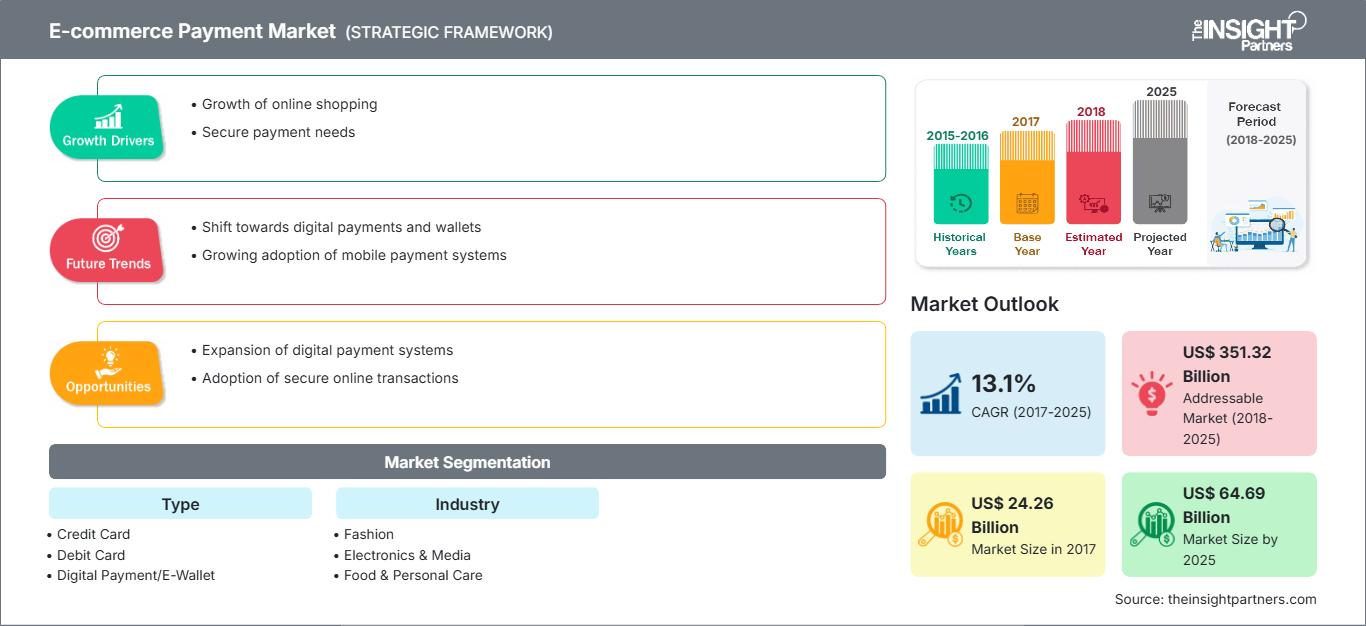

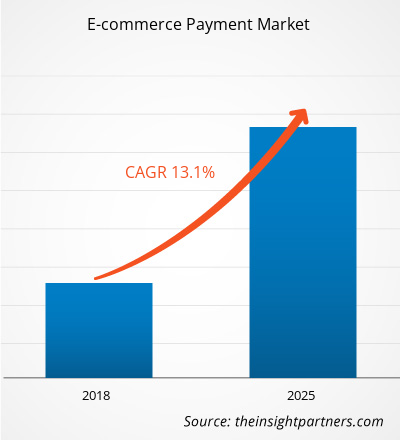

Si prevede che il mercato globale dei pagamenti e-commerce crescerà da 24,26 miliardi di dollari nel 2017 a 64,69 miliardi di dollari entro il 2025, con un CAGR del 13,1% tra il 2018 e il 2025.

Il mercato dei pagamenti e-commerce sta registrando una crescita in tutto il mondo, con la crescente preferenza per i pagamenti online grazie alla disponibilità di diversi metodi di pagamento. Inoltre, la crescente diffusione degli smartphone e la disponibilità di Internet stanno stimolando la crescita del mercato dei pagamenti e-commerce. Inoltre, grazie al crescente numero di operatori bancari e alla digitalizzazione, si prevede che il mercato dei pagamenti e-commerce prospererà durante il periodo di previsione. Il rapporto si concentra su una segmentazione approfondita del mercato dei pagamenti e-commerce in base a tipologia, settore verticale e area geografica.

Approfondimenti di mercato

L'APAC è riconosciuta come la regione leader durante il periodo di previsione

La regione Asia-Pacifico comprende diversi paesi in via di sviluppo come Corea del Sud, India, Indonesia e Malesia, tra gli altri. Questi paesi stanno assistendo a una forte crescita demografica, con conseguente crescita del mercato dei pagamenti e-commerce. Il settore dell'e-commerce nella regione sta fiorendo con la crescente penetrazione di Internet e l'elevata adozione di smartphone e tablet. Inoltre, i governi delle economie emergenti stanno adottando iniziative per migliorare il sistema bancario, fornendo così una piattaforma migliore al settore dei pagamenti online. Recentemente, si è notato un cambiamento: i consumatori dell'APAC preferiscono pagare online tramite metodi di pagamento alternativi come portafogli elettronici, bonifici bancari e carte di credito e di debito. Si prevede che il crescente utilizzo di questi metodi di pagamento contribuirà in modo significativo alla crescita dei gateway di pagamento nel settore dell'e-commerce durante il periodo di previsione. Si prevede che questi fattori stimoleranno ulteriormente la domanda di pagamenti per l'e-commerce nella regione APAC.

Personalizza questo rapporto in base alle tue esigenze

Potrai personalizzare gratuitamente qualsiasi rapporto, comprese parti di questo rapporto, o analisi a livello di paese, pacchetto dati Excel, oltre a usufruire di grandi offerte e sconti per start-up e università

Mercato dei pagamenti per l'e-commerce: Approfondimenti strategici

-

Ottieni le principali tendenze chiave del mercato di questo rapporto.Questo campione GRATUITO includerà l'analisi dei dati, che vanno dalle tendenze di mercato alle stime e alle previsioni.

L'iniziativa di mercato è stata considerata la strategia più adottata nel mercato globale dei pagamenti e-commerce. Di seguito sono elencate alcune delle strategie recenti di alcuni degli attori del mercato dei pagamenti e-commerce:

2018: PayPal ha annunciato l'estensione del suo accordo di partnership con eBay. Grazie a questo accordo, eBay continuerà a promuovere e accettare PayPal Credit tramite la piattaforma di mercato. 2018: Alipay ha annunciato il lancio in 20 paesi europei alla fine di quest'anno. L'azienda ha firmato contratti con oltre 40 società di portafogli digitali e 100 banche in tutta Europa. 2018: Visa, Inc. ha annunciato l'estensione della sua partnership con PayPal al Canada, per accelerare l'implementazione di pagamenti mobili e digitali affidabili, sicuri e appropriati per commercianti e consumatori.

Approfondimenti regionali sul mercato dei pagamenti per l'e-commerce

Le tendenze e i fattori regionali che hanno influenzato il mercato dei pagamenti e-commerce durante il periodo di previsione sono stati ampiamente spiegati dagli analisti di The Insight Partners. Questa sezione analizza anche i segmenti e la geografia del mercato dei pagamenti e-commerce in Nord America, Europa, Asia-Pacifico, Medio Oriente e Africa, America Meridionale e Centrale.

Ambito del rapporto sul mercato dei pagamenti per l'e-commerce

| Attributo del rapporto | Dettagli |

|---|---|

| Dimensioni del mercato in 2017 | US$ 24.26 Billion |

| Dimensioni del mercato per 2025 | US$ 64.69 Billion |

| CAGR globale (2017 - 2025) | 13.1% |

| Dati storici | 2015-2016 |

| Periodo di previsione | 2018-2025 |

| Segmenti coperti |

By Tipo

|

| Regioni e paesi coperti |

Nord America

|

| Leader di mercato e profili aziendali chiave |

|

Densità degli operatori del mercato dei pagamenti e-commerce: comprendere il suo impatto sulle dinamiche aziendali

Il mercato dei pagamenti per l'e-commerce è in rapida crescita, trainato dalla crescente domanda degli utenti finali dovuta a fattori quali l'evoluzione delle preferenze dei consumatori, i progressi tecnologici e una maggiore consapevolezza dei vantaggi del prodotto. Con l'aumento della domanda, le aziende stanno ampliando la propria offerta, innovando per soddisfare le esigenze dei consumatori e sfruttando le tendenze emergenti, alimentando ulteriormente la crescita del mercato.

- Ottieni il Mercato dei pagamenti per l'e-commerce Panoramica dei principali attori chiave

Segmentazione del mercato globale dei pagamenti per l'e-commerce

Per tipo

- Carta di credito

- Carta di debito

- Pagamento digitale/Portafoglio elettronico

- Net banking

- Carte regalo

- Altro

Per settore

- Moda

- Elettronica e media

- Cibo e Cura della persona

- Mobili ed elettrodomestici

- Settore dei servizi

- Altri

Per area geografica

-

Nord America

- Stati Uniti

- Canada

- Messico

-

Europa

- Francia

- Germania

- Italia

- Spagna

- Regno Unito

- Resto d'Europa

-

Asia Pacifico (APAC)

- Australia

- Cina

- India

- Giappone

- Resto dell'APAC

-

Medio Oriente e Africa (MEA)

- Arabia Saudita Arabia

- Emirati Arabi Uniti

- Sudafrica

- Resto del Medio Oriente e Africa

-

Sud America (SAM)

- Brasile

- Resto del SAM

Profili aziendali

- PayPal Holdings, Inc.

- Amazon Payments, Inc.

- CCBill, LLC

- WePay Inc.

- Alipay

- Visa, Inc.

- MasterCard Incorporated

- Stripe Inc.

- American Express Company

- UnionPay International Co., Ltd.

- Analisi storica (2 anni), anno base, previsione (7 anni) con CAGR

- Analisi PEST e SWOT

- Valore/volume delle dimensioni del mercato - Globale, Regionale, Nazionale

- Industria e panorama competitivo

- Set di dati Excel

Report recenti

Testimonianze

Motivo dell'acquisto

- Processo decisionale informato

- Comprensione delle dinamiche di mercato

- Analisi competitiva

- Analisi dei clienti

- Previsioni di mercato

- Mitigazione del rischio

- Pianificazione strategica

- Giustificazione degli investimenti

- Identificazione dei mercati emergenti

- Miglioramento delle strategie di marketing

- Aumento dell'efficienza operativa

- Allineamento alle tendenze normative

Ottieni un campione gratuito per - Mercato dei pagamenti per l'e-commerce

Ottieni un campione gratuito per - Mercato dei pagamenti per l'e-commerce