Canes Segment to Bolster Walking Aids Market Growth

According to our new research study on "Walking Aids Market Forecast to 2031 – Global Analysis – by Product, Age Group, Application, End User, and Distribution Channel," the market was valued at US$ 18.28 billion in 2024 and is projected to reach US$ 29.31 billion by 2031; it is anticipated to record a CAGR of 7.2% from 2025 to 2031. The report emphasizes the walking aids market trends, along with drivers and deterrents affecting the market growth. The rise in geriatric population and mobility impairment from traumatic injuries are contributing to the growing walking aids market size. However, the limited reimbursement coverage and high cost of advanced walking aids hamper market growth. Further, the wearable technology in mobility assistance is expected to emerge as a new market trend in the coming years.

Surge in Mobility Impairment from Traumatic Injuries Bolsters Walking Aids Market Growth

The surge in mobility impairments induced by traumatic injuries, encompassing road traffic collisions, workplace and sports accidents, falls, and conflict- or disaster-related trauma, is a prominent factor bolstering the demand for walking aids, notably canes and crutches. Globally, road traffic accidents result in nearly 20 million nonfatal injuries yearly, with a substantial share leading to temporary or permanent lower-limb impairments that necessitate mobility support during rehabilitation. In India, road accidents rose by 12% in 2023, triggering a 25% rise in crutch prescriptions for trauma-related lower-limb injuries. Similarly, spinal cord injuries—often stemming from severe physical trauma due to crashes, falls, or sports—affect 10–83 individuals per million annually worldwide, and the US registers nearly 12,000 new cases each year. These injuries frequently cause gait instability or paralysis, driving short? or long?term reliance on supportive devices.

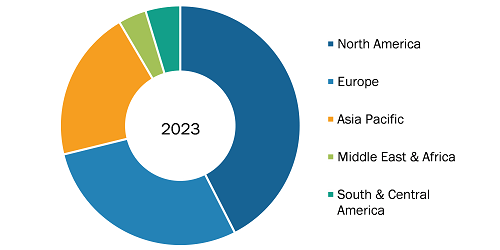

Walking Aids Market Analysis: Based on Geography

Walking Aids Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Canes, Crutches, Walkers, Rollators, and Others), Age Group (Adults and Pediatric), Application (Neurologically Impaired, Handicap Patients, and Others), End User (Homecare, Hospitals and Clinics, Rehabilitation Centers, and Others), and Distribution Channel (Online and Offline)

Walking Aids Market Analysis by Size, Share & Growth 2031

Download Free Sample

Source: The Insight Partners Analysis

According to data from the World Health Organization (WHO), in 2024, over 1.19 million annual deaths and many more nonfatal injuries, along with the widespread prevalence of sports injuries and slips/falls, especially among the elderly. Nearly 35% of orthopedic patients in clinics rely on crutches for short-term support during recovery. Moreover, 40% of rehabilitation programs are now conducted in homecare settings, amplifying demand for lightweight, user-friendly aids. Additionally, 20–50 million nonfatal injuries globally result in temporary or permanent disability, frequently necessitating walking aids during the healing process. The sustained volume of injury-induced mobility impairment driven by traffic, workplace, sports, and conflict-related trauma has extended the role of crutches and canes beyond intermittent supports, making them essential tools. Thus, a surge in the cases of mobility impairment from traumatic injuries urges continued innovation in walking aids in terms of design, ergonomics, and lightweight materials, supporting the integration with home and tele-rehabilitation ecosystems to meet the acute and chronic needs of patients, which boosts the walking aids market growth.

Scope of Walking Aids Market Report:

The walking aids market analysis has been carried out by considering the following segments: product, age group, application, end user, distribution channel, and geography.

Based on product, the walking aids market is segmented into canes, crutches, walkers, rollators, and others. The canes segment held the largest share of the market in 2024. Canes, also known as walking sticks or assistive canes, help individuals experiencing minor problems with balance or stability. They also assist individuals with mobility challenges to improve their balance and stability. According to the WHO, the population aged 60 and older in 2021 was 215 million and is projected to reach 247 million by 2030. As per UN and WHO data, as of 2024, individuals aged 65 and over represent approximately 10.3% of the global population, up from 5.5% in 1974, and this figure is projected to reach 16% by 2050, translating to over 1.6 billion older adults. Life expectancy has increased substantially, with the global average now at 73.3 years, and many seniors are expected to live well into their 80s and 90s. The rising geriatric population propels the demand for walking aids such as canes to reduce weight bearing on one or both legs, alleviating pain from injuries and compensating for weakness or poor leg control. Using a single-point cane may assist them in walking more comfortably and safely, and in some cases, it may make it easier for them to continue living independently. They also switch to quad canes, which have four points for more stability.

According to the World Health Organization (WHO) estimates published in August 2023, 2.2 billion people worldwide have vision impairment. Guiding or white canes are vital mobility aids for individuals with visual impairments. They provide physical assistance and independence to a certain extent. These canes help users navigate their surroundings, identify obstacles, and improve their spatial awareness. Additionally, they serve as a visible indicator of users' visual impairment, fostering understanding among others and encouraging them to offer assistance if needed.

Innovative designs and smart features have made canes more appealing and functional, broadening their user base. In October 2024, WeWALK launched Smart Cane 2, which integrates a GPT-powered voice assistant for real-time navigation, public transport information, and nearby points of interest. It also offers turn-by-turn guidance and menu reading capabilities. Therefore, the increasing demand for canes among the aging and disabled population and new product launches are responsible for the market growth.

By age group, the walking aids market is divided into adults and pediatric. The adults segment dominated the market in 2024. The adult segment in the walking aids market is expanding because of the higher prevalence of aging-related mobility problems. Arthritis, osteoporosis, and recovery post-surgery start affecting people in their 40s and 50s, stimulating early use of supporting devices. Improved life expectancy and inactive lifestyles also account for chronic musculoskeletal and joint conditions among the younger population. Further, increasing health consciousness and the wish to remain independent encourage adults to look for mobility aids earlier. The trend, coupled with enhanced product availability and innovation, drives demand across adult age groups.

By application, the walking aids market is divided into neurologically impaired, handicap patients, and other applications. The neurologically impaired segment dominated the market in 2024. The neurologically impaired segment dominated the market in 2024. Neurological conditions such as dementia, Alzheimer's, and Parkinson’s have a direct impact on the mobility of the patient. As per the European Academy of Neurology (EAN), ~60% of the European population suffers from neurological diseases. According to Alzheimer Europe, the number of people living with dementia is expected to increase to 14,298,671 in the EU27 by 2050 from the estimated 7,853,705 in 2019. In Europe, dementia is a growing public health concern among the aging populace. Therefore, the growing prevalence of neurological disorders is propelling the demand for wheelchairs.

Based on end user, the walking aids market is segmented into homecare, hospitals and clinics, rehabilitation centers, and others. The homecare segment held the largest share of the market in 2024. The use of wheelchairs and mobility aids in home care is rapidly growing globally, propelled by several key drivers and recent product innovations. This growth is primarily attributed to an aging population, increasing prevalence of chronic illnesses and post-surgical recovery requirements, and progressive governmental strategies that encourage aging in place and home-based rehabilitation. Notably, Germany exemplifies this trend, where statutory health insurance actively facilitates access to specialized rehabilitation equipment for home use, reinforcing the broader movement toward decentralized, patient-centric care solutions. Additionally, technological advancements have led to the launch of smart and connected mobility aids, such as powered and app-integrated wheelchairs with remote monitoring, fall detection, and customizable ergonomic designs, making them more suitable and attractive for home use. For instance, manufacturers such as Sunrise Medical and Karma Medical are introducing tailor-made wheelchairs and lightweight, foldable models that cater to home environments and individual patient needs. In September 2022, Karma Medical, a leading wheelchair manufacturer, launched the Flexx Adapt, a highly adjustable manual wheelchair designed for pediatric users. The Flexx Adapt features a dynamic backrest that absorbs sudden movements and offers tilt-in-space and recline functions to provide pressure relief and support for growing children. Additionally, Karma's pediatric wheelchair lineup includes the Flexx Junior, a versatile manual chair intended for children aged 7–15. Expanding e-commerce and robust distribution networks further improve access, while public sector support and reimbursement policies make these devices more affordable for patients. These trends are reinforced by product launches focused on smart wheelchairs with automated navigation and voice control and long-term care beds with integrated safety features, all designed to enhance independence and quality of life for users in home care settings.

As per distribution channel, the walking aids market is bifurcated into online and offline. The offline segment dominated the market in 2024. Pharmacies, medical supply stores, and healthcare facilities are the main offline points of sale of walking aids. Large pharmacy chains in North America and Europe, such as CVS, Walgreens, Boots, and Best Buy Health, continue to serve as important retail hubs that make various walking assistive devices accessible to customers. They also provide them with professional recommendations and access to fitting sessions. Hospitals and rehabilitation centers directly prescribe and supply walking aids to patients recovering from surgeries, injuries, or other chronic conditions, extending accessibility and inculcating trust in these devices. This hands-on approach fosters consumer confidence and improves proper device selection and fitting, leading to higher user satisfaction and consistent adoption. As the market expands—boosted by demographic trends, namely population aging and surge in orthopedic procedures—offline distribution provides a critical link for consumers who are less comfortable with online shopping or who require specialized products.

Companies such as Invacare, Drive Medical, Shenzhen Ruihan Meditech, Cofoe Medical, and Yuyue Medical actively employ offline retail strategies along with their online presence, maintaining broad reach and customer engagement through in-person consultation and after-sales support. In August 2024, GreenPioneer Mobility India launched "NonStop," a retail experience store, with further plans to open locations nationwide. NonStop aims to meet the mounting demand for high-quality mobility aids by offering international brands alongside exceptional service. The store displays various products, including wheelchairs, walkers, and rehabilitation equipment, designed to improve the quality of life for those with mobility challenges. NonStop's online shopping platform will ensure easy access to essential items, allowing customers to try products in the interactive showroom. Therefore, a surge in offline distribution enhances the adoption of walking aids by providing personalized service, immediate product access, and professional guidance, ensuring that mobility-impaired individuals receive aids tailored to their medical and lifestyle needs.

The geographical scope of the walking aids market includes the assessment of the market performance in North America (US, Canada, and Mexico), Europe (Spain, UK, Germany, France, Italy, and the Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and the Rest of Asia Pacific), South & Central America (Brazil, Argentina, and the Rest of South & Central America), and the Middle East & Africa (South Africa, Saudi Arabia, UAE, and the Rest of Middle East & Africa).

The European Union (EU), the World Health Organization (WHO), the American Brain Foundation, and the American College of Rheumatology, the Centers for Disease Control and Prevention (CDC), the US Census Bureau, Canadian Survey on Disability (CSD), UN Population Division are among the primary and secondary sources referred to while preparing the walking aids market report.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com