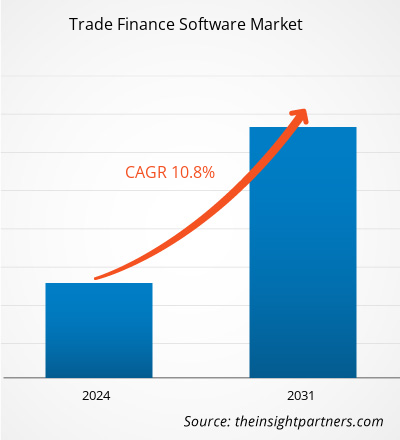

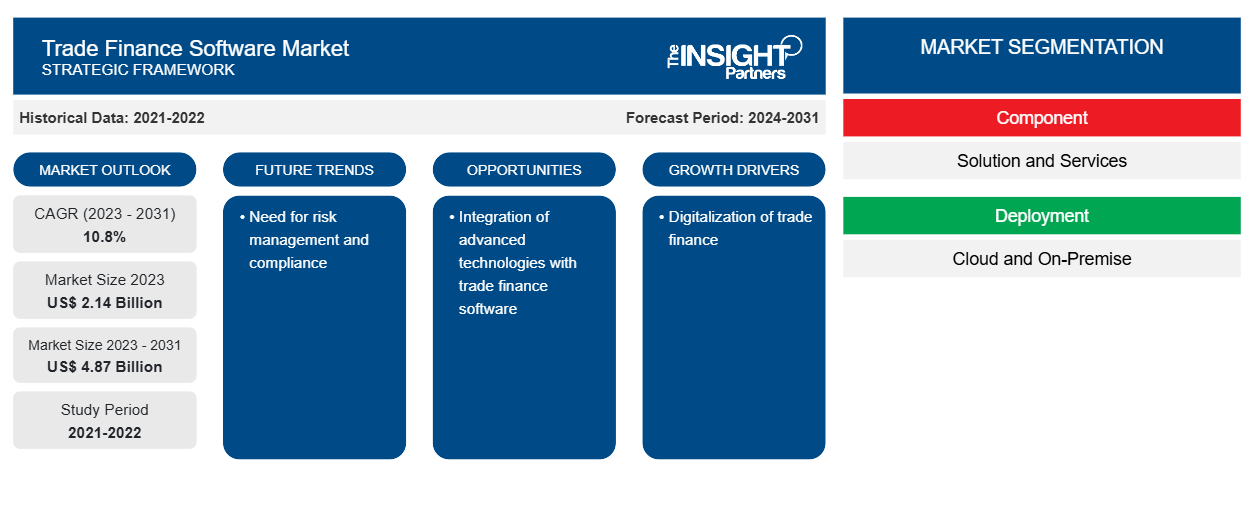

Si prevede che la dimensione del mercato del software per il finanziamento del commercio raggiungerà i 4,87 miliardi di dollari entro il 2031, rispetto ai 2,14 miliardi di dollari del 2023. Si prevede che il mercato registrerà un CAGR del 10,8% nel 2023-2031. La crescente digitalizzazione e l'adozione di tecnologie basate su cloud rimarranno probabilmente le principali tendenze del mercato del software per il finanziamento del commercio.

Analisi di mercato del software per il finanziamento del commercio

La crescente digitalizzazione dei processi di trade finance è un fattore importante che stimola la crescita del mercato del software di trade finance. Con una maggiore efficienza e costi inferiori, la documentazione elettronica e le soluzioni di trade finance basate su cloud stanno sostituendo sempre più i tradizionali metodi cartacei, contribuendo alla crescita del mercato.

Panoramica del mercato del software per il finanziamento del commercio

La necessità di trasparenza e aderenza alle normative commerciali internazionali ha spinto l'adozione di soluzioni software con funzionalità di monitoraggio e reporting in tempo reale. Con un focus sulla fornitura di soluzioni all'avanguardia che soddisfano le mutevoli esigenze del commercio internazionale, il mercato del software di finanziamento del commercio è pronto per un'ulteriore espansione mentre il panorama del commercio globale continua a cambiare e le aziende cercano operazioni di finanziamento del commercio più sicure ed efficienti.

Personalizza questo report in base alle tue esigenze

Riceverai la personalizzazione gratuita di qualsiasi report, comprese parti di questo report, o analisi a livello nazionale, pacchetto dati Excel, oltre a usufruire di grandi offerte e sconti per start-up e università

-

Scopri le principali tendenze di mercato in questo rapporto.Questo campione GRATUITO includerà analisi di dati che spaziano dalle tendenze di mercato alle stime e alle previsioni.

Driver e opportunità del mercato del software per il finanziamento del commercio

Digitalizzazione del finanziamento del commercio per favorire il mercato

Poiché le aziende di vari settori si rendono conto di aver bisogno di soluzioni all'avanguardia per velocizzare e migliorare le loro operazioni commerciali internazionali, il mercato si sta espandendo in modo significativo. Questo mercato include programmi software realizzati per migliorare e automatizzare le procedure di finanziamento del commercio , come il finanziamento della supply chain, la gestione della conformità, il factoring delle fatture e la gestione del credito. Le organizzazioni si sono rivolte al software di finanziamento del commercio per ridurre le attività manuali e dispendiose in termini di tempo, migliorare l'accuratezza e ridurre al minimo i rischi associati al commercio internazionale a causa della crescente complessità e del volume delle transazioni commerciali, il che porta ulteriormente all'adozione del software di finanziamento del commercio da parte degli operatori di mercato. Ad esempio, a novembre 2023, Finastra, un fornitore globale di applicazioni software finanziarie e marketplace, ha annunciato che CQUR Bank, una banca aziendale internazionale, aveva stretto una partnership con Finastra per realizzare la sua strategia tecnologica. Con l'implementazione delle soluzioni leader di mercato di Finastra, Trade Innovation e Corporate Channels, CQUR Bank offre ai suoi clienti aziendali un nuovo portale di online banking per un'esperienza utente fluida, ha introdotto nuovi flussi di lavoro digitali e fornisce soluzioni di integrazione host-to-host.

Necessità di gestione del rischio e conformità

La crescente necessità di una migliore gestione del rischio e conformità è un altro fattore che spinge la crescita del mercato del software di finanziamento del commercio. Il software di finanziamento del commercio offre strumenti sofisticati, come il rilevamento delle frodi, i controlli antiriciclaggio (AML) e la conformità alle leggi e alle sanzioni commerciali, per tracciare e ridurre i rischi correlati al commercio internazionale. La necessità di queste soluzioni software continua a crescere man mano che aziende e istituzioni finanziarie cercano di gestire le sfide del commercio internazionale mantenendo al contempo la conformità legale e normativa.

Analisi della segmentazione del rapporto di mercato del software di finanziamento del commercio

I segmenti chiave che hanno contribuito alla derivazione dell'analisi di mercato del software per il finanziamento del commercio sono i componenti, l'implementazione, le dimensioni aziendali e l'uso finale.

- In base al componente, il mercato è segmentato in soluzioni e servizi. Il segmento delle soluzioni ha detenuto una quota di mercato maggiore nel 2023.

- In base all'implementazione, il mercato è segmentato in cloud e on-premise. Il segmento cloud ha detenuto una quota di mercato maggiore nel 2023.

- In base alle dimensioni aziendali, il mercato è segmentato in grandi aziende e PMI. Si prevede che il segmento PMI crescerà con il CAGR più elevato.

- In base all'uso finale, il mercato è segmentato in banche, trader e altri. Il segmento bancario ha detenuto una quota di mercato maggiore nel 2023.

Analisi della quota di mercato del software di finanziamento del commercio per area geografica

L'ambito geografico del rapporto sul mercato del software per il finanziamento del commercio è suddiviso principalmente in cinque regioni: Nord America, Asia Pacifico, Europa, Medio Oriente e Africa e Sud America/Sud e Centro America.

In termini di fatturato, il Nord America ha rappresentato la quota di mercato più grande del software di finanziamento del commercio nel 2023. Il Nord America è uno dei primi ad adottare soluzioni tecnologiche, il che porta alla sua crescente quota di mercato. L'adozione di tecnologie basate su cloud da parte delle PMI porta alla crescita del mercato. La crescente digitalizzazione nelle banche richiede ulteriormente software di finanziamento del commercio, che guida la quota di mercato del finanziamento del commercio del Nord America.

Approfondimenti regionali sul mercato del software per il finanziamento del commercio

Le tendenze regionali e i fattori che influenzano il Trade Finance Software Market durante il periodo di previsione sono stati ampiamente spiegati dagli analisti di Insight Partners. Questa sezione discute anche i segmenti e la geografia del Trade Finance Software Market in Nord America, Europa, Asia Pacifico, Medio Oriente e Africa e Sud e Centro America.

- Ottieni i dati specifici regionali per il mercato del software di finanziamento del commercio

Ambito del rapporto di mercato sul software di finanziamento del commercio

| Attributo del report | Dettagli |

|---|---|

| Dimensioni del mercato nel 2023 | 2,14 miliardi di dollari USA |

| Dimensioni del mercato entro il 2031 | 4,87 miliardi di dollari USA |

| CAGR globale (2023-2031) | 10,8% |

| Dati storici | 2021-2022 |

| Periodo di previsione | 2024-2031 |

| Segmenti coperti |

Per componente

|

| Regioni e Paesi coperti |

America del Nord

|

| Leader di mercato e profili aziendali chiave |

|

Densità dei player del mercato del software di finanziamento del commercio: comprendere il suo impatto sulle dinamiche aziendali

Il mercato del software Trade Finance sta crescendo rapidamente, spinto dalla crescente domanda degli utenti finali dovuta a fattori quali l'evoluzione delle preferenze dei consumatori, i progressi tecnologici e una maggiore consapevolezza dei vantaggi del prodotto. Con l'aumento della domanda, le aziende stanno ampliando le loro offerte, innovando per soddisfare le esigenze dei consumatori e capitalizzando sulle tendenze emergenti, il che alimenta ulteriormente la crescita del mercato.

La densità degli operatori di mercato si riferisce alla distribuzione di aziende o società che operano in un particolare mercato o settore. Indica quanti concorrenti (operatori di mercato) sono presenti in un dato spazio di mercato in relazione alle sue dimensioni o al valore di mercato totale.

Le principali aziende che operano nel mercato del software per il finanziamento del commercio sono:

- CGI Inc

- Comarch SA

- IBSFINtech

- SISTEMI FINANZIARI ICS LTD

- MITech - Rendi la tecnologia intuitiva SA

- Newgen Software Technologies Ltd.

Disclaimer : le aziende elencate sopra non sono classificate secondo un ordine particolare.

- Ottieni una panoramica dei principali attori del mercato del software per il finanziamento del commercio

Notizie di mercato e sviluppi recenti del software di finanziamento del commercio

Il mercato del software Trade Finance viene valutato raccogliendo dati qualitativi e quantitativi dopo la ricerca primaria e secondaria, che include importanti pubblicazioni aziendali, dati associativi e database. Di seguito è riportato un elenco degli sviluppi nel mercato:

- A settembre 2022, Newgen Software, un fornitore leader a livello mondiale di prodotti per la trasformazione digitale, ha lanciato la prima piattaforma low-code Trade Finance al mondo al customer meet di Mumbai. Il trade finance è un processo complesso in quanto comporta molta burocrazia, più stakeholder e requisiti di conformità. La piattaforma completa, configurabile e pronta per il futuro di Newgen trade finance aiuta le banche a eliminare la carta e a semplificare i loro processi commerciali end-to-end, garantendo al contempo la conformità alle normative nazionali e internazionali. (Fonte: CXOtoday, comunicato stampa, 2022)

- A febbraio 2024, Finastra, fornitore globale di applicazioni e marketplace di software finanziari, e Tesselate, società di consulenza e integrazione per la trasformazione digitale globale, hanno annunciato il lancio di un servizio preconfezionato end-to-end per una digitalizzazione più rapida e semplice del trade finance. Tegula Trade Finance as a Service, basato su Finastra Trade Innovation e Corporate Channels, consente alle banche statunitensi di automatizzare i processi manuali e di adattarsi alle nuove esigenze con un time-to-market e un valore più rapidi. Tramite FusionFabric.cloud di Finastra, le banche possono anche integrare senza problemi applicazioni fintech che utilizzano le tecnologie più recenti come intelligenza artificiale, blockchain e strumenti di automazione. (Fonte: Finastra, comunicato stampa, 2024)

Copertura e risultati del rapporto di mercato sul software di finanziamento del commercio

Il rapporto "Dimensioni e previsioni del mercato del software per il finanziamento del commercio (2021-2031)" fornisce un'analisi dettagliata del mercato che copre le seguenti aree:

- Dimensioni e previsioni del mercato a livello globale, regionale e nazionale per tutti i segmenti di mercato chiave coperti dall'ambito

- Dinamiche di mercato come fattori trainanti, vincoli e opportunità chiave

- Principali tendenze future

- Analisi dettagliata delle cinque forze PEST/Porter e SWOT

- Analisi di mercato globale e regionale che copre le principali tendenze di mercato, i principali attori, le normative e gli sviluppi recenti del mercato

- Analisi del panorama industriale e della concorrenza che copre la concentrazione del mercato, l'analisi della mappa di calore, i principali attori e gli sviluppi recenti

- Profili aziendali dettagliati

- Analisi storica (2 anni), anno base, previsione (7 anni) con CAGR

- Analisi PEST e SWOT

- Valore/volume delle dimensioni del mercato - Globale, Regionale, Nazionale

- Industria e panorama competitivo

- Set di dati Excel

Report recenti

Rapporti correlati

Testimonianze

Motivo dell'acquisto

- Processo decisionale informato

- Comprensione delle dinamiche di mercato

- Analisi competitiva

- Analisi dei clienti

- Previsioni di mercato

- Mitigazione del rischio

- Pianificazione strategica

- Giustificazione degli investimenti

- Identificazione dei mercati emergenti

- Miglioramento delle strategie di marketing

- Aumento dell'efficienza operativa

- Allineamento alle tendenze normative

Ottieni un campione gratuito per - Mercato del software per il finanziamento del commercio

Ottieni un campione gratuito per - Mercato del software per il finanziamento del commercio