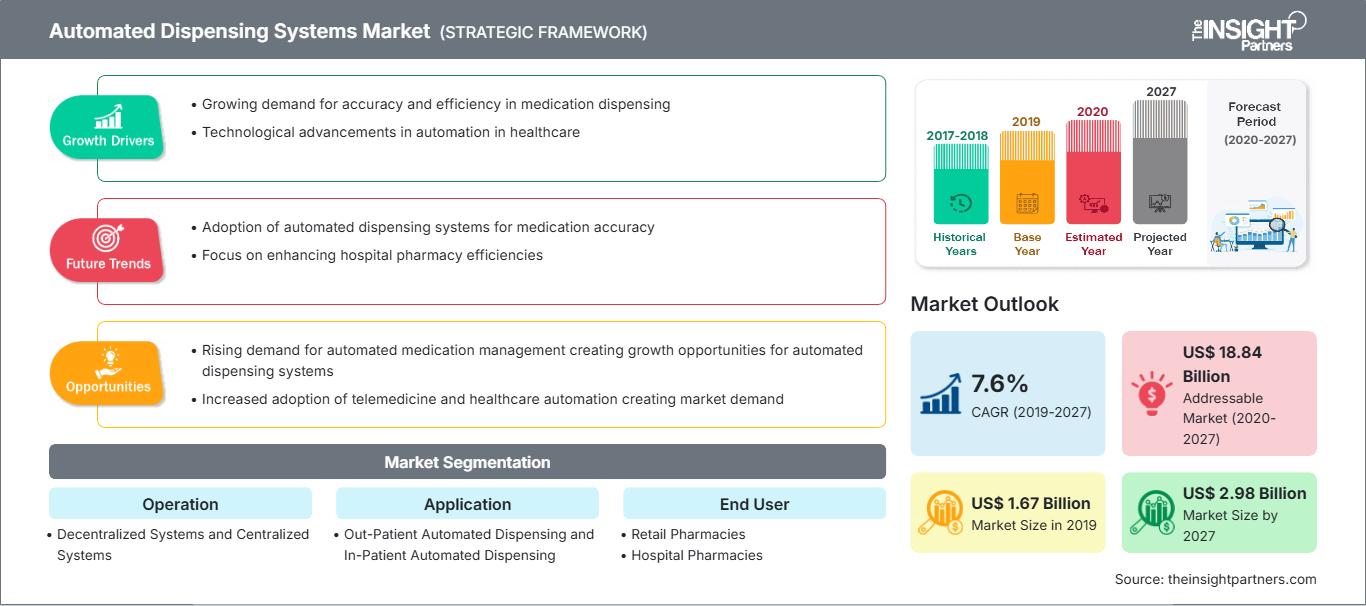

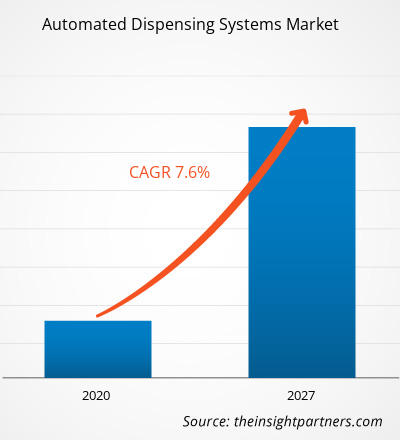

Si prevede che il mercato dei sistemi di distribuzione automatizzata raggiungerà i 2.980,38 milioni di dollari entro il 2027, rispetto ai 1.665,78 milioni di dollari del 2019; si stima una crescita a un CAGR del 7,6% tra il 2020 e il 2027.

I sistemi di distribuzione automatizzata, noti anche come armadietti automatici per farmaci, sono dispositivi elettronici per la conservazione e la distribuzione dei farmaci, utilizzati principalmente in ambito sanitario. Questi sistemi aiutano a tracciare e controllare la distribuzione dei farmaci; sono protetti da password autenticate e dati biometrici per il controllo dell'inventario e la sicurezza dei farmaci contro i furti. Questi sistemi sono stati evidenziati come uno dei potenziali strumenti per migliorare l'efficienza operativa e la sicurezza dei pazienti. Inoltre, sono ora ampiamente utilizzati, tra gli altri, in cliniche e case di cura. I sistemi di dispensazione automatizzata contribuiscono a trasformare gli ospedali in istituzioni più sicure, efficienti ed efficaci.

Il mercato globale dei sistemi di dispensazione automatizzata è trainato da fattori quali l'aumento degli errori di somministrazione dei farmaci e l'aumento della popolazione geriatrica. Tuttavia, i problemi associati ai sistemi di dispensazione automatizzata, come l'inserimento di programmi errati, i guasti delle apparecchiature e altri, possono ostacolare la crescita del mercato. Inoltre, i mercati emergenti stanno creando opportunità di crescita per gli operatori del mercato.

Personalizza questo rapporto in base alle tue esigenze

Potrai personalizzare gratuitamente qualsiasi rapporto, comprese parti di questo rapporto, o analisi a livello di paese, pacchetto dati Excel, oltre a usufruire di grandi offerte e sconti per start-up e università

Mercato dei sistemi di distribuzione automatizzati: Approfondimenti strategici

-

Ottieni le principali tendenze chiave del mercato di questo rapporto.Questo campione GRATUITO includerà l'analisi dei dati, che vanno dalle tendenze di mercato alle stime e alle previsioni.

Approfondimenti di mercato

Errori di somministrazione dei farmaci in aumento

Una somministrazione irrazionale, inappropriata e inefficace dei farmaci può portare a gravi errori terapeutici che possono danneggiare i pazienti. Alcuni degli errori terapeutici più comuni sono la somministrazione di un farmaco sbagliato, la somministrazione di una quantità di farmaco errata, la somministrazione di un farmaco con dosaggio errato e l'omissione di un articolo. Circa il 75% degli errori terapeutici è causato da distrazioni, poiché gli operatori sanitari sono impegnati in più attività come la visita dei pazienti, i colloqui con i consulenti, i colloqui con i familiari dei pazienti e le conversazioni con gli assicuratori.

Ogni anno, la Food and Drug Administration (FDA) statunitense riceve oltre 100.000 segnalazioni relative ad errori terapeutici. Inoltre, secondo lo studio "Errori di somministrazione dei farmaci" Pubblicato su StatPearls a giugno 2020, ogni anno negli Stati Uniti muoiono tra le 7.000 e le 9.000 persone a causa di errori terapeutici. Analogamente, secondo le stime pubblicate nello studio "Prevalence and Economic Burden of Medication Errors in the NHS In England" del 2018, ogni anno si verificano circa 237 milioni di errori terapeutici nel NHS e le reazioni avverse ai farmaci (ADR) evitabili causano centinaia di decessi.

Approfondimenti basati sull'operatività

In base all'operatività, il mercato dei sistemi di distribuzione automatizzata è segmentato in sistemi decentralizzati e sistemi centralizzati. Il segmento dei sistemi centralizzati ha detenuto una quota di mercato maggiore nel 2019 a causa di fattori quali la crescente necessità di ridurre i costi, garantire la disponibilità dei farmaci e modernizzare l'allocazione delle risorse. Inoltre, si prevede che i sistemi decentralizzati registreranno un CAGR maggiore nel mercato durante il periodo di previsione.

Approfondimenti basati sulle applicazioni

In base all'applicazione, il mercato dei sistemi di distribuzione automatica è segmentato in distribuzione automatica per pazienti ricoverati e distribuzione automatica per pazienti ambulatoriali. Il segmento della distribuzione automatica per pazienti ricoverati ha detenuto una quota di mercato maggiore nel 2019; tuttavia, si prevede che la distribuzione automatica per pazienti ambulatoriali registrerà un CAGR più elevato durante il periodo di previsione.

Approfondimenti basati sull'utente finale

In base all'utente finale, il mercato dei sistemi di distribuzione automatica è segmentato in farmacie ospedaliere, farmacie al dettaglio e altri. Il segmento delle farmacie ospedaliere ha detenuto la quota di mercato maggiore nel 2019; tuttavia, si prevede che il segmento delle farmacie al dettaglio registrerà il CAGR più elevato del mercato durante il periodo di previsione.

Il lancio e l'approvazione di prodotti sono le strategie comunemente adottate dalle aziende per espandere la propria presenza globale e il proprio portafoglio prodotti; queste strategie le aiutano a soddisfare la crescente domanda dei consumatori. La collaborazione è una delle principali strategie adottate dai protagonisti del mercato dei sistemi di distribuzione automatizzati per ampliare la base clienti in tutto il mondo, consentendo loro anche di mantenere il proprio marchio a livello globale.

Approfondimenti regionali sul mercato dei sistemi di distribuzione automatizzati

Le tendenze regionali e i fattori che influenzano il mercato dei sistemi di distribuzione automatizzata durante il periodo di previsione sono stati ampiamente spiegati dagli analisti di The Insight Partners. Questa sezione illustra anche i segmenti di mercato e la distribuzione geografica dei sistemi di distribuzione automatizzata in Nord America, Europa, Asia-Pacifico, Medio Oriente e Africa, America meridionale e centrale.

Ambito del rapporto di mercato sui sistemi di distribuzione automatizzati

| Attributo del rapporto | Dettagli |

|---|---|

| Dimensioni del mercato in 2019 | US$ 1.67 Billion |

| Dimensioni del mercato per 2027 | US$ 2.98 Billion |

| CAGR globale (2019 - 2027) | 7.6% |

| Dati storici | 2017-2018 |

| Periodo di previsione | 2020-2027 |

| Segmenti coperti |

By Funzionamento

|

| Regioni e paesi coperti |

Nord America

|

| Leader di mercato e profili aziendali chiave |

|

Densità degli operatori del mercato dei sistemi di distribuzione automatizzati: comprendere il suo impatto sulle dinamiche aziendali

Il mercato dei sistemi di distribuzione automatizzati è in rapida crescita, trainato dalla crescente domanda degli utenti finali, dovuta a fattori quali l'evoluzione delle preferenze dei consumatori, i progressi tecnologici e una maggiore consapevolezza dei vantaggi del prodotto. Con l'aumento della domanda, le aziende stanno ampliando la propria offerta, innovando per soddisfare le esigenze dei consumatori e sfruttando le tendenze emergenti, alimentando ulteriormente la crescita del mercato.

- Ottieni il Mercato dei sistemi di distribuzione automatizzati Panoramica dei principali attori chiave

Mercato globale dei sistemi di distribuzione automatizzata: per operazione

- Sistemi decentralizzati

- Sistemi centralizzati

Mercato globale dei sistemi di distribuzione automatizzata: per applicazione

- Distribuzione automatizzata ambulatoriale

- Distribuzione automatizzata ospedaliera

Mercato globale dei sistemi di distribuzione automatizzata: per utente finale

- Farmacie al dettaglio

- Farmacie ospedaliere

- Altri

Mercato dei sistemi di distribuzione automatizzata: per Geografia

-

Nord America

- Stati Uniti

- Canada

- Messico

-

Europa

- Francia

- Germania

- Italia

- Regno Unito

- Spagna

- Resto d'Europa

-

Asia Pacifico (APAC)

- Cina

- India

- Corea del Sud

- Giappone

- Australia

- Resto dell'Asia Pacifico

-

Medio Oriente e Africa (MEA)

- Sudafrica

- Arabia Saudita

- Emirati Arabi Uniti

- Resto del Medio Oriente e Africa

-

Sud e Centro America

- Brasile

- Argentina

- Resto del Sud America

Profili aziendali

- Cerner Corporation

- Capsa Healthcare

- Omnicell, Inc

- BD

- ARxIUM

- Accu-Chart Plus Healthcare Systems, Inc

- Innovation Associates

- RxMedic Systems, Inc

- Swiss Log Holding Ltd

- Willach Pharmacy Solutions GmbH

- Analisi storica (2 anni), anno base, previsione (7 anni) con CAGR

- Analisi PEST e SWOT

- Valore/volume delle dimensioni del mercato - Globale, Regionale, Nazionale

- Industria e panorama competitivo

- Set di dati Excel

Report recenti

Testimonianze

Motivo dell'acquisto

- Processo decisionale informato

- Comprensione delle dinamiche di mercato

- Analisi competitiva

- Analisi dei clienti

- Previsioni di mercato

- Mitigazione del rischio

- Pianificazione strategica

- Giustificazione degli investimenti

- Identificazione dei mercati emergenti

- Miglioramento delle strategie di marketing

- Aumento dell'efficienza operativa

- Allineamento alle tendenze normative

Ottieni un campione gratuito per - Mercato dei sistemi di distribuzione automatizzati

Ottieni un campione gratuito per - Mercato dei sistemi di distribuzione automatizzati