Biologics Segment to Lead Biopharmaceutical Contract Manufacturing Market During 2025–2031

According to our new research study named "Biopharmaceutical Contract Manufacturing Market Forecast to 2031 – Global Analysis – by Product Type, Source, Application, and Therapeutic Area," the market was valued at US$ 40.99 billion in 2024 and is projected to reach US$ 101.05 billion by 2031; it is expected to register a CAGR of 13.8% during 2025–2031. The rising demand for biologics and increasing demand for cost efficiency and flexibility drive the adoption of biopharmaceutical contract manufacturing. However, the tightened budget and economic uncertainty hinder the market growth. Advanced manufacturing technologies are projected to bring new biopharmaceutical contract manufacturing market trends in the coming years.

Biopharmaceutical contract manufacturing involves outsourcing the production of complex biologic drugs—such as monoclonal antibodies, vaccines, and cell or gene therapies—to specialized third-party companies. These contract manufacturers offer services, including process development, cell line development, formulation, filling, and packaging. Biopharmaceutical companies rely on them to reduce operational costs, access advanced technology, and accelerate time-to-market. Contract manufacturing is essential for small biotech firms with limited infrastructure, as well as large pharmaceutical companies seeking flexibility and scalability in production. This model supports consistent product quality and regulatory compliance while allowing biopharma firms to focus on research, development, and commercialization strategies.

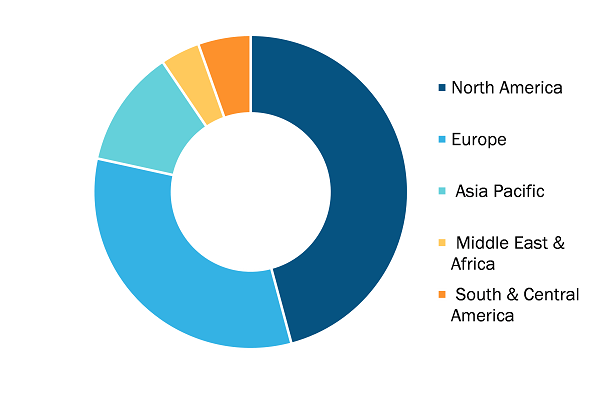

Biopharmaceutical Contract Manufacturing Market, by Region, 2024 (%)

Biopharmaceutical Contract Manufacturing Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Biologics and Biosimilar), Source (Microbial and Mammalian), Application (Commercial and Clinical), Therapeutic Area (Oncology, Autoimmune Disorders, Respiratory Disorders, Metabolic Disorders, Neurology, Infectious Diseases, and Others), and Geography

Biopharmaceutical Contract Manufacturing Market Analysis 2031

Download Free Sample

Source: The Insight Partners Analysis

The rising demand for biologics and biosimilars, fueled by increasing chronic disease prevalence and aging populations, is contributing to the growing biopharmaceutical contract manufacturing market size. Outsourcing helps reduce capital investment and accelerates drug development timelines. Technological advancements in bioprocessing, alongside increased FDA approvals for biologic drugs, further propel the market. Small biotech startups increasingly depend on contract manufacturers for access to specialized infrastructure and regulatory expertise. Moreover, global expansion of biomanufacturing capabilities, particularly in emerging markets, offers cost advantages. Strict quality standards and the complexity of biologics make outsourcing an attractive, efficient option for both established and emerging pharmaceutical companies.

Biopharmaceutical Contract Manufacturing Market Analysis Based on Segmental Evaluation:

Based on product type, the biopharmaceutical contract manufacturing market is bifurcated into biologics and biosimilar. The biologics segment held a significant biopharmaceutical contract manufacturing market share in 2024. The biologics segment comprises a diverse range of products, with each having a specialized manufacturing process. Monoclonal antibodies (mAbs), recombinant proteins, vaccines, and gene and cell therapies are the primary categories of biologics. These product types represent biopharmaceutical innovations and drive significant demand for contract manufacturing services. Monoclonal antibodies (mAbs) are one of the most prominent biological product types contributing to a substantial share of the biologics market. Herceptin and Rituxan are the leading drugs for cancer and autoimmune disease treatments. Contract manufacturing organizations (CMOs) such as Lonza and WuXi Biologics specialize in the large-scale production of mAbs and offer cell line development, process optimization, and drug formulation services. Recombinant proteins are used for the treatment of diabetes, hemophilia, and anemia, among others, and products such as insulin and erythropoietin (EPO) are commonly being used, creating the demand for cost-effective, scalable production, which has led to increased reliance on CMOs.

Both preventive and therapeutic vaccines represent a critical biologics product. The COVID-19 pandemic significantly underscored the importance of contract manufacturing for vaccines, with Samsung Biologics, Catalent, and other organizations partnering with pharmaceutical companies to ramp up production. Gene and cell therapies, including CAR-T and gene editing technologies, are emerging as therapies requiring cutting-edge manufacturing expertise and are fueling the demand for specialized CMOs with advanced capabilities. As these biologic product types evolve, contract manufacturers play a vital role in scaling production, ensuring quality, and meeting global regulatory standards.

The geographic scope of the biopharmaceutical contract manufacturing market report includes the assessment of the market performance in North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. In terms of revenue, North America dominated the biopharmaceutical contract manufacturing market share in 2024. This growth is attributed to the increasing demand for biologics and biosimilars, which are gaining popularity for treating chronic and complex diseases. The US Food and Drug Administration (FDA) has approved numerous biosimilars, facilitating their adoption and prompting pharmaceutical companies to outsource production to specialized contract manufacturers.

The region's strong regulatory framework further supports market growth. The FDA's streamlined approval processes and emphasis on Good Manufacturing Practices (GMP) attract both domestic and international pharmaceutical companies seeking reliable manufacturing partners, thereby contributing to the biopharmaceutical contract manufacturing market growth in North America.

The US is the largest market for contract research organizations owing to the presence of leading contract research organizations and manufacturers. This well-established healthcare industry provides a broader scope for contract research organizations and a growing shift toward outsourcing R&D and clinical trial services.

Contract research organizations are crucial in biotechnology, pharmaceutical, and medical device industries as they offer outsourced research services to accelerate the typically prolonged and complicated drug development process. Due to the need for quicker drug and technical developments, the landscape for contract research organizations in the US is evolving quickly. The regulatory environment heavily impacts the operation of contract research organizations. Initiatives such as real-time assessment, which permits simultaneous data assessment during clinical trials, have been established by the US FDA. Contract research organizations manage and evaluate data related to this change in real time.

Clinical trials are rising with growing investments in R&D in the country. According to an article published in the United States National Library of Medicine in May 2023, ~437,533 clinical trials were registered in 221 countries in 2023, a surge from 399,499 in 2022, among which 140,492 (31%) were registered in the US. Contract research organizations help reduce the risks of trial delays and regulatory obstacles by assisting pharmaceutical businesses navigate this environment, which bolsters the growth of biopharmaceutical contract manufacturing market.

Boehringer Ingelheim International GmbH, Thermo Fisher Scientific Inc., Lonza Group AG, Merck KGaA, AbbVie Inc., General Electric Co, Samsung Biologics Co Ltd, WuXi Biologics Inc., Inno Bio Ventures Sdn Bhd, and Ajinomoto Co Inc. are among the leading companies profiled in the biopharmaceutical contract manufacturing market report.

Based on product type, the biopharmaceutical contract manufacturing market is bifurcated into biologics and biosimilar. By source, the market is bifurcated into microbial and mammalian. In terms of application, the biopharmaceutical contract manufacturing market is segmented into commercial and clinical. In terms of therapeutic area, the biopharmaceutical contract manufacturing market is classified into oncology, autoimmune disorders, respiratory disorders, metabolic disorders, neurology, infectious diseases, and others. Geographically, the market is categorized into North America (US, Canada, and Mexico), Europe (France, Germany, UK, Spain, Italy, and the Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, and the Rest of Asia Pacific), the Middle East & Africa (Saudi Arabia, South Africa, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com