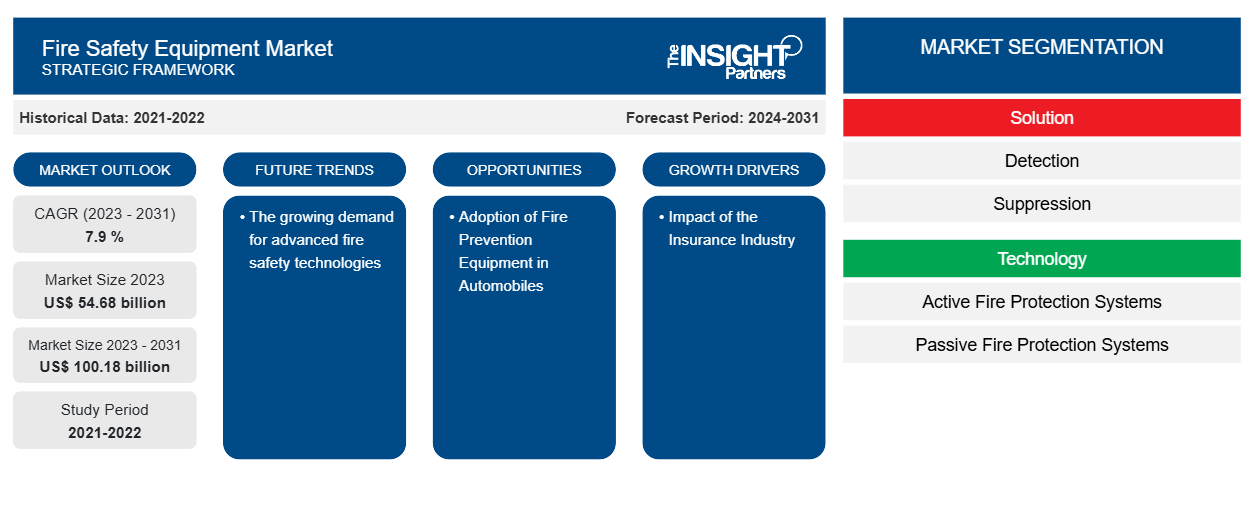

La taille du marché des équipements de sécurité incendie devrait atteindre 100,18 milliards de dollars américains d'ici 2031, contre 54,68 milliards de dollars américains en 2023. Le marché devrait enregistrer un TCAC de 7,9 % en 2023-2031.La demande croissante en technologies avancées de sécurité incendie devrait rester l’une des principales tendances du marché des équipements de sécurité incendie.

Analyse du marché des équipements de sécurité incendie

La mise en œuvre de réglementations de sécurité pour les projets de sécurité incendie et de réhabilitation favorisera la croissance du marché. Les avancées technologiques telles que les technologies de brouillard d'eau, les détecteurs de fumée et les systèmes d'alarme sans fil contribueront à augmenter encore ce chiffre. On prévoit que la sensibilisation croissante aux équipements de sécurité incendie et aux conséquences potentiellement catastrophiques stimulera la croissance du marché. Cependant, les coûts de remplacement élevés des équipements de lutte contre l'incendie traditionnels empêcheront le marché de se développer.

Aperçu du marché des équipements de sécurité incendie

Les améliorations apportées aux réseaux de capteurs sans fil et l’utilisation croissante de dispositifs de détection d’incendie sans fil devraient également avoir un impact positif sur le marché. Le marché devrait être impacté par l’augmentation des activités de développement des infrastructures de construction ainsi que par la sensibilisation croissante aux risques d’incendie. Afin de réduire le nombre de décès, les organisations du monde entier investissent davantage d’argent dans la sûreté et la sécurité des infrastructures. Le besoin mondial d’équipements de sécurité incendie devrait augmenter, car les activités de construction et de rénovation sont soumises aux règles de sécurité incendie . L’utilisation de composants électroniques dans les équipements de sécurité incendie a considérablement augmenté avec l’avancement des technologies de capteurs et le lancement ultérieur de systèmes sans fil intelligents. Ces appareils améliorés réagissent plus rapidement aux situations d’urgence et ont une sensibilité accrue. Ces pièces et systèmes sont coûteux car ils sont fabriqués à partir de matériaux de qualité supérieure et d’une grande précision.

Personnalisez ce rapport en fonction de vos besoins

Vous bénéficierez d'une personnalisation gratuite de n'importe quel rapport, y compris de certaines parties de ce rapport, d'une analyse au niveau des pays, d'un pack de données Excel, ainsi que d'offres et de remises exceptionnelles pour les start-ups et les universités.

Marché des équipements de sécurité incendie : informations stratégiques

-

Obtenez les principales tendances clés du marché de ce rapport.Cet échantillon GRATUIT comprendra une analyse de données, allant des tendances du marché aux estimations et prévisions.

Moteurs et opportunités du marché des équipements de sécurité incendie

Impact du secteur des assurances

Pour réduire les risques et les coûts d'assurance, les entreprises sont encouragées à investir dans des équipements de sécurité incendie. Cela s'explique par les règles et les récompenses établies par le secteur des assurances pour l'installation de mesures de sécurité incendie appropriées.

Adoption d'équipements de prévention des incendies dans les automobiles

L'intégration de systèmes de prévention des incendies dans les automobiles, en particulier dans les véhicules électriques, apparaît comme un moteur important du marché des équipements de protection contre les incendies . Cela est dû aux préoccupations de sécurité concernant les batteries haute tension. Ainsi, l'adoption d'équipements de prévention des incendies dans les automobiles devrait offrir de nouvelles opportunités aux acteurs du marché des équipements de sécurité incendie au cours de la période de prévision.

Analyse de segmentation du rapport sur le marché des équipements de sécurité incendie

Les segments clés qui ont contribué à l’élaboration de l’analyse du marché des équipements de sécurité incendie sont la solution, la technologie et l’application.

- Sur la base de la solution, le marché des équipements de sécurité incendie est segmenté en détection et suppression.

- En termes de technologie, le marché est segmenté en systèmes de protection incendie actifs et systèmes de protection incendie passifs.

-

Par application, le marché est segmenté encommercial, industriel et résidentiel

Le segment commercial détenait la plus grande part de marché en 2023.

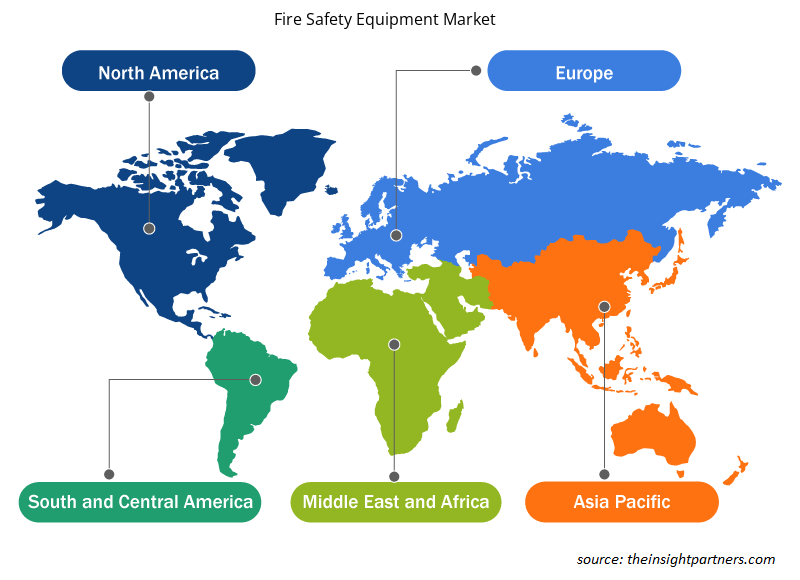

Analyse des parts de marché des équipements de sécurité incendie par zone géographique

La portée géographique du rapport sur le marché des équipements de sécurité incendie est principalement divisée en cinq régions : Amérique du Nord, Asie-Pacifique, Europe, Moyen-Orient et Afrique, et Amérique du Sud/Amérique du Sud et centrale. En termes de chiffre d'affaires, l'Amérique du Nord représentait la plus grande part de marché des équipements de sécurité incendie. Cela est dû au niveau élevé de sensibilisation à la sécurité incendie dans la région ainsi qu'aux réglementations strictes en matière de sécurité incendie qui y sont appliquées.

Aperçu régional du marché des équipements de sécurité incendie

Les tendances et facteurs régionaux influençant le marché des équipements de sécurité incendie tout au long de la période de prévision ont été expliqués en détail par les analystes d’Insight Partners. Cette section traite également des segments et de la géographie du marché des équipements de sécurité incendie en Amérique du Nord, en Europe, en Asie-Pacifique, au Moyen-Orient et en Afrique, ainsi qu’en Amérique du Sud et en Amérique centrale.

- Obtenez les données régionales spécifiques au marché des équipements de sécurité incendie

Portée du rapport sur le marché des équipements de sécurité incendie

| Attribut de rapport | Détails |

|---|---|

| Taille du marché en 2023 | 54,68 milliards de dollars américains |

| Taille du marché d'ici 2031 | 100,18 milliards de dollars américains |

| Taux de croissance annuel composé mondial (2023-2031) | 7,9 % |

| Données historiques | 2021-2022 |

| Période de prévision | 2024-2031 |

| Segments couverts |

Par Solution

|

| Régions et pays couverts |

Amérique du Nord

|

| Leaders du marché et profils d'entreprises clés |

|

Densité des acteurs du marché : comprendre son impact sur la dynamique des entreprises

Le marché des équipements de sécurité incendie connaît une croissance rapide, tirée par la demande croissante des utilisateurs finaux en raison de facteurs tels que l'évolution des préférences des consommateurs, les avancées technologiques et une plus grande sensibilisation aux avantages du produit. À mesure que la demande augmente, les entreprises élargissent leurs offres, innovent pour répondre aux besoins des consommateurs et capitalisent sur les tendances émergentes, ce qui alimente davantage la croissance du marché.

La densité des acteurs du marché fait référence à la répartition des entreprises ou des sociétés opérant sur un marché ou un secteur particulier. Elle indique le nombre de concurrents (acteurs du marché) présents sur un marché donné par rapport à sa taille ou à sa valeur marchande totale.

Les principales entreprises opérant sur le marché des équipements de sécurité incendie sont :

- Systèmes de sécurité Bosch GmbH

- Eaton Corporation plc

- Société Gentex

- Halma SA

- Société Hochiki

- Honeywell International, Inc.

Avis de non-responsabilité : les sociétés répertoriées ci-dessus ne sont pas classées dans un ordre particulier.

- Obtenez un aperçu des principaux acteurs du marché des équipements de sécurité incendie

Actualités et développements récents du marché des équipements de sécurité incendie

Le marché des équipements de sécurité incendie est évalué en collectant des données qualitatives et quantitatives issues de recherches primaires et secondaires, qui comprennent d'importantes publications d'entreprise, des données d'associations et des bases de données. Voici une liste des évolutions du marché des troubles de la parole et du langage et des stratégies :

- En septembre 2022, Johnson Controls, précurseur dans le développement de bâtiments inventifs, durables et sains, a proposé une méthode alternative de détection d'incendie avec sa gamme FireClass de dispositifs de détection d'incendie à protocole ouvert. Afin de rendre les zones plus sûres et plus sécurisées en cas d'incendie, FireClass propose un large choix de solutions que l'industrie a autorisées pour une utilisation dans les environnements commerciaux, résidentiels, de vente au détail, d'entreprise, de loisirs, de maisons de retraite, de fabrication et d'entrepôt. (Source : Johnson Controls, communiqué de presse)

- En septembre 2022, Siemens a dévoilé son premier portefeuille de services de sécurité incendie gérés et numériques. Ces services relient les systèmes de sécurité incendie au cloud, permettant aux entreprises de passer d'une approche réactive et axée sur la conformité à une protection complète grâce à une sécurité intelligente. En surveillant en permanence les niveaux de salissure des détecteurs avec les services numériques de sécurité incendie, vous pouvez être sûr que chaque détecteur d'incendie fonctionne comme prévu et que les facteurs de risque externes ou l'environnement ne compromettent pas les performances des systèmes de sécurité incendie. (Source : Siemens, communiqué de presse)

Rapport sur le marché des équipements de sécurité incendie : couverture et livrables

Le rapport « Taille et prévisions du marché des équipements de sécurité incendie (2021-2031) » fournit une analyse détaillée du marché couvrant les domaines ci-dessous :

- Taille du marché et prévisions aux niveaux mondial, régional et national pour tous les segments de marché clés couverts par le périmètre

- Dynamique du marché, comme les facteurs moteurs, les contraintes et les opportunités clés

- Principales tendances futures

- Analyse détaillée des cinq forces de PEST/Porter et SWOT

- Analyse du marché mondial et régional couvrant les principales tendances du marché, les principaux acteurs, les réglementations et les développements récents du marché

- Analyse du paysage industriel et de la concurrence couvrant la concentration du marché, l'analyse de la carte thermique, les principaux acteurs et les développements récents

- Profils d'entreprise détaillés

- Analyse historique (2 ans), année de base, prévision (7 ans) avec TCAC

- Analyse PEST et SWOT

- Taille du marché Valeur / Volume - Mondial, Régional, Pays

- Industrie et paysage concurrentiel

- Ensemble de données Excel

Rapports récents

Témoignages

Raison d'acheter

- Prise de décision éclairée

- Compréhension de la dynamique du marché

- Analyse concurrentielle

- Connaissances clients

- Prévisions de marché

- Atténuation des risques

- Planification stratégique

- Justification des investissements

- Identification des marchés émergents

- Amélioration des stratégies marketing

- Amélioration de l'efficacité opérationnelle

- Alignement sur les tendances réglementaires

Obtenez un échantillon gratuit pour - Marché des équipements de sécurité incendie

Obtenez un échantillon gratuit pour - Marché des équipements de sécurité incendie