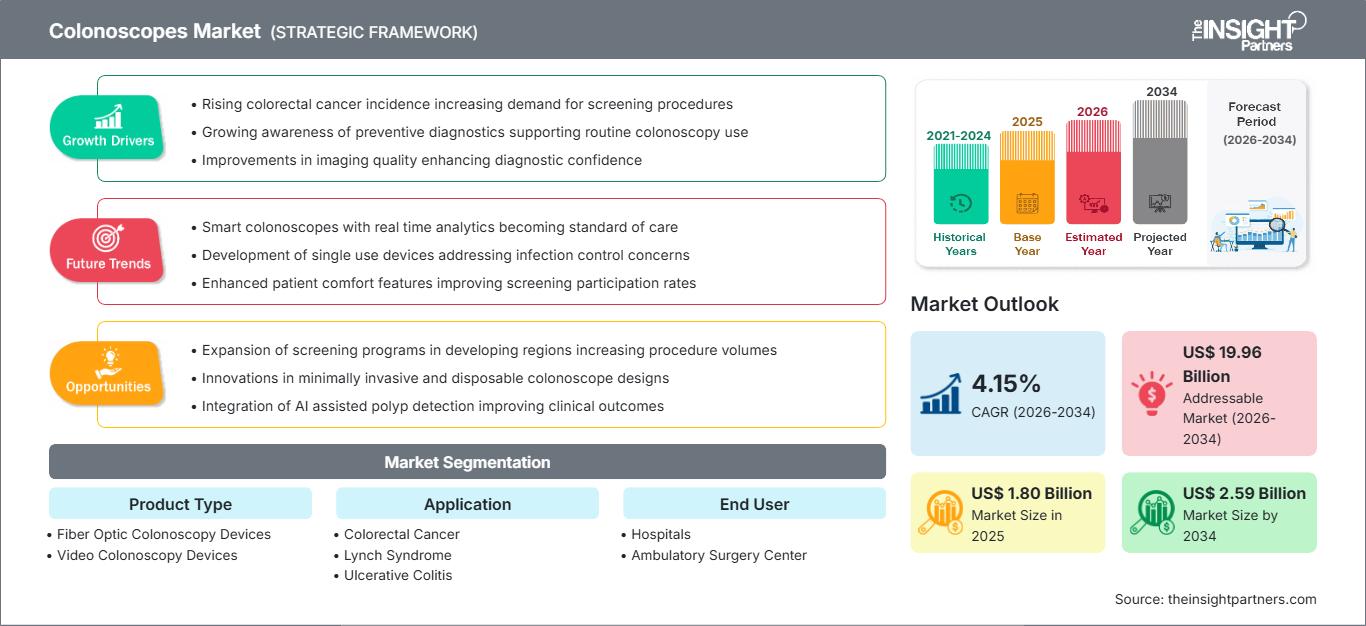

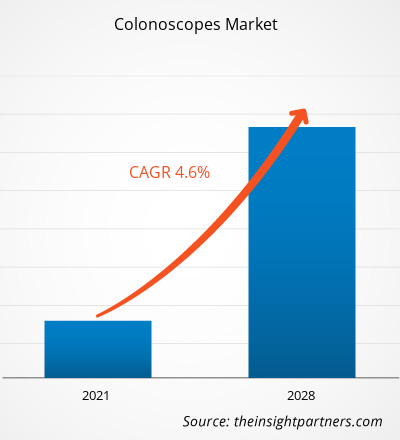

Se espera que el tamaño del mercado de colonoscopios alcance los 2.590 millones de dólares estadounidenses para 2034, desde los 1.800 millones de dólares estadounidenses en 2025. Se anticipa que el mercado registre una CAGR del 4,15 % durante el período 2026-2034.

Análisis del mercado de colonoscopios

El mercado de colonoscopios está experimentando un sólido crecimiento impulsado por la creciente prevalencia mundial del cáncer colorrectal (CCR) y las enfermedades inflamatorias intestinales (EII). Los colonoscopios son herramientas endoscópicas esenciales para la exploración visual del colon y el recto, y desempeñan un papel fundamental en la detección temprana del cáncer y la extirpación de pólipos. El mercado está en transición de los sistemas tradicionales de fibra óptica a colonoscopios de video de alta definición (HD) y plataformas con IA integrada. La Inteligencia Artificial (IA) se utiliza cada vez más para mejorar las tasas de detección de adenomas (ADR), ayudando a los gastroenterólogos a identificar pólipos pequeños o planos que podrían pasar desapercibidos durante los procedimientos estándar. Además, el desarrollo de colonoscopios desechables se perfila como una tendencia importante para abordar las preocupaciones relacionadas con la contaminación cruzada y las complejidades del reprocesamiento de dispositivos.

Descripción general del mercado de colonoscopios

Los colonoscopios son dispositivos médicos sofisticados que permiten intervenciones tanto diagnósticas como terapéuticas en el tracto gastrointestinal inferior. El desarrollo del mercado se debe en gran medida a la transición hacia la cirugía mínimamente invasiva y la integración de imágenes 4K y sistemas de visualización 3D. Los videocolonoscopios actualmente representan la mayor parte del mercado gracias a su excelente calidad de imagen y capacidad de grabación. Si bien los hospitales siguen siendo los principales usuarios finales, existe una creciente tendencia a realizar procedimientos en centros de cirugía ambulatoria (CAA) y clínicas de diagnóstico especializadas debido a la rentabilidad y una rotación de pacientes más rápida. Además, innovaciones como la colonoscopia asistida por capuchón y los sistemas asistidos magnéticamente están mejorando la seguridad de los procedimientos y reduciendo los tiempos de intubación cecal.

Personalice este informe según sus necesidades

Obtenga PERSONALIZACIÓN GRATUITAMercado de colonoscopios: perspectivas estratégicas

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Impulsores y oportunidades del mercado de colonoscopios

Factores impulsores del mercado:

- Alta carga mundial de cáncer colorrectal: como segunda causa principal de muertes relacionadas con el cáncer en todo el mundo, la alta incidencia del CCR requiere exámenes de detección frecuentes, lo que mantiene una demanda constante de equipos de colonoscopia.

- Avances tecnológicos en imágenes: la transición de la definición estándar a los sistemas 4K y asistidos por IA está mejorando significativamente la precisión del diagnóstico y alentando a los centros de atención médica a actualizar sus flotas existentes.

- Aumento de la población envejecida: el cambio demográfico hacia una población de mayor edad, que tiene un mayor riesgo de sufrir trastornos gastrointestinales, sigue siendo un catalizador principal para el crecimiento del volumen de procedimientos.

Oportunidades de mercado:

- Expansión de los colonoscopios de un solo uso: existe una oportunidad significativa para que los fabricantes capturen participación de mercado en el segmento desechable, particularmente en centros de gran volumen que buscan eliminar los riesgos de infección y los costos de esterilización.

- Crecimiento en las economías emergentes: La rápida mejora de la infraestructura de atención de salud y la implementación de programas nacionales de detección del cáncer en las regiones de Asia y el Pacífico y América Latina ofrecen un enorme potencial sin explotar.

- Integración de IA y aprendizaje automático: el impulso a las suites de "endoscopia inteligente" que brindan apoyo a la toma de decisiones clínicas en tiempo real ofrece un camino hacia evaluaciones colorrectales más automatizadas y estandarizadas.

Análisis de segmentación del informe de mercado de colonoscopios

La cuota de mercado de colonoscopios se analiza en varios segmentos para comprender mejor su estructura, potencial de crecimiento y tendencias emergentes. A continuación, se presenta el enfoque de segmentación estándar utilizado en la mayoría de los informes del sector:

Por tipo de producto:

- Dispositivos de videocolonoscopia: utilizan sensores electrónicos para transmitir imágenes de alta definición a un monitor; dominan el mercado debido a sus capacidades diagnósticas y terapéuticas superiores.

- Dispositivos de colonoscopia de fibra óptica: utilizan haces de fibras ópticas para transmitir imágenes; aunque todavía se utilizan en algunos entornos con limitaciones presupuestarias, están siendo reemplazados rápidamente por versiones digitales.

Por aplicación:

- Cáncer colorrectal: Los colonoscopios son la principal modalidad para la detección temprana y estadificación de tumores malignos del colon y el recto.

- Síndrome de Lynch: Esta predisposición genética requiere una vigilancia colonoscópica más frecuente para la detección temprana de cánceres colorrectales de rápido desarrollo.

- Colitis ulcerosa: la colonoscopia es esencial para evaluar la extensión de la inflamación de la mucosa y monitorear la actividad de la enfermedad a largo plazo en pacientes con esta afección.

- Enfermedad de Crohn: esta aplicación implica el uso de endoscopios para identificar inflamación transmural, estenosis y fístulas en los segmentos del intestino grueso y delgado.

- Pólipo: El segmento se centra en la identificación y eliminación de crecimientos precancerosos (polipectomía) para prevenir el desarrollo futuro de neoplasias malignas colorrectales invasivas.

Por usuario final:

- Hospitales: Estas instalaciones siguen siendo los principales proveedores y ofrecen servicios integrales de colonoscopia con atención hospitalaria integrada para casos diagnósticos y terapéuticos complejos.

- Centros de cirugía ambulatoria: ofrecen colonoscopias ambulatorias rentables y eficientes y, por lo tanto, muestran una tasa de crecimiento muy rápida debido a un rendimiento más rápido de los pacientes y a una experiencia endoscópica especializada.

Por geografía:

- América del norte

- Europa

- Asia-Pacífico

- América del Sur y Central

- Oriente Medio y África

Perspectivas regionales del mercado de colonoscopios

Los analistas de The Insight Partners han explicado detalladamente las tendencias y los factores regionales que influyen en el mercado de colonoscopios durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de colonoscopios en Norteamérica, Europa, Asia Pacífico, Oriente Medio y África, y Sudamérica y Centroamérica.

Alcance del informe de mercado de colonoscopios

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2025 | 1.800 millones de dólares estadounidenses |

| Tamaño del mercado en 2034 | US$ 2.59 mil millones |

| CAGR global (2026-2034) | 4,15% |

| Datos históricos | 2021-2024 |

| Período de pronóstico | 2026-2034 |

| Segmentos cubiertos |

Por tipo de producto

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de colonoscopios: comprensión de su impacto en la dinámica empresarial

El mercado de colonoscopios está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y un mayor conocimiento de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían su oferta, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

- Obtenga una descripción general de los principales actores clave del mercado de colonoscopios

Análisis de la cuota de mercado de colonoscopios por geografía

Norteamérica posee la mayor cuota de mercado, caracterizada por un alto gasto sanitario, una sofisticada red de centros gastroenterológicos especializados y un sólido apoyo a los reembolsos para la detección del cáncer colorrectal. Se prevé que Asia-Pacífico sea el mercado regional de mayor crecimiento gracias a la creciente concienciación y a las iniciativas de detección impulsadas por los gobiernos en China e India.

América del norte

- Cuota de mercado: Posee la mayor cuota de mercado, liderada por Estados Unidos y Canadá.

-

Factores clave:

- Gran volumen de procedimientos de detección

- Guías clínicas establecidas

- Presencia de grandes actores de la industria.

- Tendencias: Creciente adopción de sistemas habilitados para IA y transición de procedimientos a los centros ambulatorios.

Europa

- Cuota de mercado: Cuota de mercado significativa, respaldada por programas de salud nacionalizados y altos estándares de control de infecciones.

-

Factores clave:

- Fuerte énfasis en la atención preventiva

- Alta prevalencia de EII

- Las estrictas regulaciones médicas garantizan una gran demanda de sistemas endoscópicos avanzados.

- Tendencias: Enfoque creciente en el reprocesamiento ambientalmente sustentable y en iniciativas de endoscopia “verde”.

Asia-Pacífico

- Cuota de mercado: El mercado regional de más rápido crecimiento.

-

Factores clave:

- Clase media en rápida expansión

- Modernización de la infraestructura sanitaria

- Alta carga de enfermedad.

- Tendencias: Cambio hacia la fabricación nacional en China y aumento del turismo médico para diagnósticos avanzados.

América del Sur y Central

- Cuota de mercado: Región emergente con crecimiento constante en el sector de salud privado.

-

Factores clave:

- Aumento de la incidencia de enfermedades gastrointestinales relacionadas con el estilo de vida

- Ampliación de redes hospitalarias en Brasil y México.

- Las crecientes redes de hospitales privados facilitan la adopción de colonoscopios modernos.

- Tendencias: Transición a videocolonoscopios en las principales ciudades.

Oriente Medio y África

- Cuota de mercado: Un mercado en crecimiento con inversiones en alta tecnología en los países del CCG.

-

Factores clave:

- Estrategias nacionales de transformación de la atención sanitaria

- Crecimiento de centros médicos especializados.

- Aumento de las evaluaciones de expatriados

- Tendencias: adquisición de sistemas de alta gama para hospitales emblemáticos

Densidad de actores del mercado de colonoscopios

Alta densidad de mercado y competencia

El mercado de colonoscopios está altamente consolidado, con un pequeño número de gigantes globales que controlan la mayor parte del mercado. La competencia se centra en la resolución de las imágenes, la ergonomía y la integración de soluciones de salud digital.

El panorama competitivo está impulsando a los proveedores a diferenciarse a través de:

- Integración avanzada de inteligencia artificial: desarrollo de software que pueda identificar y caracterizar lesiones en tiempo real, reduciendo la "tasa de error" de pólipos precancerosos.

- Maniobrabilidad mejorada: Mejora mediante técnicas avanzadas de flexibilidad del tubo de inserción y navegación magnética para minimizar las molestias del paciente.

- Modelos de suscripción: Ofrecemos modelos basados en suscripción a hospitales a través de opciones de adquisición flexibles de SUD (dispositivos de un solo uso) así como SaaS (software como servicio).

Oportunidades y movimientos estratégicos:

- Adquisición de nuevas empresas de inteligencia artificial para integrar visión artificial en sus osciloscopios.

- Proporcionar simuladores de entrenamiento y paquetes de servicios para contratos a largo plazo.

- Localizar la producción para contrarrestar los riesgos de la cadena de suministro.

Las principales empresas que operan en el mercado de colonoscopios son:

- Corporación Fujifilm

- Corporación Olympus

- KARL STORZ SE & Co. KG

- Sistemas EndoMed

- PENTAX Medical

- Consis Medical

- Vista GI

- Corporación Científica de Boston

- Ambu A/S

Descargo de responsabilidad: Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

Noticias y desarrollos recientes del mercado de colonoscopios

- En junio de 2025, FUJIFILM Healthcare Europe presentó el nuevo colonoscopio delgado EC-860P como la última incorporación a la gama europea de endoscopia. Equipado con un nuevo sensor CMOS de alta resolución, el nuevo colonoscopio delgado de la serie 800 está diseñado para ayudar a los endoscopistas con imágenes de alta definición y bajo ruido.

- En septiembre de 2024, Odin Medical Ltd., una empresa de Olympus Corporation, recibió la autorización 510(k) de la Administración de Alimentos y Medicamentos de los Estados Unidos (FDA) para la primera tecnología de inteligencia artificial (IA) basada en la nube diseñada para ayudar a los gastroenterólogos a detectar pólipos colorrectales sospechosos durante los procedimientos de colonoscopia, el dispositivo de detección asistida por computadora (CADe) CADDIE™.

Informe de mercado sobre colonoscopios: cobertura y resultados

El informe "Tamaño y pronóstico del mercado de colonoscopios (2021-2034)" ofrece un análisis detallado del mercado que abarca las siguientes áreas:

- Tamaño del mercado de colonoscopios y pronóstico a nivel global, regional y nacional para todos los segmentos clave del mercado cubiertos bajo el alcance

- Colonoscopios Tendencias del mercado, así como dinámicas del mercado como impulsores, restricciones y oportunidades clave

- Análisis PEST y FODA detallado

- Análisis del mercado de colonoscopios que abarca las tendencias clave del mercado, el marco global y regional, los principales actores, las regulaciones y los desarrollos recientes del mercado.

- Análisis del panorama industrial y de la competencia que abarca la concentración del mercado, el análisis de mapas de calor, los actores destacados y los desarrollos recientes en el mercado de colonoscopios.

- Perfiles detallados de empresas.

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de colonoscopios

Obtenga una muestra gratuita para - Mercado de colonoscopios