäuremarkt

Umfang des Buttersäure-Marktberichts

| Berichtsattribut | Details |

|---|---|

| Marktgröße im Jahr 2021 | 183,48 Millionen US-Dollar |

| Marktgröße bis 2028 | 484,55 Millionen US-Dollar |

| Globale CAGR (2021 - 2028) | 14,9 % |

| Historische Daten | 2019-2020 |

| Prognosezeitraum | 2022–2028 |

| Abgedeckte Segmente |

Nach Quelle

|

| Abgedeckte Regionen und Länder |

Nordamerika

|

| Marktführer und wichtige Unternehmensprofile |

|

Dichte der Marktteilnehmer für Buttersäure: Deren Auswirkungen auf die Geschäftsdynamik verstehen

Der Markt für Buttersäure wächst rasant, angetrieben durch die steigende Nachfrage der Endverbraucher aufgrund von Faktoren wie sich entwickelnden Verbraucherpräferenzen, technologischen Fortschritten und einem größeren Bewusstsein für die Vorteile des Produkts. Mit steigender Nachfrage erweitern Unternehmen ihr Angebot, entwickeln Innovationen, um die Bedürfnisse der Verbraucher zu erfüllen, und nutzen neue Trends, was das Marktwachstum weiter ankurbelt.

Die Marktteilnehmerdichte bezieht sich auf die Verteilung von Firmen oder Unternehmen, die in einem bestimmten Markt oder einer bestimmten Branche tätig sind. Sie gibt an, wie viele Wettbewerber (Marktteilnehmer) in einem bestimmten Marktraum im Verhältnis zu seiner Größe oder seinem gesamten Marktwert präsent sind.

Die wichtigsten auf dem Buttersäuremarkt tätigen Unternehmen sind:

- Eastman Chemical Company

- OQ Chemicals GmbH

- Tokio Chemieindustrie Co., Ltd.

- Perstorp Holding AB

- Alfa Aesar

Haftungsausschluss : Die oben aufgeführten Unternehmen sind nicht in einer bestimmten Reihenfolge aufgeführt.

- Überblick über die wichtigsten Akteure auf dem Buttersäuremarkt

Bericht-Spotlights

- Fortschrittliche Branchentrends auf dem Buttersäuremarkt helfen den Akteuren bei der Entwicklung wirksamer langfristiger Strategien

- In Industrie- und Entwicklungsländern angewandte Strategien für Unternehmenswachstum

- Quantitative Analyse des Buttersäuremarktes von 2019 bis 2028

- Schätzung der weltweiten Nachfrage nach HR-PIB

- Porters Fünf-Kräfte-Analyse zur Veranschaulichung der Wirksamkeit der in der Branche tätigen Käufer und Lieferanten

- Aktuelle Entwicklungen zum Verständnis des Wettbewerbsmarktszenarios

- Markttrends und -aussichten sowie Faktoren, die das Wachstum des Buttersäuremarktes vorantreiben und bremsen

- Unterstützung im Entscheidungsprozess durch Aufzeigen von Marktstrategien, die das kommerzielle Interesse untermauern und zum Marktwachstum führen

- Die Größe des Buttersäuremarktes an verschiedenen Knotenpunkten

- Detaillierte Übersicht und Segmentierung des Marktes sowie der HR-PIB-Branchendynamik

- Größe des Buttersäuremarktes in verschiedenen Regionen mit vielversprechenden Wachstumschancen

Globaler Buttersäuremarkt

Quelle

- Erneuerbare Buttersäure

- Synthetische Buttersäure

Anwendung

- Druckfarben

- Tierfutter

- Lebensmittelaromen und Lebensmitteldüfte

- Chemische Zwischenprodukte

- Pharmazeutische

- Sonstiges

Firmenprofile

- Eastman Chemical Company

- OQ Chemicals GmbH

- Tokio Chemieindustrie Co., Ltd.

- Perstorp Holding AB

- Alfa Aesar

- MERCK KGaA

- Vigon International, LLC.

- Hefei TNJ Chemieindustrie Co., Ltd.

- KUNSHAN ODOWELL CO., LTD

- Yufeng International Co., Ltd.

- Historische Analyse (2 Jahre), Basisjahr, Prognose (7 Jahre) mit CAGR

- PEST- und SWOT-Analyse

- Marktgröße Wert/Volumen – Global, Regional, Land

- Branchen- und Wettbewerbslandschaft

- Excel-Datensatz

Aktuelle Berichte

Verwandte Berichte

Erfahrungsberichte

Grund zum Kauf

- Fundierte Entscheidungsfindung

- Marktdynamik verstehen

- Wettbewerbsanalyse

- Kundeneinblicke

- Marktprognosen

- Risikominimierung

- Strategische Planung

- Investitionsbegründung

- Identifizierung neuer Märkte

- Verbesserung von Marketingstrategien

- Steigerung der Betriebseffizienz

- Anpassung an regulatorische Trends

Kostenlose Probe anfordern für - Buttersäuremarkt

Kostenlose Probe anfordern für - Buttersäuremarkt