GMP Grade Segment to Bolster DNA Plasmid Manufacturing Market Growth During 2024–2031

According to our new research study on "DNA Plasmid Manufacturing Market Forecast to 2031 – Global Analysis – by Product Type, Application, and End User," the market was valued at US$ 0.69 billion in 2024 and is projected to reach US$ 2.65 billion by 2031; it is estimated to register a CAGR of 21.4% during 2024–2031. The DNA plasmid manufacturing market report emphasizes the trends prevalent in the global market, along with drivers and deterrents affecting its growth.

The increasing plasmid developments for gene therapy and growing research on DNA plasmid vaccine development contribute to the growing DNA plasmid manufacturing market size. However, high manufacturing costs hamper the growth of the market. Further, the expansion of contract development and manufacturing organizations (CDMOs) is expected to bring new DNA plasmid manufacturing market trends in the coming years.

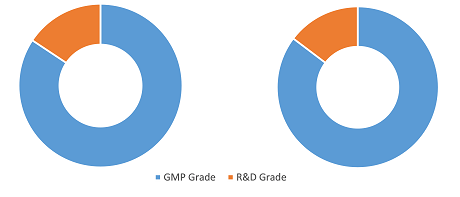

DNA Plasmid Manufacturing Market Share, by Product Type, 2024 (%)

DNA Plasmid Manufacturing Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (GMP Grade and R&D grade), Application (Cell and Gene Therapy, DNA Vaccines, Immunotherapy, and Others), End User (Pharmaceutical and Biotechnology Companies, CROs and CDMOs, and Others) and Geography

DNA Plasmid Manufacturing Market Report, Analysis by 2031

Download Free Sample

Source: The Insight Partners Analysis

Increasing Plasmid Developments for Gene Therapy Bolsters DNA Plasmid Manufacturing Market Growth

The rise in the prevalence of genetic diseases, orphan diseases, and other cancers has accelerated the advancement of gene therapy technologies, which are based largely on plasmid DNA as the fundamental element. Plasmid DNA helps introduce genetic material into patients' cells. It acts as a non-viral vector to deliver therapeutic genes that can fix or replace faulty genes. Unlike viral vectors, plasmids are safer, easier to produce, and cheaper, making them popular in gene therapy.

As gene therapies transition from preclinical development to clinical trials and commercial launch, the demand for substantial quantities of high-purity, GMP-grade plasmid DNA has escalated significantly. In March 2023, Charles River Laboratories International, Inc. announced the launch of its off-the-shelf pHelper (Helper Plasmid) offering, which is designed to secure supply and streamline adeno-associated virus (AAV)-based gene therapy programs from early discovery through commercial manufacturing.

Growing partnerships between companies to meet the quality and regulatory demands of gene therapy pipelines. In 2022, Myrtelle and Forge Biologics announced a viral vector and plasmid DNA cGMP manufacturing partnership. Forge will provide research-grade and GMP-Pathway plasmid manufacturing services as well as cGMP adeno-associated viral (AAV) process development and scale-up manufacturing services for Myrtelle’s program, Myr-201 (novel gene therapy for monogenic hearing loss).

Governments and regulatory agencies are also helping to drive this trend with expedited approvals for gene therapy products and national biotech infrastructure investment. VGXI, Inc. recently completed a successful FDA inspection at its GMP facility in Conroe, Texas. This inspection led to the approval of a client’s Biologics License Application (BLA). VGXI’s achievement reinforces its credibility as a plasmid DNA manufacturing leader as well as underscores its importance in enabling commercial-stage gene therapies, DNA vaccines, and RNA-based medicines.

The DNA plasmid market is transforming from a specialized research supply chain to an essential backbone of contemporary therapeutic development. Therefore, the increasing development of plasmid for gene therapy drives the DNA plasmid manufacturing market.

The DNA plasmid manufacturing market analysis is carried out by considering the following segments: product type, application, end user, and geography. Based on product type, the DNA plasmid manufacturing market is bifurcated into GMP grade and R&D grade. The GMP grade segment held the largest share of the DNA plasmid manufacturing market in 2024, and it is expected to register the highest CAGR during 2024–2031. Good Manufacturing Practice (GMP) grade plasmids are produced under stringent regulatory standards to ensure their suitability for clinical applications, including gene therapies, DNA vaccines, and cell-based treatments. These plasmids must meet rigorous quality control measures, including sterility, endotoxin levels, and identity verification, to comply with FDA and EMA guidelines. Leading producers of GMP-grade plasmids include Aldevron; Lonza; VGXI, Inc.; and Cobra Biologics. Aldevron offers its pALD-HELP plasmid, designed for AAV viral vector production under GMP-S quality standards, while Charles River Laboratories provides high-quality plasmid DNA for gene therapy trials, exemplified by its collaboration with Cure AP-4 for Phase I or Phase II trials. The growth of GMP-grade plasmids is propelled by the surge in gene therapy applications, increased demand for cell and gene therapies, and the rise of mRNA vaccine development.

By application, the market is segmented into cell and gene therapy, DNA Vaccines, immunotherapy, and others. Plasmid DNA plays a pivotal role in cell and gene therapy by serving as a non-viral vector to deliver therapeutic genes into patient cells. These plasmids can be engineered to express specific proteins, correct genetic mutations, or modulate gene expression, offering a versatile approach to treating a range of genetic disorders. Notably, exagamglogene autotemcel (Casgevy), developed by Vertex Pharmaceuticals and CRISPR Therapeutics, represents a significant advancement in gene therapy. This treatment utilizes CRISPR/Cas9 technology to edit genes in patients with sickle cell disease and transfusion-dependent beta-thalassemia, marking the first FDA-approved CRISPR-based gene therapy.

Companies such as VGXI and WuXi Vaccines specialize in providing high-quality plasmid DNA for gene therapy applications. In June 2024, ProBio expanded its plasmid and viral vector production facilities in New Jersey to accelerate the development of cell and gene therapies, underscoring the industry's commitment to meeting growing therapeutic needs.

The growth of plasmid DNA in cell and gene therapy is driven by its rising advancements in gene editing technologies, the increasing prevalence of genetic disorders, and the growing potential for personalized medicine. As regulatory frameworks evolve to accommodate gene therapies, the demand for high-quality plasmid DNA continues to rise.

The geographic scope of the DNA plasmid manufacturing market report includes the assessment of the market performance in North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

The DNA plasmid manufacturing market in North America is segmented into the US, Canada, and Mexico. North America is leading the DNA plasmid manufacturing market in terms of market share owing to its advanced biotechnology infrastructure, strong pharmaceutical industry presence, and significant investments in gene therapy and vaccine development. Additionally, the continuous R&D investments and expanding applications in personalized medicine, oncology, and infectious disease vaccines are expected to propel the growth of the market during the forecast period. The US holds the major share of the market as the country houses many leading biotech companies and research institutions focused on innovative genetic therapies. This region benefits from a robust regulatory framework and government initiatives that support cutting-edge research and development in plasmid DNA technologies. Additionally, the surging demand for gene therapies and DNA vaccines has further propelled the growth of DNA plasmid manufacturing in the region. For instance, companies such as PlasmidFactory and Aldevron have established large-scale plasmid DNA manufacturing facilities in the US allowing efficient production for clinical and commercial use. These organizations play a critical role in supplying high-quality plasmid DNA for various applications, including mRNA vaccine production, which gained global prominence during the COVID-19 pandemic.

The presence of contract development and manufacturing organizations (CDMOs) in the region enables scalable plasmid DNA production, catering to both small biotech startups and large pharmaceutical firms. Technological advancements such as improved bacterial fermentation processes and purification techniques have enhanced production efficiency and product quality. Additionally, collaborations between academic institutions and industry players, such as the partnership between the National Institutes of Health (NIH) and private companies, have accelerated innovation in gene editing and plasmid manufacturing technologies.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com