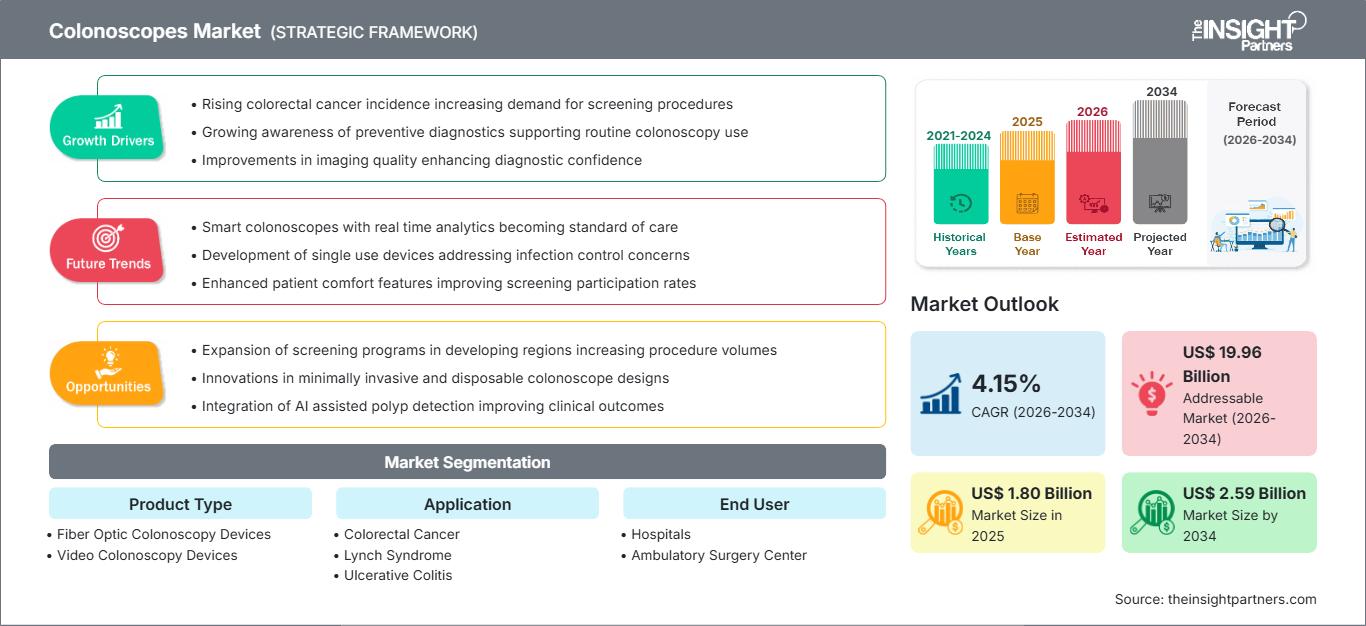

Colonoscopes Market Size & Growth Drivers by 2034

Colonoscopes Market Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Fiber Optic Colonoscopy Devices, Video Colonoscopy Devices); Application (Colorectal Cancer, Lynch Syndrome, Ulcerative Colitis, Crohn's Disease, Polyp); End User (Hospitals, Ambulatory Surgery Center, Others), and Geography

Historic Data: 2021-2024 | Base Year: 2025 | Forecast Period: 2026-2034- Status : Data Released

- Report Code : TIPRE00039019

- Category : Life Sciences

- No. of Pages : 150

- Available Report Formats :

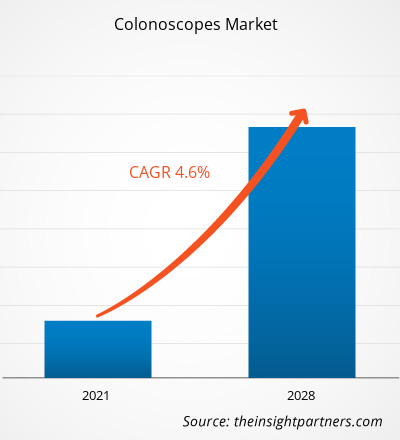

The colonoscopes market size is expected to reach US$ 2.59 billion by 2034 from US$ 1.80 billion in 2025. The market is anticipated to register a CAGR of 4.15% during 2026–2034.

Colonoscopes Market Analysis

The colonoscopes market is witnessing robust growth driven by the rising global prevalence of colorectal cancer (CRC) and inflammatory bowel diseases (IBD). Colonoscopes are essential endoscopic tools used for the visual examination of the colon and rectum, playing a pivotal role in early cancer detection and polyp removal. The market is transitioning from traditional fiber-optic systems to high-definition (HD) video colonoscopes and AI-integrated platforms. Artificial Intelligence (AI) is increasingly being used to enhance adenoma detection rates (ADR) by assisting gastroenterologists in identifying small or flat polyps that might be missed during standard procedures. Furthermore, the development of single-use (disposable) colonoscopes is emerging as a significant trend to address concerns regarding cross-contamination and the complexities of device reprocessing.

Colonoscopes Market Overview

Colonoscopes are sophisticated medical devices that allow for both diagnostic and therapeutic interventions within the lower gastrointestinal tract. The development in the market is driven significantly by the shift toward minimally invasive surgery and the integration of 4K imaging and 3D visualization systems. Video colonoscopes currently account for the majority market share due to their superior image quality and recording capabilities. While hospitals remain the primary end-users, there is a growing trend toward procedures being performed in ambulatory surgery centers (ASCs) and specialized diagnostic clinics due to cost-efficiency and faster patient turnover. Additionally, innovations such as cap-assisted colonoscopy and magnetic-assisted systems are improving procedural safety and reducing cecal intubation times.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONColonoscopes Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Colonoscopes Market Drivers and Opportunities

Market Drivers:

- High Global Burden of Colorectal Cancer: As the second leading cause of cancer-related deaths worldwide, the high incidence of CRC necessitates frequent screenings, maintaining a steady demand for colonoscopic equipment.

- Technological Advancements in Imaging: The move from standard-definition to 4K and AI-assisted systems is significantly improving diagnostic accuracy and encouraging healthcare facilities to upgrade their existing fleets.

- Increasing Aging Population: The demographic shift toward an older population, which is at a higher risk for gastrointestinal disorders, continues to be a primary catalyst for procedure volume growth.

Market Opportunities:

- Expansion of Single-Use Colonoscopes: There is a significant opportunity for manufacturers to capture market share in the disposable segment, particularly in high-volume centers looking to eliminate infection risks and sterilization costs.

- Growth in Emerging Economies: Rapidly improving healthcare infrastructure and the implementation of national cancer screening programs in the Asia-Pacific and Latin American regions offer vast untapped potential.

- Integration of AI and Machine Learning: The push for "smart endoscopy" suites that provide real-time clinical decision support offers a path toward more automated and standardized colorectal screenings.

Colonoscopes Market Report Segmentation Analysis

The Colonoscopes Market share is analyzed across various segments to provide a clearer understanding of its structure, growth potential, and emerging trends. Below is the standard segmentation approach used in most industry reports:

By Product Type:

- Video Colonoscopy Devices: Utilize electronic sensors to transmit high-definition images to a monitor; these dominate the market due to their superior diagnostic and therapeutic capabilities.

- Fiber-Optic Colonoscopy Devices: Use bundles of optical fibers to transmit images; though still in use in some budget-constrained settings, they are being rapidly phased out by digital versions.

By Application:

- Colorectal Cancer: Colonoscopes are the major modality for screening, early detection, and staging of malignant tumors of the colon and rectum.

- Lynch Syndrome: This genetic predisposition requires more frequent colonoscopic surveillance for the early detection of rapidly developing colorectal cancers.

- Ulcerative Colitis: Colonoscopy is essential to assess the extent of mucosal inflammation and monitor long-term disease activity in patients with this condition.

- Crohn's Disease: This application involves using endoscopes to identify transmural inflammation, strictures, and fistulas throughout the large and small bowel segments.

- Polyp: The segment focuses on identifying and removing precancerous growths (polypectomy) to prevent the future development of invasive colorectal malignancies

By End User:

- Hospitals: These facilities remain the primary providers, offering comprehensive colonoscopy services with integrated inpatient care for complex diagnostic and therapeutic cases.

- Ambulatory Surgery Centers: These provide cost-effective, efficient outpatient colonoscopies and are thus showing a very rapid growth rate due to faster patient throughput and specialized endoscopic expertise.

By Geography:

- North America

- Europe

- Asia-Pacific

- South & Central America

- Middle East & Africa

Colonoscopes Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 1.80 Billion |

| Market Size by 2034 | US$ 2.59 Billion |

| Global CAGR (2026 - 2034) | 4.15% |

| Historical Data | 2021-2024 |

| Forecast period | 2026-2034 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Colonoscopes Market Players Density: Understanding Its Impact on Business Dynamics

The Colonoscopes Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Colonoscopes Market Share Analysis by Geography

North America holds the largest market share, characterized by high healthcare expenditure, a sophisticated network of specialized GI centers, and strong reimbursement support for colorectal cancer screening. Asia-Pacific is anticipated to be the fastest-growing regional market due to rising awareness and government-led screening initiatives in China and India.

North America

- Market Share: Holds the largest market share, led by the U.S. and Canada.

- Key Drivers:

- High volume of screening procedures

- Established clinical guidelines

- Presence of major industry players.

- Trends: Growing adoption of AI-enabled systems and transition of procedures to ASCs.

Europe

- Market Share: Significant market share, supported by nationalized health programs and high standards for infection control.

- Key Drivers:

- Strong emphasis on preventive care

- High prevalence of IBD

- Stringent medical regulations ensure high demand for advanced endoscopic systems.

- Trends: Increasing focus on environmentally sustainable reprocessing and "green" endoscopy initiatives.

Asia-Pacific

- Market Share: The fastest-growing regional market.

- Key Drivers:

- Rapidly expanding middle class

- Healthcare infrastructure modernization

- High disease burden.

- Trends: Shift toward domestic manufacturing in China and increased medical tourism for advanced diagnostics.

South and Central America

- Market Share: Emerging region with steady growth in the private healthcare sector.

- Key Drivers:

- Rising incidence of lifestyle-related GI diseases

- Expansion of hospital networks in Brazil and Mexico.

- Growing private hospital networks facilitate the adoption of modern colonoscopes.

- Trends: Transition to video colonoscopes in major cities.

Middle East and Africa

- Market Share: A growing market with high-tech investments in the GCC countries.

- Key Drivers:

- National healthcare transformation strategies

- Growth in specialized medical centers.

- Rising expatriate screenings

- Trends: procurement of high-end systems for flagship hospitals

Colonoscopes Market Players Density

High Market Density and Competition

The Colonoscopes Market is highly consolidated, with a small number of global giants holding the majority of the market share. Competition is centered on imaging resolution, ergonomics, and the integration of digital health solutions.

The competitive landscape is driving vendors to differentiate through:

- Advanced AI Integration: Developing software that can identify and characterize lesions in real-time, reducing the "miss rate" for precancerous polyps.

- Enhanced Maneuverability: Improvement through advanced insertion tube flexibility techniques and magnetic navigation to minimize patient discomfort.

- Subscription Models: Offering subscription-based models to hospitals through flexible procurement options of SUDs (Single-Use Devices) as well as SaaS (Software as a Service).

Opportunities and Strategic Moves:

- Acquiring AI startups to embed computer vision in scopes.

- Providing training simulators and service bundles for long-term contracts.

- Localizing production to counter supply chain risks.

Major Companies Operating in the Colonoscopes Market Are:

- Fujifilm Corporation

- Olympus Corporation

- KARL STORZ SE & Co. KG

- EndoMed Systems

- PENTAX Medical

- Consis Medical

- GI-View

- Boston Scientific Corporation

- Ambu A/S

Disclaimer: The companies listed above are not ranked in any particular order.

Colonoscopes Market News and Recent Developments

- In June 2025, FUJIFILM Healthcare Europe introduced the new EC-860P slim colonoscope as the latest addition to the European endoscopy portfolio. Equipped with a new high-resolution CMOS sensor, the new 800 series slim colonoscope is designed to support endoscopists with high-definition, low-noise imaging.

- In September 2024, Odin Medical Ltd., an Olympus Corporation company, received U.S. Food and Drug Administration (FDA) 510(k) clearance for the first cloud-based Artificial Intelligence (AI) technology designed to assist gastroenterologists in detecting suspected colorectal polyps during colonoscopy procedures, the CADDIE™ computer-aided detection (CADe) device.

Colonoscopes Market Report Coverage and Deliverables

The "Colonoscopes Market Size and Forecast (2021–2034)" report provides a detailed analysis of the market covering the below areas:

- Colonoscopes Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Colonoscopes Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Colonoscopes Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the Colonoscopes Market

- Detailed company profiles.

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For