Increasing Spending on Healthcare-Related Services Fueling Air Ambulance Services Market Growth

According to our latest market study on "Air Ambulance Services Market Forecast to 2031 – Global Analysis – by Aircraft Type (Rotary Wing and Fixed Wing), Service Model (Hospital-Based, Government Run, and Independent), End User (Domestic and International), and Geography," the air ambulance services market is expected to reach US$ 20,182.23 million by 2031 from US$ 10,540.17 million in 2023. It is expected to register a CAGR of 8.5% from 2023 to 2031.

The air ambulance services market size is likely to surge by 2031 owing to their growing coverage, improved services, and rising expenditure by public and private players. In addition, with the increasing awareness and focus on well-being and health-related concerns, the majority of the population is increasing spending on healthcare-related services. Rising household income and increasing awareness about health and wellness have resulted in a growing demand for medical and healthcare services, including better treatment facilities, multi-specialty hospitals, advanced medical equipment and devices, and patient pick-up and drop services using air ambulance services. Patients are now focusing more on premium healthcare facilities in terms of transportation and overall services. Customers in higher income groups emphasized faster pick-up facilities in times of emergency and opted for air ambulance facilities offered by hospitals or independent trauma care centers. For instance, the US has one of the highest healthcare costs in the world. In 2022, US healthcare spending reached ~US$ 4.5 trillion, which averages to ~US$ 13,493 per person. According to a study published by the American Medical Association, in 2021, the majority of the population was spending on private health insurance policies, which accounted for almost 28.5% of the overall healthcare expenditure. High-range healthcare policies cover all the client's expenses and allow patients to opt for premium services, including ambulance services. The growing demand for air ambulance services among customers positively impacts the market growth. Germany has a well-structured public healthcare system where all residents can access complete medical care. In Germany, all employed workers pay a healthcare insurance contribution as part of their social security involvement. This is approximately 8% of their gross paycheck, usually matched by the employer, who gives ~7.8%, totaling ~15.8%. In France, the Social Health Insurance system provides coverage to the complete population based on residence via numerous compulsory schemes.

Air Ambulance Services Market Share — by Region, 2023

Air Ambulance Services Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Aircraft Type (Rotary Wing and Fixed Wing), Service Model (Hospital-Based, Government Run, and Independent), End User (Domestic and International), and Geography

Air Ambulance Services Market Analysis by Size & Share 2031

Download Free Sample

Source: The Insight Partners Analysis

Since April 2020, healthcare spending in India has grown widely and experienced a small spike in 2021. Post-COVID-19, the total expenditure on healthcare grew from ~US$ 1.2 billion in March 2021 to ~US$ 1.26 billion in April 2021, which included spending on healthcare services such as doctor fees, medicines, hospital facilities and services, and medical tests. Thus, the increasing spending on premium healthcare services and facilities for fast recovery and immediate healthcare support propels the air ambulance services market growth.

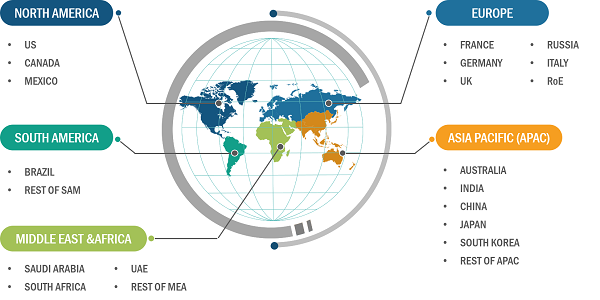

Geographically, the scope of the air ambulance services market report is primarily divided into North America (the US, Canada, and Mexico), Europe (Russia, the UK, Germany, France, Italy, and the Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and the Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South America (Brazil and the Rest of South America).

The air ambulance services market analysis has been performed by considering the following segments: aircraft type, service model, and end user. The rotary wing segment accounted for 59.8% of the market share in 2023, and it is predicted to continue its dominance over the forecast period. Opting for air medical services in times of emergency is a major driver for the market. The air ambulance services market trends include increasing spending on healthcare-related services.ok

The COVID-19 pandemic boosted the demand for air ambulance services across different regions due to the rise in medical transportation emergencies. This further pushed new companies to come forward and contribute to the betterment of medical ecosystems across different countries. Several new companies in the air ambulance services market received good recognition in terms of the support they provided during the COVID-19 emergencies. Currently, the majority of such companies have started to provide air ambulance services for non-COVID emergency cases as well, which is driving the growth of the air ambulance market across different regions, such as North America, Europe, and Asia Pacific.

Several countries have been adopting air ambulance services for their respective regions. For instance, in January 2023, the Bulgarian Ministry of Health announced its plans to acquire six emergency medical helicopters in order to launch a state-run air ambulance service in the region. Similarly, other European countries have also been pushing their investments in terms of establishing or boosting their existing air ambulance services ecosystem to provide better medical services across their respective countries. For instance, in December 2023, Gama Aviation, the UK-based aviation service provider, announced that it had full control of the Welsh Air Ambulance Charity’s fleet of helicopters in a contract worth US$ 82.7 million, set to start by January 2024. Following this contract, the company will operate four Airbus H145 helicopters from four different locations, including Dafen, Cardiff, Caernarfon, and Welshpool.

In terms of revenue, North America dominated the air ambulance services market share in 2023. The North America market is categorized into the US, Canada, and Mexico. North America accounted for 39.8% of the total market share in 2023 and is projected to maintain its dominance during the forecast period. The market growth in North America is attributed to the mounting prevalence of chronic diseases such as cardiovascular diseases, cancer, and stroke and the growing consumer preference for emergency medical services for improved and immediate medical attention. Moreover, the region has the presence of air ambulance service providers such as Air Methods, Global Medical Response, and PHI Air Medical. In 2023, Bell Textron Inc. announced that Life Flight Network had procured two additional Bell 407GXi helicopters and planned to obtain an additional Bell 429.

The US is one of the key countries in the North America air ambulance services market, with a significantly higher number of medical aircraft and a rise in investments in the development of the air ambulance sector. Also, the country has a high presence of air ambulance service providers. Air Methods, REVA Air Ambulance Global Medical Response, and PHI Air Medical are among the prominent players in the US. Market players are taking various strategic initiatives to expand their business. For instance, in February 2024, Care Flight, a service of REMSA Health, procured a new helicopter. The new aircraft, Care Flight 1, is anticipated to start its service in late 2024, ensuring access to life-saving emergency medical care in rural Nevada. The growing prevalence of chronic diseases and the rising incidence of medical emergencies are propelling the demand for air ambulance services in Canada. Hospitals in Canada are focusing on expanding their medical facilities, including air medical services for critically ill patients.

Mexico is one of the major business travel and tourist destinations. Steady air ambulance service is crucial when sudden injuries or chronic health challenges require patients to be shifted to the US, Canada, or their home country for medical support. The growing need for air emergency medical services for moving critical patients is steering the growth of the air ambulance services market in Mexico.

Air Methods, Aero-Dienst GmbH, Airlec Air Espace, Babcock International Group Plc, Trust Air Aviation Ltd, FAI Aviation Group, IAS Medical, Medical Air Service, PHI Air Medical, and Quick Air Jet Charter GmbH are among the prominent players profiled in the air ambulance services market report. In addition, several other important market players have been studied and analyzed during the study to get a holistic view of the market and its ecosystem.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com